- The TD Sequential which completely timed Bitcoin prime on the twenty first of January is now flashing a purchase sign on the every day chart.

- After BTC swept liquidity beneath $95K, it’s headed for liquidity in ranges above $98K as Whale buys at $97K.

Evaluation of Bitcoin [BTC] utilizing the TD Sequential indicator signaled a market prime on the twenty first of January 2025, at $103,000. Following this peak, the worth of Bitcoin noticed a notable decline, reinforcing the TD Sequential’s predictive reliability.

Just lately, TD Sequential issued a purchase sign on the every day timeframe, with Bitcoin’s value round $96,214.

This recommended the potential for a market backside, indicating an opportune second for buyers to think about coming into the market.

The presence of a purchase sign after a decline signifies that the promoting stress could also be exhausting, and a reversal could possibly be imminent.

If the purchase sign doesn’t result in sustained shopping for stress, BTC might check decrease assist ranges, probably across the latest lows of $94,400.

Such a drop would align with TD Sequential’s sample of figuring out pivotal factors, however as a substitute of a rally, it might precipitate additional declines.

Thus, whereas the present purchase sign presents a probably bullish situation for Bitcoin, buyers ought to stay cautious.

They need to take into account each the opportunity of a rebound in the direction of greater ranges, corresponding to $100,000, or a continued downtrend if the sign fails to manifest into tangible shopping for momentum.

Dormant whale buys as BTC targets liquidity above

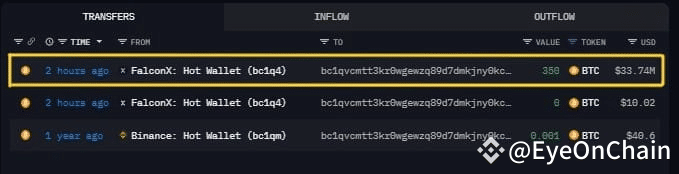

A dormant whale pockets “bc1qv…” withdrew 350 BTC, valued at$33.97 million, from FalconX at $97,053 per BTC. The substantial buy by a significant participant might point out potential upward momentum.

Nonetheless, if the market sentiment doesn’t align with the whale’s shopping for technique, this might probably push costs down if others determine to money out, fearing a prime.

Following a sweep of liquidity beneath $95K, BTC seems poised to check greater ranges, significantly round $98K. This transfer helps a possible continuation if BTC can keep assist above these vital liquidity thresholds.

Sometimes, overcoming such zones can catalyze additional shopping for curiosity, probably pushing costs upwards. Conversely, if BTC fails to breach the $98K liquidity zone, it might point out inadequate shopping for stress, presumably main to a different retracement.

Lastly, in keeping with analyst Benjamin Cowen on X, the Whole On-Chain Danger indicator recommended that Bitcoin’s peak might not have been reached.

The metric at present reveals ranges that aren’t typical of a market prime. This means a possible for an extra rally.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

Conversely, if the chance indicator begins to indicate values related to earlier market tops, it might sign that the present rally is perhaps nearing its finish.

This situation would require shut monitoring of any shifts in on-chain exercise that would precede a value correction.