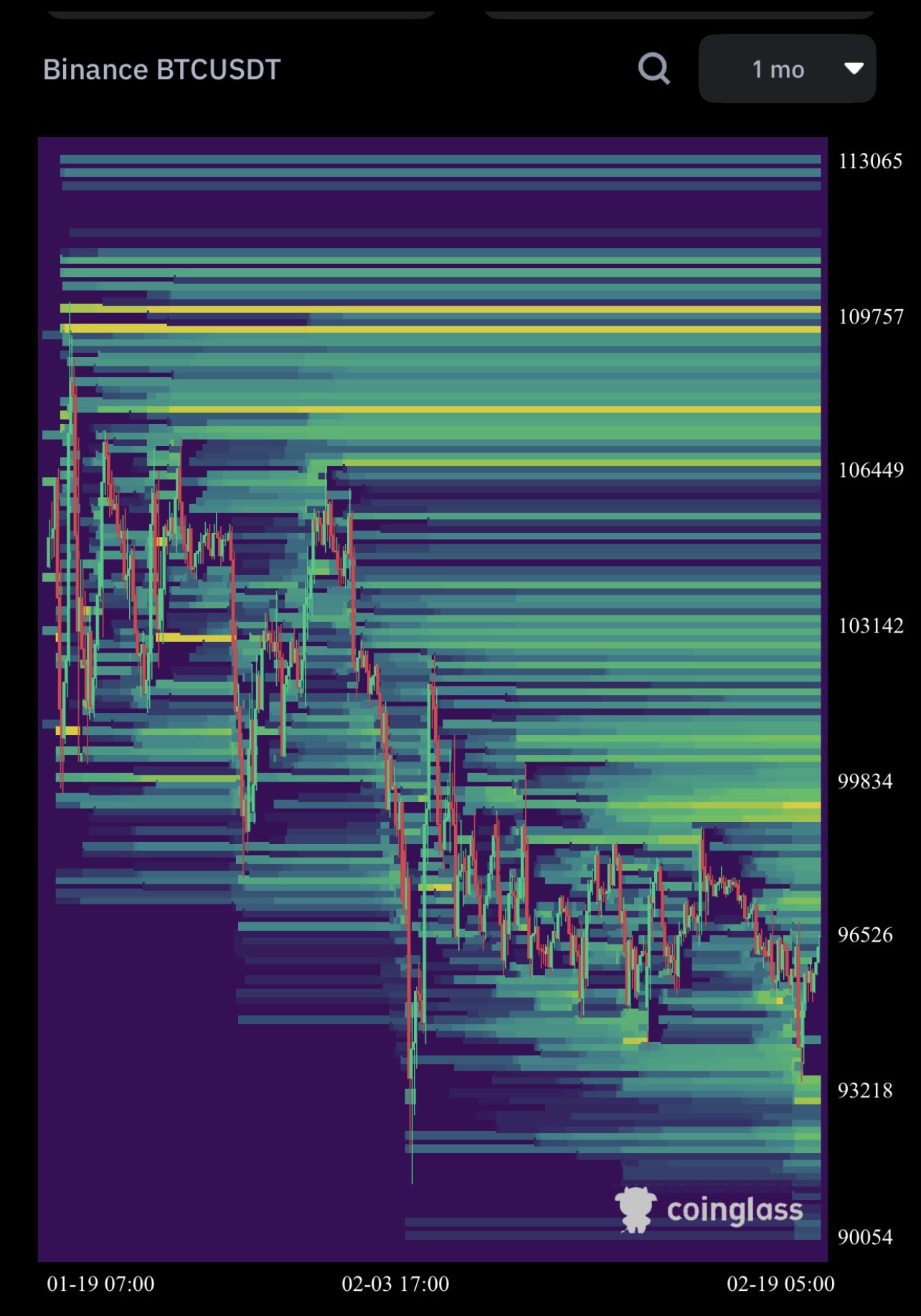

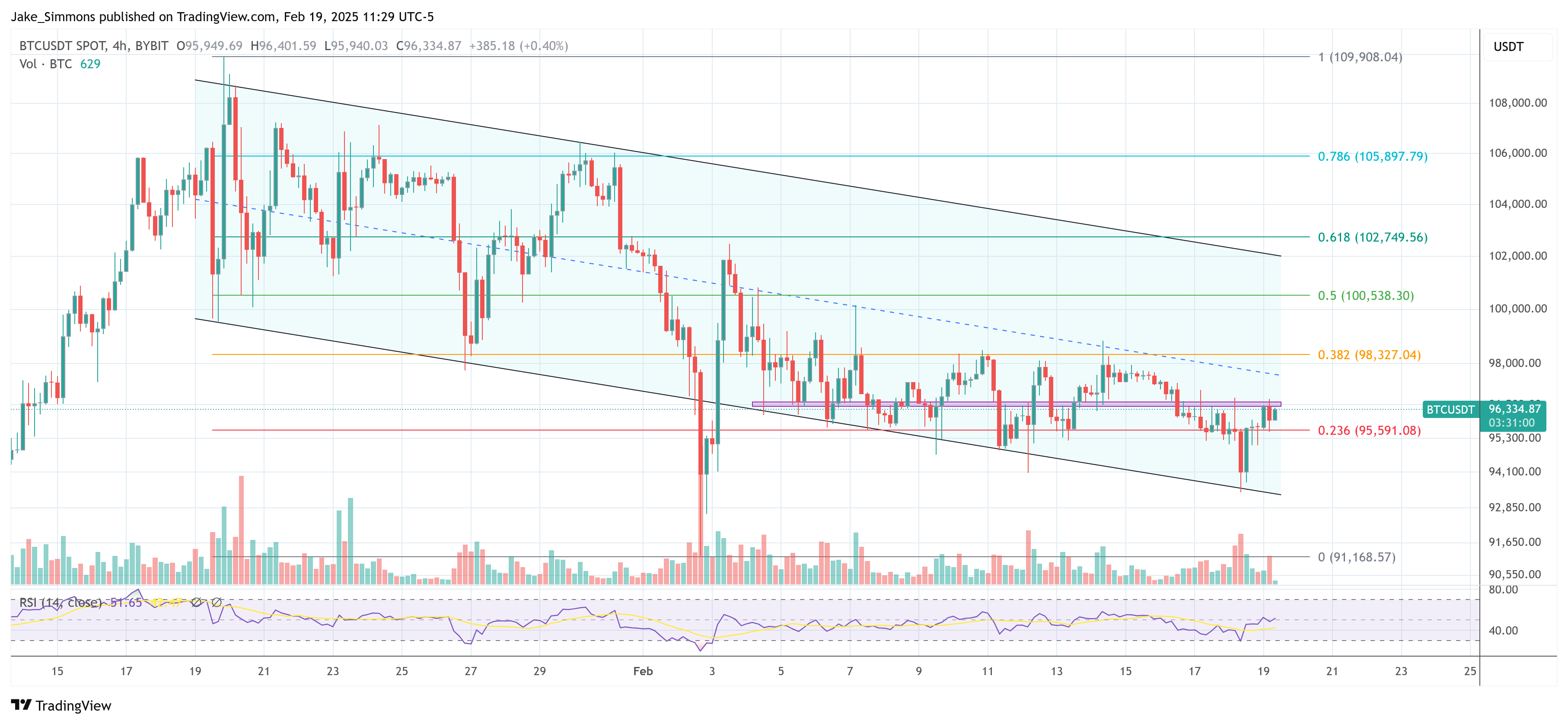

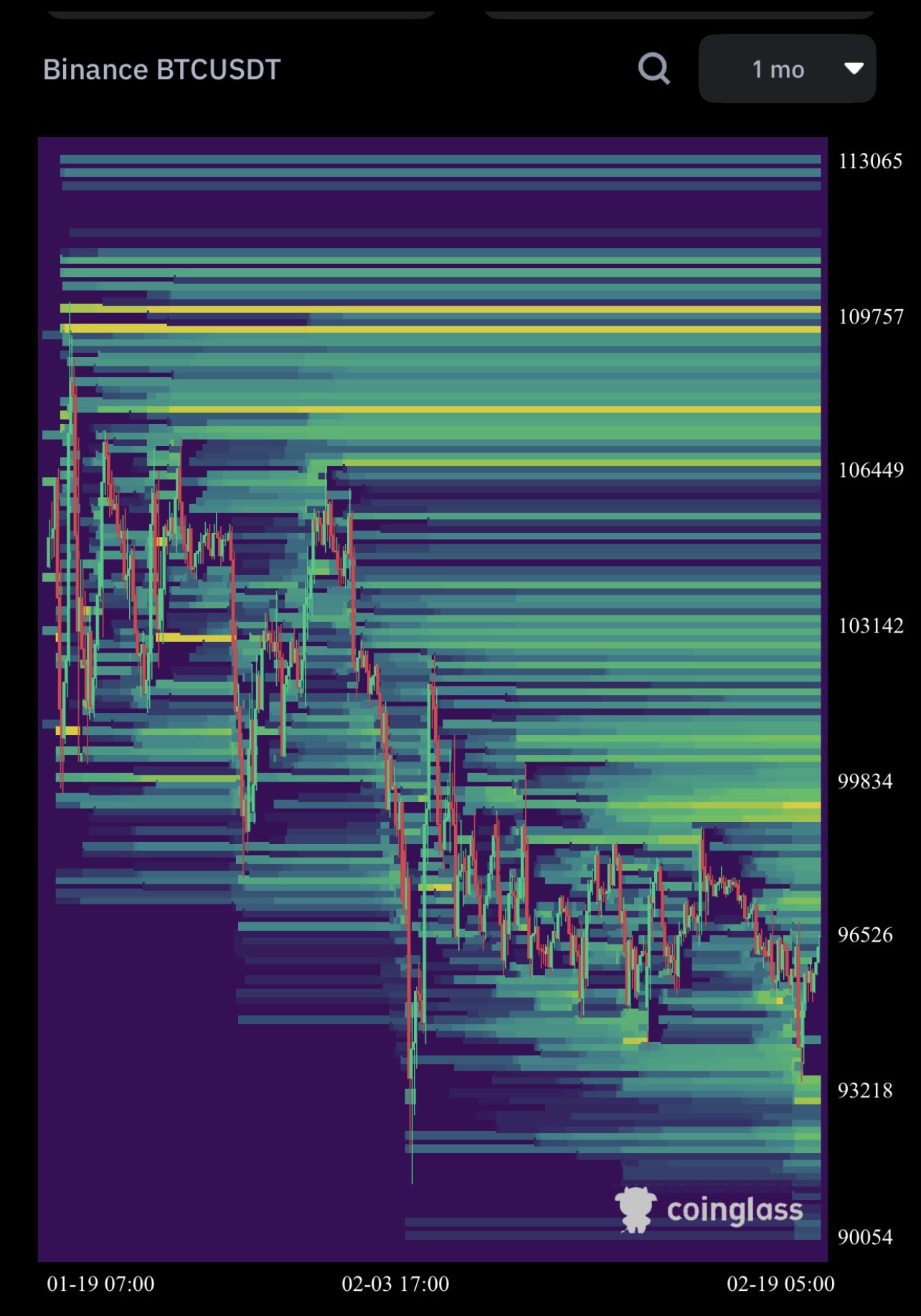

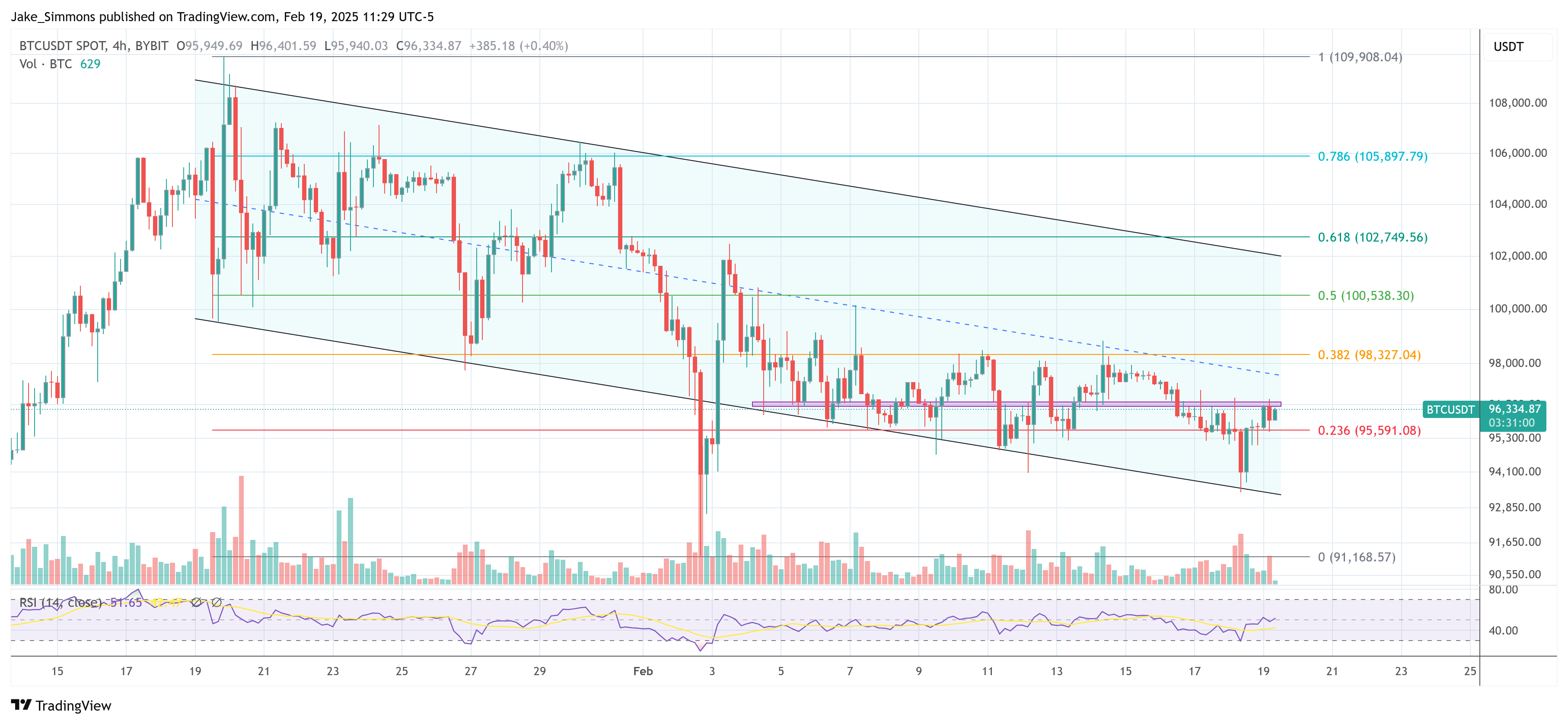

Whereas the Bitcoin worth is hovering beneath the essential resistance at $96,500, the liquidation heatmap on Binance’s BTC/USDT pair is sending highly effective alerts of a possible quick squeeze to the upside. Analyst Kevin (@Kev_Capital_TA) shared his insights alongside the hooked up liquidation heatmap, noting indicators of serious liquidity swimming pools forming each above and beneath Bitcoin’s present buying and selling vary.

“What we’re seeing over the past couple of days is lining up completely with what I’ve been saying,” Kevin defined, referencing his earlier market calls. “Sweep liquidity in the direction of 91K which