The crypto market has been experiencing vital volatility, with the Bitcoin worth main the cost. Over the previous month, BTC has been trading sideways, recording declines which have pushed its worth beneath the $100,000 mark. As analysts speculate concerning the cryptocurrency’s subsequent main transfer, current information suggests {that a} traditional Flag Pole sample is starting to emerge on the Bitcoin worth chart. The crypto analyst who has recognized this sample has shared a bullish roadmap prediction for Bitcoin, projecting that it may rise to a brand new all-time excessive above $120,000.

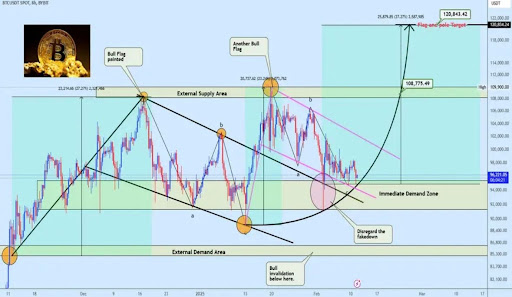

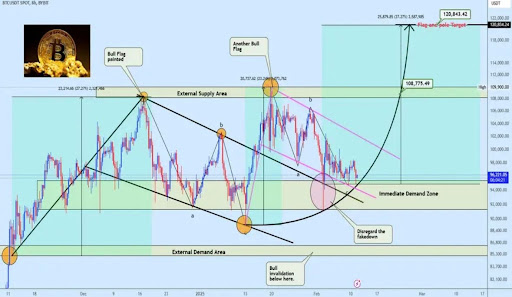

In a TradingView evaluation, crypto skilled Weslad expressed optimism about Bitcoin’s future trajectory, projecting that it may soar as excessive as $120,843 on this bull cycle. The analyst highlighted the present formation of a traditional Flag Pole pattern on the BTC worth chart. The emergence of this distinct technical sample within the Bitcoin construction has sparked an enthusiastic response from analysts, as they anticipate an enormous breakout to the upside.

Roadmap To $120,000 Bitcoin Worth Goal

Associated Studying

This bull flag sample is usually often known as a bullish continuation sign throughout an uptrend. It represents a halt in a cryptocurrency’s upward motion earlier than the development resumes. Within the case of Bitcoin, Weslad means that its current rejection will not be seen as a downturn however moderately as a wise cash accumulation zone designed to shake out weaker hands who panic throughout market declines.

Regardless of its pullback, Bitcoin’s recent price action has demonstrated a robust resilience in a right away demand zone between $91,000 and $95,000. The analyst additionally describes this correction as a “faux down,” noting that it was on account of liquidity engineering. This strategic liquidity seize permits large players to accumulate BTC at beneficial costs earlier than the subsequent vital transfer upward.

Whereas noting the Flag Pole formation, Weslad additionally highlights a current breakout from a Descending Channel that has beforehand restricted Bitcoin’s worth actions. This channel breakout alerts the attainable resurgence of Bitcoin’s bullishness, with the analyst predicting an preliminary surge to $108,089.

If Bitcoin can maintain a positive momentum, the pathway to an final Flag Pole goal of $120,843 turns into believable.

Monitoring Breakout Alerts

Whereas Weslad initiatives a brand new all-time excessive for Bitcoin at $120,843, the analyst additionally emphasizes necessary alerts that would point out an imminent breakout. He revealed that if Bitcoin can efficiently flip the aforementioned exterior provide zone between $108,000 and $109,000, the cryptocurrency may see its worth skyrocket to new highs.

Associated Studying

On the time of writing, Bitcoin’s worth is $96,142, marking a 2.25% decline over the previous week.

Featured picture from Unsplash, chart from Tradingview.com

The crypto market has been experiencing vital volatility, with the Bitcoin worth main the cost. Over the previous month, BTC has been trading sideways, recording declines which have pushed its worth beneath the $100,000 mark. As analysts speculate concerning the cryptocurrency’s subsequent main transfer, current information suggests {that a} traditional Flag Pole sample is starting to emerge on the Bitcoin worth chart. The crypto analyst who has recognized this sample has shared a bullish roadmap prediction for Bitcoin, projecting that it may rise to a brand new all-time excessive above $120,000.

In a TradingView evaluation, crypto skilled Weslad expressed optimism about Bitcoin’s future trajectory, projecting that it may soar as excessive as $120,843 on this bull cycle. The analyst highlighted the present formation of a traditional Flag Pole pattern on the BTC worth chart. The emergence of this distinct technical sample within the Bitcoin construction has sparked an enthusiastic response from analysts, as they anticipate an enormous breakout to the upside.

Roadmap To $120,000 Bitcoin Worth Goal

Associated Studying

This bull flag sample is usually often known as a bullish continuation sign throughout an uptrend. It represents a halt in a cryptocurrency’s upward motion earlier than the development resumes. Within the case of Bitcoin, Weslad means that its current rejection will not be seen as a downturn however moderately as a wise cash accumulation zone designed to shake out weaker hands who panic throughout market declines.

Regardless of its pullback, Bitcoin’s recent price action has demonstrated a robust resilience in a right away demand zone between $91,000 and $95,000. The analyst additionally describes this correction as a “faux down,” noting that it was on account of liquidity engineering. This strategic liquidity seize permits large players to accumulate BTC at beneficial costs earlier than the subsequent vital transfer upward.

Whereas noting the Flag Pole formation, Weslad additionally highlights a current breakout from a Descending Channel that has beforehand restricted Bitcoin’s worth actions. This channel breakout alerts the attainable resurgence of Bitcoin’s bullishness, with the analyst predicting an preliminary surge to $108,089.

If Bitcoin can maintain a positive momentum, the pathway to an final Flag Pole goal of $120,843 turns into believable.

Monitoring Breakout Alerts

Whereas Weslad initiatives a brand new all-time excessive for Bitcoin at $120,843, the analyst additionally emphasizes necessary alerts that would point out an imminent breakout. He revealed that if Bitcoin can efficiently flip the aforementioned exterior provide zone between $108,000 and $109,000, the cryptocurrency may see its worth skyrocket to new highs.

Associated Studying

On the time of writing, Bitcoin’s worth is $96,142, marking a 2.25% decline over the previous week.

Featured picture from Unsplash, chart from Tradingview.com