- The current weak sentiment was marked by prolonged Binance stablecoin outflows.

- USDT dominance additionally spiked as buyers opted to protect capital as markets tanked.

This week’s risk-off sentiment has unnerved some crypto buyers, forcing most to lock-in revenue or opt-out altogether to protect capital.

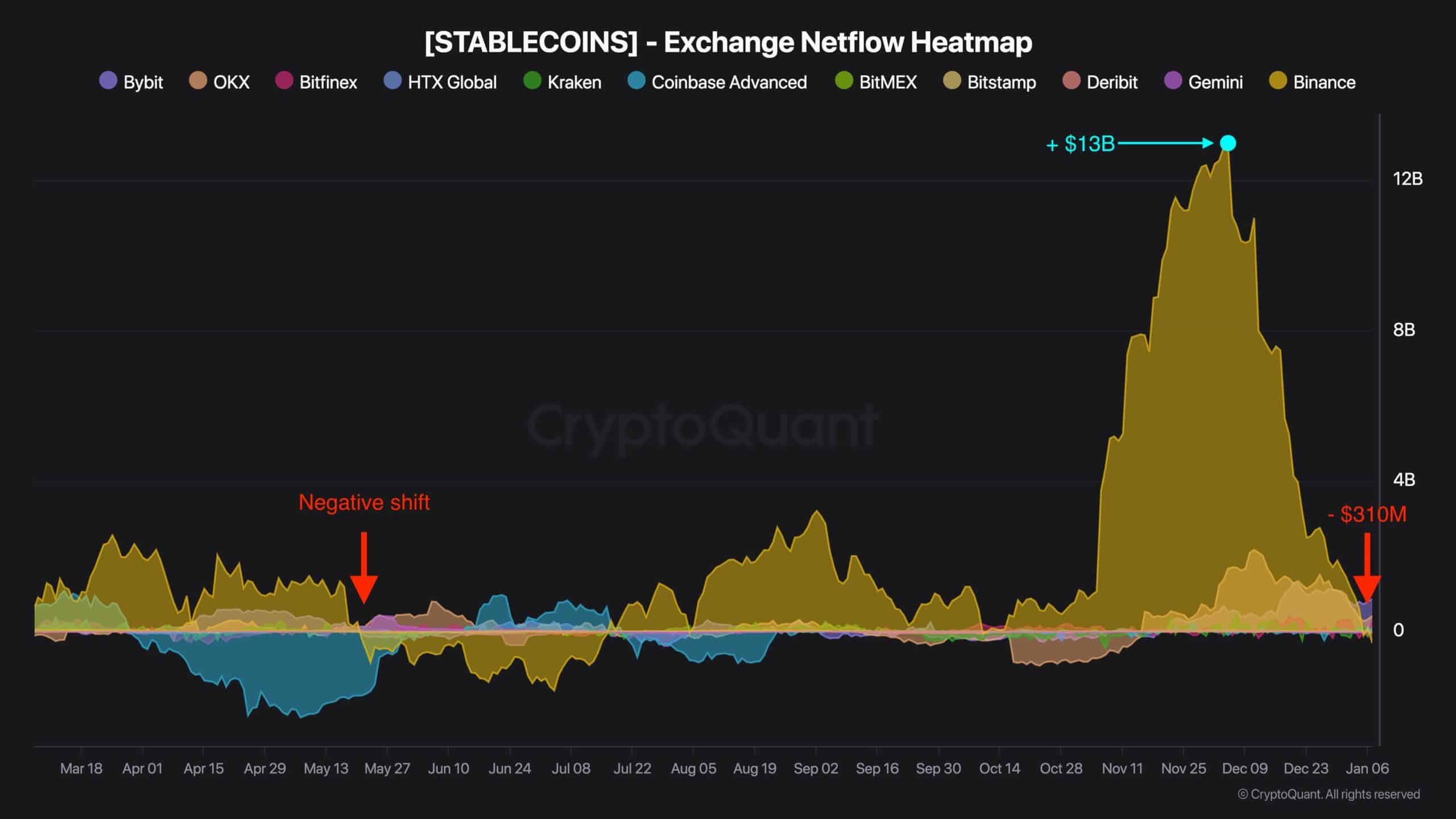

In keeping with pseudonymous CryptoQuant analyst Darkish Fost, the reversal of Binance stablecoins from a +$13B influx in November to report an outflow of $310M in early January, mirrored final summer time’s BTC market hunch.