we did yesterday. Perhaps we take extra possibly we don’t however general I’ve by no means seen this a lot liquidity to the upside on the month-to-month timeframe on #BTC.”

In accordance with Kevin, the information strongly suggests that giant liquidity—the place merchants’ positions can be compelled to liquidate—is now stacked across the 91K area and, extra crucially, close to the 111K mark. Whereas the decrease zone would possibly nonetheless see occasional sweeps, it’s the large cluster of liquidity round 111K that has prompted him to forecast a possible transfer to that stage.

Associated Studying

“There may be extra feelings on this market proper then I’ve ever seen,”he continued. “Gurus are quitting X, Youtubers aren’t streaming or making content material anymore, The feedback are hateful and insulting each single day […] In the meantime over right here we’re staying measured and calculated.”

Kevin emphasizes that many market contributors are fixated on altcoins moderately than monitoring Bitcoin’s liquidity construction, general market capitalization, and USDT dominance. He argues that merchants’ slender deal with particular person altcoins, moderately than these broader metrics, is inflicting them to overlook important alerts.

“The issue is everyone seems to be hyper centered on the improper factor and that’s #Altcoins charts,”he stated. “I’m actually supplying you with the playbook. Comply with it.”

What The Bitcoin Liquidation Heatmap Tells Us

A liquidation heatmap illustrates the place massive batches of leveraged positions—reminiscent of futures or margin trades—are almost certainly to be force-closed if the value reaches sure ranges. When many merchants place stop-losses or preserve closely margined trades round comparable worth factors, these zones usually accumulate as “scorching spots” on the heatmap. If worth motion nears these clusters, it could set off a sequence response: compelled liquidations drive additional worth motion, which may then cascade right into a quicker squeeze or sell-off.

Associated Studying

In Kevin’s view, Bitcoin’s heatmap presently reveals billions of {dollars} in potential liquidations concentrated at increased ranges (111K) and a big liquidity block beneath (round 91K). The presence of this deep liquidity on the upside has led Kevin to anticipate a “greater relief rally” that may pressure out quick positions en masse.

