- Bitcoin has fallen by 11.28% from its ATH, decreasing miners profitability

- Miners might capitulate as revenue/loss sustainability enters extraordinarily underpaid zone

Since hitting a brand new all-time excessive of $109k almost 3 weeks in the past, Bitcoin [BTC] has dropped by roughly 11.28% on the charts.

This decline has not solely affected short-term holders by way of profitability, but additionally miners. Actually, the most recent dip in BTC’s worth charts has left miners struggling to maintain up with the market.

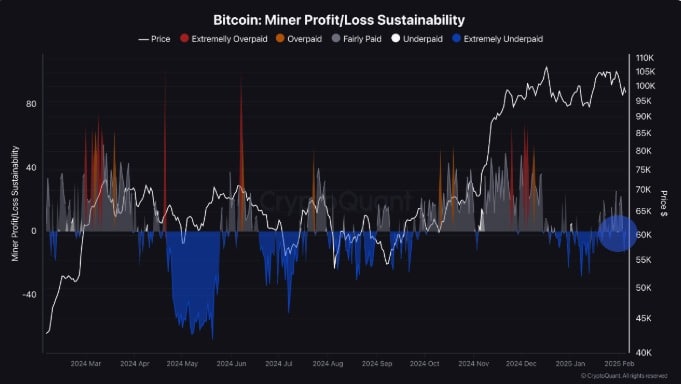

CryptoQuant analyst Frost, as an illustration, noticed that miners are extraordinarily underpaid proper now, risking miners’ capitulation.

Bitcoin’s Miner Revenue/Loss enters excessive underpaid zone

In keeping with CryptoQuant, Bitcoin miners’ profit-loss sustainability has entered the extraordinarily underpaid zone.

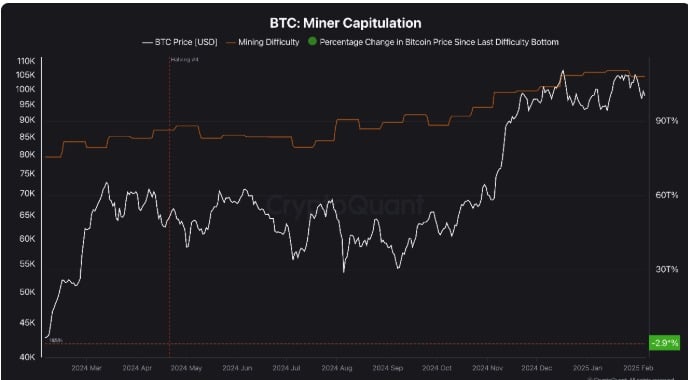

This, following the April 2024 halving which resulted in a rising mining issue. Whereas it has turn out to be tougher to mine, Bitcoin’s hash fee has continued to develop – An indication of the surge in competitors amongst miners.

With Bitcoin persevering with to say no since hitting its ATH, miners’ returns have been shrinking. Quite the opposite, the realized mining value has been comparatively excessive, in comparison with the final issue backside.

This market situation means that miners may begin to capitulate quickly. Traditionally, when miner revenue/loss profitability turns detrimental, it’s usually adopted by a mid-term constructive worth response. Merely put, miners have reacted by promoting Bitcoin to cowl prices.

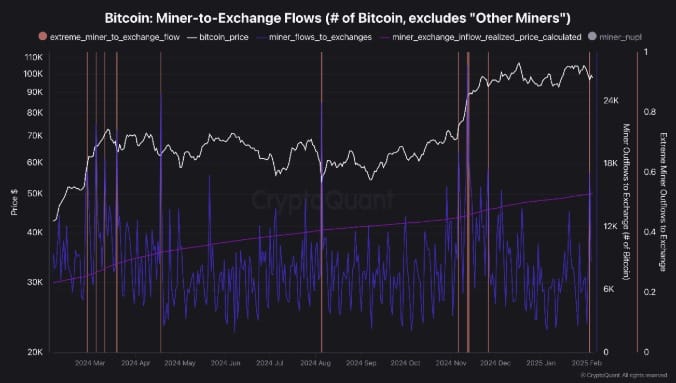

With miners actively promoting, the miner-to-exchange flows hit report ranges too, indicating that miners are promoting closely in the intervening time.

