Market analyst Axel Adler Jr has shared some beneficial insights on the Bitcoin market in relation to current short-term holders’ exercise. This commentary comes because the premier cryptocurrency is presently caught in a consolidation part following a flash crash in early February.

Bitcoin STHs Take Revenue From Overheated Market – Analyst

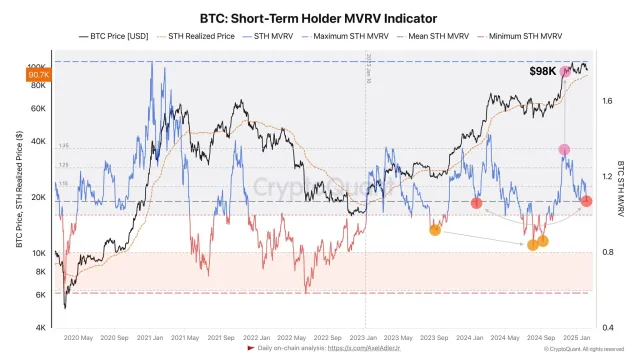

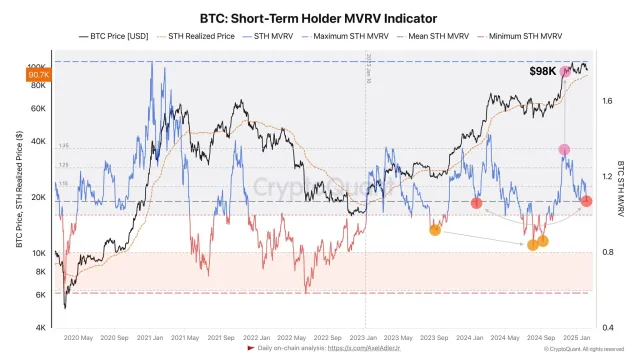

In an X post on February 8, Axel Adler Jr explains that Bitcoin Short-Term Holders (STH) i.e. holders of Bitcoin between 1-3 months have been realizing their earnings. This improvement is predicated on a fall within the STH MVRV – a buying and selling metric that measures market worth to the realized worth of all Bitcoin held by short-term holders thus serving to to find out their revenue/loss standing.

Typically, an STH MVRV round 1.30-1.35 suggests an overheated market as short-term holders have excessive unrealized earnings indicating potential for a sell-off and value falls. In line with Adler Jr., the STH MVRV has just lately dropped from 1.35 to common ranges that means a good portion of STH have closed their positions, serving to to chill the market.

Traditionally, the top of an overheated part normally interprets right into a interval of value consolidation supplied that market demand stays robust. Axel Adler Jr attracts a reference to January 2024, when the same fall in STH MVRV was even robust sufficient to ultimately provoke a value rally.

Nevertheless, the crypto analyst cautions that US President Donald Trump’s choices are largely influencing the present market panorama. This was clearly illustrated final week when the US transfer to impose new tariffs on China, Mexico, and Canada attracted retaliatory measures inflicting buyers to maneuver funds out of dangerous belongings amidst fears of a brewing commerce struggle.

Axler Adler Jr states that barring any extra detrimental triggers from Donald Trump’s political actions, Bitcoin could escape of its present FOMO-driven consolidation into an uptrend. Nevertheless, within the case of eventualities, Bitcoin seems to have shaped a powerful help zone round $90,000 able to stopping deeper corrections.

BTC Value Overview

On the time of writing, Bitcoin trades at $96,998 following a 0.98% achieve within the final 24 hours. In the meantime, its buying and selling quantity stands at $22.53 billion having crashed by 59.04% up to now day. For the market bulls, related resistance ranges lie at $102,000 and $106,000. A failure to interrupt above the preliminary resistance will power Bitcoin to stay in consolidation for the foreseeable future.

Featured picture from iStock, chart from Tradingview

Market analyst Axel Adler Jr has shared some beneficial insights on the Bitcoin market in relation to current short-term holders’ exercise. This commentary comes because the premier cryptocurrency is presently caught in a consolidation part following a flash crash in early February.

Bitcoin STHs Take Revenue From Overheated Market – Analyst

In an X post on February 8, Axel Adler Jr explains that Bitcoin Short-Term Holders (STH) i.e. holders of Bitcoin between 1-3 months have been realizing their earnings. This improvement is predicated on a fall within the STH MVRV – a buying and selling metric that measures market worth to the realized worth of all Bitcoin held by short-term holders thus serving to to find out their revenue/loss standing.

Typically, an STH MVRV round 1.30-1.35 suggests an overheated market as short-term holders have excessive unrealized earnings indicating potential for a sell-off and value falls. In line with Adler Jr., the STH MVRV has just lately dropped from 1.35 to common ranges that means a good portion of STH have closed their positions, serving to to chill the market.

Traditionally, the top of an overheated part normally interprets right into a interval of value consolidation supplied that market demand stays robust. Axel Adler Jr attracts a reference to January 2024, when the same fall in STH MVRV was even robust sufficient to ultimately provoke a value rally.

Nevertheless, the crypto analyst cautions that US President Donald Trump’s choices are largely influencing the present market panorama. This was clearly illustrated final week when the US transfer to impose new tariffs on China, Mexico, and Canada attracted retaliatory measures inflicting buyers to maneuver funds out of dangerous belongings amidst fears of a brewing commerce struggle.

Axler Adler Jr states that barring any extra detrimental triggers from Donald Trump’s political actions, Bitcoin could escape of its present FOMO-driven consolidation into an uptrend. Nevertheless, within the case of eventualities, Bitcoin seems to have shaped a powerful help zone round $90,000 able to stopping deeper corrections.

BTC Value Overview

On the time of writing, Bitcoin trades at $96,998 following a 0.98% achieve within the final 24 hours. In the meantime, its buying and selling quantity stands at $22.53 billion having crashed by 59.04% up to now day. For the market bulls, related resistance ranges lie at $102,000 and $106,000. A failure to interrupt above the preliminary resistance will power Bitcoin to stay in consolidation for the foreseeable future.

Featured picture from iStock, chart from Tradingview