- U.S greenback index has surged to 109, marking its highest stage since November 2022

- A robust greenback may weaken the demand for danger property equivalent to Bitcoin, which may restrict the crypto’s uptrend

Bitcoin (BTC) fell beneath $100,000 in mid-December. Since then, the king coin has struggled to regain its momentum on the charts. At press time, BTC was buying and selling at $96,789 following beneficial properties of 1.5% in 24 hours, with the crypto nonetheless simply over 10% shy of its ATH.

Whereas Bitcoin may stage a restoration later this month due to Donald Trump’s inauguration as U.S President, two key components may proceed to weigh on the value.

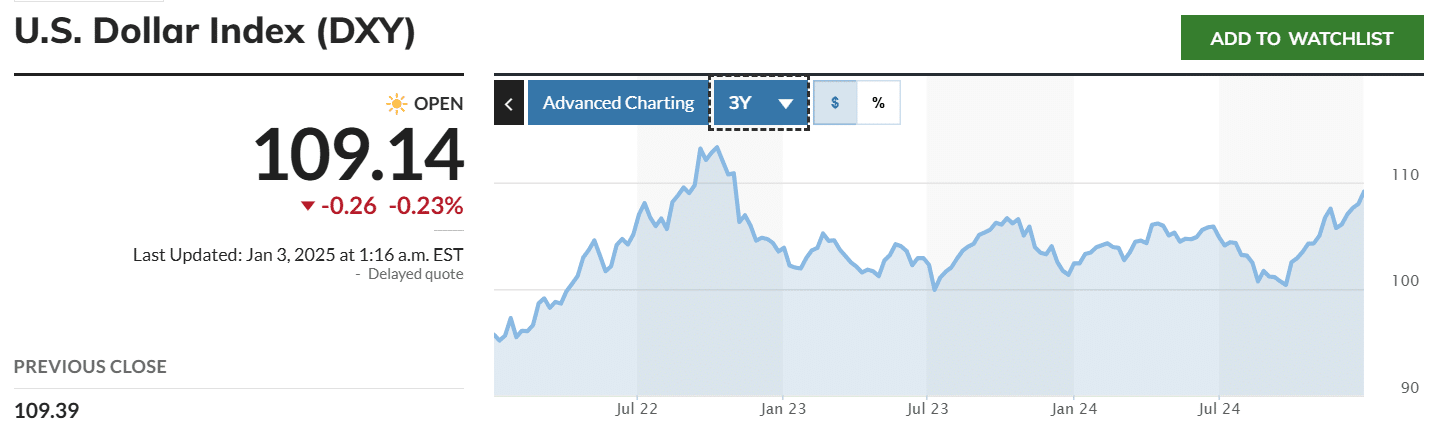

U.S greenback index soars to two-year highs

The U.S greenback index (DXY), which measures the efficiency of the U.S greenback towards main currencies, has surged to 109 – its highest stage since November 2022. What this hike signifies is that the U.S greenback has been gaining power recently.

The DXY is inversely correlated with Bitcoin’s value, that means {that a} hike limits the coin’s upside potential. Moreover, a stronger greenback tends to weaken the demand for danger property equivalent to cryptocurrencies.

In truth, the autumn in demand is already evident within the exchange-traded fund (ETF) market. On the primary day of buying and selling in 2025, the BlackRock iShares Bitcoin Belief (IBIT) ETF recorded $332M in outflows, marking its highest outflows in historical past. The full outflows from all 11 Bitcoin ETFs hit $242M, as per SoSoValue.

If these outflows persist, it may gasoline a surge in sell-side stress. This can, in flip, gasoline a downtrend for BTC on the charts.