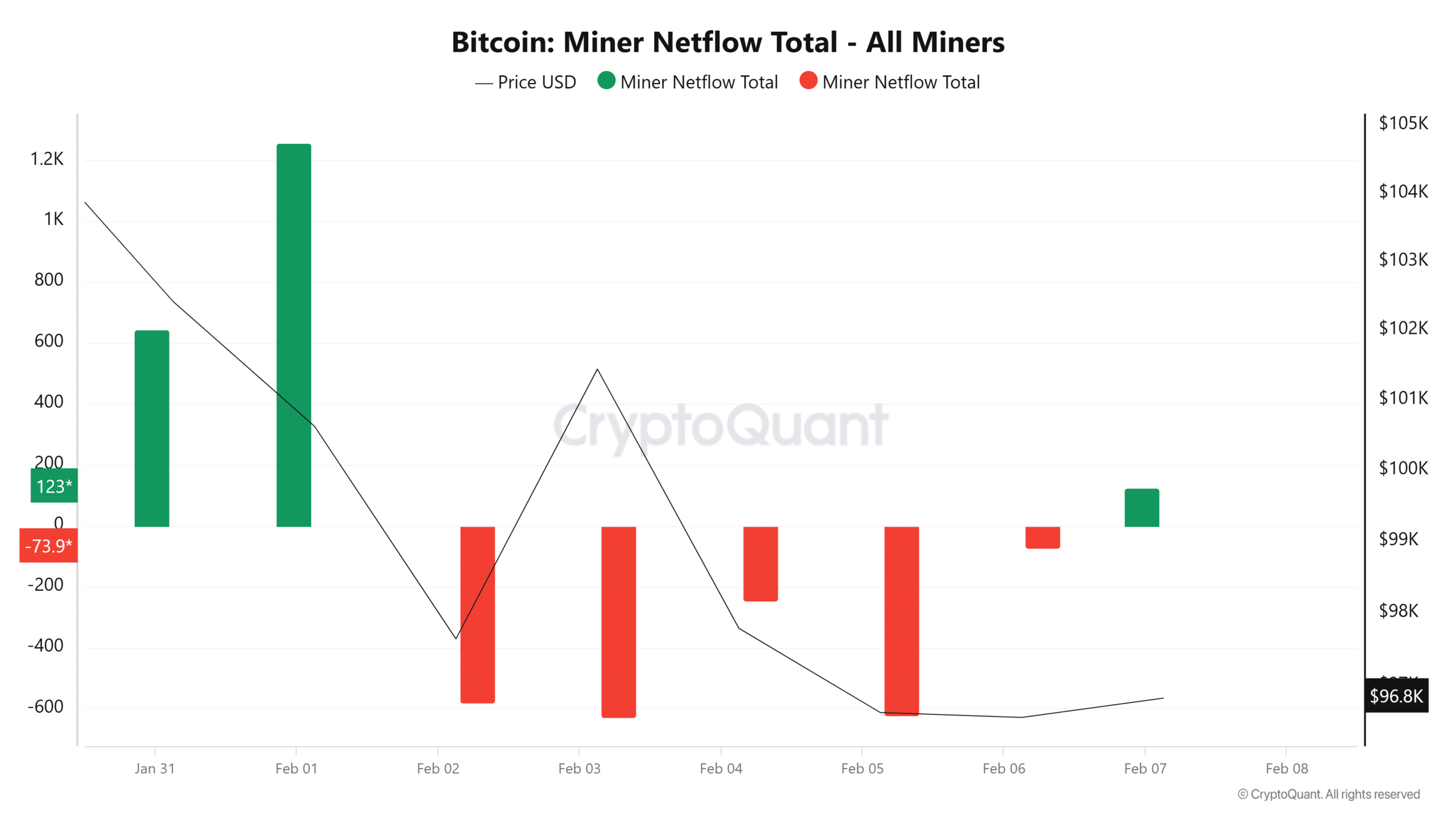

We are able to additionally see this because the miners’ netflow complete turned constructive after being detrimental for five consecutive days. This appeared to suggest that extra miners are sending their BTC tokens to exchanges to promote.

