Software program subscriptions. Workplace lease. Worker advantages. Is your online business cash vanishing into skinny air? A enterprise funds template places you again in management by monitoring each greenback you spend.

Whether or not you‘re launching a startup or scaling an enterprise, you’ll spot precisely the place to chop prices and the place to speculate for progress.

In my roles, I created budgets for entire tasks and smaller writing tasks.

Whereas organizing the numbers could sound tough, I discover enterprise funds templates make the method easy. Plus, there are literally thousands of enterprise funds templates to select from.

On this article, I share seven funds templates to assist arrange your funds. However first, you’ll find out about several types of enterprise budgets and how one can create one.

What’s a enterprise funds?

A enterprise funds is a spending plan that estimates the income and bills of a enterprise for a time frame, sometimes month-to-month, quarterly, or yearly. A enterprise funds follows a set template — you fill it in with estimated revenues and any recurring or anticipated enterprise bills.

For instance, say your online business is planning a web site redesign. You’d want to interrupt down the prices by class: software program, content material and design, testing, and extra. Having a transparent breakdown will enable you to estimate how a lot every class will value and examine it with the precise prices.

Kinds of Enterprise Budgets

Enterprise budgets aren’t one dimension matches all. In actual fact, there are a lot of forms of budgets that serve varied functions. Let’s dive into some generally used budgets.

Grasp Finances

A master budget brings collectively all the person budgets from completely different elements of your organization right into a consolidated plan. It covers all the things from gross sales and manufacturing to advertising and marketing and funds.

This funds consists of particulars like projected revenues, bills, and profitability for every division or enterprise unit. It additionally considers necessary monetary features, like money movement and capital expenditures. The funds even creates a steadiness sheet to indicate the group’s monetary place.

The grasp funds acts as a information for decision-making, helps with strategic planning, and provides a transparent image of your organization’s total monetary well being and efficiency. It ties all the things collectively and helps the group transfer in the proper route.

For instance, think about you run a software program firm. Your grasp funds would mix the next:

- Gross sales workforce funds ($100,000 for salaries and commissions).

- Advertising funds ($50,000 for adverts and campaigns).

- Growth funds ($200,000 for engineering expertise).

- Operations funds ($75,000 for workplace area and utilities).

This merged view exhibits you may want $425,000 to run all departments for the yr. You may then examine this in opposition to your projected income of $600,000 to see in case your marketing strategy is viable. The grasp funds helps you notice potential points (like overspending in advertising and marketing) earlier than they change into issues and determine alternatives (like having sufficient revenue to rent one other developer).

Professional tip: From my expertise managing varied enterprise budgets, I like to recommend beginning with a grasp funds after which creating extra particular budgets as your wants develop.

Working Finances

Your working funds exhibits how a lot cash your organization expects to make and spend throughout a particular interval, often a yr. It predicts your online business’s income and descriptions bills, like salaries, lease, payments, and different operational prices.

By evaluating your precise bills and income to the budgeted quantities, your organization can see the way it’s performing and make changes if wanted. It retains issues in test, permitting your online business to make clever monetary choices and keep on observe with its targets.

For instance, a small advertising and marketing company’s month-to-month working funds could appear to be this.

- Anticipated Revenue: $50,000 from consumer retainers

- Common Bills:

- Workers salaries: $25,000

- Workplace lease: $3,000

- Software program subscriptions: $1,500

- Utilities: $500

- Advertising: $2,000

By monitoring these numbers month-to-month, you possibly can spot tendencies — like if consumer income drops in summer season months or if software program prices are creeping up — and regulate your spending earlier than points come up.

Money Finances

A money funds estimates the money inflows and outflows of your online business over a particular interval, sometimes a month, quarter, or yr. It gives an in depth projection of money sources and makes use of, together with income, bills, and financing actions.

The money funds helps you successfully handle your money movement, plan for money shortages or surpluses, consider the necessity for exterior financing, and make knowledgeable choices about useful resource allocation.

By utilizing a money funds, your online business can guarantee it has sufficient money readily available to fulfill its monetary obligations, navigate fluctuations, and seize progress alternatives.

