- The Bitcoin trilemma helps clarify why the blockchain has very low transaction speeds

- Enhancements in scalability can enhance performance and promote BTC adoption

The latest Bitcoin [BTC] halving occurred on 19 April 2024. The blockchain’s mining reward was slashed to three.125 BTC, decreasing provide and forcing miners to optimize their {hardware}. It additionally bolstered the shortage of Bitcoin, making it a viable various as a retailer of worth.

Michael Saylor, co-founder and former CEO of MicroStrategy [MSTR], realized how he may use this mechanism to his firm’s benefit through the earlier cycle. The truth is, he sees it as a hedge towards inflation.

To safe his treasury towards inflation, he’s not afraid to make use of leverage to purchase extra Bitcoin. “The one use of time is to purchase extra Bitcoin. Take all the cash and purchase extra Bitcoin. Then take all of your time to determine what you possibly can promote to purchase extra Bitcoin,” he stated in January 2024. The king of cryptos is up by practically 115% since then.

His legendary conviction helps the concept increasingly establishments would add BTC to their treasuries.

Past being an funding and inflation hedge, what do customers anticipate from the blockchain? What developments progressed in 2024, and what does 2025 doubtless have in retailer for BTC’s on-chain customers?

Bitcoin trilemma

The three key facets of a blockchain are scalability, decentralization, and safety. Scalability refers back to the capability to course of transactions, decentralization is the distribution of decision-making and management throughout the blockchain, and safety is the community’s capability to defend towards fraud and assaults.

One among Bitcoin’s main challenges is scalability. Its Proof of Work mechanism and the ever-growing hash price imply that Bitcoin is very safe as a community. Decentralization can also be not one of many main drawbacks, though, through the years, Bitcoin mining has turn into extra centralized because of the emergence and progress of mining swimming pools.

Supply: CoinLedger

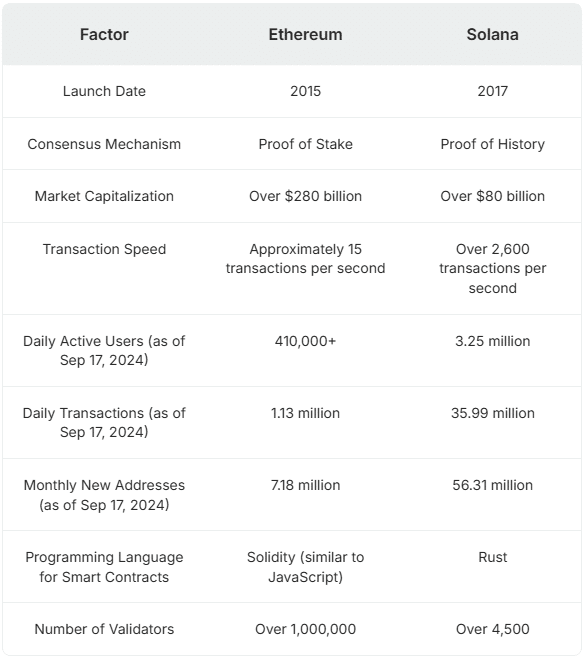

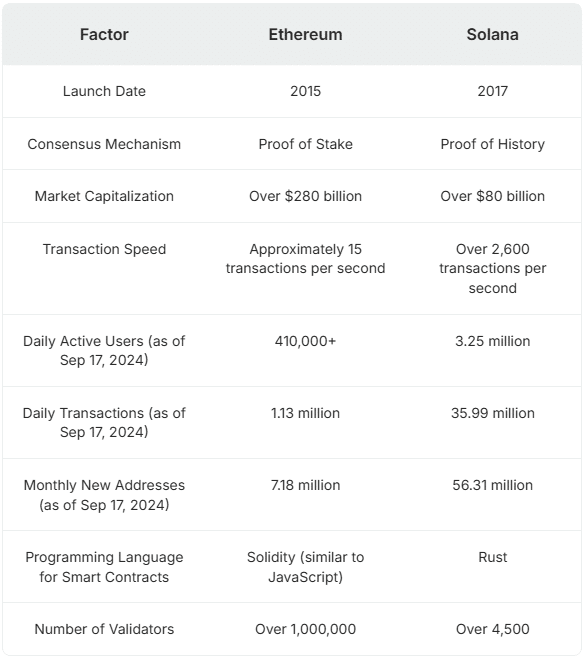

The Bitcoin blockchain can deal with about 7 transactions per second (TPS) whereas Ethereum [ETH] and Solana [SOL] stand at 15 and a couple of,600 TPS, respectively. That is the blockchain trilemma. The idea highlights the trade-offs between safety, decentralization, and scalability.

