A carefully adopted crypto analyst says altcoins might endure an explosive rally as soon as a key Bitcoin (BTC) metric reverses.

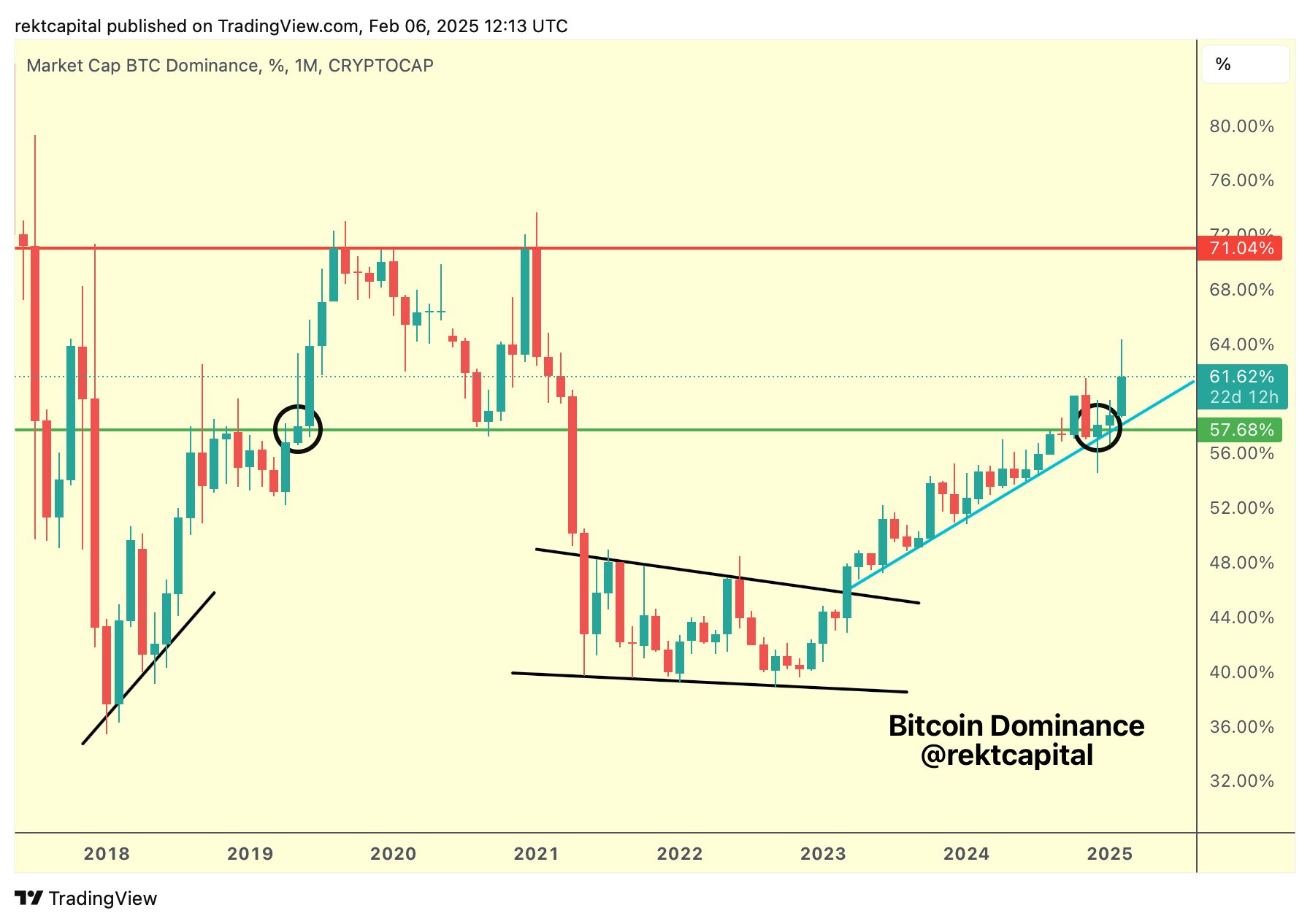

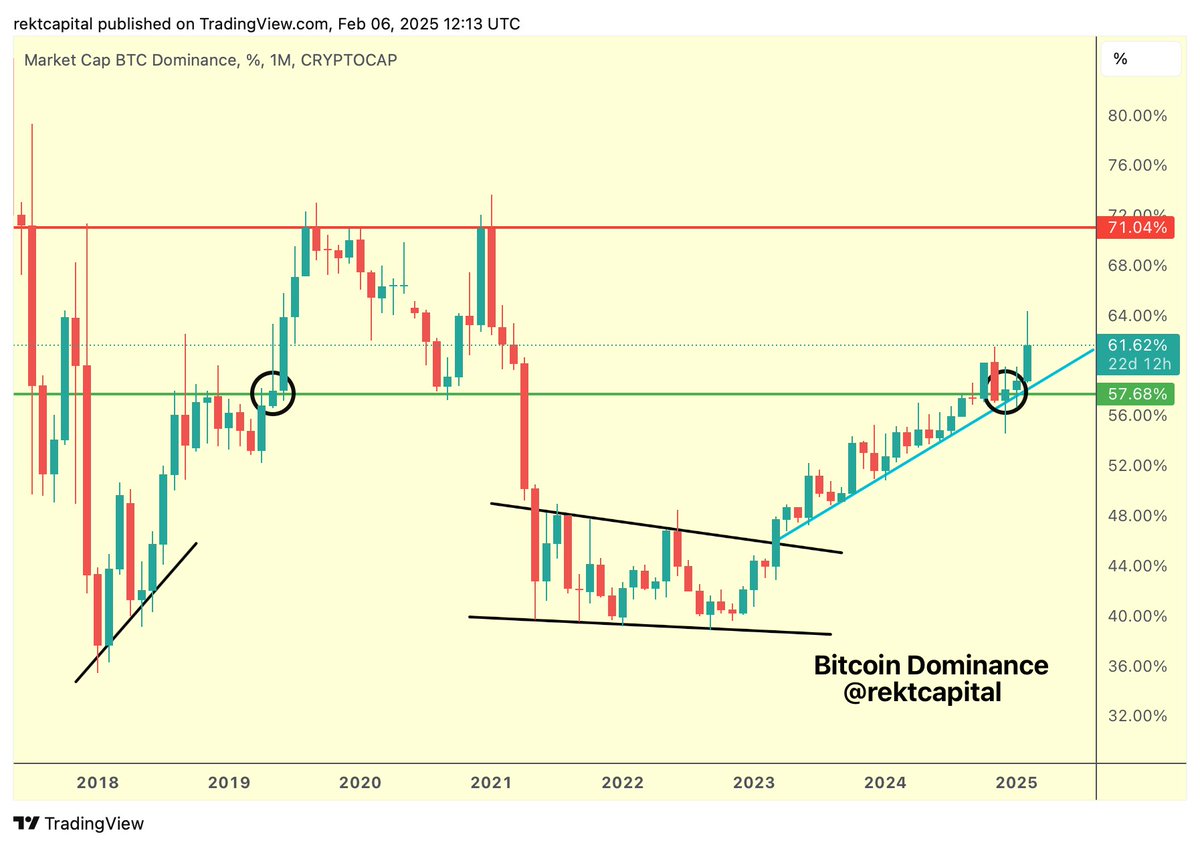

In a brand new technique session, crypto dealer Rekt Capital tells his 536,300 followers on the social media platform X that the Bitcoin dominance (BTC.D) metric might quickly enter a downward section after hitting a historic peak degree, setting alts as much as outperform the flagship crypto asset.

Bitcoin dominance presently stands at 61.86%. Merchants use BTC.D to trace if altcoins are outperforming Bitcoin because the metric calculates how a lot of the crypto market cap belongs to BTC.

Rekt additionally says that alts might have smaller rallies when there are short-term BTC.D pullbacks earlier than a pattern reversal.

“Sure, Bitcoin dominance is in a macro uptrend that might see it revisit 71% over the course of the subsequent few months However as with all macro uptrend pullbacks do occur as a part of the journey within the meantime.

And it’s these pullbacks in Bitcoin dominance that may allow altcoin home windows. These altcoin home windows might progress according to altcoin hype cycles, whereby will increase in altcoin valuations happen throughout the second half of respective quarters. It’s simply that these altcoin home windows (i.e. retraces in Bitcoin dominance) could also be 5%-10% deep throughout the macro Bitcoin dominance uptrend.

However as soon as Bitcoin dominance revisits 71% and rejects from there that’s the place an outsized correction would happen. And an outsized Bitcoin dominance correction would create an outsized altseason.”

He additionally says that Bitcoin dominance is getting into a section of the market that traditionally results in a breakout for altcoins.

“Bitcoin dominance has lastly damaged into its 58%-71% vary (green-red). And each time BTC dominance broke into this vary, Bitcoin dominance would revisit 71% (purple) earlier than rejecting harshly to the draw back to allow a robust altseason.”

He notes that BTC.D has traditionally hit the 71% degree earlier than correcting.

“There’s a number of hypothesis about whether or not Bitcoin dominance will even have the ability to revisit the 71% resistance Traditionally, every part BTC dominance has damaged into the 58%-71% macro vary, it could revisit 71%. This has occurred three out of thrice. Historical past suggests the Bitcoin dominance macro tops don’t appear to vary a lot throughout time.”

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Test Price Action

Observe us on X, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl should not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses you might incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney

![How to Boost a Post on Social Media [Instagram, Facebook, and Twitter]](https://latestbitcoin.news/wp-content/uploads/2025/02/social-media-boosting-1-20250205-921042.webp-120x86.webp)