For instance, think about you run an e-commerce enterprise.

- Beginning Money: $20,000

- Anticipated Money In:

- Product gross sales: $15,000

- Affiliate income: $2,000

- Stock restock: $8,000

- Transport prices: $3,000

- Workers payroll: $5,000

- Advertising: $2,000

This exhibits you may finish with $19,000 in money. But when your stock cost is due earlier than buyer funds arrive, you should still face a brief money scarcity. A money funds helps you notice and plan for these timing gaps.

Static Finances

A static budget is a monetary plan that is still unchanged, no matter precise gross sales or manufacturing volumes.

This funds is usually created in the beginning of a funds interval and doesn’t account for any fluctuations or modifications in enterprise circumstances. It additionally assumes that each one variables, equivalent to gross sales, bills, and manufacturing ranges, will stay the identical all through the funds interval.

Whereas a static funds gives a baseline for comparability, it will not be reasonable for companies with fluctuating gross sales volumes or variable bills.

For instance, in case you run a consulting enterprise, your annual static funds could allocate $60,000 for promoting — that is $5,000 per thirty days. Even if in case you have an incredible Q1 and may benefit from elevated advert spend or a sluggish Q3 the place it is best to in the reduction of, a static funds retains that $5,000 month-to-month allocation unchanged. Whereas this makes planning easy, it may possibly restrict your means to adapt to altering enterprise circumstances.

Departmental Finances

A departmental funds focuses on the monetary features of a particular division inside your organization, equivalent to gross sales, advertising and marketing, or human sources.

When making a departmental funds, chances are you’ll have a look at income sources like departmental gross sales, grants, and different sources of revenue. On the expense facet, you contemplate prices, equivalent to salaries, provides, tools, and every other bills distinctive to that division.

The purpose of a departmental funds is to assist the division handle its funds correctly. It acts as a information for making choices and allocating sources successfully. By evaluating the precise numbers to the budgeted quantities, division heads can see in the event that they’re on observe or if changes must be made.

Let‘s have a look at an instance of a advertising and marketing division’s quarterly funds.

- Lead era: $100,000

- Occasion sponsorships: $25,000

- Group salaries: $75,000

- Content material creation: $15,000

- Advert campaigns: $20,000

- Advertising instruments: $5,000

This detailed breakdown helps the advertising and marketing director observe efficiency in opposition to targets and regulate ways — like shifting cash from underperforming advert campaigns to profitable content material creation — with out affecting different departments’ budgets.

Capital Finances

A capital budget is all about planning for large investments in the long run. It focuses on deciding the place to spend cash on issues like upgrading tools, sustaining services, growing new merchandise, and hiring new workers.

The funds appears to be like on the prices of shopping for new stuff, upgrading present issues, and even considers depreciation, which is when one thing loses worth over time. It additionally considers the return on funding, like how a lot cash these investments may herald or how they may save prices sooner or later.

The funds additionally appears to be like at alternative ways to finance these investments, whether or not by means of loans, leases, or different choices. It’s all about making sensible choices for the long run, evaluating money movement, and selecting investments that may assist the corporate develop and succeed.

For instance, a rising tech firm may create a 5-year capital funds like this.

- 12 months 1: $200,000 for brand new workplace area

- 12 months 2: $150,000 for server infrastructure

- 12 months 3: $300,000 for customized software program growth

- 12 months 4: $250,000 for growth to second location

- 12 months 5: $100,000 for tools upgrades

Every funding is evaluated primarily based on ROI and depreciation. The corporate may determine to lease the workplace area (decrease upfront value) however purchase the servers outright (higher long-term worth).

Labor Finances

A labor funds helps you propose and handle the prices associated to your workers. It entails determining how a lot your online business will spend on wages, salaries, advantages, and different labor-related bills.

To create a labor funds, contemplate how a lot work must be completed, what number of of us you’ll must get it completed, and the way a lot it will all value. This may help your online business forecast and management labor-related bills and guarantee enough staffing ranges.

For instance, a small design company’s month-to-month labor funds may appear to be this.

- 2 Senior Designers ($90,000/yr every)

- 3 Junior Designers ($60,000/yr every)

- 1 Venture Supervisor ($75,000/yr)

- Advantages & Taxes (30% of salaries): $121,500/yr

- Freelance Finances: $5,000/month

- Coaching & Growth: $2,000/month

This helps the company plan hiring wants and guarantee they’ve sufficient billable hours to cowl labor prices.

Venture Finances

A challenge funds is a monetary plan for a particular challenge.

Let’s say you’ve an thrilling new challenge you need to deal with. A challenge funds showst how a lot cash you’ll want and how one can allocate. It covers all the things from personnel to tools and supplies — principally, something you may must make the challenge occur.

By making a challenge funds, you can also make positive the challenge is doable from a monetary standpoint. It tracks how a lot you deliberate to spend versus how a lot you truly spend as you go alongside.

That means, you’ve a transparent thought of whether or not you’re staying inside funds or if there are any monetary challenges that want consideration.

For instance, right here’s a funds for a web site redesign challenge:

- UI/UX designer: $12,000

- Model advisor: $8,000

- Growth Section: $45,000

- Frontend developer: $25,000

- Backend developer: $20,000

- Content material & Testing: $15,000

- Content material author: $8,000

- QA testing: $7,000

- Buffer for revisions (10%): $8,000

- Complete challenge funds: $88,000 over 3 months

This detailed breakdown helps observe spending at every part and ensures you’ve sufficient buffer for sudden modifications.

The right way to Create a Enterprise Finances

Whereas making a business budget might be simple, the method could also be extra complicated for bigger corporations with a number of income streams and bills.

Regardless of the dimensions of your online business, listed below are the essential steps to making a enterprise funds.

1. Collect monetary knowledge.

Earlier than making a enterprise funds, collect insights out of your previous monetary knowledge. By revenue statements, expense reviews, and gross sales knowledge, you possibly can spot tendencies, be taught from previous experiences, and see the place you possibly can enhance.

Going by means of your monetary historical past paints an correct image of your revenue and bills. So, if you create your funds, you possibly can set achievable targets and ensure your estimates match what’s been taking place in your online business.

In addition to previous financials, contemplate new bills. As an illustration, if your online business needs to strive a brand new advertising and marketing channel, doc your targets for that channel. Afterward, stroll backward to determine how a lot it is advisable obtain these targets and embrace it in your funds.

Professional tip: I all the time maintain my earlier yr’s monetary knowledge in a separate spreadsheet. This makes it simpler to identify tendencies and helps forestall unintended overwrites.

2. Discover a template or make a spreadsheet.

There are numerous free or paid funds templates on-line. You can begin with an present funds template. We record a couple of useful templates beneath.

You may additionally choose to make a spreadsheet with customized rows and columns primarily based on your online business.

3. Fill in revenues.

After you have your template, begin by itemizing all of the sources of your online business’ revenue. A funds plans for the long run, so that you’ll must forecast income streams primarily based on earlier months or years.

For a brand new small enterprise funds, you’ll depend on your market analysis to estimate early income in your firm. When you’re attempting out new channels, think about using trade benchmarks to gauge the anticipated income.

If you estimate your revenue, you are determining how a lot cash you need to work with. This helps you determine the place to allocate your sources and which bills you possibly can fund.

4. Subtract mounted prices for the time interval.

Mounted prices are the recurring prices you’ve every month, quarter, or yr. Examples embrace insurance coverage, lease for workplace area, web site internet hosting, and web. Bear in mind, mounted prices keep comparatively steady, no matter modifications in enterprise exercise. Even when your gross sales lower or manufacturing slows down, these prices stay the identical.

Notice that mounted prices can change over the long run, equivalent to when renegotiating lease agreements or adjusting worker salaries.

5. Think about variable prices.

Variable prices will change occasionally. In contrast to mounted prices, variable costs improve or lower as the extent of manufacturing or gross sales modifications.

Examples embrace uncooked supplies wanted to fabricate your merchandise, packaging and transport prices, utility payments, promoting prices, workplace provides, and new software program or know-how.

You could all the time must pay some variable prices, like utility payments. Nevertheless, you possibly can shift how a lot you spend towards different bills, like promoting prices, when you’ve a lower-than-average estimated revenue.

