In a wide-ranging dialogue on The Tradition Bit podcast, Bitcoin Coverage Institute (BPI) Government Director and nationwide safety professional Matthew Pines gave his newest evaluation of the evolving relationship between the Trump administration and Bitcoin. Joined by Merely Bitcoin host Nico Moran and present host Alan Helm, Pines underscored how BTC’s rising affect in Washington has shortly turn into a key factor of US financial and geopolitical technique.

Trump Is ‘Paying Critical Consideration To Bitcoin’

Pines shortly turned to Washington, the place the Trump administration has launched a number of initiatives that place BTC firmly on the federal agenda. Specifically, the White Home’s current executive orders have prompted businesses to discover whether or not the US ought to set up a Strategic Bitcoin Reserve (SBR), incorporate BTC into a possible sovereign wealth fund, and devise clearer guidelines round stablecoins.

In keeping with Pines, the prospect of a nationwide BTC reserve, as soon as thought of fringe, now carries rising traction: “Trump got here in and signed an govt order establishing a President’s Working Group on digital belongings, particularly mentioning the concept of a strategic digital asset stockpile,” he mentioned. “They are surely finding out this concern—this isn’t simply lip service. If the US does one thing important with Bitcoin, it may have huge geopolitical implications.”

Pines cautioned that coverage improvement in Washington is sluggish and deliberate, significantly when it includes a number of businesses, but he believes momentum is constructing: “As soon as the federal government decides to maneuver on one thing like this, issues can occur shortly,” he famous, “however proper now, there are numerous new officers and nominations settling in. They must do the homework first.”

Alongside speak of a reserve, the administration has additionally tasked Secretary of Commerce Howard Lutnick and Secretary of the Treasury Scott Bessent to develop the framework for a US Sovereign Wealth Fund, prompting debate over whether or not it ought to embrace Bitcoin.

Pines described how a sovereign wealth fund may broaden assist for BTC amongst influential sectors—corresponding to power, AI, and protection—since future returns on BTC may finance strategic home investments: “If Bitcoin is within the fund, it may align numerous stakeholders to be pro-Bitcoin, as a result of a rising Bitcoin worth straight enhances the fund’s capability to take a position,” he defined.

But there stay loads of particulars to iron out, not least of which is how one can mitigate considerations over BTC’s volatility and how one can deal with potential pushback from different corners of the “crypto” sector. Pines famous there’s lobbying from sure giant altcoin organizations to dilute the concept of a strictly BTC reserve and push for a broader “digital asset” focus.

Commenting on the realities of lobbying and politics, Moran underscored how Bitcoiners—a lot of whom are staunchly anti-establishment—have needed to regulate to the newfound necessity of political engagement. “If you concentrate on it, this was at all times going to occur,” Moran identified. “Cash itself is inherently political. Bitcoin represents a substitute for central banking. After all it’s going to turn into a heated subject in D.C.”

Within the closing evaluation, Pines and Moran each anticipate swift developments in how the Trump administration crafts its digital asset insurance policies. Whereas the precise type of a possible SBR or sovereign wealth fund stays unclear, Pines emphasised that the BPI will proceed offering data-driven steerage to policymakers on Capitol Hill and throughout the administration:

“They are surely paying severe consideration to Bitcoin, and the window of alternative to form coverage is true now,” he mentioned. “We wish to make it possible for policymakers absolutely perceive Bitcoin’s technological underpinnings, its strategic makes use of, and what it represents for each financial safety and particular person freedoms.”

Moran echoed that sentiment, underscoring the distinction in how Washington now treats BTC relative to only a few years in the past: “Final yr, we weren’t even within the room. Immediately, among the highest-ranking officers within the nation personal Bitcoin themselves. That modifications the whole lot,” he concluded.