“Now as we are able to see […] we’ve billions in liquidity to the upside at 111K. Greater than I’ve ever seen on the 1M timeframe,” he remarked, emphasizing how uncommon he finds this month-long focus. “It will be completely advantageous and preferable if we swiped [the 91K area] first to construct up much more liquidity to then begin the true aid rally.”

Alongside liquidity knowledge, Kevin additionally cites sentiment indicators such because the Fear & Greed Index, presently reflecting a “worry” studying. From his standpoint, this atmosphere means that the market’s emotional extremes—coupled with heavy positioning—may very well be setting the stage for a swift momentum shift increased, as unfavourable sentiment usually accompanies native bottoms.

“You possibly can inform this aid rally desires to get going however it’s simply not completely there but […] I see no purpose to be overly bearish on this market. You guys must settle down and cease being so offended. Cease being so comfortable.”

At press time, BTC traded at $96,334.

Featured picture created with DALL.E, chart from TradingView.com

Whereas the Bitcoin worth is hovering beneath the essential resistance at $96,500, the liquidation heatmap on Binance’s BTC/USDT pair is sending highly effective alerts of a possible quick squeeze to the upside. Analyst Kevin (@Kev_Capital_TA) shared his insights alongside the hooked up liquidation heatmap, noting indicators of serious liquidity swimming pools forming each above and beneath Bitcoin’s present buying and selling vary.

“What we’re seeing over the past couple of days is lining up completely with what I’ve been saying,” Kevin defined, referencing his earlier market calls. “Sweep liquidity in the direction of 91K which we did yesterday. Perhaps we take extra possibly we don’t however general I’ve by no means seen this a lot liquidity to the upside on the month-to-month timeframe on #BTC.”

In accordance with Kevin, the information strongly suggests that giant liquidity—the place merchants’ positions can be compelled to liquidate—is now stacked across the 91K area and, extra crucially, close to the 111K mark. Whereas the decrease zone would possibly nonetheless see occasional sweeps, it’s the large cluster of liquidity round 111K that has prompted him to forecast a possible transfer to that stage.

Associated Studying

“There may be extra feelings on this market proper then I’ve ever seen,”he continued. “Gurus are quitting X, Youtubers aren’t streaming or making content material anymore, The feedback are hateful and insulting each single day […] In the meantime over right here we’re staying measured and calculated.”

Kevin emphasizes that many market contributors are fixated on altcoins moderately than monitoring Bitcoin’s liquidity construction, general market capitalization, and USDT dominance. He argues that merchants’ slender deal with particular person altcoins, moderately than these broader metrics, is inflicting them to overlook important alerts.

“The issue is everyone seems to be hyper centered on the improper factor and that’s #Altcoins charts,”he stated. “I’m actually supplying you with the playbook. Comply with it.”

What The Bitcoin Liquidation Heatmap Tells Us

A liquidation heatmap illustrates the place massive batches of leveraged positions—reminiscent of futures or margin trades—are almost certainly to be force-closed if the value reaches sure ranges. When many merchants place stop-losses or preserve closely margined trades round comparable worth factors, these zones usually accumulate as “scorching spots” on the heatmap. If worth motion nears these clusters, it could set off a sequence response: compelled liquidations drive additional worth motion, which may then cascade right into a quicker squeeze or sell-off.

Associated Studying

In Kevin’s view, Bitcoin’s heatmap presently reveals billions of {dollars} in potential liquidations concentrated at increased ranges (111K) and a big liquidity block beneath (round 91K). The presence of this deep liquidity on the upside has led Kevin to anticipate a “greater relief rally” that may pressure out quick positions en masse.

“Now as we are able to see […] we’ve billions in liquidity to the upside at 111K. Greater than I’ve ever seen on the 1M timeframe,” he remarked, emphasizing how uncommon he finds this month-long focus. “It will be completely advantageous and preferable if we swiped [the 91K area] first to construct up much more liquidity to then begin the true aid rally.”

Alongside liquidity knowledge, Kevin additionally cites sentiment indicators such because the Fear & Greed Index, presently reflecting a “worry” studying. From his standpoint, this atmosphere means that the market’s emotional extremes—coupled with heavy positioning—may very well be setting the stage for a swift momentum shift increased, as unfavourable sentiment usually accompanies native bottoms.

“You possibly can inform this aid rally desires to get going however it’s simply not completely there but […] I see no purpose to be overly bearish on this market. You guys must settle down and cease being so offended. Cease being so comfortable.”

At press time, BTC traded at $96,334.

Featured picture created with DALL.E, chart from TradingView.com