- Trump’s crypto czar confirmed that they’ll conduct a BTC reserve feasibility.

- BTC dropped under $100K once more after Sacks’ presser amid combined neighborhood reactions.

President Donald Trump’s crypto and AI czar, David Sacks, held his first press convention on digital belongings on the 4th of February, eliciting combined views from the crypto neighborhood.

In a presser flanked by key congressional leaders, together with Banking Committee Chair Tim Scott, Sacks famous that they’re ‘evaluating’ the feasibility of Bitcoin reserve. He said,

‘One of many issues that the president instructed us to do is to judge the concept of Bitcoin reserve. We’re nonetheless ready for some Cupboard Secretaries of the working group to be confirmed.”

The crypto chief additionally reiterated that the just lately introduced Sovereign Wealth Fund will likely be separate from the Bitcoin[BTC] reserve.

Nevertheless, some within the crypto neighborhood had been skeptical of this end result.

No extra Bitcoin reserve?

In response to market analysis analyst, Jim Bianco, the ‘wordings’ utilized by the officers urged doable ‘stalling’ for BTC reserve. He said,

“Trump stated he would do a $BTC Reserve, not promise to “consider it.” Consider/Research is what Washington does once they don’t need to do one thing. $BTC is down ~5% since this announcement.”

Apparently, Arthur Hayes, founding father of BitMEX, echoed the same sentiment and said that Trump insurance policies would take longer to materialize.

In a rejoinder, famend macro knowledgeable Lyn Alden urged customers to double down on BTC and ignore the reserve. She stated,

“Lengthy Bitcoin. Fade the reserve.”

For perspective, in his first week in workplace, President Trump signed a crypto executive order, which included a possible ‘nationwide digital asset stockpile’ inside 180 days.

Insiders like Senator Cynthia Lummis implored {that a} BTC reserve wants a legislative framework that stands no matter who’s in energy.

In consequence, the preliminary excessive expectation of a U.S. BTC reserve inside 100 days has evaporated. Nevertheless, some leaders additionally criticized the skeptical response to Sacks’ presser.

Bitwise CEO Hunter Horsely, urged the neighborhood to be affected person for the seemingly fruitful end result from the anticipated crypto insurance policies.

“The crypto neighborhood’s impatience is one in all it’s nice strengths and nice weaknesses. A lot that this house has hoped for is underway — however the mainstream strikes on the velocity of months, not days. Good issues come to those that can wait.”

