- Ethereum ETF’s institutional possession jumped from 4.5% to 14.5% in This autumn of 2024

- Grayscale has sought the SEC’s nod for its ETH ETF staking function

Institutional adoption of Ethereum ETFs elevated in This autumn of 2024, not like the bearish sentiment among the many retail crowd. In actual fact, according to Juan Leon, senior funding strategist at Bitwise, institutional possession of ETH ETFs jumped by about 10% from 4.8% to 14.5%.

She noted,

“Institutional possession of ETH ETFs elevated from 4.8% in Q3 to 14.5% in This autumn. The establishments are coming for ETH.”

A large adoption uptick

Right here, one other noteworthy pattern is the comparatively larger adoption price of ETH ETFs, in comparison with BTC ETFs, over the identical interval. This, regardless of Bitcoin sustaining total dominance throughout all sectors of the market.

In accordance with Leon, institutional adoption for Bitcoin ETFs stood at 21.5% in This autumn 2024, in comparison with 22.3% in Q3.

Supply: X

The report was from the most recent 13F filings with the SEC, that are made quarterly and provide a glimpse into bids by high managers with over $100M in AUM (Property beneath administration).

Notably, Fintel data revealed that BlackRock’s ETH Belief, ETHA, was dominated by Goldman Sachs, Millennium Administration, and Brevan Howard Capital. The highest three companies had $235M, $105M, and $94M value of ETHA shares.

Leon added that an uptick in institutional possession marks the following part in adoption.

“I believe that factors to coming into the following part of institutional accumulation: main establishments resembling sovereign wealth funds and pension funds.”

One other potential bullish replace for the merchandise is the push for ETF staking. The SEC Crypto Activity Drive just lately met Jito Labs and crypto VC MultiCoin Capital on the problem. The transfer has been extensively seen as optimistic for possible ETF staking options. In actual fact, Grayscale submitted a current SEC application for an ETF staking function for its U.S Spot ETF product.

Commenting on the developments, Nate Geraci of the ETF Retailer stated that ETF staking is a “matter of time.”

“As a substitute of simply saying “no”, SEC is definitely participating in constructive conversations. Encouraging. IMO, staking in ETH ETFs is just a matter of time.”

