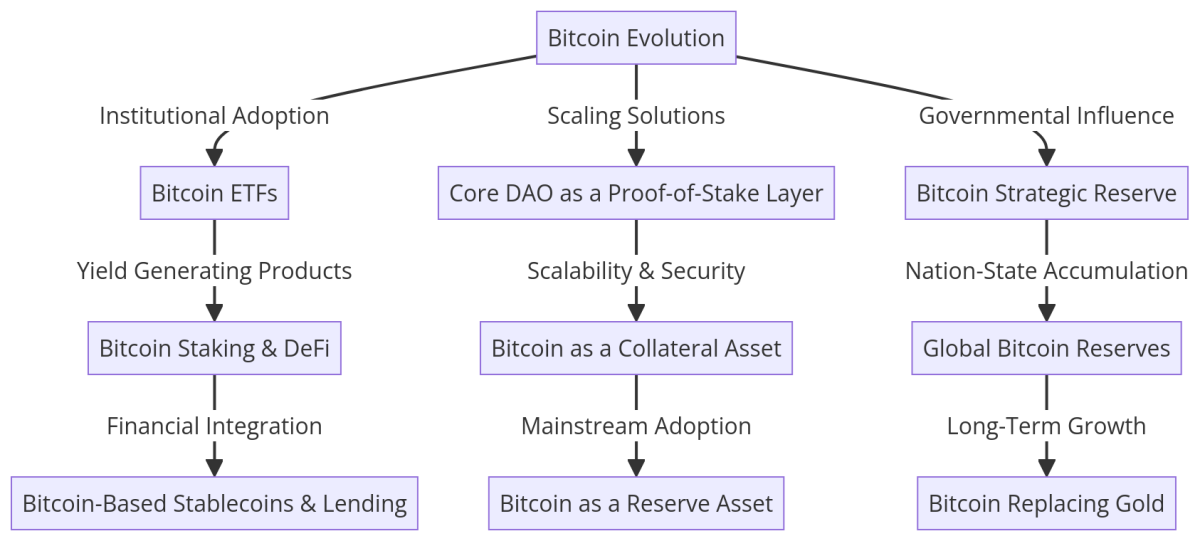

Bitcoin’s evolution from an obscure digital foreign money to a world monetary pressure has been nothing in need of extraordinary. As Bitcoin enters a brand new period, establishments, governments, and builders are working to unlock its full potential. Matt Crosby, Bitcoin Magazine Pro’s lead market analyst, sat down with Wealthy Rines, contributor at Core DAO, to debate Bitcoin’s subsequent section of development, the rise of Bitcoin DeFi, and its potential as a world reserve asset. Watch the total interview right here: The Future Of Bitcoin – Featuring Rich Rines

Bitcoin’s Evolution & Institutional Adoption

Wealthy Rines has been within the Bitcoin house since 2013, having witnessed firsthand its transformation from an experimental know-how to a globally acknowledged monetary instrument.

“By the 2017 cycle, I used to be fairly decided that that is what I used to be going to spend the remainder of my profession on.”

The dialog delves into Bitcoin’s rising position in institutional portfolios, with spot Bitcoin ETFs already surpassing $41 billion in inflows. Rines believes the institutionalization of Bitcoin will proceed to reshape world finance, notably with the rise of yield-generating merchandise that enchantment to Wall Avenue buyers.

“Each asset supervisor on the planet can now purchase Bitcoin with ETFs, and that essentially modifications the market.”

What’s Core DAO?

Core DAO is an revolutionary blockchain ecosystem designed to reinforce Bitcoin’s performance by way of a proof-of-stake (PoS) mechanism. In contrast to conventional Bitcoin scaling options, Core DAO leverages a decentralized PoS construction to enhance scalability, programmability, and interoperability whereas sustaining Bitcoin’s safety and decentralization.

At its core, Core DAO acts as a Bitcoin-aligned Layer-1 blockchain, which means it extends Bitcoin’s capabilities with out altering its base layer. This allows a spread of DeFi purposes, sensible contracts, and staking alternatives for Bitcoin holders.

“Core is the main Bitcoin scaling resolution, and the way in which to consider it’s actually the proof-of-stake layer for Bitcoin.”

By securing 75% of the Bitcoin hash rate, Core DAO ensures that Bitcoin’s safety rules stay intact whereas providing larger performance for builders and customers. With a rising ecosystem of over 150+ initiatives, Core DAO is paving the way in which for the subsequent section of Bitcoin’s monetary enlargement.

