The Bitcoin worth has nearly struggled to shine these days on weekends, with its efficiency to this point within the present one not a lot totally different. Whereas it confirmed promising bullish signs on Friday night, the premier cryptocurrency appears to have returned to its dour weekend nature.

Because of the bounce within the late hours of Friday, the worth of BTC moved again right into a mini-consolidation vary between $97,000 and $98,000. Curiously, the most recent on-chain knowledge exhibits that Bitcoin worth is now trapped inside a vital bracket.

Why Buyers Watch Out For $96,365 And $98,467

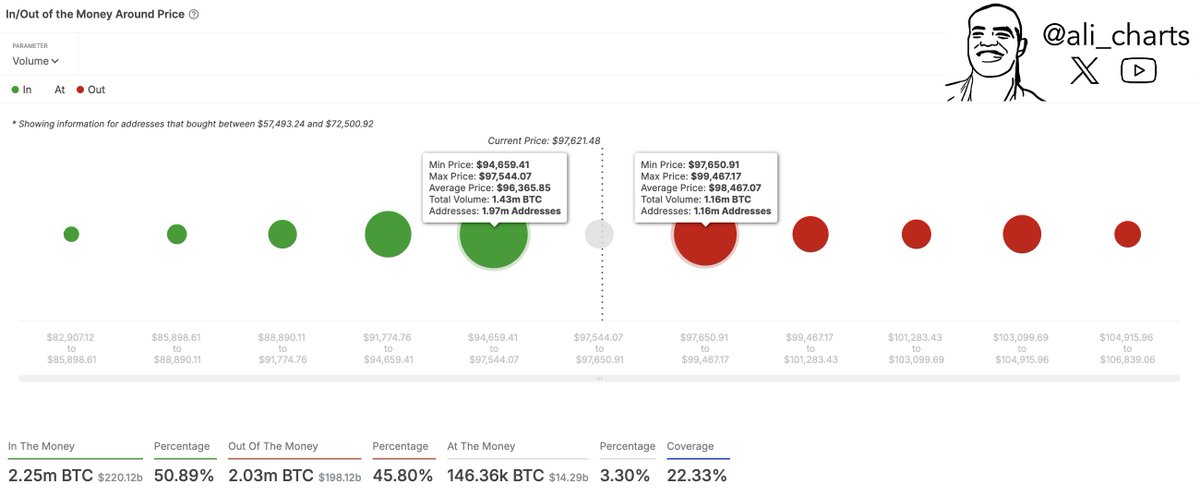

In a publish on the X platform, outstanding crypto analyst Ali Martinez shared an attention-grabbing on-chain perception into the Bitcoin worth and its future trajectory. In keeping with Martinez, the flagship cryptocurrency is wedged between two key worth ranges that might decide its pattern within the close to time period.

This on-chain evaluation relies on the typical price foundation of a number of BTC buyers. For context, cost-basis evaluation evaluates a stage’s capability to function help or resistance relying on the entire quantity of cash final bought by buyers within the area.

Supply: Ali_charts/X

As noticed within the chart above, the scale of the dot (inexperienced and purple) represents and immediately corresponds to the variety of bitcoins acquired inside a worth vary. In keeping with knowledge from IntoTheBlock, round 1.97 million addresses purchased roughly 1.43 million BTC throughout the worth vary of $94,659 and $97,544 (at a median worth of $96,365.)

This excessive shopping for exercise has led to the formation of a key support cushion inside this worth area. The reasoning is that, when Bitcoin worth returns to $96,365, buyers with their price foundation in and round this stage are prone to defend their place by buying extra cash, permitting the worth to remain above the help space.

On the identical time, the $97,650 and $99,470 area can be full of buyers — about $1.16 million addresses who purchased over 1.16 million BTC. This worth vary may act as a major provide barrier, as buyers in loss could wish to shortly offload their belongings as soon as the Bitcoin worth reaches their price foundation.

With costs set between these two ranges, the premier cryptocurrency seems to be at a important juncture that might determine its future over the following few weeks. Martinez famous that “a breakout in both route may set the pattern.”

Bitcoin Worth At A Look

As of this writing, the price of Bitcoin stands at round $97,700, reflecting no important motion up to now 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

The Bitcoin worth has nearly struggled to shine these days on weekends, with its efficiency to this point within the present one not a lot totally different. Whereas it confirmed promising bullish signs on Friday night, the premier cryptocurrency appears to have returned to its dour weekend nature.

Because of the bounce within the late hours of Friday, the worth of BTC moved again right into a mini-consolidation vary between $97,000 and $98,000. Curiously, the most recent on-chain knowledge exhibits that Bitcoin worth is now trapped inside a vital bracket.

Why Buyers Watch Out For $96,365 And $98,467

In a publish on the X platform, outstanding crypto analyst Ali Martinez shared an attention-grabbing on-chain perception into the Bitcoin worth and its future trajectory. In keeping with Martinez, the flagship cryptocurrency is wedged between two key worth ranges that might decide its pattern within the close to time period.

This on-chain evaluation relies on the typical price foundation of a number of BTC buyers. For context, cost-basis evaluation evaluates a stage’s capability to function help or resistance relying on the entire quantity of cash final bought by buyers within the area.

Supply: Ali_charts/X

As noticed within the chart above, the scale of the dot (inexperienced and purple) represents and immediately corresponds to the variety of bitcoins acquired inside a worth vary. In keeping with knowledge from IntoTheBlock, round 1.97 million addresses purchased roughly 1.43 million BTC throughout the worth vary of $94,659 and $97,544 (at a median worth of $96,365.)

This excessive shopping for exercise has led to the formation of a key support cushion inside this worth area. The reasoning is that, when Bitcoin worth returns to $96,365, buyers with their price foundation in and round this stage are prone to defend their place by buying extra cash, permitting the worth to remain above the help space.

On the identical time, the $97,650 and $99,470 area can be full of buyers — about $1.16 million addresses who purchased over 1.16 million BTC. This worth vary may act as a major provide barrier, as buyers in loss could wish to shortly offload their belongings as soon as the Bitcoin worth reaches their price foundation.

With costs set between these two ranges, the premier cryptocurrency seems to be at a important juncture that might determine its future over the following few weeks. Martinez famous that “a breakout in both route may set the pattern.”

Bitcoin Worth At A Look

As of this writing, the price of Bitcoin stands at round $97,700, reflecting no important motion up to now 24 hours.

The value of BTC on the day by day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView