- Bitcoin value projections revealed a variety of $145k to $249k by 2025

- CryptoQuant’s evaluation linked BTC progress to realized cap and declining miner reserves

Bitcoin [BTC] traders could also be an explosive market by 2025, with new knowledge revealing potential value targets that would push BTC into uncharted territory. With projections displaying Bitcoin’s market cap hitting practically $5 trillion underneath optimum situations, the query is not ‘if’ however ‘how excessive?’

The newest insights come from Ki Young Ju, Founder and CEO of Cryptoquant. He shared a variety of attainable outcomes for Bitcoin’s realized cap progress. These situations counsel BTC might skyrocket to as a lot as $249,000 by 2025, with a conservative estimate nonetheless putting the cryptocurrency’s value at $145,000.

An summary of core insights

CryptoQuant’s mannequin presents three Bitcoin situations for 2025, based mostly on realized cap progress and market multipliers. Within the “higher” situation, a $520 billion realized cap progress, multiplied by six, would push Bitcoin’s market cap to $4.969 trillion and its value to $249,000.

Whereas the chart simplified these situations, the implications are profound.

The “higher” goal assumes a continuation of institutional adoption, bolstered by the incoming pro-crypto U.S administration and robust capital inflows. At $197,000 within the mid-tier situation, Bitcoin would nonetheless be a standout performer in monetary markets, reflecting regular progress even in a reasonably bullish local weather.

The conservative projection, with a $145,000 goal, highlights Bitcoin’s resilience and skill to retain investor curiosity regardless of potential macroeconomic headwinds.

Analyzing key metrics

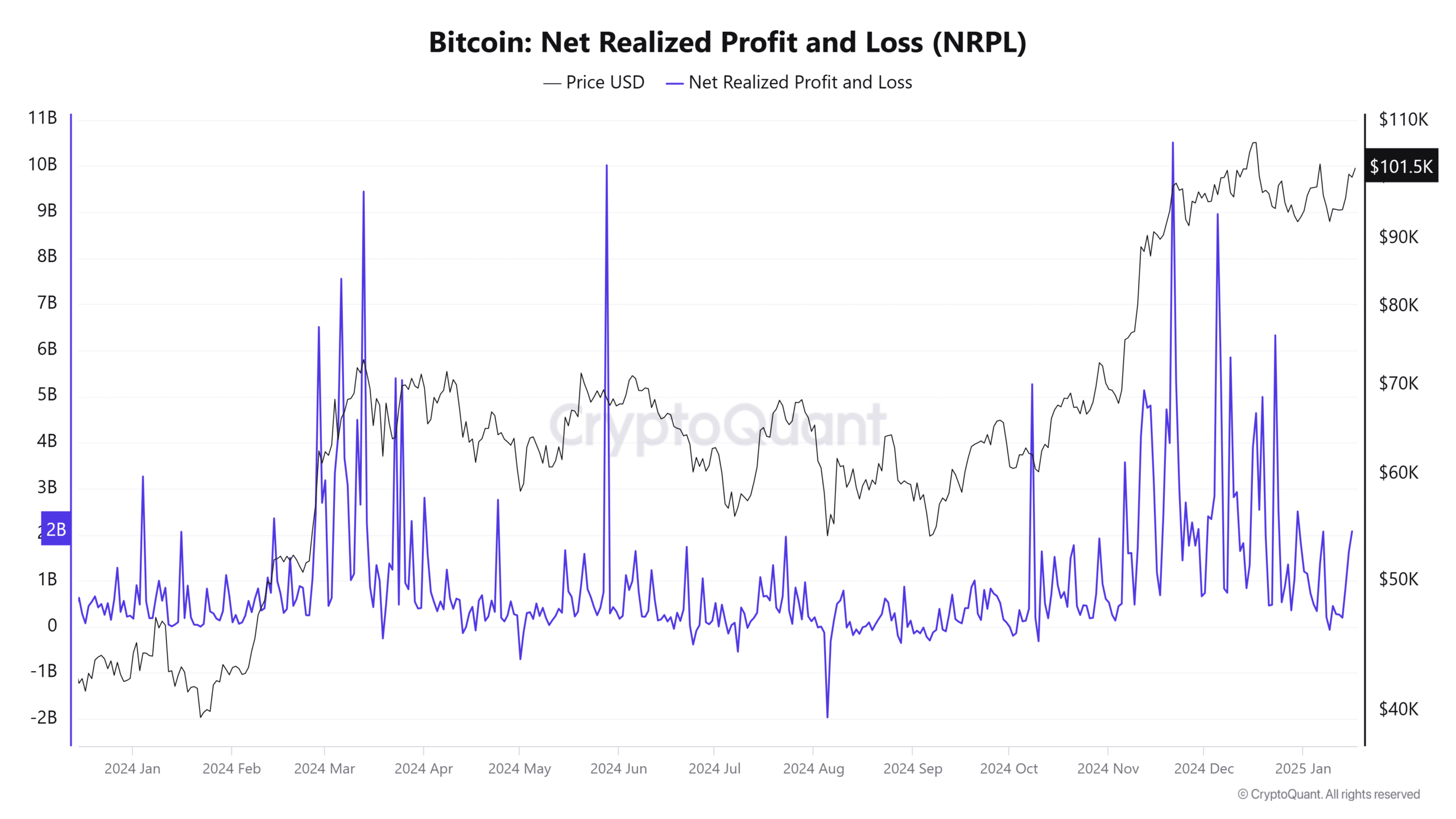

At press time, the Web Realized Revenue and Loss indicated heightened profit-taking throughout Bitcoin’s rallies, displaying sturdy market confidence at increased value ranges.

