- Bitcoin’s Trade Reserves are at multi-year lows, elevating considerations a couple of doable provide shock.

- With fewer BTC accessible for buying and selling, analysts predict a possible worth surge if demand stays robust.

Bitcoin [BTC] reserves on spot exchanges have dropped to their lowest ranges lately, based on CryptoQuant data. Trade reserves grew between 2020 and 2022 however have been in a steep decline since.

Traders proceed withdrawing BTC from exchanges and transferring it to chilly storage, reinforcing a long-term holding development.

A shrinking alternate provide reduces the variety of Bitcoins accessible for buying and selling, which may create upward strain on worth if demand stays robust.

With Bitcoin displaying an upward development in 2024 and 2025, this shift suggests a tightening supply-demand stability.

The continued reserve decline has raised hypothesis a couple of doable provide shock, as much less BTC on exchanges might result in worth surges just like previous cycles.

On-chain knowledge suggests robust Bitcoin accumulation

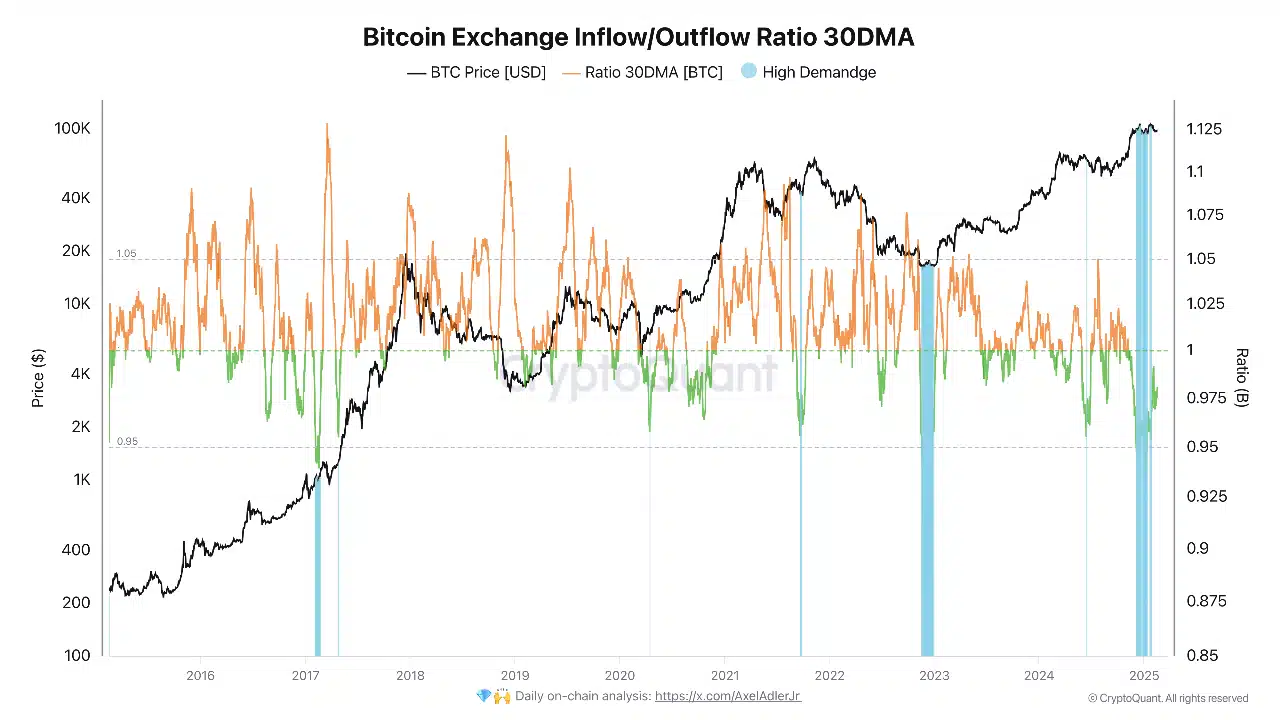

Bitcoin has been buying and selling between $90,000 and $105,000, and data indicates ongoing accumulation. The 30-day transferring common (30DMA) of the Trade Influx/Outflow Ratio has remained under 1, signaling that extra BTC is leaving exchanges than coming into.

Analysts typically take into account this a bullish sign, because it suggests traders are holding fairly than promoting.

When this ratio drops under 1, it means that outflows dominate inflows, a situation {many professional} traders view as a bullish sign.

