- Knowledge indicated that BTC is now in an oversold area, which might sign an imminent worth rebound

- Whole provide in revenue revealed that BTC isn’t but on the cycle’s low, leaving room for a major upward transfer

Market sentiment has been regularly turning bullish. In actual fact, over the past 24 hours, Bitcoin has gained by 2.57%, pushing its worth to roughly $97,500 at press time. Nevertheless, this worth leap isn’t absolutely supported by market momentum, with the identical falling by 23.23% inside the similar interval.

A broader market evaluation primarily based on historic tendencies underlined the potential for additional progress. What this implies is that BTC should still have the chance to set a brand new all-time excessive within the coming weeks.

An ‘undervalued’ place

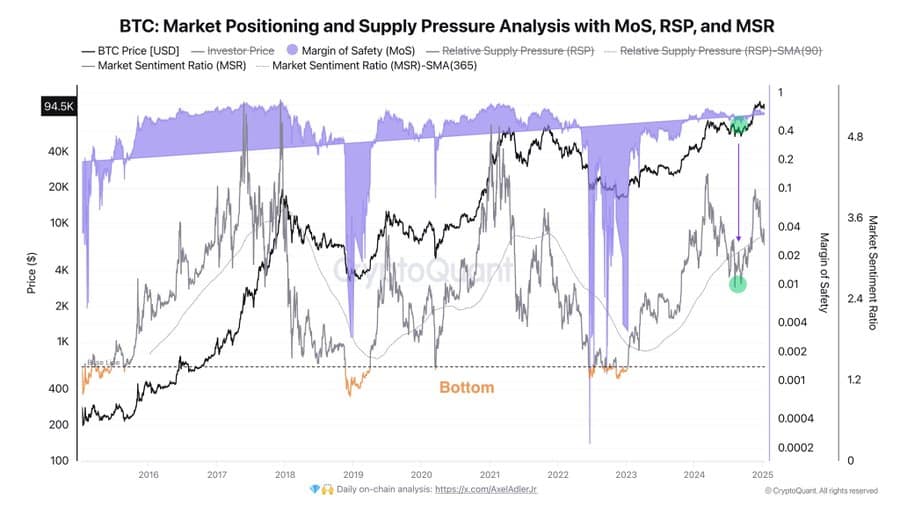

Knowledge from CryptoQuant’s Market Place and Provide Strain metrics urged that Bitcoin (BTC) could also be undervalued. This evaluation relies on the Margin of Security (MoS) and Market Sentiment Ratio (MSR) indicators.

The Margin of Security (MoS) evaluates whether or not BTC is overvalued or oversold relative to a crucial baseline. When the MoS tendencies above this line, it signifies overvaluation, whereas a place under suggests the asset is undervalued.

On the time of writing, the MoS (represented by the purple cloud) was trending under the baseline, valued close to the $90,000-zone (baseline). This implied that BTC is now in an oversold place – An indication {that a} rally could also be arising subsequent.

Equally, the Market Sentiment Ratio (MSR) measures the extent of optimism or pessimism out there by evaluating its worth to the yearly Easy Shifting Common (SMA). On the time of writing, it had a studying of at 1.4.

A worth above the SMA signifies prevailing optimism, whereas a worth under displays market pessimism. Press time knowledge revealed that the MSR was under the yearly SMA – An indication of pessimistic sentiment.

Traditionally, as indicated by inexperienced dots on CryptoQuant’s chart, every time the MoS falls under the baseline and the MSR tendencies under the yearly SMA, these circumstances current a powerful shopping for alternative. In such circumstances, BTC has typically seen vital rallies on the charts.

The identical sample appears to be forming now out there – An indication that BTC could possibly be prepared for an additional uptrend.

Removed from the market prime?

Knowledge from Glassnode’s Whole Provide of Bitcoin in Revenue, a key metric for figuring out BTC’s cyclical tops and bottoms, urged that Bitcoin remains to be removed from reaching its market prime.

In accordance with the identical, BTC has not but touched the crimson trendline, which traditionally marks these crucial ranges.