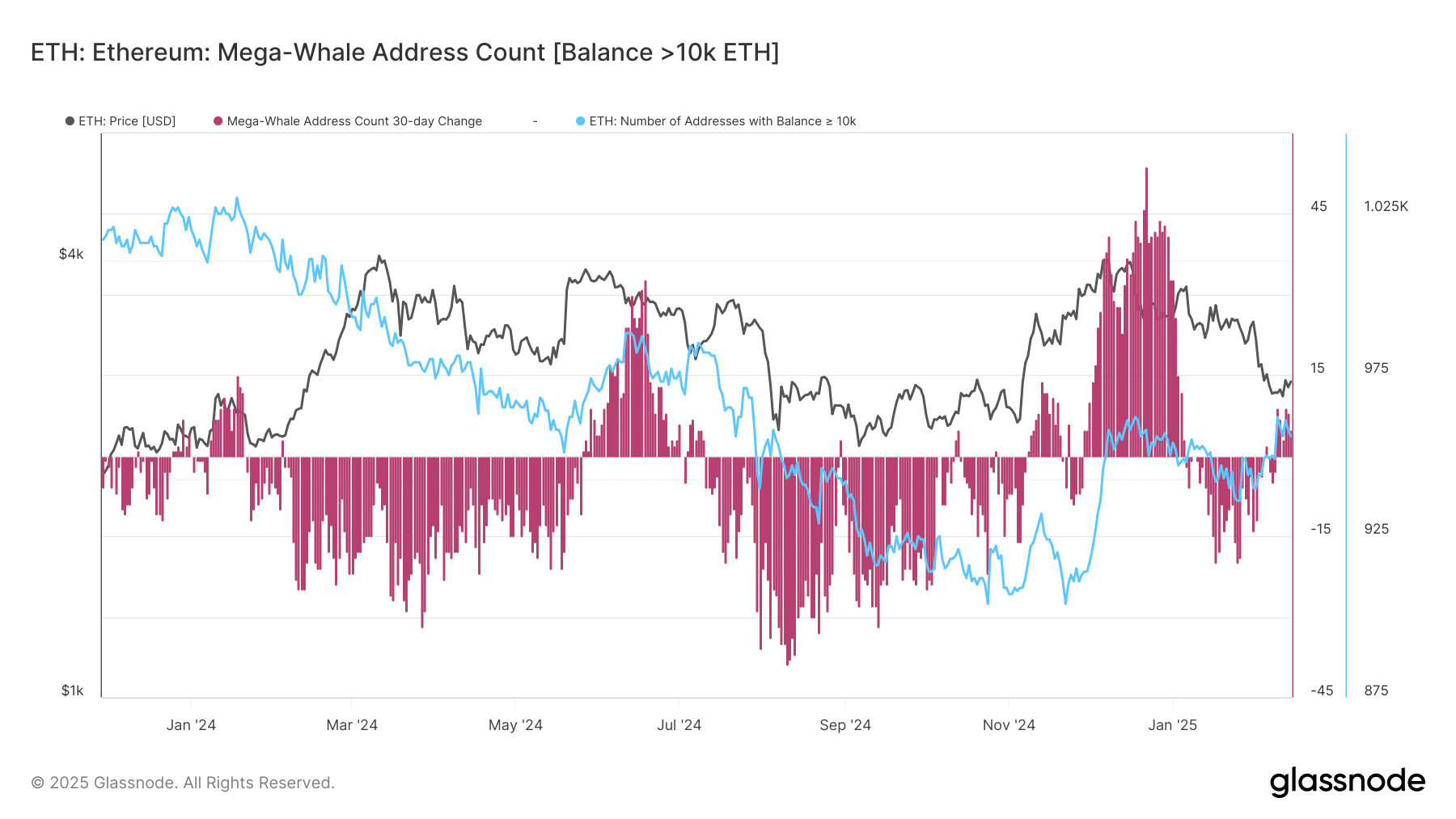

That being mentioned, the 30-day mega-whale tackle depend (with over 10K ETH) turned optimistic once more in February. The variety of addresses with over 10k ETH has additionally surged to 956 from 936 thus far.

Quite the opposite, ETH’s value has remained muted regardless of the institutional adoption surge. On the time of writing, the altcoin was valued at $2.7k and was 34% down from its December excessive of $4.1k.

- Ethereum ETF’s institutional possession jumped from 4.5% to 14.5% in This autumn of 2024

- Grayscale has sought the SEC’s nod for its ETH ETF staking function

Institutional adoption of Ethereum ETFs elevated in This autumn of 2024, not like the bearish sentiment among the many retail crowd. In actual fact, according to Juan Leon, senior funding strategist at Bitwise, institutional possession of ETH ETFs jumped by about 10% from 4.8% to 14.5%.

She noted,

“Institutional possession of ETH ETFs elevated from 4.8% in Q3 to 14.5% in This autumn. The establishments are coming for ETH.”

A large adoption uptick

Right here, one other noteworthy pattern is the comparatively larger adoption price of ETH ETFs, in comparison with BTC ETFs, over the identical interval. This, regardless of Bitcoin sustaining total dominance throughout all sectors of the market.

In accordance with Leon, institutional adoption for Bitcoin ETFs stood at 21.5% in This autumn 2024, in comparison with 22.3% in Q3.

Supply: X

The report was from the most recent 13F filings with the SEC, that are made quarterly and provide a glimpse into bids by high managers with over $100M in AUM (Property beneath administration).

Notably, Fintel data revealed that BlackRock’s ETH Belief, ETHA, was dominated by Goldman Sachs, Millennium Administration, and Brevan Howard Capital. The highest three companies had $235M, $105M, and $94M value of ETHA shares.

Leon added that an uptick in institutional possession marks the following part in adoption.

“I believe that factors to coming into the following part of institutional accumulation: main establishments resembling sovereign wealth funds and pension funds.”

One other potential bullish replace for the merchandise is the push for ETF staking. The SEC Crypto Activity Drive just lately met Jito Labs and crypto VC MultiCoin Capital on the problem. The transfer has been extensively seen as optimistic for possible ETF staking options. In actual fact, Grayscale submitted a current SEC application for an ETF staking function for its U.S Spot ETF product.

Commenting on the developments, Nate Geraci of the ETF Retailer stated that ETF staking is a “matter of time.”

“As a substitute of simply saying “no”, SEC is definitely participating in constructive conversations. Encouraging. IMO, staking in ETH ETFs is just a matter of time.”

That being mentioned, the 30-day mega-whale tackle depend (with over 10K ETH) turned optimistic once more in February. The variety of addresses with over 10k ETH has additionally surged to 956 from 936 thus far.

Quite the opposite, ETH’s value has remained muted regardless of the institutional adoption surge. On the time of writing, the altcoin was valued at $2.7k and was 34% down from its December excessive of $4.1k.