Crypto analyst Master Kenobi has recognized a bullish sample for the Bitcoin value, which is analogous to at least one that was noticed within the earlier bull cycle. Primarily based on this sample, the analyst defined why the Bitcoin value might rally to as excessive as $169,000 on this cycle.

Bitcoin Value Might Rally To $169,000 As Fractal Sample Seems

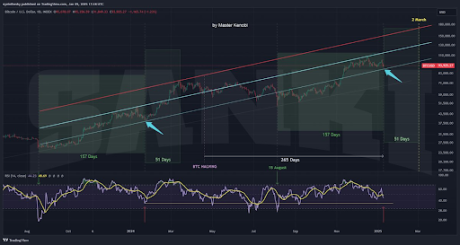

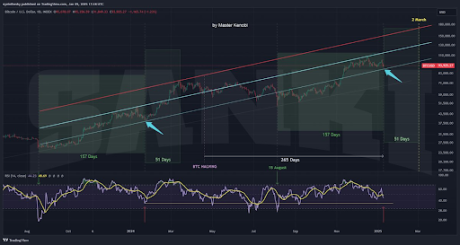

In an X post, Grasp Kenobi predicted that the Bitcoin value might rally to $169,000 as an analogous fractal sample from the earlier bull cycle is once more unfolding. The analyst famous that every day Relative Strength Index (RSI) measurements point out that this fractal section lasted 157 days final yr.

Associated Studying

Grasp Kenobi additional remarked that the Bitcoin value replicates this 157-day sequence for the present interval, then this fractal section started on August 5, 2024, and ended yesterday. Subsequently, in response to the fractal, this bullish phase ought to start at the moment. The crypto analyst added that the precise length of this bullish interval can’t be decided. Nevertheless, after the 157-day fractal final yr, Bitcoin entered a 51-day rally.

Consistent with this, he asserted that if the Bitcoin value follows the identical sample this yr, the rally might finish on March 2, with BTC reaching $169,000 by then. Grasp Kenobi additionally went additional to investigate the charts. The crypto analyst talked about that the accompanying chart has been barely adjusted, with trendlines now originating from the peaks reached through the cycle.

For symmetry and extra affirmation of historical past repeating itself, the crypto analyst remarked that it could be best if the Bitcoin value motion closes close to the pattern line that aligns with the identical zone from final yr. Though this isn’t important, he defined that such a detailed would strengthen the fractal’s alignment. If this situation unfolds, Grasp Kenobi warned that BTC might first fall to between $88,000 and $89,000.

In the meantime, the crypto analyst famous that the variety of days on this cycle is probably not equivalent to final yr and will prolong barely longer. This may enable adequate time for the BTC value to succeed in its goal alongside each the pattern line and the horizontal yellow RSI line.

BTC Bull Market Nonetheless Intact

In an X submit, crypto analyst Titan of Crypto affirmed that the Bitcoin value bull market continues to be intact. He revealed that this bullish momentum will proceed so long as Bitcoin maintains a month-to-month shut above the 38.2% Fibonacci retracement degree.

Associated Studying

The Bitcoin value has been on a downtrend since December final yr and not too long ago crashed below $93,000. Nevertheless, Titan of Crypto instructed that this wasn’t misplaced. He famous that BTC surged by 120% from August to December. As such, the crypto analyst defined {that a} correction is pure because the market digests this rally.

On the time of writing, the Bitcoin value is buying and selling at round $94,000, down within the final 24 hours, in response to data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com

Crypto analyst Master Kenobi has recognized a bullish sample for the Bitcoin value, which is analogous to at least one that was noticed within the earlier bull cycle. Primarily based on this sample, the analyst defined why the Bitcoin value might rally to as excessive as $169,000 on this cycle.

Bitcoin Value Might Rally To $169,000 As Fractal Sample Seems

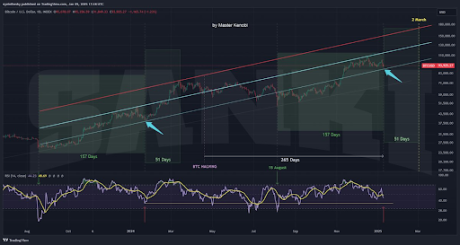

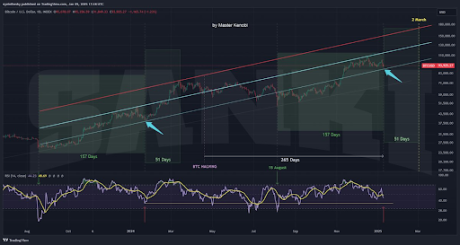

In an X post, Grasp Kenobi predicted that the Bitcoin value might rally to $169,000 as an analogous fractal sample from the earlier bull cycle is once more unfolding. The analyst famous that every day Relative Strength Index (RSI) measurements point out that this fractal section lasted 157 days final yr.

Associated Studying

Grasp Kenobi additional remarked that the Bitcoin value replicates this 157-day sequence for the present interval, then this fractal section started on August 5, 2024, and ended yesterday. Subsequently, in response to the fractal, this bullish phase ought to start at the moment. The crypto analyst added that the precise length of this bullish interval can’t be decided. Nevertheless, after the 157-day fractal final yr, Bitcoin entered a 51-day rally.

Consistent with this, he asserted that if the Bitcoin value follows the identical sample this yr, the rally might finish on March 2, with BTC reaching $169,000 by then. Grasp Kenobi additionally went additional to investigate the charts. The crypto analyst talked about that the accompanying chart has been barely adjusted, with trendlines now originating from the peaks reached through the cycle.

For symmetry and extra affirmation of historical past repeating itself, the crypto analyst remarked that it could be best if the Bitcoin value motion closes close to the pattern line that aligns with the identical zone from final yr. Though this isn’t important, he defined that such a detailed would strengthen the fractal’s alignment. If this situation unfolds, Grasp Kenobi warned that BTC might first fall to between $88,000 and $89,000.

In the meantime, the crypto analyst famous that the variety of days on this cycle is probably not equivalent to final yr and will prolong barely longer. This may enable adequate time for the BTC value to succeed in its goal alongside each the pattern line and the horizontal yellow RSI line.

BTC Bull Market Nonetheless Intact

In an X submit, crypto analyst Titan of Crypto affirmed that the Bitcoin value bull market continues to be intact. He revealed that this bullish momentum will proceed so long as Bitcoin maintains a month-to-month shut above the 38.2% Fibonacci retracement degree.

Associated Studying

The Bitcoin value has been on a downtrend since December final yr and not too long ago crashed below $93,000. Nevertheless, Titan of Crypto instructed that this wasn’t misplaced. He famous that BTC surged by 120% from August to December. As such, the crypto analyst defined {that a} correction is pure because the market digests this rally.

On the time of writing, the Bitcoin value is buying and selling at round $94,000, down within the final 24 hours, in response to data from CoinMarketCap.

Featured picture created with Dall.E, chart from Tradingview.com