6. Put aside time for enterprise funds planning.

Sudden bills may come up, otherwise you may need to save to develop your online business. Both means, evaluation your funds after together with all bills, mounted prices, and variable prices.

As soon as accomplished, decide how a lot cash it can save you. It’s clever to create two or extra financial savings accounts to stop overspending. As an illustration, use one for emergencies and the opposite to drive enterprise progress.

7. Conduct funds evaluations.

Each funds requires periodic evaluations. Common evaluations let you understand what’s working and reply to modifications in your monetary outlook.

When reviewing your funds, examine your estimated funds to your precise spend. This lets you understand how to make higher income and expense projections.

There’s no rule stating when it is best to conduct your funds evaluation. Nevertheless, I like to recommend doing it month-to-month, quarterly, and yearly.

- Month-to-month evaluations: Verify your estimated versus precise spend. Search for gadgets whose precise spend surpasses the estimated value. Think about cost-cutting measures for such gadgets when forecasting your bills for the subsequent month.

- Quarterly evaluations: Use this evaluation to determine month-over-month funds estimates and precise spend for 3 months. Use the insights to find out what it is best to spend much less or extra on and forecast higher for the subsequent quarter.

- Yearly evaluations: This evaluation allows you to assess your projections for the yr. In the event that they have been correct, double down on it. If in any other case, replicate on what didn’t work and use what you’ve realized to make higher long-term monetary projections for the subsequent yr.

The right way to Handle a Enterprise Finances

Sensible funds administration separates thriving companies from struggling ones. Probably the most profitable corporations comply with three key methods to remain financially wholesome.

1. Set clear monetary targets and limits.

First, set up particular income targets for every month, quarter, and yr. Based mostly on these targets, assign strict spending limits to every division.

Subsequent, shield your online business by setting apart emergency funds — most specialists suggest three to 6 months of working bills.

Lastly, create separate budgets to steadiness each day operations with long-term progress initiatives.

2. Monitor each greenback (each day or weekly).

As soon as your targets are set, make funds check-ins a part of your each day routine. Throughout these evaluations, fastidiously examine precise spending in opposition to your projections.

To take care of accuracy, file each expense instantly — sure, even that $4 espresso run. Higher but, use software program to routinely seize and categorize transactions, which helps forestall any unwelcome surprises at month’s finish.

3. Analyze and regulate month-to-month.

Overview your month-to-month efficiency to identify patterns in income and spending. When you discover pointless bills, lower them instantly. In the meantime, search for alternatives to safe higher offers on common purchases. Then, use these insights to regulate division budgets primarily based on efficiency.

Most significantly, if you are available in beneath funds, make sensible decisions about saving that extra cash or reinvesting it in progress alternatives.

Why is a funds necessary for a enterprise?

A enterprise funds is your monetary roadmap, exhibiting the place you’re and the place you possibly can afford to go. Your funds prevents monetary surprises by monitoring each greenback coming in and going out. This clear visibility helps you notice and repair money movement issues earlier than they harm your online business.

With this monetary readability, you possibly can flip intestine choices into data-driven decisions. As an illustration, when contemplating a brand new rent or a software program improve, your funds exhibits when you possibly can afford these investments — and when it is best to wait.

Most significantly, constant budgeting builds long-term safety. By planning your financial savings, you may have money reserves prepared for emergencies and alternatives, protecting your online business resilient and prepared for progress.

Greatest Free Enterprise Finances Templates

After testing dozens of funds templates over time, I’ve discovered these seven to be probably the most user-friendly and adaptable for various enterprise wants.

