- Bitcoin goes by means of a deleveraging course of, and costs may drop within the short-term.

- Nonetheless, vendor exhaustion may happen the longer BTC consolidates round $100k.

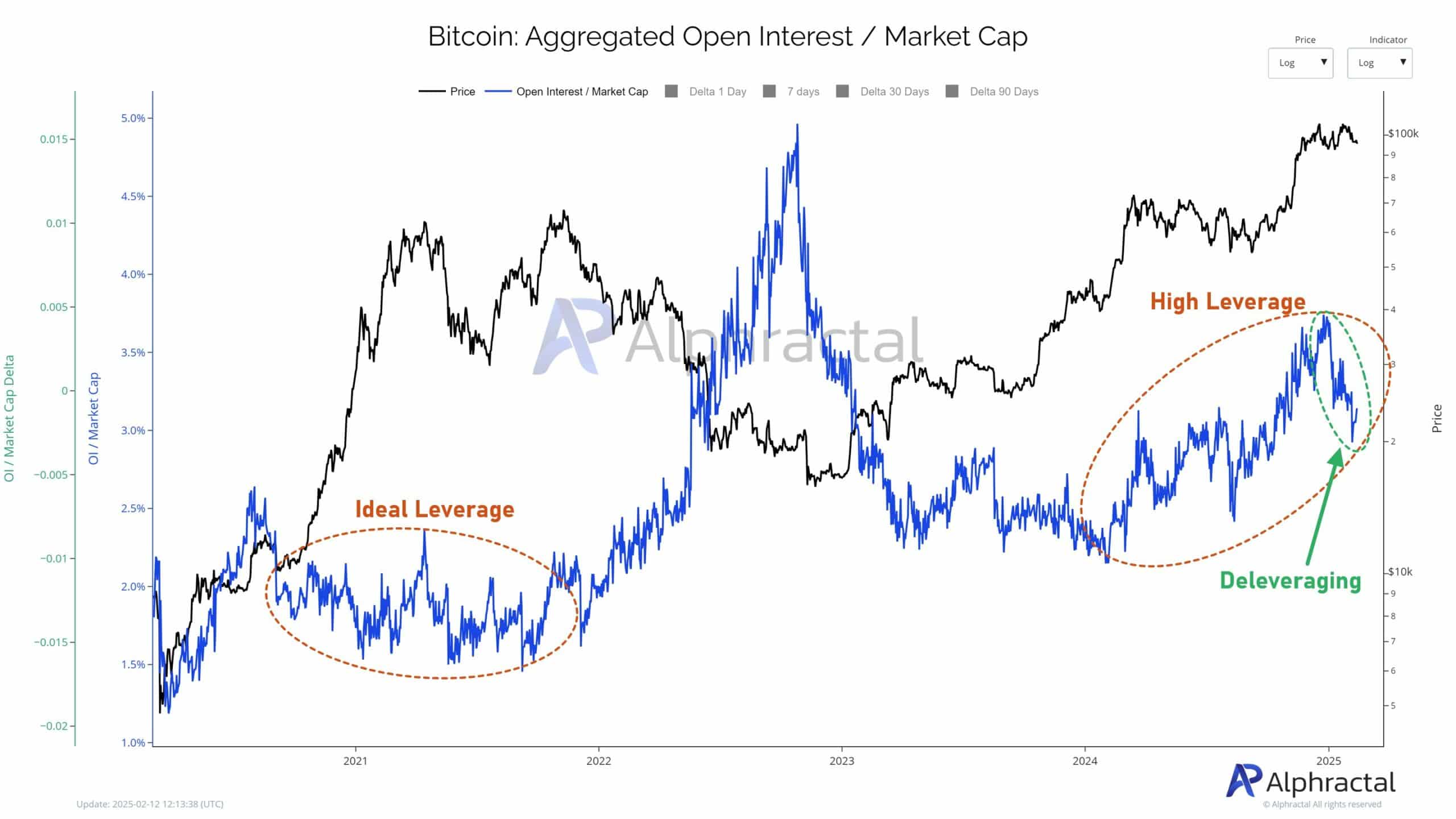

Bitcoin [BTC] is at present in a deleveraging course of, as indicated by the 90-day Aggregated Open Curiosity Delta throughout 17 main exchanges.

This pattern is commonly adopted by value drops or prolonged sideways motion in response to closing or liquidating positions.

Significantly noteworthy is the Open Curiosity to Market Cap ratio, which has risen markedly since early 2024, suggesting elevated Bitcoin market danger in comparison with the extra balanced situations in the course of the 2021 Bull Run.

