Breez, in partnership with 1A1z, has launched a new report investigating using Bitcoin as a funds system and transactional forex. Bitcoin has all the time been painted as digital gold, that is without doubt one of the longest working narratives at this level when it comes to what Bitcoin truly is. It does seize the use as a long-term funding or speculative asset, and has been a really useful assist in getting individuals over the primary hump of primary understanding, however it’s certainly not a complete rationalization of what Bitcoin is.

The report dives into a number of components of Bitcoin’s use as a fee mechanism. It dissects completely different use instances, regulatory therapies obtained in several jurisdictions, companies and platforms with current integration of Lightning funds, and so forth.

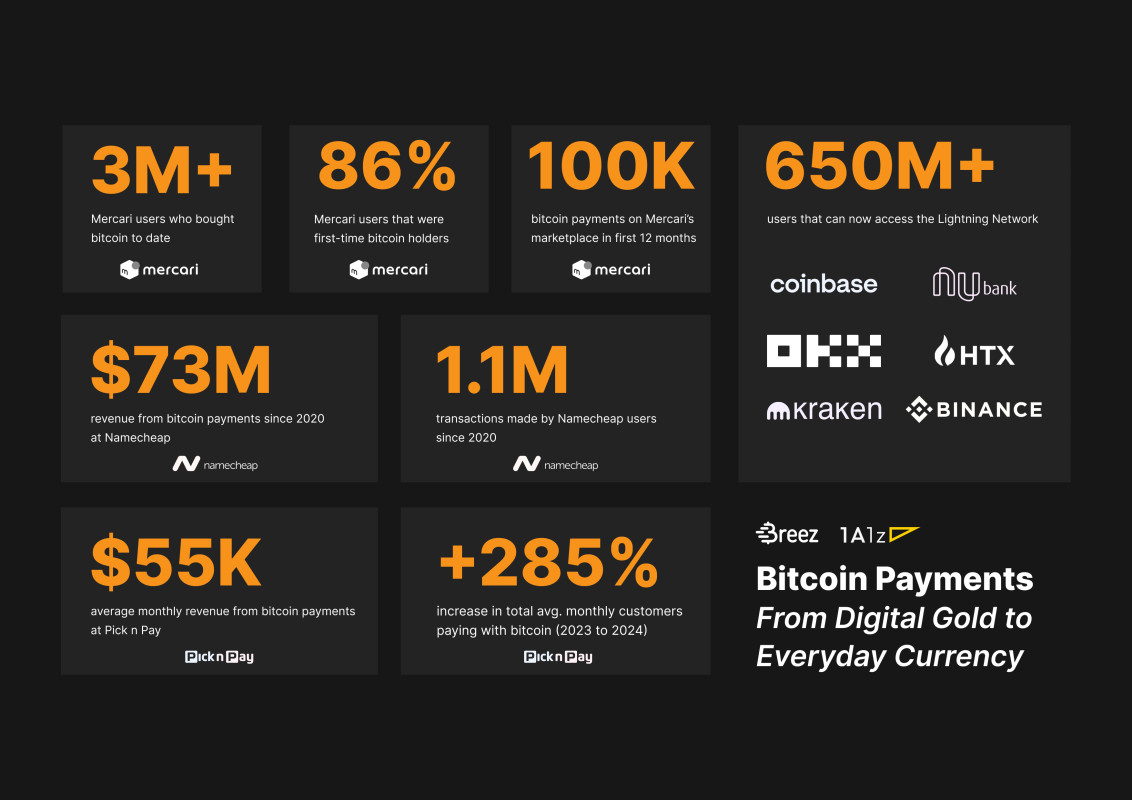

Case research are included particular companies and the amount of transactions or userbase they’ve supplied entry to Bitcoin for. Mercari, a significant Japanese market just like Amazon, accepts bitcoin. Mullvad VPN, Namecheap, and Protonmail are all cases of digital companies benefiting from bitcoin funds.

Whereas the Bitcoin digital gold narrative is working sturdy, Bitcoin’s use as a fee mechanism is rising quietly within the background. Storing worth could also be a essential element of Bitcoin’s use in commerce, however the final goal it was created for was to transact with.

Learn the report here for extra particulars on how Bitcoin’s transactional use goes via a quiet renaissance.