With miners dealing with operational difficulties, they’ve responded by promoting. Some might even be pressured to capitulate briefly.

In earlier cycles, this case has created accumulation zones for different market contributors to re-enter the market.

Is miner capitulation forward for BTC?

Therefore, with miners’ profitability dropping, it’s important to find out if capitulation for miners is forward or not.

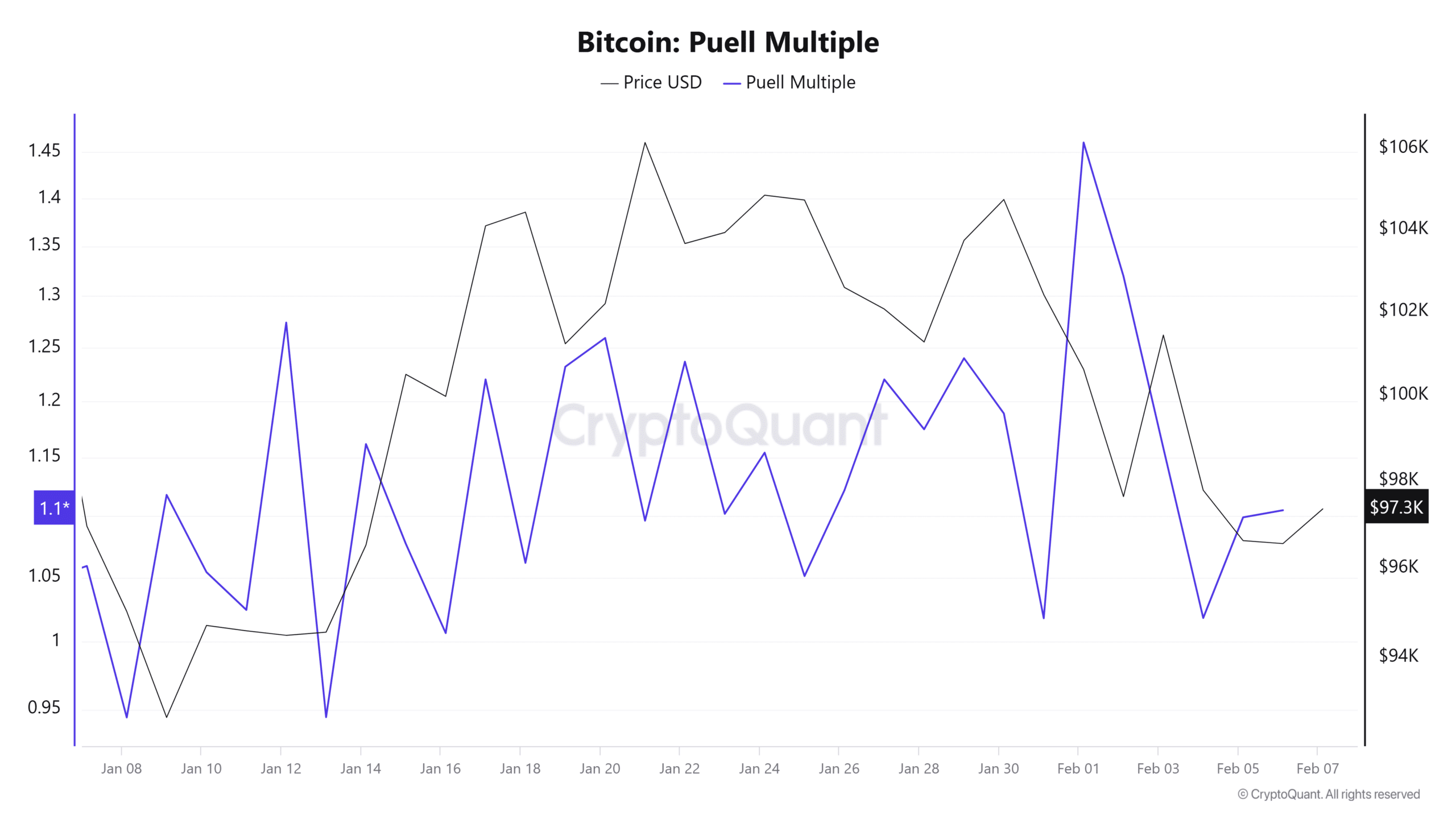

Take a look at the Puell a number of, as an illustration – This metric has remained above 1 since 13 January, dropping beneath 1 solely twice in 2025, in the course of the first weeks of the yr. What this implies is that though the Puell a number of has fluctuated, miner income stays reasonably wholesome.