He stated,

“We’re at the moment witnessing a reversal in stablecoin stream dynamics on Binance. This sort of development reversal was final noticed in Could 2024, proper earlier than Bitcoin’s sharp worth decline in the course of the summer time.”

Bitcoin market on edge

Fost added {that a} lukewarm stablecoin influx sometimes signifies weak shopping for power.

Nevertheless, he warned that persistent outflows, as seen since mid-December, underscored market warning and will dent the Bitcoin [BTC] outlook.

“Whereas a discount in stablecoin inflows indicators weakening a shopping for strain, outright stablecoin outflows point out a extra vital market shift, with buyers leaning towards warning.”

The weak market sentiment was triggered by sticky U.S. inflation, reinforcing the Fed’s gradual fee reduce path, which might stall risk-on property.

Moreover, hawkish FOMC Minutes and information of the U.S. authorities reportedly getting approval to promote seized BTC from Silk Highway muted market optimism.

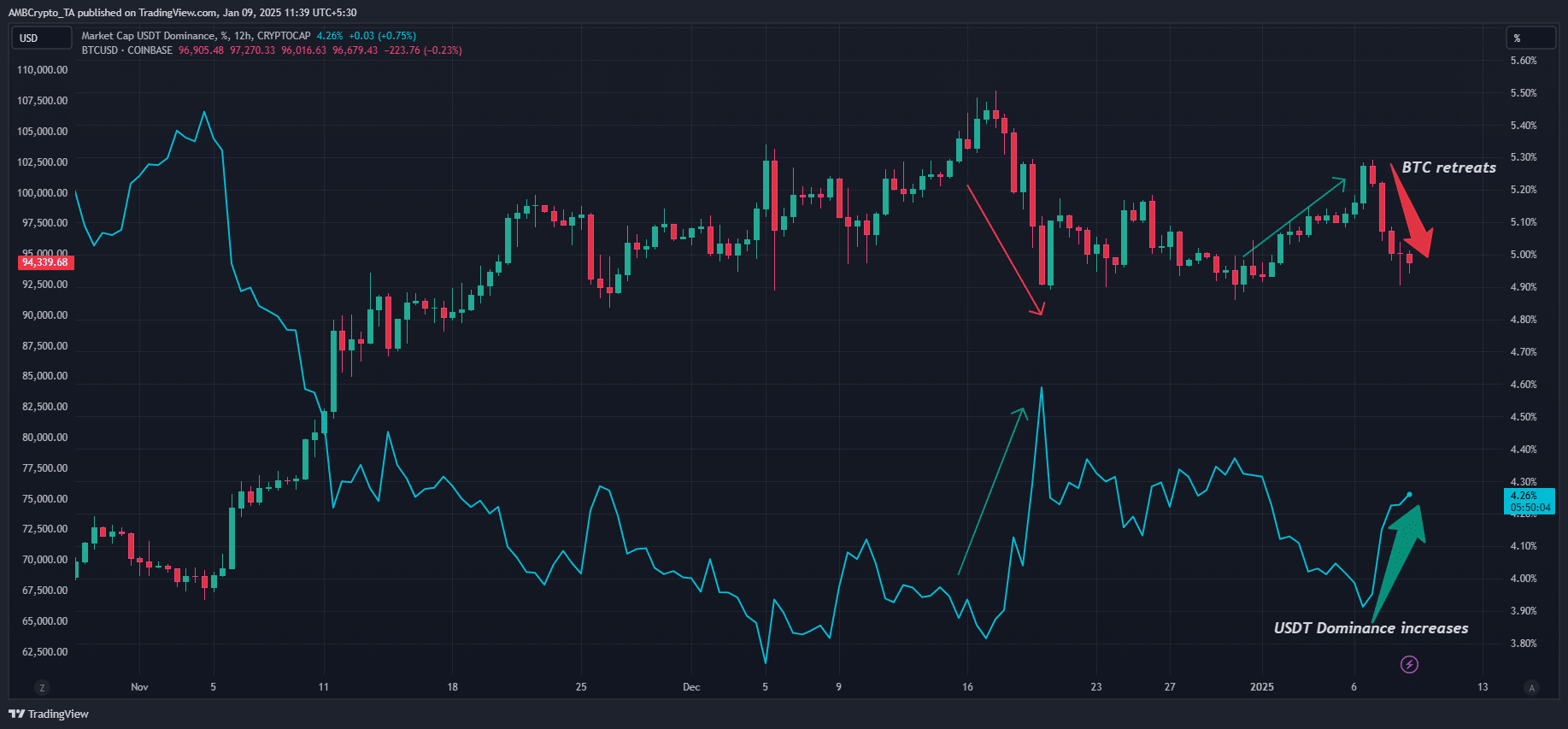

The rising Tether (USDT) dominance additionally confirmed Darkish Fost considerations. The indicator is inversely correlated with BTC worth, and the current spikes marked the native high at $108K and $102K.

In actual fact, some analysts, like Peter Brandt, beforehand warned that BTC’s inverted head-and-shoulder sample might drag it to $75K ranges if it breaks under $90K.

Whether or not the USDT dominance will high out once more above 4% and permit BTC to rebound stays unsure.

Nevertheless, Benjamin Cowen and CoinDesk’s senior analyst James Van Straten downplayed the current BTC decline as a typical January pullback in the course of the post-halving yr.

At press time, the asset tried to stabilize above $94K.

- The current weak sentiment was marked by prolonged Binance stablecoin outflows.

- USDT dominance additionally spiked as buyers opted to protect capital as markets tanked.

This week’s risk-off sentiment has unnerved some crypto buyers, forcing most to lock-in revenue or opt-out altogether to protect capital.