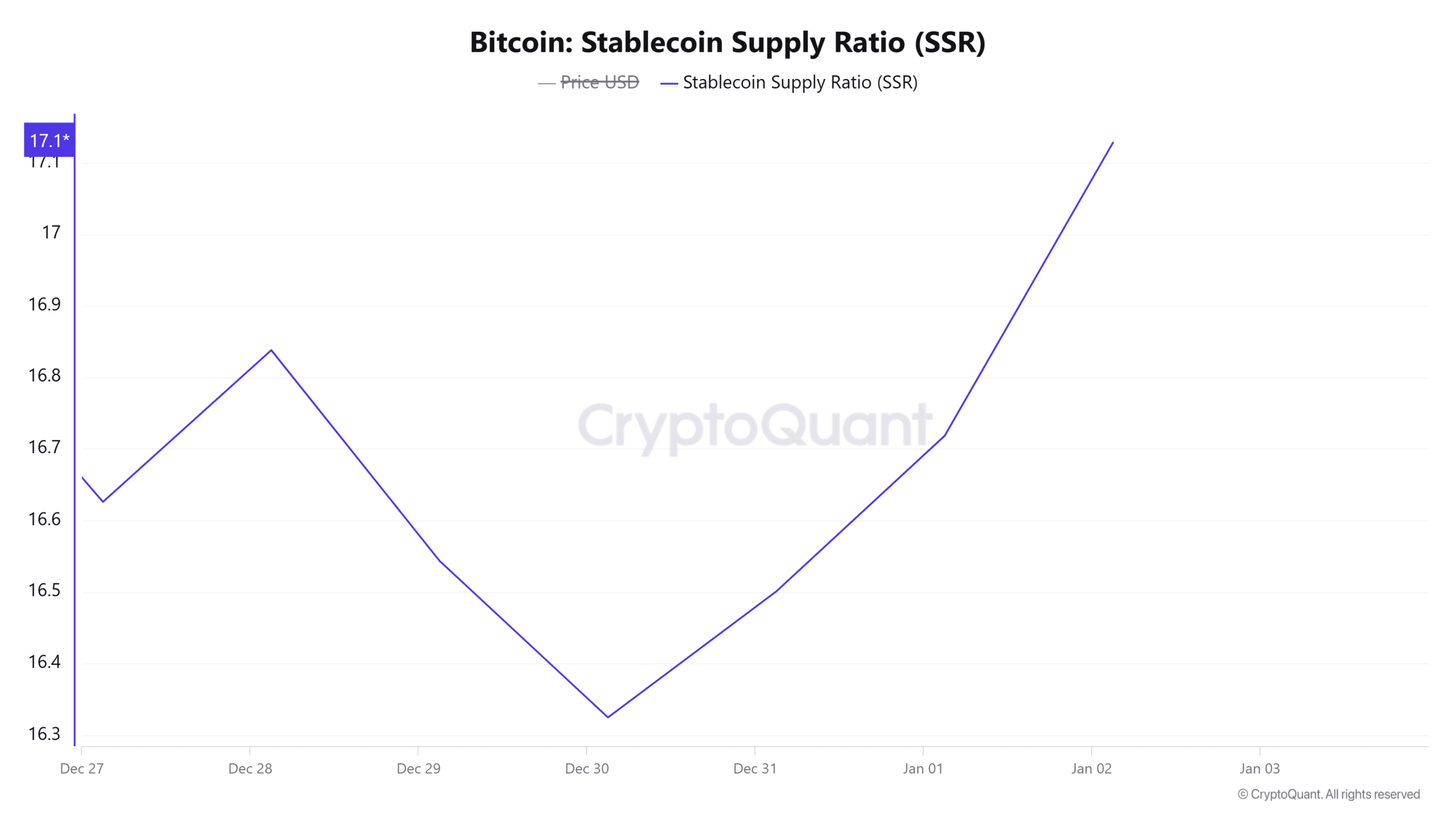

Rising stablecoin provide ratio

The weakened demand appeared not solely evident amongst institutional traders, but in addition within the retail market. For example – In accordance with CryptoQuant, Bitcoin’s Stablecoin Provide Ratio (SSR) surged to 17 – Its highest stage in seven days.

The next ratio implies that the availability of stablecoins is low, in comparison with BTC’s market cap. This leads to low shopping for stress that might exert downward stress on the value.

Bitcoin’s worry and greed index remains to be bullish

Regardless of market components pointing to lowering demand and shopping for stress, the Fear and Greed Index, which measures the market sentiment, revealed that merchants are nonetheless bullish.

This index had a worth of 74 at press time, suggesting that the majority merchants are optimistic about BTC’s value motion. Because the index climbed from 65 earlier this week, it may very well be excellent news for BTC if merchants begin shopping for.

Nonetheless, if the buy-side stress isn’t sufficient to soak up the bought cash, it may restrict the beneficial properties on the charts.

- U.S greenback index has surged to 109, marking its highest stage since November 2022

- A robust greenback may weaken the demand for danger property equivalent to Bitcoin, which may restrict the crypto’s uptrend

Bitcoin (BTC) fell beneath $100,000 in mid-December. Since then, the king coin has struggled to regain its momentum on the charts. At press time, BTC was buying and selling at $96,789 following beneficial properties of 1.5% in 24 hours, with the crypto nonetheless simply over 10% shy of its ATH.

Whereas Bitcoin may stage a restoration later this month due to Donald Trump’s inauguration as U.S President, two key components may proceed to weigh on the value.

U.S greenback index soars to two-year highs

The U.S greenback index (DXY), which measures the efficiency of the U.S greenback towards main currencies, has surged to 109 – its highest stage since November 2022. What this hike signifies is that the U.S greenback has been gaining power recently.

The DXY is inversely correlated with Bitcoin’s value, that means {that a} hike limits the coin’s upside potential. Moreover, a stronger greenback tends to weaken the demand for danger property equivalent to cryptocurrencies.

In truth, the autumn in demand is already evident within the exchange-traded fund (ETF) market. On the primary day of buying and selling in 2025, the BlackRock iShares Bitcoin Belief (IBIT) ETF recorded $332M in outflows, marking its highest outflows in historical past. The full outflows from all 11 Bitcoin ETFs hit $242M, as per SoSoValue.

If these outflows persist, it may gasoline a surge in sell-side stress. This can, in flip, gasoline a downtrend for BTC on the charts.

Rising stablecoin provide ratio

The weakened demand appeared not solely evident amongst institutional traders, but in addition within the retail market. For example – In accordance with CryptoQuant, Bitcoin’s Stablecoin Provide Ratio (SSR) surged to 17 – Its highest stage in seven days.

The next ratio implies that the availability of stablecoins is low, in comparison with BTC’s market cap. This leads to low shopping for stress that might exert downward stress on the value.

Bitcoin’s worry and greed index remains to be bullish

Regardless of market components pointing to lowering demand and shopping for stress, the Fear and Greed Index, which measures the market sentiment, revealed that merchants are nonetheless bullish.

This index had a worth of 74 at press time, suggesting that the majority merchants are optimistic about BTC’s value motion. Because the index climbed from 65 earlier this week, it may very well be excellent news for BTC if merchants begin shopping for.

Nonetheless, if the buy-side stress isn’t sufficient to soak up the bought cash, it may restrict the beneficial properties on the charts.