Core: Bitcoin’s Proof-of-Stake Layer & DeFi Enlargement

One of many greatest challenges going through Bitcoin is scalability. The Bitcoin community’s excessive charges and gradual transaction speeds make it a strong settlement layer however restrict its utility for day-to-day transactions. That is the place Core DAO is available in.

“Bitcoin lacks scalability, programmability. It’s too costly. All these items that make it an amazing settlement layer is strictly the rationale that we want an answer like Core to increase these capabilities.”

Core DAO features as a proof-of-stake layer for Bitcoin, permitting customers to generate yield with out third-party danger. It gives an ecosystem the place Bitcoin holders can take part in DeFi purposes with out compromising on safety.

“We’re going to see Bitcoin DeFi dwarf Ethereum DeFi throughout the subsequent three years as a result of Bitcoin is a superior collateral asset.”

Bitcoin as a Strategic Reserve Asset

Governments and sovereign wealth funds are starting to view Bitcoin not as a foreign money however as a strategic reserve asset. The potential for a U.S. Bitcoin strategic reserve, in addition to broader world adoption on the nation-state degree, might create a brand new monetary paradigm.

“Persons are speaking about constructing strategic Bitcoin reserves for the primary time.”

The concept of Bitcoin changing gold as a main retailer of worth is turning into extra tangible. Rines asserts that Bitcoin’s shortage and decentralization make it a superior various to gold.

“I believe throughout the subsequent decade, Bitcoin will grow to be the worldwide reserve asset, changing gold.”

Bitcoin Privateness: The Closing Frontier

Whereas Bitcoin is commonly hailed as a decentralized and censorship-resistant asset, privateness stays a big problem. In contrast to money transactions, Bitcoin’s public ledger exposes all transactions to anybody with entry to the blockchain.

Rines believes that enhancing Bitcoin privateness can be a vital step in its evolution.

“I’ve wished personal Bitcoin transactions for a very very long time. I’m fairly bearish on it ever taking place on the bottom layer, however there’s potential in scaling options.”

Whereas options like CoinJoin and the Lightning Community provide some privateness enhancements, full-scale anonymity stays elusive. Core is exploring improvements that might allow confidential transactions with out sacrificing Bitcoin’s safety and transparency.

“On Core, we’re working with groups on probably having confidential transactions—the place you possibly can inform {that a} transaction is occurring, however not the quantity or counterparties concerned.”

As governments proceed to extend scrutiny over digital monetary exercise, the necessity for enhanced Bitcoin privateness options will solely develop. Whether or not by way of native protocol upgrades or second-layer options, the way forward for Bitcoin privateness stays a vital space of growth.

The Way forward for Bitcoin: A Trillion-Greenback Market within the Making

Because the interview progresses, Rines outlines how Bitcoin’s financial framework is increasing past hypothesis and into productive monetary devices. He predicts that inside a decade, Bitcoin will command a $10 trillion market cap, with DeFi purposes turning into a good portion of its financial ecosystem.

“The Bitcoin DeFi market is a trillion-dollar alternative, and we’re simply getting began.”

His perspective aligns with a broader trade development the place Bitcoin just isn’t solely used as a retailer of worth but in addition as an lively monetary asset inside decentralized networks.

Wealthy Rines Roadmap for Bitcoin’s Future

Closing Ideas

The dialog between Matt Crosby and Wealthy Rines gives a compelling glimpse into the way forward for Bitcoin. With institutional adoption accelerating, Bitcoin DeFi increasing, and the rising recognition of Bitcoin as a strategic reserve, it’s clear that Bitcoin’s finest years are forward.

As Rines places it:

“Constructing on Bitcoin is likely one of the most enjoyable alternatives on the planet. There’s a trillion-dollar market ready to be unlocked.”

For buyers, builders, and policymakers, the important thing takeaway is obvious: Bitcoin is not only a speculative asset—it’s the basis of a brand new monetary system.

For extra detailed Bitcoin evaluation and to entry superior options like reside charts, personalised indicator alerts, and in-depth trade stories, take a look at Bitcoin Magazine Pro.

Disclaimer: This text is for informational functions solely and shouldn’t be thought-about monetary recommendation. All the time do your individual analysis earlier than making any funding choices.