Current actions present vital deleveraging, signaling a BTC wave of liquidations and the closure of institutional positions—akin to a liquidity reset.

This larger ratio may elevate the chance of additional value drops, impacting these in lengthy positions.

Assessing liquidity zones and Dealer Sentiment Hole

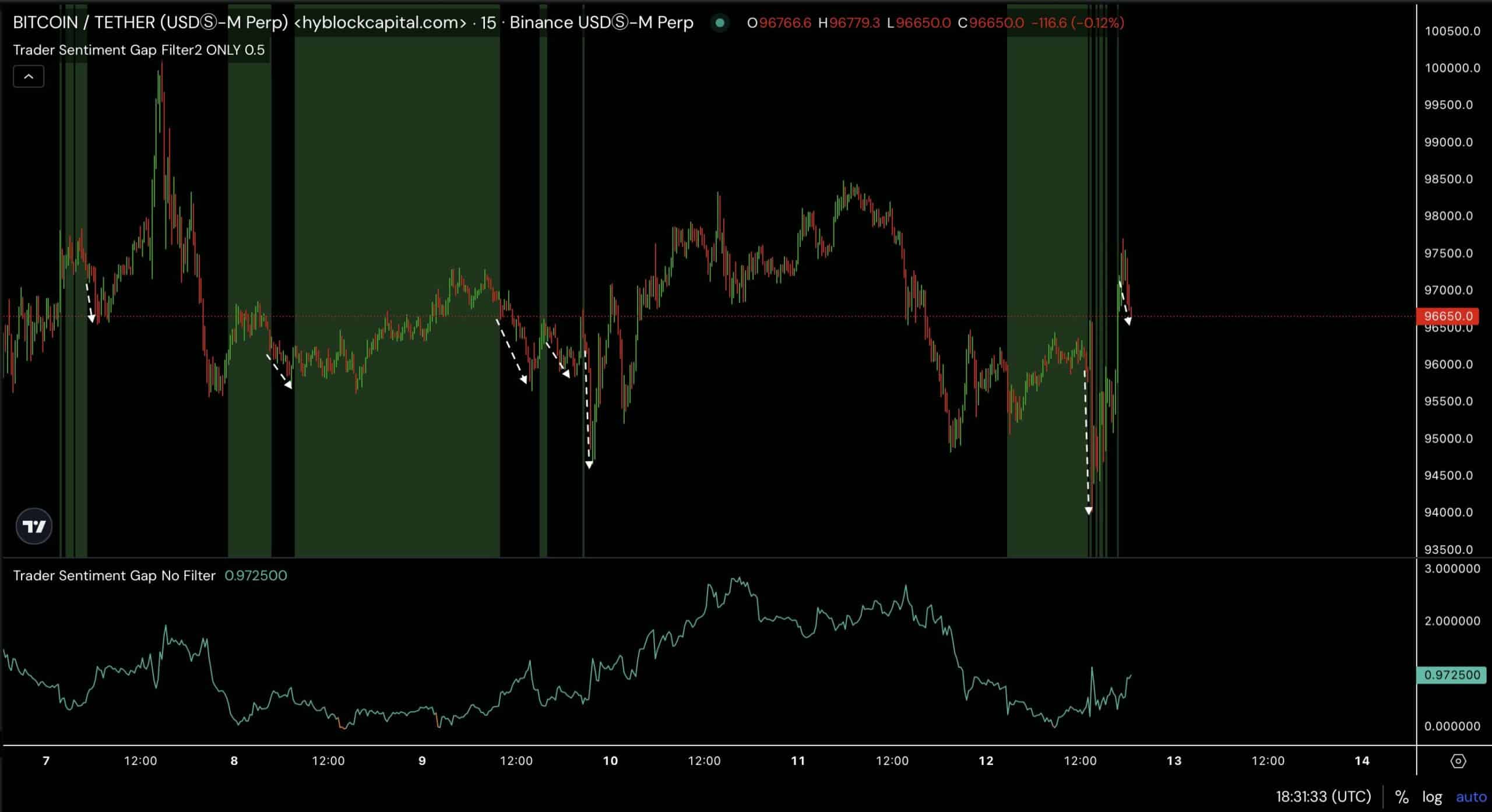

Extra evaluation famous vital liquidity was pooled at $93,700 and $98,800. After yesterday’s information, there was a short-term restoration for BTC adopted by a decline.

This preliminary drop may goal for the $93,700 stage to soak up this “liquid liquidity,” the place purchase orders are ready.

If BTC doesn’t drop to $93.7K, it would sign robust underlying assist or bullish sentiment, the place consumers step in at larger ranges, stopping a deeper fall. This state of affairs may result in a faster restoration or perhaps a value surge.