With a view to have a excessive throughput, networks must sacrifice safety or decentralization and choose to have fewer nodes to allow the next TPS. In the meantime, extremely decentralized networks battle with effectivity and velocity.

Options to the scalability drawback

Over time, the recognition and variety of customers on the Bitcoin community are prone to improve. This is able to result in better consumer demand, and will additionally spark a necessity for the blockchain to reinforce its utility and worth to a consumer.

As a Layer 1, Bitcoin is constructed to have a low TPS and a restricted variety of use instances in comparison with chains like Ethereum or Solana which boast a strong decentralized finance (DeFi) ecosystem. To attain scalability and help extra complicated functions, the community has to look in direction of Layer 2 options.

Layer 2 options are constructed on high of an current blockchains and don’t want a network-wide consensus to deploy, in contrast to Layer 1 options. This makes them a extra versatile and enticing answer possibility.

Among the current Layer 2s are Lightning Community, Stacks, and Merlin Chain. Stacks goals to convey good contracts to Bitcoin with out altering the unique protocol. Initially known as Blockstack, it was rebranded in October 2020. Stacks is a Bitcoin Layer for good contracts, extending the community’s utility to incorporate good contracts, DeFi, NFTs (non-fungible tokens), and dApp (decentralized software) functionalities.

Lightning Community and its potential in 2025

Lightning Community was proposed in 2015 and has been operational since 2018. It goals to extend transaction speeds and scale back prices by permitting transactions to happen off the primary blockchain.

And but, it faces some challenges. The Lightning Community permits customers to switch by creating channels between them that may stay open for additional funds. It slashes the transaction payment, bringing it to the area of $0.001 from the present $2.8 value per transaction, and permits its completion in seconds.

LN had round 15,000 and practically 54,000 fee channels as of August 2024, with a channel liquidity of simply over 5,000 Bitcoin. It has seen the implementation of varied new wallets reminiscent of Muun and Phoenix that enhance the consumer expertise. Rising adoption throughout Asia, Africa, and Latin America makes e-commerce extra viable. LN utilization is boosted by entities reminiscent of Bitrefill, a cryptocurrency reward card retailer, and OpenNode, a fee processor that allows retailers to just accept BTC as fee.

In 2025, Lightning Community’s enlargement to make use of stablecoins for fee other than BTC would assist obtain mass adoption. This integration with stablecoins can result in real-world funds utilizing crypto stablecoins and may permit overseas alternate transactions to be settled virtually immediately wherever throughout the globe.

Past Layer 2s

The way forward for Bitcoin Layer 2 options is filled with potential, however there’s a additional evolution attainable. Layer 3 options constructed on high of Layer 2 scalability purpose to reinforce interoperability and application-specific performance.

Layer 3 can allow customizable performance by tailoring for particular wants, and optimizing efficiency and effectivity. They will seamlessly join totally different blockchains and totally different Layer 2 options, thereby increasing the chances of blockchain know-how.

One instance of a Bitcoin Layer 3 is Impervious, the browser constructed on high of Bitcoin. It’s decentralized, and all knowledge transmitted is completed so privately, leaving no area for knowledge surveillance. It’s also censorship-free.

It makes use of the Lightning Community to course of transactions, which signifies that messaging and sharing paperwork will likely be completed virtually immediately and later submitted to the blockchain. This is able to levy a payment for every transaction, however privateness may very well be price it.

One other instance of a Layer 3 answer outdoors of Bitcoin is Cosmos. It was designed to deal with the cacophony of blockchains by integrating them into an “web of blockchains”. It presents safe knowledge switch between impartial blockchains, and sharding is used for scalability. This enhances the potential for dApps by enabling using belongings and functionalities from totally different blockchains.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Bitcoin Layer 2 options can reshape the utilization of the blockchain. By boosting decrease transaction charges and sooner speeds, it fosters adoption by the general public even for micropayments and informal spending. Developments alongside this path would imply that Bitcoin is not only a retailer of worth, however would even be a sensible medium for alternate – Because it was initially envisioned.