If historic patterns maintain, Bitcoin may see a short-term worth enhance as soon as the promoting strain weakens.

Nonetheless, a few of these outflows could also be linked to routine asset transfers by centralized exchanges to custodial wallets, equivalent to ETFs, institutional accounts, or OTC desks.

Bitcoin market traits and worth motion

As of press time, Bitcoin was buying and selling at $96,071, reflecting a -1.23% decline within the final 24 hours and a -1.43% drop over the previous seven days.

The entire circulating provide stands at 20 million BTC, giving Bitcoin a market capitalization of $1.9 trillion.

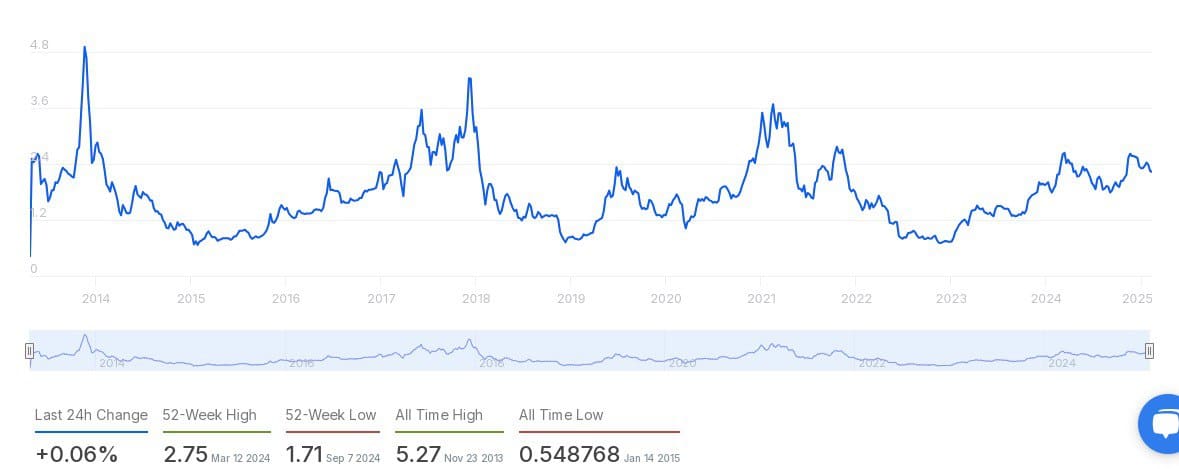

The Market Worth to Realized Worth (MVRV) Ratio, which measures market valuation towards the worth at which BTC was final moved, stays inside a reasonable vary.

The all-time excessive of 5.27 on November 2013, mirrored excessive optimism, whereas the all-time low of 0.548768 on January 2015, recommended deep undervaluation.

Prior to now 12 months, the MVRV ratio hit a excessive of two.75 on March 2024, and a low of 1.71 on September 2024. With solely a +0.06% change within the final 24 hours, market sentiment seems steady.

Institutional transactions stay energetic

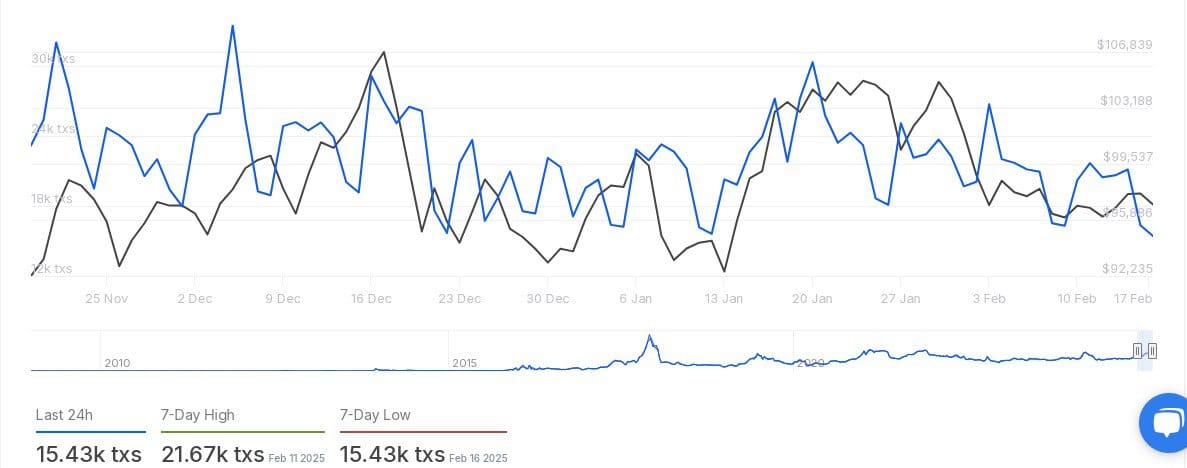

The variety of Bitcoin transactions value $100,000 or extra reveals fluctuations in large-scale exercise. The final 24-hour transaction rely stands at 15.43k, which additionally marks the 7-day low recorded on February 16, 2025.

