ARK Make investments’s Cathie Wooden is steadfast on her estimate that Bitcoin might rise to $1.5 million by 2030, regardless of a daring projection that’s inflicting a stir throughout the crypto area.

Associated Studying

Recognized for her lofty tech forecasts, the monetary guru described this case throughout Ark’s Big Ideas 2025 conference, the place she revealed that the percentages of reaching this astronomical determine have really elevated.

The Path To A Million-Greenback Bitcoin

Wooden’s forecast goes past merely hauling figures out of skinny air. Given Bitcoin’s current market value of $95,500, Ark’s prediction could be a startling 1,470% rise over the following 5 years.

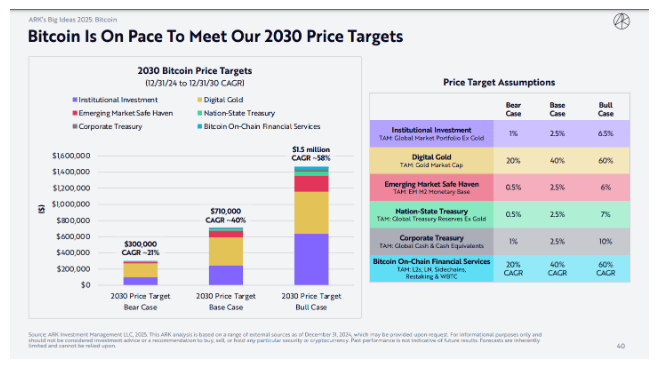

The corporate has sketched three potential routes: a middle-ground goal of $710,000, a conservative estimate of $300,000, and the headline-grabbing bull state of affairs of $1.5 million. These situations correspond to compound annual development charges of 21%, 40%, and 58% respectively.

Institutional Cash Floods The Crypto Markets

Analysis by Ark signifies that the terrain of bitcoin funding is altering considerably. Beneath probably the most hopeful state of affairs, their research reveals institutional buyers would possibly commit as much as 6.5% of their worldwide market portfolio to Bitcoin.

Main monetary firms are already seeing the flagship crypto as a portfolio diversifier, drawn by its particular risk-return profile, therefore this isn’t solely theoretical considering. The potential for the digital asset to account for as much as 60% of gold’s market capitalization lends nonetheless one other diploma of legitimacy to those daring forecasts.

Cathie Wooden: BTC might attain $600K by 2030, and even $1.5M in bull market

ARK Make investments CEO Cathie Wooden said in an interview with CNBC that Bitcoin (BTC) is anticipated to achieve $600,000 within the agency’s base case state of affairs by 2030 and will even hit $1.5 million in a bull case,…

— CoinNess International (@CoinnessGL) December 31, 2024

Stablecoins Dominate Typical Fee Titans

Maybe probably the most eye-opening revelation from Ark’s analysis considerations stablecoins, which have quietly revolutionized the cost panorama.

In 2024, stablecoin transaction values reached a whopping $15.6 trillion, surpassing each Mastercard and Visa. Stablecoin volumes had been, compared, 119% of Visa’s and double Mastercard’s transaction numbers.

Though typical cost methods at present handle extra particular person transactions, the sheer monetary worth passing by way of stablecoins reveals an interesting image of the course of digital finance.

A number of Progress Catalysts Level North

Wooden’s optimistic forecast just isn’t predicated on anyone component. As an alternative, Ark sees a confluence of development drivers, together with the adoption of Bitcoin as a secure haven by rising economies, the incorporation of the digital forex into treasury holdings by nations, the rising use of on-chain monetary providers by companies to diversify their money reserves, and extra.

Associated Studying

This big selection of utility methods might make it simple for Bitcoin’s value to rise. As cryptocurrencies grow to be extra standard as an choice to digital gold, and as their share of institutional portfolios grows, plainly the market might not be giving them sufficient credit score for his or her long-term potential.

With the digital revolution occurring in conventional finance proper now, Wooden’s large objectives won’t be so out of attain in any case.

Featured picture from Pexels, chart from TradingView

![29 Work Bios I Keep in My Back Pocket for Inspo [+ Templates]](https://latestbitcoin.news/wp-content/uploads/2025/02/Untitled20design20286329-120x86.jpg)