After beginning the week with a pink Monday, Bitcoin (BTC) has recovered the $100,000 zone, registering a 4% restoration from yesterday’s lows. Following its restoration, some crypto analysts urged that BTC might be preparing for a February pump.

Associated Studying

Uneven January, Double-Digit February?

On Monday, the crypto market suffered a shakeout generated by the broader sell-off ignited by DeepSeek’s Synthetic Intelligence (AI) news. Altcoins like Ethereum (ETH) and Solana (SOL) fell 8.4% and 15%, respectively, whereas Bitcoin dropped 5%.

The flagship cryptocurrency fell under the $100,000 mark for the primary time in over every week, dipping to $98,000 on Monday. Nevertheless, it has skilled a powerful rebound, recovering the essential help zone because the day ended.

After surging to $102,000 on Tuesday morning, Bitcoin has been unable to reclaim $103,000, transferring sideways inside the $102,000-$102,990 value vary all through the day.

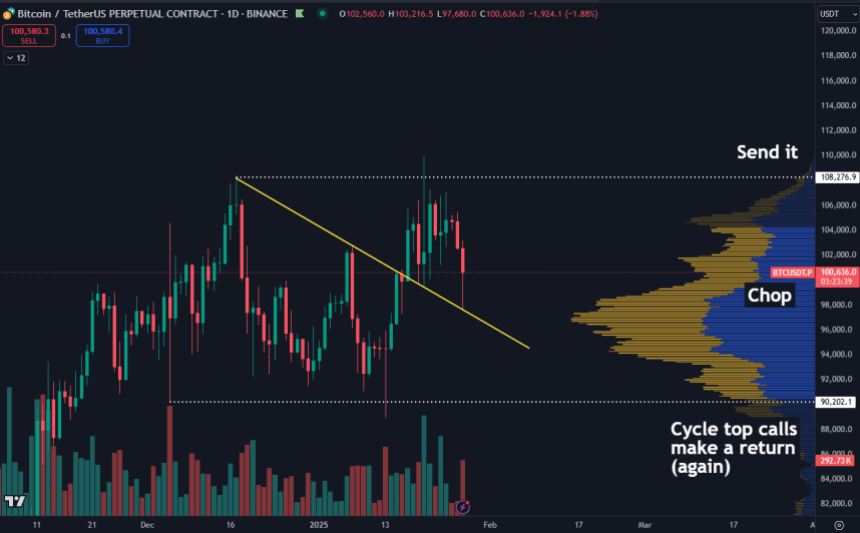

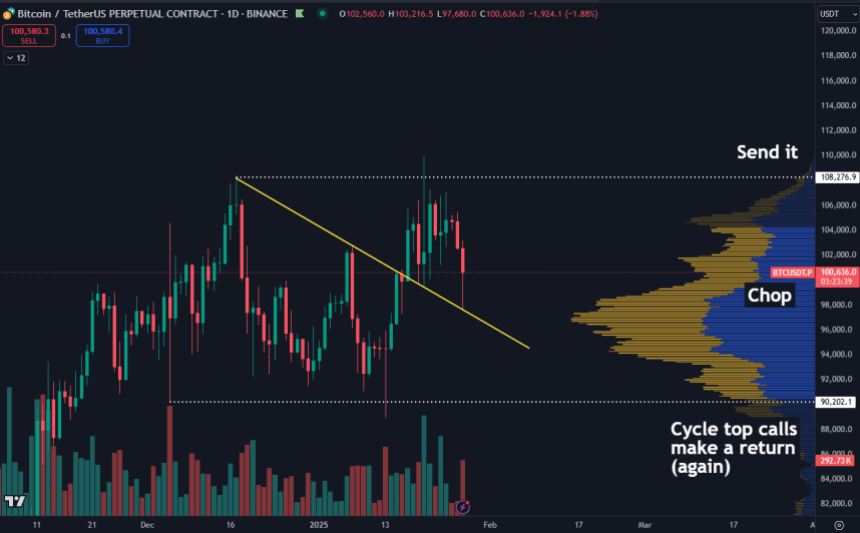

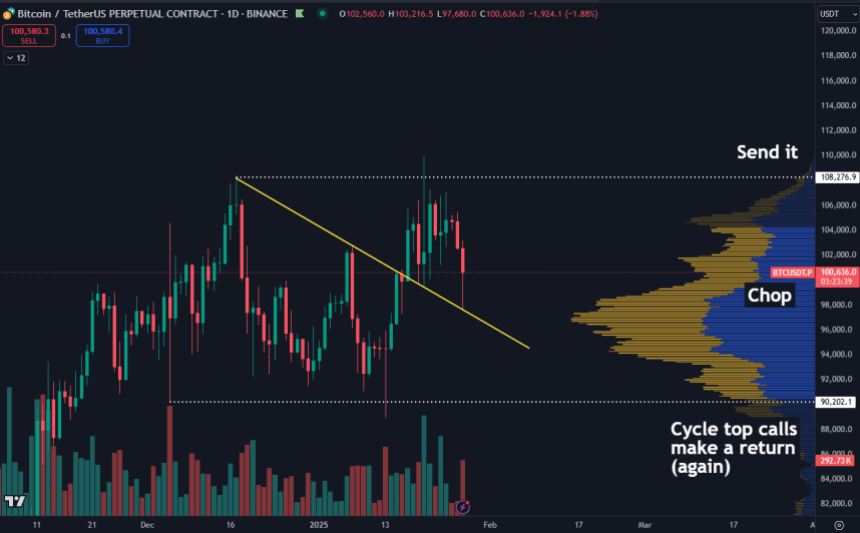

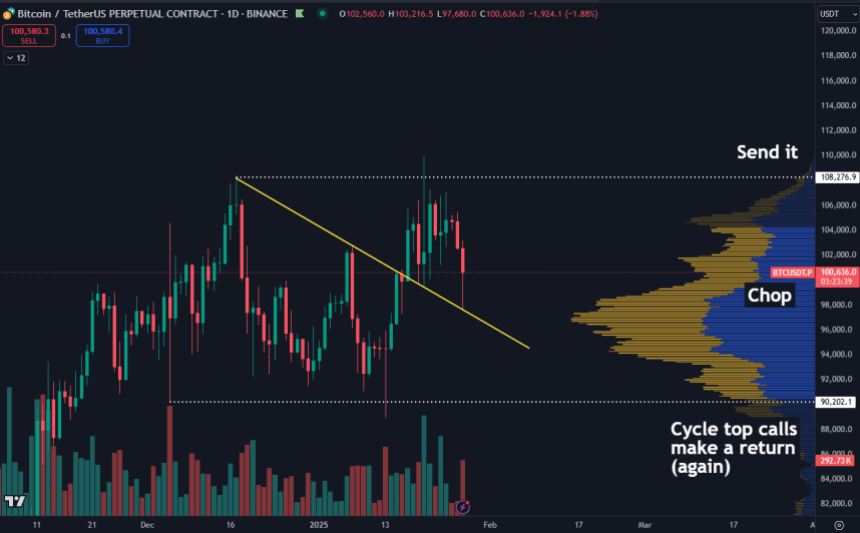

Dealer Daan Crypto famous that Bitcoin continued transferring within the mid-zone of its post-election vary regardless of the drop. “Proper again into the high-volume space inside this vary. Doesn’t appear to be the $100K mark is left behind so simply simply but,” he wrote.

Daan considers that so long as Bitcoin doesn’t break under or above $90,000 or $108,000, the value will proceed with its “respectable however uneven” efficiency. Nevertheless, he urged that Bitcoin might have a greater value motion subsequent month based mostly on its historic efficiency.

The dealer factors out that February has been historically BTC’s second-best month, solely behind October. Within the final 12 years, Bitcoin has seen a inexperienced efficiency throughout this month 10 instances, registering as much as 61% month-to-month return, in response to CloinGlass knowledge.

Equally, Rekt Capital said that in its post-halving years, Bitcoin saw a double-digit revenue in February, with 61% in 2013, 23% in 2017, and 36% in 2021. The analysts added that “8 out of the previous 12 February courting again to 2013 have produced double-digit upside.”

Bitcoin Subsequent Leg Up Coming Quickly

Rekt Capital additionally considers that BTC is making ready for its subsequent leg up. The analyst defined that Bitcoin accomplished its first post-halving Value Discovery Uptrend and first Value Discovery Uptrend Correction.