Additionally, the Dealer Sentiment Hole on the BTC confirmed a notable shrinkage to a decrease stage, significantly when filtered at 0.5, indicative of a minimal sentiment hole between prime merchants and retail merchants.

Traditionally, such a contraction typically precedes a big value motion. On February 12, following a spot discount, Bitcoin’s value sharply dropped from $96,650 to a low of $94,000 earlier than rebounding.

This sample recommended {that a} slim sentiment hole might result in preliminary value declines, adopted by a restoration, reflecting shifts in dealer habits and market dynamics.

This additional helps the anticipated drop as per the deleveraging sign.

Given the present low sentiment hole, BTC would possibly see an analogous short-term volatility with potential draw back adopted by an upward correction.

Why accumulation round $100K is essential for BTC

Nonetheless, a big pattern the place Quick-Time period Holders (STHs) now possess 4 million Bitcoin has emerged. This represents 46% of the 2017 peak and 86% of the 2021 peak, having gathered 1.6 million BTC since September.

The growing variety of Quick-Time period Holders (STHs) contrasts with the declining distribution from Lengthy-Time period Holders (LTHs) as seen of their reducing share of the whole BTC provide.

This reveals BTC continues to build up across the $90K — $100K value vary.

This consolidation may suggests vendor exhaustion, offering a secure base for a possible continuation of the rally.

As BTC stabilizes, the market may acquire confidence, lowering the probability of sudden sell-offs. This could set the stage for a sustained uptrend after the deleveraging is over.

- Bitcoin goes by means of a deleveraging course of, and costs may drop within the short-term.

- Nonetheless, vendor exhaustion may happen the longer BTC consolidates round $100k.

Bitcoin [BTC] is at present in a deleveraging course of, as indicated by the 90-day Aggregated Open Curiosity Delta throughout 17 main exchanges.

This pattern is commonly adopted by value drops or prolonged sideways motion in response to closing or liquidating positions.

Significantly noteworthy is the Open Curiosity to Market Cap ratio, which has risen markedly since early 2024, suggesting elevated Bitcoin market danger in comparison with the extra balanced situations in the course of the 2021 Bull Run.

Current actions present vital deleveraging, signaling a BTC wave of liquidations and the closure of institutional positions—akin to a liquidity reset.

This larger ratio may elevate the chance of additional value drops, impacting these in lengthy positions.

Assessing liquidity zones and Dealer Sentiment Hole

Extra evaluation famous vital liquidity was pooled at $93,700 and $98,800. After yesterday’s information, there was a short-term restoration for BTC adopted by a decline.

This preliminary drop may goal for the $93,700 stage to soak up this “liquid liquidity,” the place purchase orders are ready.

If BTC doesn’t drop to $93.7K, it would sign robust underlying assist or bullish sentiment, the place consumers step in at larger ranges, stopping a deeper fall. This state of affairs may result in a faster restoration or perhaps a value surge.

Additionally, the Dealer Sentiment Hole on the BTC confirmed a notable shrinkage to a decrease stage, significantly when filtered at 0.5, indicative of a minimal sentiment hole between prime merchants and retail merchants.

Traditionally, such a contraction typically precedes a big value motion. On February 12, following a spot discount, Bitcoin’s value sharply dropped from $96,650 to a low of $94,000 earlier than rebounding.

This sample recommended {that a} slim sentiment hole might result in preliminary value declines, adopted by a restoration, reflecting shifts in dealer habits and market dynamics.

This additional helps the anticipated drop as per the deleveraging sign.

Given the present low sentiment hole, BTC would possibly see an analogous short-term volatility with potential draw back adopted by an upward correction.

Why accumulation round $100K is essential for BTC

Nonetheless, a big pattern the place Quick-Time period Holders (STHs) now possess 4 million Bitcoin has emerged. This represents 46% of the 2017 peak and 86% of the 2021 peak, having gathered 1.6 million BTC since September.

The growing variety of Quick-Time period Holders (STHs) contrasts with the declining distribution from Lengthy-Time period Holders (LTHs) as seen of their reducing share of the whole BTC provide.

This reveals BTC continues to build up across the $90K — $100K value vary.

This consolidation may suggests vendor exhaustion, offering a secure base for a possible continuation of the rally.

As BTC stabilizes, the market may acquire confidence, lowering the probability of sudden sell-offs. This could set the stage for a sustained uptrend after the deleveraging is over.

![29 Work Bios I Keep in My Back Pocket for Inspo [+ Templates]](https://latestbitcoin.news/wp-content/uploads/2025/02/Untitled20design20286329-120x86.jpg)