If BTC touches this crimson trendline, it might imply {that a} majority of the holders are in revenue. Traditionally, such situations have triggered main market sell-offs. Particularly as merchants start to understand earnings, exerting downward stress on the value.

Proper now, BTC stays effectively above this trendline, indicating a good place for additional rallying as addresses holding this provide are incentivized to proceed holding in anticipation of upper good points.

Change netflows’ findings

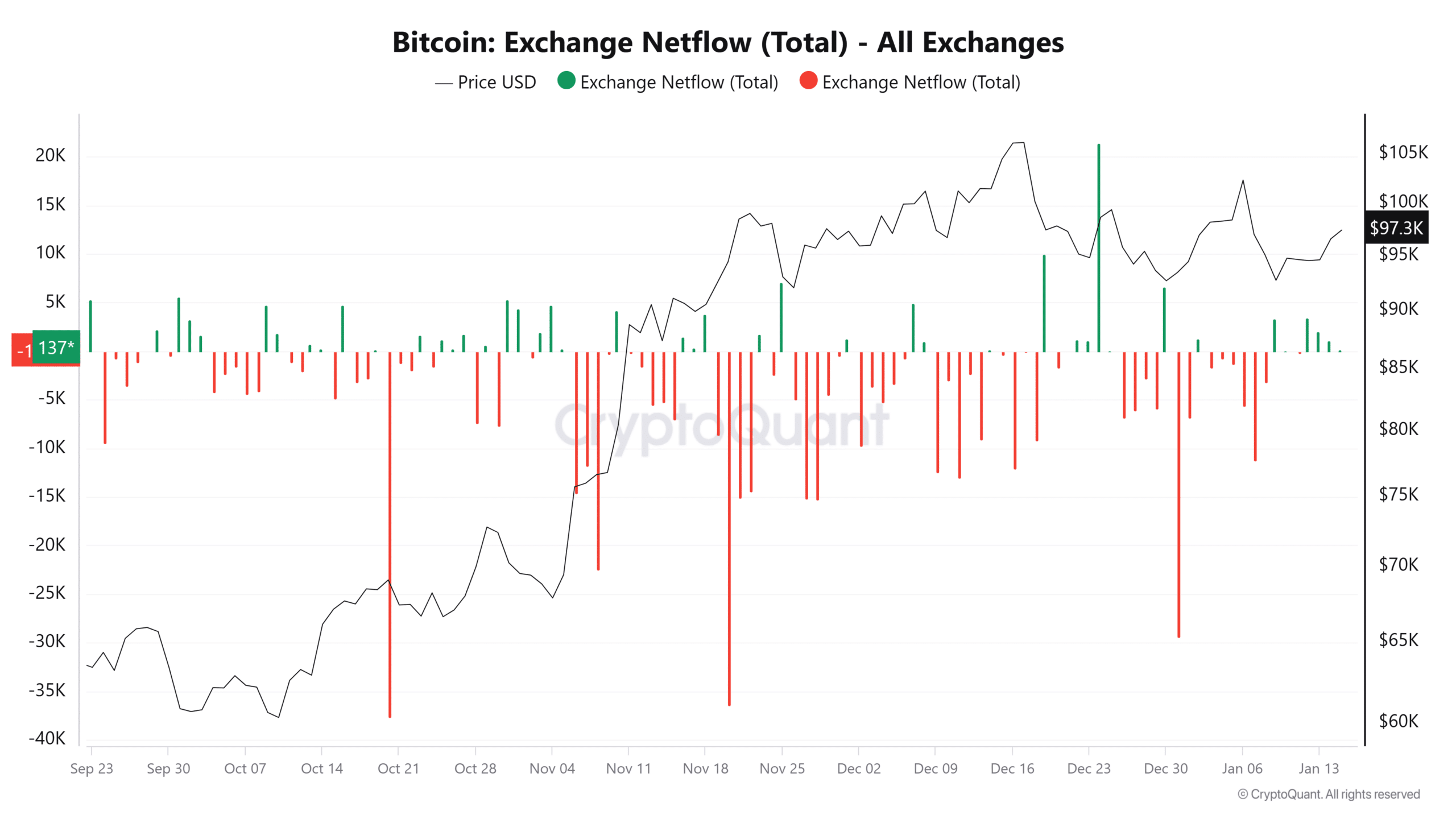

Lastly, change netflows revealed that there was a constant decline in change netflow from 12 January – Dropping considerably from roughly 3,431.69 BTC to only 137 BTC.