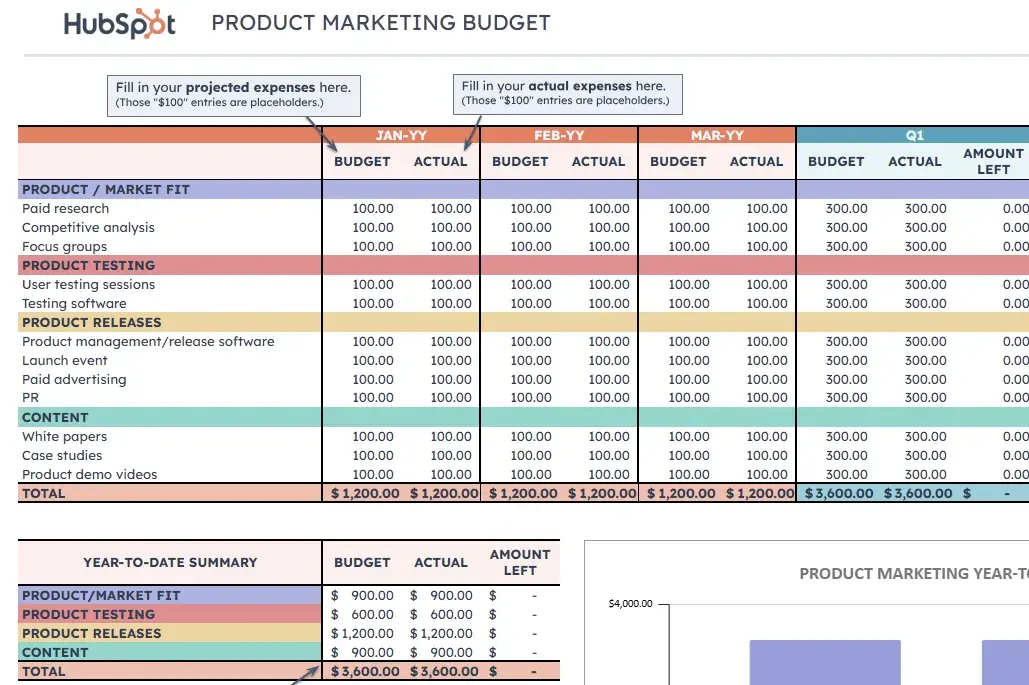

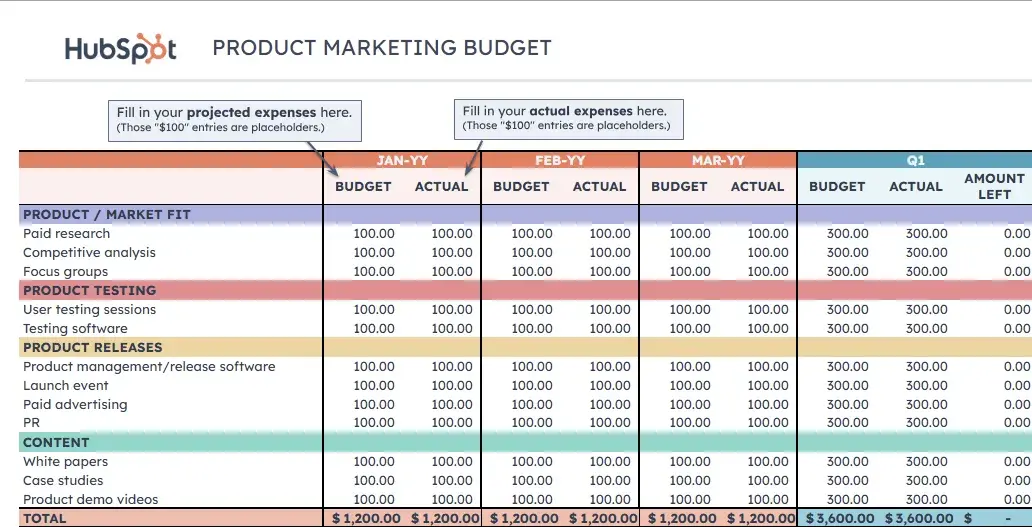

1. Marketing Budget Template

Greatest for: Firms executing a number of initiatives throughout a number of advertising and marketing channels

Understanding how to manage a marketing budget could be a problem, however with useful free templates like this marketing budget template bundle, you possibly can observe all the things from promoting bills to occasions and extra.

I like this bundle as a result of it’s complete and has eight free enterprise funds templates. There are templates for:

- Branding and inventive funds.

- Product advertising and marketing funds.

- Paid promoting funds.

- Public relations funds.

- Net design funds.