On the eleventh of February 2025, transactions peaked at 21.67k, indicating excessive institutional exercise. Though transaction quantity has declined from late January highs, it stays inside a traditionally energetic vary.

This means continued curiosity from institutional traders and high-net-worth people.

What’s subsequent for Bitcoin?

With BTC reserves on exchanges shrinking, the opportunity of a provide shock stays a key focus. If demand holds or will increase, Bitcoin may expertise upward worth strain.

Because the market watches for the subsequent main transfer, many are assessing whether or not this development may sign the start of the subsequent bull run.

- Bitcoin’s Trade Reserves are at multi-year lows, elevating considerations a couple of doable provide shock.

- With fewer BTC accessible for buying and selling, analysts predict a possible worth surge if demand stays robust.

Bitcoin [BTC] reserves on spot exchanges have dropped to their lowest ranges lately, based on CryptoQuant data. Trade reserves grew between 2020 and 2022 however have been in a steep decline since.

Traders proceed withdrawing BTC from exchanges and transferring it to chilly storage, reinforcing a long-term holding development.

A shrinking alternate provide reduces the variety of Bitcoins accessible for buying and selling, which may create upward strain on worth if demand stays robust.

With Bitcoin displaying an upward development in 2024 and 2025, this shift suggests a tightening supply-demand stability.

The continued reserve decline has raised hypothesis a couple of doable provide shock, as much less BTC on exchanges might result in worth surges just like previous cycles.

On-chain knowledge suggests robust Bitcoin accumulation

Bitcoin has been buying and selling between $90,000 and $105,000, and data indicates ongoing accumulation. The 30-day transferring common (30DMA) of the Trade Influx/Outflow Ratio has remained under 1, signaling that extra BTC is leaving exchanges than coming into.

Analysts typically take into account this a bullish sign, because it suggests traders are holding fairly than promoting.

When this ratio drops under 1, it means that outflows dominate inflows, a situation {many professional} traders view as a bullish sign.

If historic patterns maintain, Bitcoin may see a short-term worth enhance as soon as the promoting strain weakens.

Nonetheless, a few of these outflows could also be linked to routine asset transfers by centralized exchanges to custodial wallets, equivalent to ETFs, institutional accounts, or OTC desks.

Bitcoin market traits and worth motion

As of press time, Bitcoin was buying and selling at $96,071, reflecting a -1.23% decline within the final 24 hours and a -1.43% drop over the previous seven days.

The entire circulating provide stands at 20 million BTC, giving Bitcoin a market capitalization of $1.9 trillion.

The Market Worth to Realized Worth (MVRV) Ratio, which measures market valuation towards the worth at which BTC was final moved, stays inside a reasonable vary.

The all-time excessive of 5.27 on November 2013, mirrored excessive optimism, whereas the all-time low of 0.548768 on January 2015, recommended deep undervaluation.

Prior to now 12 months, the MVRV ratio hit a excessive of two.75 on March 2024, and a low of 1.71 on September 2024. With solely a +0.06% change within the final 24 hours, market sentiment seems steady.

Institutional transactions stay energetic

The variety of Bitcoin transactions value $100,000 or extra reveals fluctuations in large-scale exercise. The final 24-hour transaction rely stands at 15.43k, which additionally marks the 7-day low recorded on February 16, 2025.

On the eleventh of February 2025, transactions peaked at 21.67k, indicating excessive institutional exercise. Though transaction quantity has declined from late January highs, it stays inside a traditionally energetic vary.

This means continued curiosity from institutional traders and high-net-worth people.

What’s subsequent for Bitcoin?

With BTC reserves on exchanges shrinking, the opportunity of a provide shock stays a key focus. If demand holds or will increase, Bitcoin may expertise upward worth strain.

Because the market watches for the subsequent main transfer, many are assessing whether or not this development may sign the start of the subsequent bull run.