Crypto analyst Akademik, who referred to as the Bitcoin value crash early has revealed his complete predictions for the flagship crypto’s trajectory within the brief and mid-term. Primarily based on these predictions, BTC is ready to expertise an extra crash which may ship its value to as low as $80,000.

What Subsequent For The Bitcoin Worth

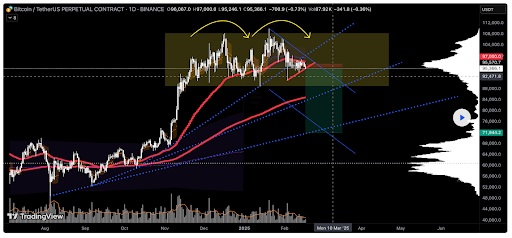

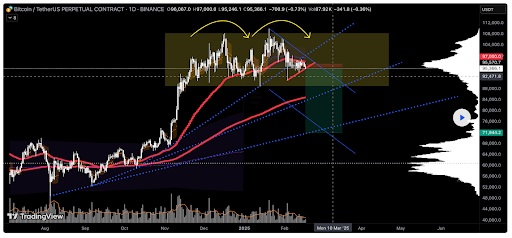

In a TradingView post, Akademik predicted that the Bitcoin value may drop to as little as $80,000 whereas revealing his brief buying and selling technique for the flagship crypto going ahead. The analyst’s accompanying chart confirmed that the flagship crypto may pull again to the $80,000 vary and even drop to as low as $60,000.

Associated Studying

Whereas outlining his buying and selling technique to preserve shorting BTC, he stated he expects this downtrend for the flagship crypto to proceed. The analyst advised merchants that it’s doable to enter on the pattern stage, which he highlighted on the charts if there may be an exercise within the feed or volumes can be substituted.

Certainly, the Bitcoin value at present boasts a bearish outlook because it dropped to the $93,000 vary yesterday earlier than bouncing again above the psychological $95,000 help stage. Crypto analyst Ali Martinez offered insights into the present value motion and the way the flagship crypto is in danger if dropping decrease.

In an X publish, he acknowledged that the Bitcoin value faces a provide wall of 1.88 million BTC at $97,000, whereas the help at $94,500 is backed by simply 695,000 BTC. Martinez remarked that this imbalance may play a key function within the subsequent transfer. This means that there’s a larger provide than demand for the flagship crypto, which places it susceptible to dropping decrease earlier than it rallies to new highs.

In one other X publish, the analyst additionally famous {that a} decline in Bitcoin’s mining exercise has traditionally been adopted by extended value corrections. This implies BTC may nonetheless drop decrease earlier than one other rally to new native highs.

BTC’s Lengthy Time period Outlook Is Nonetheless Bullish

In an X publish, crypto analyst Titan of Crypto acknowledged that the long-term pattern for the Bitcoin value stays bullish. This got here as he famous that Bitcoin continues to be within the consolidation vary. He added that so long as BTC stays inside the vary, there is no such thing as a clear short-term course for the flagship crypto.

Associated Studying

In the meantime, Martinez acknowledged that the market is at present within the ‘despair’ stage of the market cycle. This implies that the Bitcoin value continues to be sure to report one final pump earlier than this cycle ends. The ‘disbelief’ stage often comes after the despair stage, throughout which the flagship crypto enjoys a ‘sucker’s rally.’

On the time of writing, the Bitcoin value is buying and selling at round $95,300, down within the final 24 hours, based on data from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com

Crypto analyst Akademik, who referred to as the Bitcoin value crash early has revealed his complete predictions for the flagship crypto’s trajectory within the brief and mid-term. Primarily based on these predictions, BTC is ready to expertise an extra crash which may ship its value to as low as $80,000.

What Subsequent For The Bitcoin Worth

In a TradingView post, Akademik predicted that the Bitcoin value may drop to as little as $80,000 whereas revealing his brief buying and selling technique for the flagship crypto going ahead. The analyst’s accompanying chart confirmed that the flagship crypto may pull again to the $80,000 vary and even drop to as low as $60,000.

Associated Studying

Whereas outlining his buying and selling technique to preserve shorting BTC, he stated he expects this downtrend for the flagship crypto to proceed. The analyst advised merchants that it’s doable to enter on the pattern stage, which he highlighted on the charts if there may be an exercise within the feed or volumes can be substituted.

Certainly, the Bitcoin value at present boasts a bearish outlook because it dropped to the $93,000 vary yesterday earlier than bouncing again above the psychological $95,000 help stage. Crypto analyst Ali Martinez offered insights into the present value motion and the way the flagship crypto is in danger if dropping decrease.

In an X publish, he acknowledged that the Bitcoin value faces a provide wall of 1.88 million BTC at $97,000, whereas the help at $94,500 is backed by simply 695,000 BTC. Martinez remarked that this imbalance may play a key function within the subsequent transfer. This means that there’s a larger provide than demand for the flagship crypto, which places it susceptible to dropping decrease earlier than it rallies to new highs.

In one other X publish, the analyst additionally famous {that a} decline in Bitcoin’s mining exercise has traditionally been adopted by extended value corrections. This implies BTC may nonetheless drop decrease earlier than one other rally to new native highs.

BTC’s Lengthy Time period Outlook Is Nonetheless Bullish

In an X publish, crypto analyst Titan of Crypto acknowledged that the long-term pattern for the Bitcoin value stays bullish. This got here as he famous that Bitcoin continues to be within the consolidation vary. He added that so long as BTC stays inside the vary, there is no such thing as a clear short-term course for the flagship crypto.

Associated Studying

In the meantime, Martinez acknowledged that the market is at present within the ‘despair’ stage of the market cycle. This implies that the Bitcoin value continues to be sure to report one final pump earlier than this cycle ends. The ‘disbelief’ stage often comes after the despair stage, throughout which the flagship crypto enjoys a ‘sucker’s rally.’

On the time of writing, the Bitcoin value is buying and selling at round $95,300, down within the final 24 hours, based on data from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com