- Content material funds.

- Occasion funds.

The grasp funds template brings all the things collectively and serves as your single supply of fact. It consolidates the completely different budgets into an enormous, company-wide funds sheet. Having a particular template for every initiative helps groups observe spending and plan for progress.

2. Project Budget Template

Greatest for: In-house groups looking for buy-in for complicated tasks

Each new challenge comes with bills. This free business budget template will assist your workforce calculate the whole value when you enter your labor, materials, and glued prices. You may simply spot in case you’re over funds halfway by means of a challenge so you possibly can regulate.

This template is very helpful for small corporations which can be reporting budgets to shoppers and for in-house groups getting buy-in for complicated tasks.

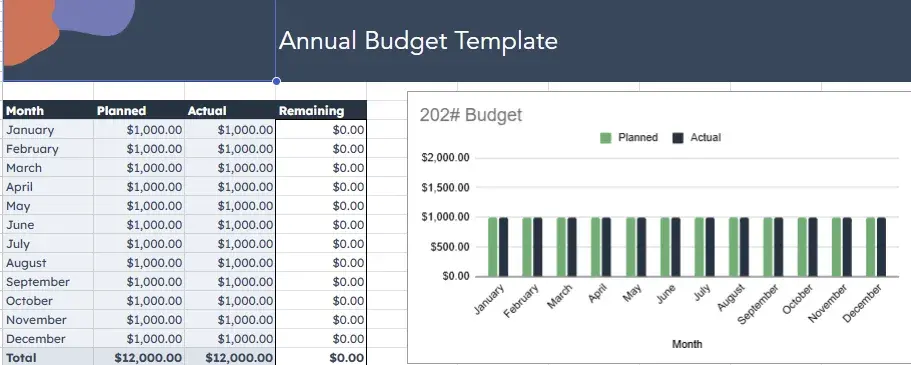

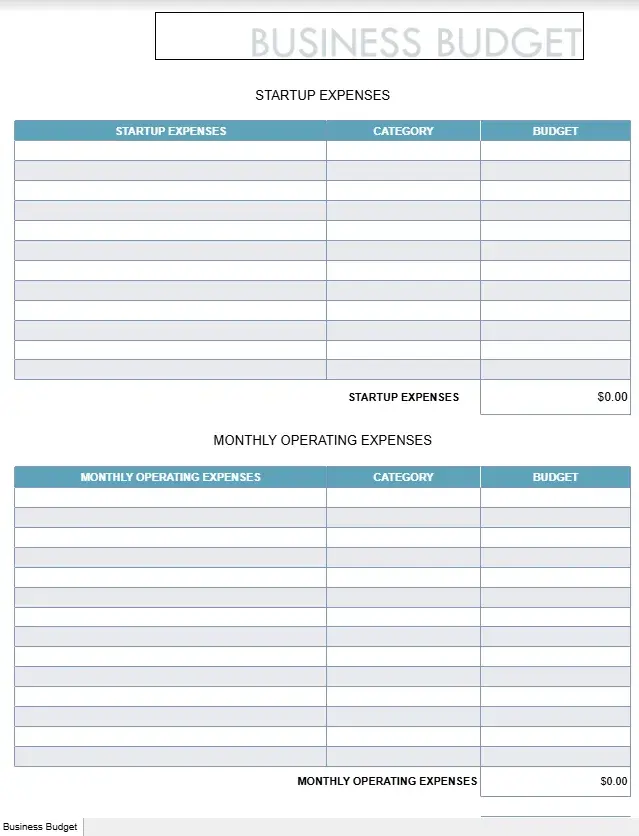

3. Free Business Budget Template

Greatest for: Companies of every type executing a minimal variety of initiatives

Generally, chances are you’ll must doc a easy funds for a couple of initiatives. In such circumstances, this free business budget template, which works in Google Sheets and Excel, could also be supreme. I like the concept of Google Sheets as a result of it lets others collaborate and touch upon the funds.

These enterprise funds templates function cells for getting into your bills, class, and funds. Afterward, the spreadsheet makes use of the info to create your complete estimated funds.