Spikes in NRPL typically correspond with new peaks in BTC’s value, signaling strong investor participation.

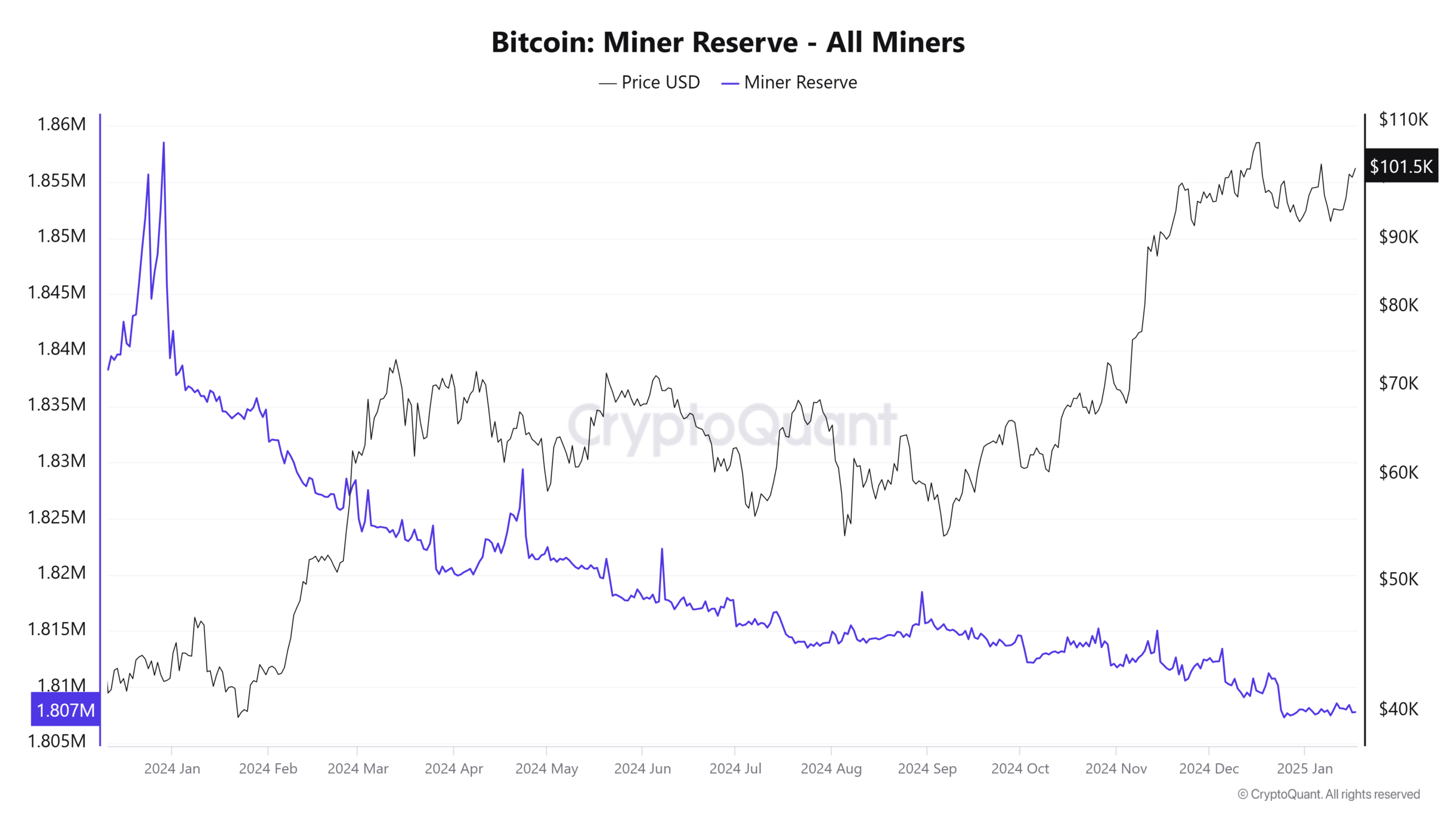

Concurrently, the decline in miner reserves highlighted supply-side constraints as miners more and more liquidate holdings, doubtless in anticipation of upper costs. This declining pattern in reserves aligns with a fall in promoting stress, creating a positive atmosphere for upward value momentum.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

Comparability to previous cycles

Bitcoin’s historic bull runs in 2017 and 2021 revealed a sample of exponential progress pushed by adoption cycles and macroeconomic elements. The 2017 peak of $20,000 marked Bitcoin’s emergence as a speculative asset, fueled by retail euphoria. In distinction, the 2021 peak of $69,000 was characterised by institutional adoption, widespread acceptance of crypto as an asset class, and narratives surrounding inflation hedging.

CryptoQuant’s 2025 projections counsel the following progress part might surpass prior cycles in scale and maturity. The higher goal of $249,000 is in keeping with Bitcoin’s long-term logarithmic progress curve and displays growing shortage, amplified by halving occasions and constrained miner reserves.

In contrast to previous cycles, the 2025 trajectory hinges on structural shifts – just like the anticipated pro-crypto rules and capital inflows by way of ETFs – which will drive sustained demand.