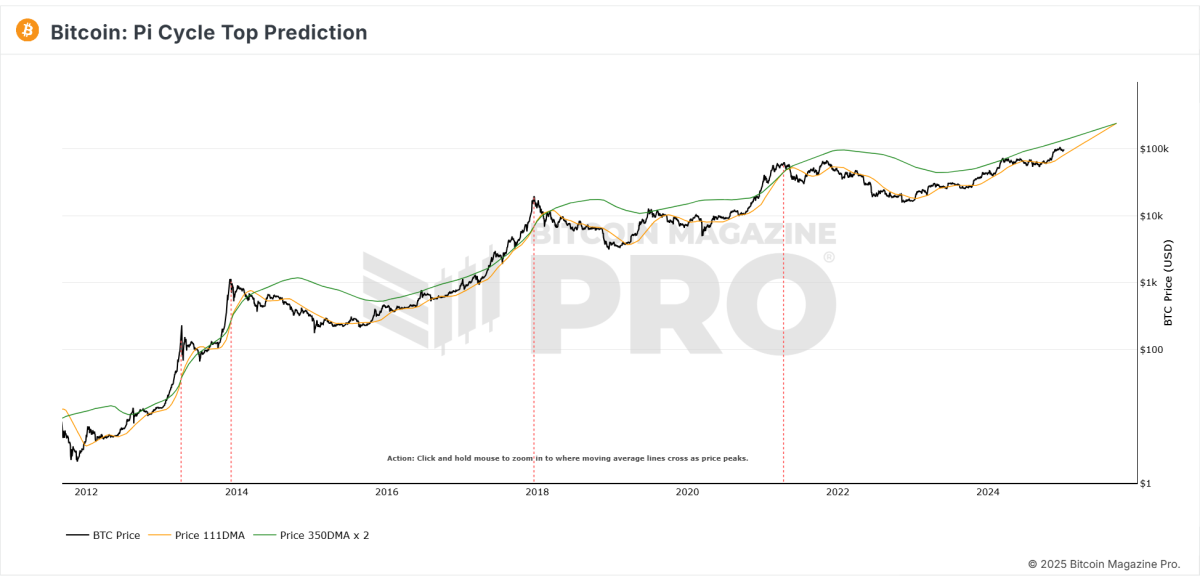

Bitcoin traders and analysts always search revolutionary instruments and indicators to realize a aggressive edge in navigating unstable market cycles. A current addition to this arsenal is the Pi Cycle Top Prediction chart, now out there on Bitcoin Magazine Pro. Designed for skilled and institutional traders, this chart builds on the well known Pi Cycle Top indicator—a software that has traditionally pinpointed Bitcoin’s market cycle peaks with exceptional accuracy.

Understanding the Pi Cycle Prime Prediction Indicator

The Pi Cycle Prime Prediction chart enhances the idea of its predecessor by projecting future potential crossover factors of two key shifting averages:

- 111-day Shifting Common (111DMA)

- 350-day Shifting Common multiplied by two (350DMA x2)

By calculating the speed of change of those two shifting averages over the previous 14 days, the software extrapolates their trajectory into the longer term. This method offers a predictive estimate of when these two averages will cross, signaling a possible market prime.

Traditionally, the crossover of those shifting averages has been intently related to Bitcoin’s cycle tops. In actual fact, the unique Pi Cycle Prime indicator efficiently recognized Bitcoin’s earlier cycle peaks to inside three days, each earlier than and after its creation.

Implications for Market Conduct

When the 111DMA approaches the 350DMA x2, it means that Bitcoin’s value could also be rising unsustainably, typically reflecting heightened speculative fervor. A crossover sometimes alerts the tip of a bull market, adopted by a value correction or bear market.

For skilled traders, this software is invaluable as a danger administration mechanism. By figuring out intervals when market situations is likely to be overheating, it permits traders to make knowledgeable choices about their publicity to Bitcoin and modify their methods accordingly.

Key Prediction: September 17, 2025

The present projection estimates that the shifting averages will cross on September 17, 2025. This date represents a possible market prime, providing traders a timeline to observe and reassess their positions as market dynamics evolve. Customers can view this projection intimately by hovering over the chart on the Bitcoin Journal Professional platform.

Origins and Associated Instruments

The Pi Cycle Prime Prediction indicator was conceptualized by Matt Crosby, Lead Analyst at Bitcoin Journal Professional. It builds on the unique Pi Cycle Prime indicator, created by Philip Swift, Managing Director of Bitcoin Journal Professional. Swift’s Pi Cycle Prime has turn into a trusted useful resource amongst Bitcoin analysts and traders for its historic accuracy in figuring out market peaks.

Buyers curious about a deeper exploration of market cycles also can discuss with:

- The Unique Pi Cycle Prime Indicator: View the chart

- The Pi Cycle Prime and Backside Indicator: View the chart

Video Explainer and Instructional Assets

For a complete clarification of the Pi Cycle Prime Prediction chart, traders can watch an in depth video by Matt Crosby, out there here. This video offers an outline of the methodology, sensible functions, and historic context for this predictive software.

Why This Issues for Skilled Buyers

In a market as dynamic and unpredictable as Bitcoin, skilled traders require refined instruments to anticipate and reply to vital market shifts. The Pi Cycle Prime Prediction chart presents:

- Knowledge-Pushed Insights: By leveraging historic knowledge and predictive modeling, the chart delivers actionable insights for portfolio administration.

- Timing Precision: The power to estimate cycle tops with a excessive diploma of accuracy enhances strategic decision-making.

- Threat Mitigation: Early warning alerts of market overheating empower traders to guard their portfolios from potential draw back dangers.

As Bitcoin matures into an asset class more and more adopted by institutional traders, instruments just like the Pi Cycle Prime Prediction chart turn into important for understanding and navigating its distinctive market cycles. By integrating this chart into their analytical toolkit, traders can deepen their insights and enhance their long-term funding outcomes.

To discover stay knowledge and keep knowledgeable on the most recent evaluation, go to bitcoinmagazinepro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding choices.