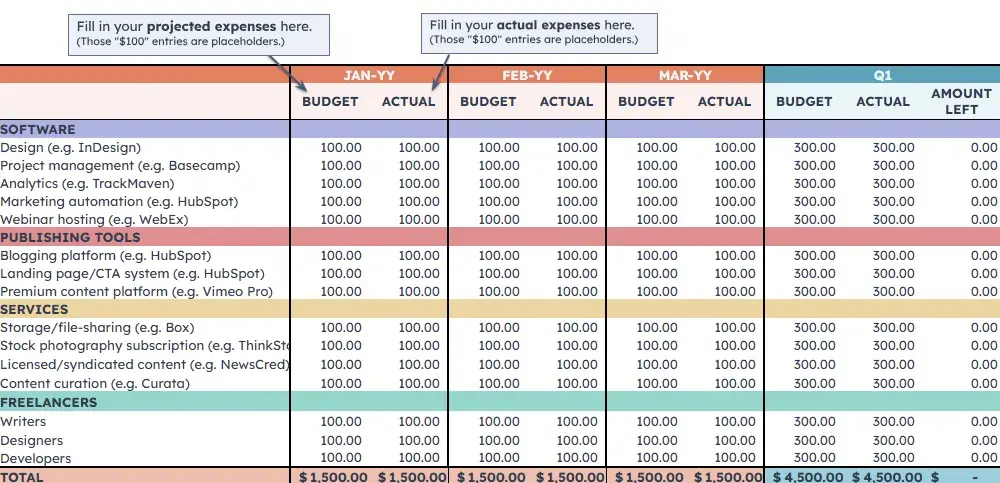

4. Content Budget Template

Greatest for: Content material advertising and marketing groups and companies managing a number of content material sorts

This template helps you propose and observe bills throughout your content material advertising and marketing initiatives. From weblog posts to movies, you may know precisely the place your content material funds goes.

The template consists of devoted sections for:

- Freelancer funds.

- Providers (e.g., storage, inventory photographs, and so forth.).

- Publishing instruments (e.g., HubSpot).

- Software program (e.g., Basecampe and Indesign).

Breaking down content material prices this manner helps you determine which content material sorts ship the very best ROI and the place you could be overspending.

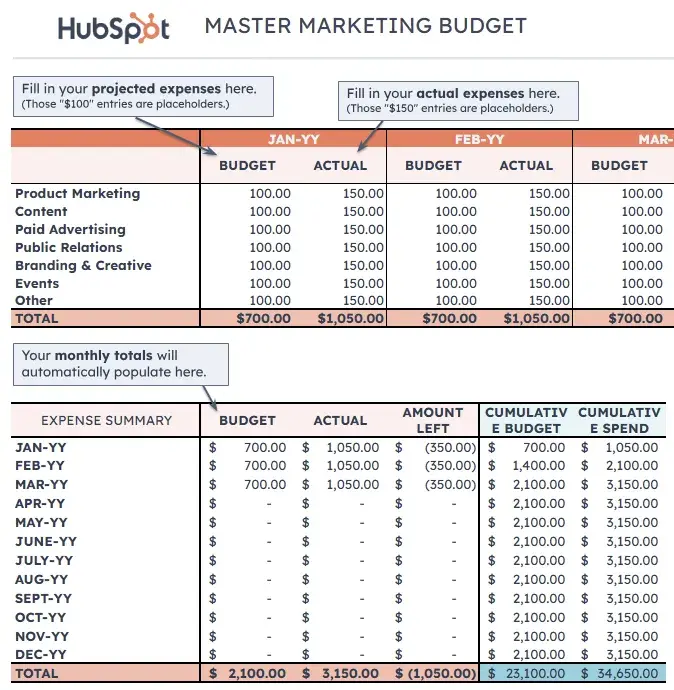

5. Master Marketing Budget Template

Greatest for: Advertising administrators managing a number of campaigns and channels

This complete template brings all of your advertising and marketing bills into one view. It is good for companies working a number of campaigns throughout completely different channels.

The grasp advertising and marketing funds template helps you:

- Monitor spending throughout all advertising and marketing initiatives.

- Examine channel efficiency.