Subsequently, so long as this stays above 1, miners are much less prone to capitulate. Therefore, the drop might simply be a wholesome correction as an alternative of weak point. This might suggest accumulation by robust miners and traders.

What’s subsequent now?

In keeping with AMBCrypto’s evaluation, for Bitcoin miners to keep away from capitulation, BTC’s worth has to get better to extend miner revenue/loss.

If the worth continues to fall, simply because it has over the previous week, miners’ capitulation may very well be subsequent. Subsequently, BTC should reclaim and maintain above $100k for miners’ sustainability targets to be achieved.

- Bitcoin has fallen by 11.28% from its ATH, decreasing miners profitability

- Miners might capitulate as revenue/loss sustainability enters extraordinarily underpaid zone

Since hitting a brand new all-time excessive of $109k almost 3 weeks in the past, Bitcoin [BTC] has dropped by roughly 11.28% on the charts.

This decline has not solely affected short-term holders by way of profitability, but additionally miners. Actually, the most recent dip in BTC’s worth charts has left miners struggling to maintain up with the market.

CryptoQuant analyst Frost, as an illustration, noticed that miners are extraordinarily underpaid proper now, risking miners’ capitulation.

Bitcoin’s Miner Revenue/Loss enters excessive underpaid zone

In keeping with CryptoQuant, Bitcoin miners’ profit-loss sustainability has entered the extraordinarily underpaid zone.

This, following the April 2024 halving which resulted in a rising mining issue. Whereas it has turn out to be tougher to mine, Bitcoin’s hash fee has continued to develop – An indication of the surge in competitors amongst miners.

With Bitcoin persevering with to say no since hitting its ATH, miners’ returns have been shrinking. Quite the opposite, the realized mining value has been comparatively excessive, in comparison with the final issue backside.

This market situation means that miners may begin to capitulate quickly. Traditionally, when miner revenue/loss profitability turns detrimental, it’s usually adopted by a mid-term constructive worth response. Merely put, miners have reacted by promoting Bitcoin to cowl prices.

With miners actively promoting, the miner-to-exchange flows hit report ranges too, indicating that miners are promoting closely in the intervening time.

We are able to additionally see this because the miners’ netflow complete turned constructive after being detrimental for five consecutive days. This appeared to suggest that extra miners are sending their BTC tokens to exchanges to promote.

With miners dealing with operational difficulties, they’ve responded by promoting. Some might even be pressured to capitulate briefly.

In earlier cycles, this case has created accumulation zones for different market contributors to re-enter the market.

Is miner capitulation forward for BTC?

Therefore, with miners’ profitability dropping, it’s important to find out if capitulation for miners is forward or not.

Take a look at the Puell a number of, as an illustration – This metric has remained above 1 since 13 January, dropping beneath 1 solely twice in 2025, in the course of the first weeks of the yr. What this implies is that though the Puell a number of has fluctuated, miner income stays reasonably wholesome.

Subsequently, so long as this stays above 1, miners are much less prone to capitulate. Therefore, the drop might simply be a wholesome correction as an alternative of weak point. This might suggest accumulation by robust miners and traders.

What’s subsequent now?

In keeping with AMBCrypto’s evaluation, for Bitcoin miners to keep away from capitulation, BTC’s worth has to get better to extend miner revenue/loss.

If the worth continues to fall, simply because it has over the previous week, miners’ capitulation may very well be subsequent. Subsequently, BTC should reclaim and maintain above $100k for miners’ sustainability targets to be achieved.