Bitcoin’s value motion prior to now 24 hours has been characterized by intense volatility because it touched each the decrease and higher ends of $98,380 and $103,369, respectively. Technical evaluation of the Bitcoin value motion on the weekly candlestick timeframe reveals that the main cryptocurrency is on the path to a price target of $117,000.

An analyst on the TradingView platform has outlined a detailed roadmap for Bitcoin’s journey to this $117,000 value goal, highlighting a collection of key value zones and market cycles to be careful for.

Momentum And Resistance Ranges On The Approach To $117,000

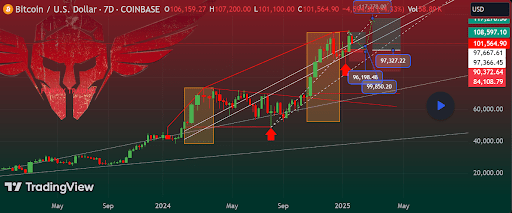

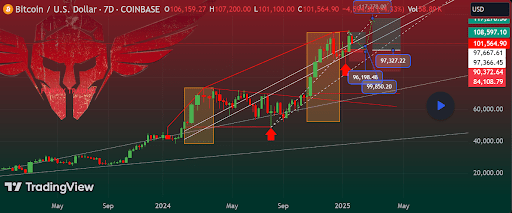

Technical development evaluation reveals that Bitcoin has been buying and selling in an ascending channel in a weekly candlestick timeframe since This autumn 2024, with the value steadily climbing throughout the channel. As demonstrated within the chart beneath, essentially the most recent 7-day candlestick is bearish, pushing Bitcoin to retest the midline of this ascending channel. This bearish motion displays short-term promoting stress however aligns with the broader sample of corrections inside an total uptrend.

Associated Studying

A rebound is anticipated from right here, which might ship Bitcoin on one other transfer towards the higher trendline. Curiously, a transfer towards the higher resistance zone places the value goal round $117,000, marking a big milestone for Bitcoin. Nonetheless, there stays a possible draw back threat, and the journey to $117,000 isn’t anticipated to be linear.

In keeping with the analyst, Bitcoin could witness a pullback to the zone between $95,000, $97,000, and $100,000, which can act as a consolidation area earlier than Bitcoin resumes its upward trajectory. This zone coincides with earlier help ranges and trendlines, additional solidifying its significance as a crucial space for accumulation and stability. The Harmonic Fibonacci projection software additionally suggests the pullback to the vary between $97,000 and $95,000 might type a “healthier setup” for a sustained rally.

Moreover, short-term resistance close to $108,000 might additionally sluggish Bitcoin’s climb. This degree is much more notable, contemplating the actual fact that it’s the present all-time excessive that would need to be surpassed. The general long-term construction stays bullish even with the potential pullback, with increased highs and better lows forming on the roadmap to $117,000.

Bitcoin’s Market Cycles Throughout A number of Timeframes

The analyst additionally seemed into Bitcoin’s market cycles throughout completely different timeframes. On the each day chart, Bitcoin is at the moment in Cycle 2, which the analyst describes as a part with little shopping for momentum. Getting into on the present degree carries a better threat, and Cycle 1 would wish to return for an entry level. The weekly timeframe additionally displays Cycle 2 on the prime of the chart. This placement usually transitions into Cycle 3, which might result in important value motion both upward or downward.

Associated Studying

On a two-week timeframe, Cycle 1 is current however can be positioned on the prime, which can be not entry level. Nevertheless, the removing of a current promote sign means that the rapid threat of Bitcoin dropping below $97,000 has diminished, however isn’t completely over.

On the time of writing, Bitcoin is trading at $102,700 and is up by 4% prior to now 24 hours.

Featured picture from iStock, chart from Tradingview.com

Bitcoin’s value motion prior to now 24 hours has been characterized by intense volatility because it touched each the decrease and higher ends of $98,380 and $103,369, respectively. Technical evaluation of the Bitcoin value motion on the weekly candlestick timeframe reveals that the main cryptocurrency is on the path to a price target of $117,000.

An analyst on the TradingView platform has outlined a detailed roadmap for Bitcoin’s journey to this $117,000 value goal, highlighting a collection of key value zones and market cycles to be careful for.

Momentum And Resistance Ranges On The Approach To $117,000

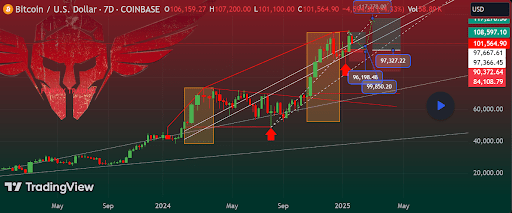

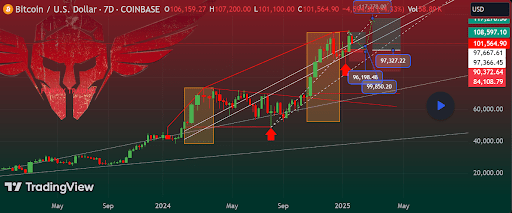

Technical development evaluation reveals that Bitcoin has been buying and selling in an ascending channel in a weekly candlestick timeframe since This autumn 2024, with the value steadily climbing throughout the channel. As demonstrated within the chart beneath, essentially the most recent 7-day candlestick is bearish, pushing Bitcoin to retest the midline of this ascending channel. This bearish motion displays short-term promoting stress however aligns with the broader sample of corrections inside an total uptrend.

Associated Studying

A rebound is anticipated from right here, which might ship Bitcoin on one other transfer towards the higher trendline. Curiously, a transfer towards the higher resistance zone places the value goal round $117,000, marking a big milestone for Bitcoin. Nonetheless, there stays a possible draw back threat, and the journey to $117,000 isn’t anticipated to be linear.

In keeping with the analyst, Bitcoin could witness a pullback to the zone between $95,000, $97,000, and $100,000, which can act as a consolidation area earlier than Bitcoin resumes its upward trajectory. This zone coincides with earlier help ranges and trendlines, additional solidifying its significance as a crucial space for accumulation and stability. The Harmonic Fibonacci projection software additionally suggests the pullback to the vary between $97,000 and $95,000 might type a “healthier setup” for a sustained rally.

Moreover, short-term resistance close to $108,000 might additionally sluggish Bitcoin’s climb. This degree is much more notable, contemplating the actual fact that it’s the present all-time excessive that would need to be surpassed. The general long-term construction stays bullish even with the potential pullback, with increased highs and better lows forming on the roadmap to $117,000.

Bitcoin’s Market Cycles Throughout A number of Timeframes

The analyst additionally seemed into Bitcoin’s market cycles throughout completely different timeframes. On the each day chart, Bitcoin is at the moment in Cycle 2, which the analyst describes as a part with little shopping for momentum. Getting into on the present degree carries a better threat, and Cycle 1 would wish to return for an entry level. The weekly timeframe additionally displays Cycle 2 on the prime of the chart. This placement usually transitions into Cycle 3, which might result in important value motion both upward or downward.

Associated Studying

On a two-week timeframe, Cycle 1 is current however can be positioned on the prime, which can be not entry level. Nevertheless, the removing of a current promote sign means that the rapid threat of Bitcoin dropping below $97,000 has diminished, however isn’t completely over.

On the time of writing, Bitcoin is trading at $102,700 and is up by 4% prior to now 24 hours.

Featured picture from iStock, chart from Tradingview.com