- Modify budgets primarily based on ROI.

- Plan future advertising and marketing investments.

This big-picture view of your advertising and marketing spend helps you make smarter choices about funds allocation throughout channels.

6. Paid Advertising Budget Template

Greatest for: Digital entrepreneurs managing a number of advert platforms

Maintain observe of your promoting spend throughout Google Advertisements, social media, and different platforms. This template helps you optimize your advert spend and enhance ROI.

Key options embrace:

- Platform-specific funds monitoring.

- Marketing campaign efficiency metrics.

- ROI calculations.

- Month-to-month and quarterly comparisons.

With these metrics at hand, you possibly can shortly spot which advert platforms are value your funding and which want adjustment.

7. Event Budget Template

Greatest for: Occasion planners and advertising and marketing groups organizing enterprise occasions

Whether or not you are planning a product launch or trade convention, this template helps you handle each occasion expense.

It tracks prices for:

- Venue and tools.

- Catering and refreshments.

- Speaker charges.

- Advertising supplies.

- Workers.

- Promotion.

- Miscellaneous gadgets (e.g., title tags and swag baggage).

It additionally features a visible pie chart to see how your cash is cut up, making it simple to identify the place your occasion funds goes and the place you may want to regulate.

The right way to Use a Enterprise Finances Template

Getting began with a enterprise funds template is simple if you comply with these key steps.

1. Arrange your template.

Start by downloading your chosen template and taking time to grasp its construction. You may discover pattern knowledge exhibiting how the template works — that is your information for correct knowledge entry.

Take away these instance figures, however watch out to protect the underlying formulation that make the template work. Most templates embrace a number of sheets or sections, so familiarize your self with how they join earlier than including your knowledge.

Professional tip: I all the time make a backup copy of any template earlier than eradicating instance knowledge. This offers me a clear reference level if I must test the unique formulation later.

2. Enter your revenue sources.

Begin along with your income streams. Enter your major revenue first, equivalent to product gross sales or service charges. Then, add secondary revenue, equivalent to affiliate income or promoting revenue.

Be conservative along with your estimates — it is higher to underestimate revenue barely than to overproject and fall brief. Make sure that to doc any seasonal patterns or irregular revenue so you possibly can plan accordingly.

3. Add your bills.

Sort out your bills methodically, beginning with mounted prices like lease and salaries. These are best to challenge since they not often change.

Subsequent, add variable bills, equivalent to provides and advertising and marketing prices. However pay particular consideration to bills that fluctuate seasonally. And remember to incorporate irregular bills like annual software program subscriptions or quarterly tax funds.

The extra detailed you’re right here, the extra correct your funds will probably be.

4. Overview and regulate month-to-month.

Month-to-month evaluations maintain your funds correct and helpful. So, put aside time every month to check your projected figures in opposition to precise spending and revenue.

Search for patterns and examine any important variances. Then, use this info to refine subsequent month’s projections. When you constantly over or underestimate sure classes, regulate your future projections accordingly.

5. Use the analytics options.

Most templates embrace built-in analytics that reveal necessary insights about your online business. Examine the graphs and charts to grasp spending patterns and determine potential issues earlier than they change into critical.

Additionally, take note of tendencies in your money movement and search for alternatives to scale back prices or improve effectivity. These visible instruments may help you clarify funds choices to stakeholders or workforce members.

6. Maintain recording.

Doc all the things as you go — small bills add up shortly and are simple to neglect. Create a easy system for storing receipts and recording transactions instantly.

If you spot uncommon bills or windfalls, add notes explaining them. This context turns into invaluable throughout future planning. Overview your funds classes quarterly to make sure they nonetheless match your online business wants. Do not hesitate to regulate them if your online business mannequin modifications.

Create a Enterprise Finances to Assist Your Firm Develop

Creating your first enterprise funds is less complicated than you may suppose. Decide a template that matches your online business wants, add your numbers, and also you’re in your technique to higher monetary choices.

The toughest half is getting began — and these enterprise funds templates make that simple. Select one and take step one towards rising your online business.

Editor’s be aware: This publish was initially printed in September 2021 and has been up to date for comprehensiveness.