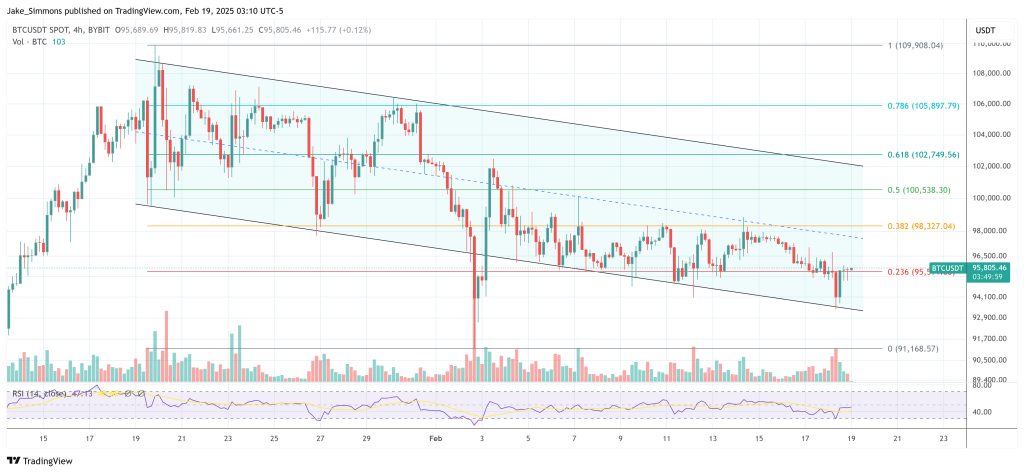

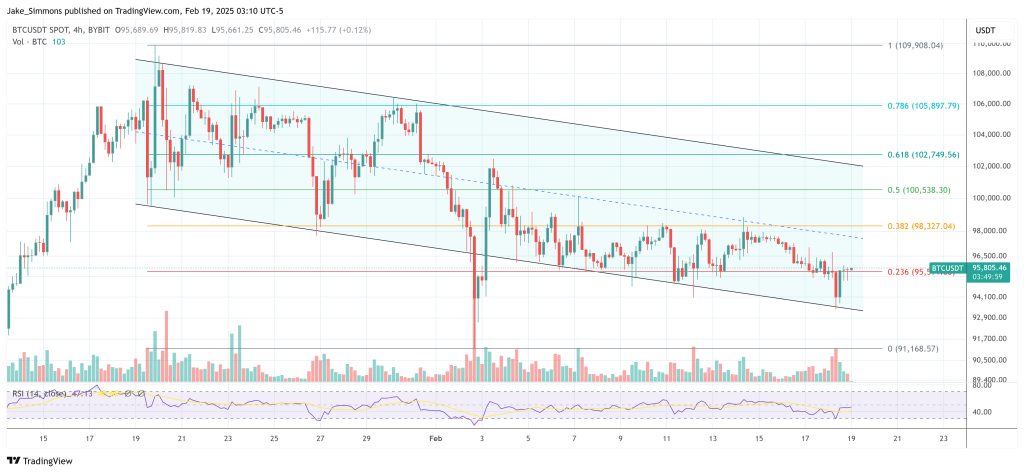

At press time, BTC traded at $95,805.

Featured picture from YouTube, chart from TradingView.com

In a wide-ranging dialogue on The Tradition Bit podcast, Bitcoin Coverage Institute (BPI) Government Director and nationwide safety professional Matthew Pines gave his newest evaluation of the evolving relationship between the Trump administration and Bitcoin. Joined by Merely Bitcoin host Nico Moran and present host Alan Helm, Pines underscored how BTC’s rising affect in Washington has shortly turn into a key factor of US financial and geopolitical technique.

Trump Is ‘Paying Critical Consideration To Bitcoin’

Pines shortly turned to Washington, the place the Trump administration has launched a number of initiatives that place BTC firmly on the federal agenda. Specifically, the White Home’s current executive orders have prompted businesses to discover whether or not the US ought to set up a Strategic Bitcoin Reserve (SBR), incorporate BTC into a possible sovereign wealth fund, and devise clearer guidelines round stablecoins.

In keeping with Pines, the prospect of a nationwide BTC reserve, as soon as thought of fringe, now carries rising traction: “Trump got here in and signed an govt order establishing a President’s Working Group on digital belongings, particularly mentioning the concept of a strategic digital asset stockpile,” he mentioned. “They are surely finding out this concern—this isn’t simply lip service. If the US does one thing important with Bitcoin, it may have huge geopolitical implications.”

Pines cautioned that coverage improvement in Washington is sluggish and deliberate, significantly when it includes a number of businesses, but he believes momentum is constructing: “As soon as the federal government decides to maneuver on one thing like this, issues can occur shortly,” he famous, “however proper now, there are numerous new officers and nominations settling in. They must do the homework first.”

Alongside speak of a reserve, the administration has additionally tasked Secretary of Commerce Howard Lutnick and Secretary of the Treasury Scott Bessent to develop the framework for a US Sovereign Wealth Fund, prompting debate over whether or not it ought to embrace Bitcoin.

Pines described how a sovereign wealth fund may broaden assist for BTC amongst influential sectors—corresponding to power, AI, and protection—since future returns on BTC may finance strategic home investments: “If Bitcoin is within the fund, it may align numerous stakeholders to be pro-Bitcoin, as a result of a rising Bitcoin worth straight enhances the fund’s capability to take a position,” he defined.

But there stay loads of particulars to iron out, not least of which is how one can mitigate considerations over BTC’s volatility and how one can deal with potential pushback from different corners of the “crypto” sector. Pines famous there’s lobbying from sure giant altcoin organizations to dilute the concept of a strictly BTC reserve and push for a broader “digital asset” focus.

Commenting on the realities of lobbying and politics, Moran underscored how Bitcoiners—a lot of whom are staunchly anti-establishment—have needed to regulate to the newfound necessity of political engagement. “If you concentrate on it, this was at all times going to occur,” Moran identified. “Cash itself is inherently political. Bitcoin represents a substitute for central banking. After all it’s going to turn into a heated subject in D.C.”

Within the closing evaluation, Pines and Moran each anticipate swift developments in how the Trump administration crafts its digital asset insurance policies. Whereas the precise type of a possible SBR or sovereign wealth fund stays unclear, Pines emphasised that the BPI will proceed offering data-driven steerage to policymakers on Capitol Hill and throughout the administration:

“They are surely paying severe consideration to Bitcoin, and the window of alternative to form coverage is true now,” he mentioned. “We wish to make it possible for policymakers absolutely perceive Bitcoin’s technological underpinnings, its strategic makes use of, and what it represents for each financial safety and particular person freedoms.”

Moran echoed that sentiment, underscoring the distinction in how Washington now treats BTC relative to only a few years in the past: “Final yr, we weren’t even within the room. Immediately, among the highest-ranking officers within the nation personal Bitcoin themselves. That modifications the whole lot,” he concluded.

At press time, BTC traded at $95,805.

Featured picture from YouTube, chart from TradingView.com