This suggests that BTC “ought to have the ability to embark on its second Value Discovery Uptrend to new highs” within the subsequent two weeks. In line with Rekt Capital, the second section traditionally begins throughout week 16 of Bitcoin’s Parabolic Section, with Bitcoin at present beginning the 14th week.

“In Week 14 of the 2017 cycle, Bitcoin was recovering from its first Value Discovery Correction solely to make new highs in Week 16 In Week 14 of the 2021 cycle, Bitcoin was nonetheless simply bottoming on its first Value Discovery Correction solely to make new highs in Week 16,” the analyst detailed.

Associated Studying

Because of this, Rekt Capital suggests investor “Patienlly HODL” for the subsequent two weeks, as “affirmation Of The 2nd Value Discovery Uptrend” is ready to start out subsequent month.

Furthermore, Bitcoin’s Monday shut above $101,200 developed a “new early-stage Larger Low,” which might see the value “consolidate additional right here to as excessive because the Vary Excessive at $106,200” if it continues to carry above this degree.

Featured Picture from Unsplash.com, Chart from TradingView.com

After beginning the week with a pink Monday, Bitcoin (BTC) has recovered the $100,000 zone, registering a 4% restoration from yesterday’s lows. Following its restoration, some crypto analysts urged that BTC might be preparing for a February pump.

Associated Studying

Uneven January, Double-Digit February?

On Monday, the crypto market suffered a shakeout generated by the broader sell-off ignited by DeepSeek’s Synthetic Intelligence (AI) news. Altcoins like Ethereum (ETH) and Solana (SOL) fell 8.4% and 15%, respectively, whereas Bitcoin dropped 5%.

The flagship cryptocurrency fell under the $100,000 mark for the primary time in over every week, dipping to $98,000 on Monday. Nevertheless, it has skilled a powerful rebound, recovering the essential help zone because the day ended.

After surging to $102,000 on Tuesday morning, Bitcoin has been unable to reclaim $103,000, transferring sideways inside the $102,000-$102,990 value vary all through the day.

Dealer Daan Crypto famous that Bitcoin continued transferring within the mid-zone of its post-election vary regardless of the drop. “Proper again into the high-volume space inside this vary. Doesn’t appear to be the $100K mark is left behind so simply simply but,” he wrote.

Daan considers that so long as Bitcoin doesn’t break under or above $90,000 or $108,000, the value will proceed with its “respectable however uneven” efficiency. Nevertheless, he urged that Bitcoin might have a greater value motion subsequent month based mostly on its historic efficiency.

The dealer factors out that February has been historically BTC’s second-best month, solely behind October. Within the final 12 years, Bitcoin has seen a inexperienced efficiency throughout this month 10 instances, registering as much as 61% month-to-month return, in response to CloinGlass knowledge.

Equally, Rekt Capital said that in its post-halving years, Bitcoin saw a double-digit revenue in February, with 61% in 2013, 23% in 2017, and 36% in 2021. The analysts added that “8 out of the previous 12 February courting again to 2013 have produced double-digit upside.”

Bitcoin Subsequent Leg Up Coming Quickly

Rekt Capital additionally considers that BTC is making ready for its subsequent leg up. The analyst defined that Bitcoin accomplished its first post-halving Value Discovery Uptrend and first Value Discovery Uptrend Correction.

This suggests that BTC “ought to have the ability to embark on its second Value Discovery Uptrend to new highs” within the subsequent two weeks. In line with Rekt Capital, the second section traditionally begins throughout week 16 of Bitcoin’s Parabolic Section, with Bitcoin at present beginning the 14th week.

“In Week 14 of the 2017 cycle, Bitcoin was recovering from its first Value Discovery Correction solely to make new highs in Week 16 In Week 14 of the 2021 cycle, Bitcoin was nonetheless simply bottoming on its first Value Discovery Correction solely to make new highs in Week 16,” the analyst detailed.

Associated Studying

Because of this, Rekt Capital suggests investor “Patienlly HODL” for the subsequent two weeks, as “affirmation Of The 2nd Value Discovery Uptrend” is ready to start out subsequent month.

Furthermore, Bitcoin’s Monday shut above $101,200 developed a “new early-stage Larger Low,” which might see the value “consolidate additional right here to as excessive because the Vary Excessive at $106,200” if it continues to carry above this degree.

Featured Picture from Unsplash.com, Chart from TradingView.com