In keeping with pseudonymous CryptoQuant analyst Darkish Fost, the reversal of Binance stablecoins from a +$13B influx in November to report an outflow of $310M in early January, mirrored final summer time’s BTC market hunch.

He stated,

“We’re at the moment witnessing a reversal in stablecoin stream dynamics on Binance. This sort of development reversal was final noticed in Could 2024, proper earlier than Bitcoin’s sharp worth decline in the course of the summer time.”

Bitcoin market on edge

Fost added {that a} lukewarm stablecoin influx sometimes signifies weak shopping for power.

Nevertheless, he warned that persistent outflows, as seen since mid-December, underscored market warning and will dent the Bitcoin [BTC] outlook.

“Whereas a discount in stablecoin inflows indicators weakening a shopping for strain, outright stablecoin outflows point out a extra vital market shift, with buyers leaning towards warning.”

The weak market sentiment was triggered by sticky U.S. inflation, reinforcing the Fed’s gradual fee reduce path, which might stall risk-on property.

Moreover, hawkish FOMC Minutes and information of the U.S. authorities reportedly getting approval to promote seized BTC from Silk Highway muted market optimism.

The rising Tether (USDT) dominance additionally confirmed Darkish Fost considerations. The indicator is inversely correlated with BTC worth, and the current spikes marked the native high at $108K and $102K.

In actual fact, some analysts, like Peter Brandt, beforehand warned that BTC’s inverted head-and-shoulder sample might drag it to $75K ranges if it breaks under $90K.

Whether or not the USDT dominance will high out once more above 4% and permit BTC to rebound stays unsure.

Nevertheless, Benjamin Cowen and CoinDesk’s senior analyst James Van Straten downplayed the current BTC decline as a typical January pullback in the course of the post-halving yr.

At press time, the asset tried to stabilize above $94K.