A sustained decline in netflow means diminished promoting stress, as extra traders transfer their BTC off exchanges into non-public wallets. This conduct might be interpreted to imply rising conviction amongst holders.

If the change netflow turns damaging, it might imply that spot merchants are more and more assured – A sentiment that traditionally correlates with a higher BTC price.

Merely put, BTC stays in a powerful place to maintain its upward rally, supported by diminishing promoting stress and rising market confidence.

- Knowledge indicated that BTC is now in an oversold area, which might sign an imminent worth rebound

- Whole provide in revenue revealed that BTC isn’t but on the cycle’s low, leaving room for a major upward transfer

Market sentiment has been regularly turning bullish. In actual fact, over the past 24 hours, Bitcoin has gained by 2.57%, pushing its worth to roughly $97,500 at press time. Nevertheless, this worth leap isn’t absolutely supported by market momentum, with the identical falling by 23.23% inside the similar interval.

A broader market evaluation primarily based on historic tendencies underlined the potential for additional progress. What this implies is that BTC should still have the chance to set a brand new all-time excessive within the coming weeks.

An ‘undervalued’ place

Knowledge from CryptoQuant’s Market Place and Provide Strain metrics urged that Bitcoin (BTC) could also be undervalued. This evaluation relies on the Margin of Security (MoS) and Market Sentiment Ratio (MSR) indicators.

The Margin of Security (MoS) evaluates whether or not BTC is overvalued or oversold relative to a crucial baseline. When the MoS tendencies above this line, it signifies overvaluation, whereas a place under suggests the asset is undervalued.

On the time of writing, the MoS (represented by the purple cloud) was trending under the baseline, valued close to the $90,000-zone (baseline). This implied that BTC is now in an oversold place – An indication {that a} rally could also be arising subsequent.

Equally, the Market Sentiment Ratio (MSR) measures the extent of optimism or pessimism out there by evaluating its worth to the yearly Easy Shifting Common (SMA). On the time of writing, it had a studying of at 1.4.

A worth above the SMA signifies prevailing optimism, whereas a worth under displays market pessimism. Press time knowledge revealed that the MSR was under the yearly SMA – An indication of pessimistic sentiment.

Traditionally, as indicated by inexperienced dots on CryptoQuant’s chart, every time the MoS falls under the baseline and the MSR tendencies under the yearly SMA, these circumstances current a powerful shopping for alternative. In such circumstances, BTC has typically seen vital rallies on the charts.

The identical sample appears to be forming now out there – An indication that BTC could possibly be prepared for an additional uptrend.

Removed from the market prime?

Knowledge from Glassnode’s Whole Provide of Bitcoin in Revenue, a key metric for figuring out BTC’s cyclical tops and bottoms, urged that Bitcoin remains to be removed from reaching its market prime.

In accordance with the identical, BTC has not but touched the crimson trendline, which traditionally marks these crucial ranges.

If BTC touches this crimson trendline, it might imply {that a} majority of the holders are in revenue. Traditionally, such situations have triggered main market sell-offs. Particularly as merchants start to understand earnings, exerting downward stress on the value.

Proper now, BTC stays effectively above this trendline, indicating a good place for additional rallying as addresses holding this provide are incentivized to proceed holding in anticipation of upper good points.

Change netflows’ findings

Lastly, change netflows revealed that there was a constant decline in change netflow from 12 January – Dropping considerably from roughly 3,431.69 BTC to only 137 BTC.

A sustained decline in netflow means diminished promoting stress, as extra traders transfer their BTC off exchanges into non-public wallets. This conduct might be interpreted to imply rising conviction amongst holders.

If the change netflow turns damaging, it might imply that spot merchants are more and more assured – A sentiment that traditionally correlates with a higher BTC price.

Merely put, BTC stays in a powerful place to maintain its upward rally, supported by diminishing promoting stress and rising market confidence.