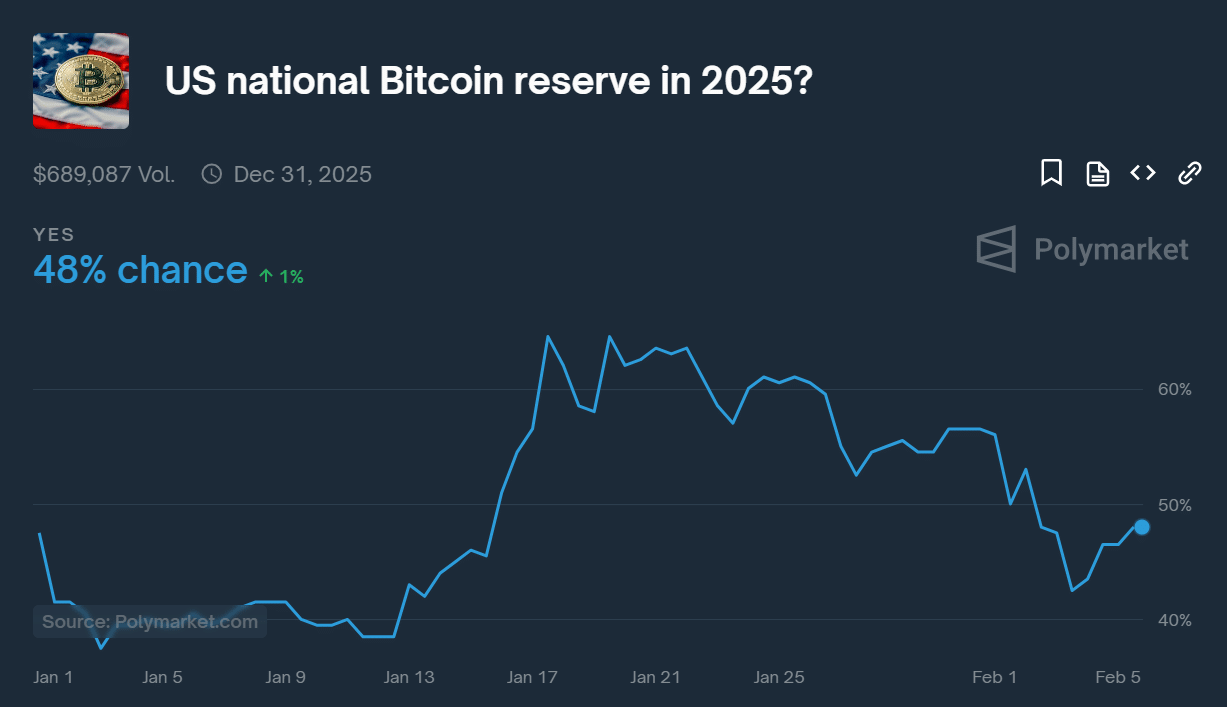

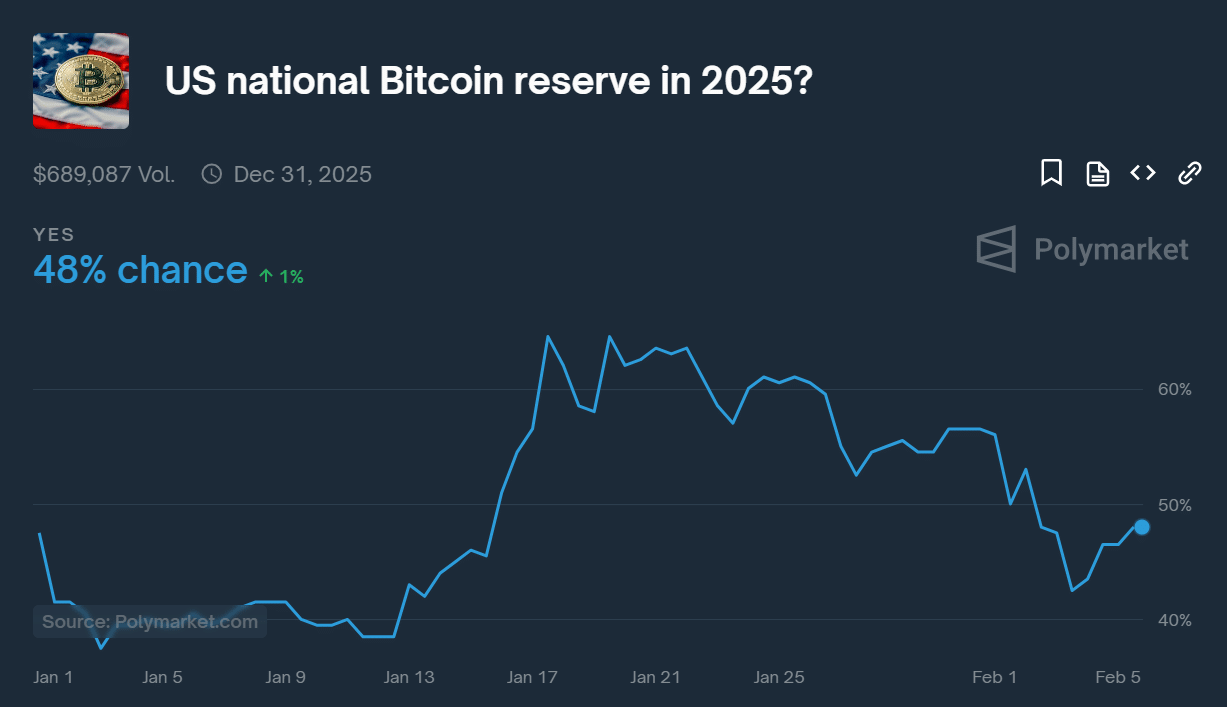

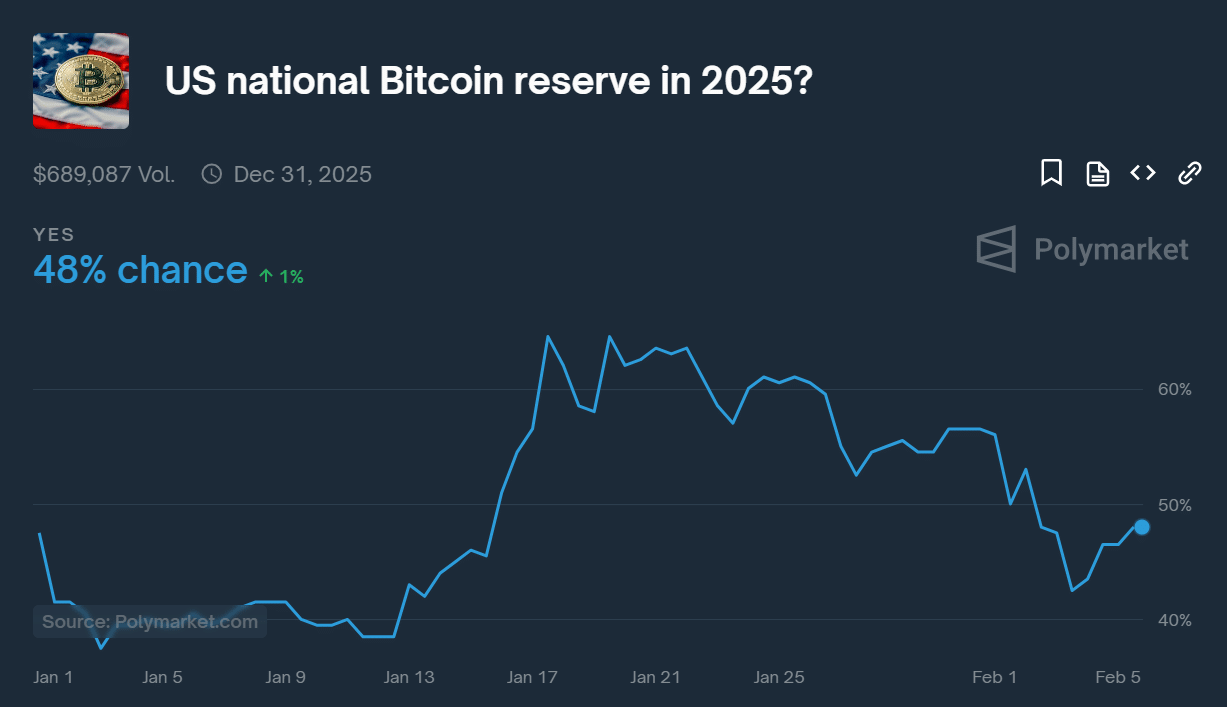

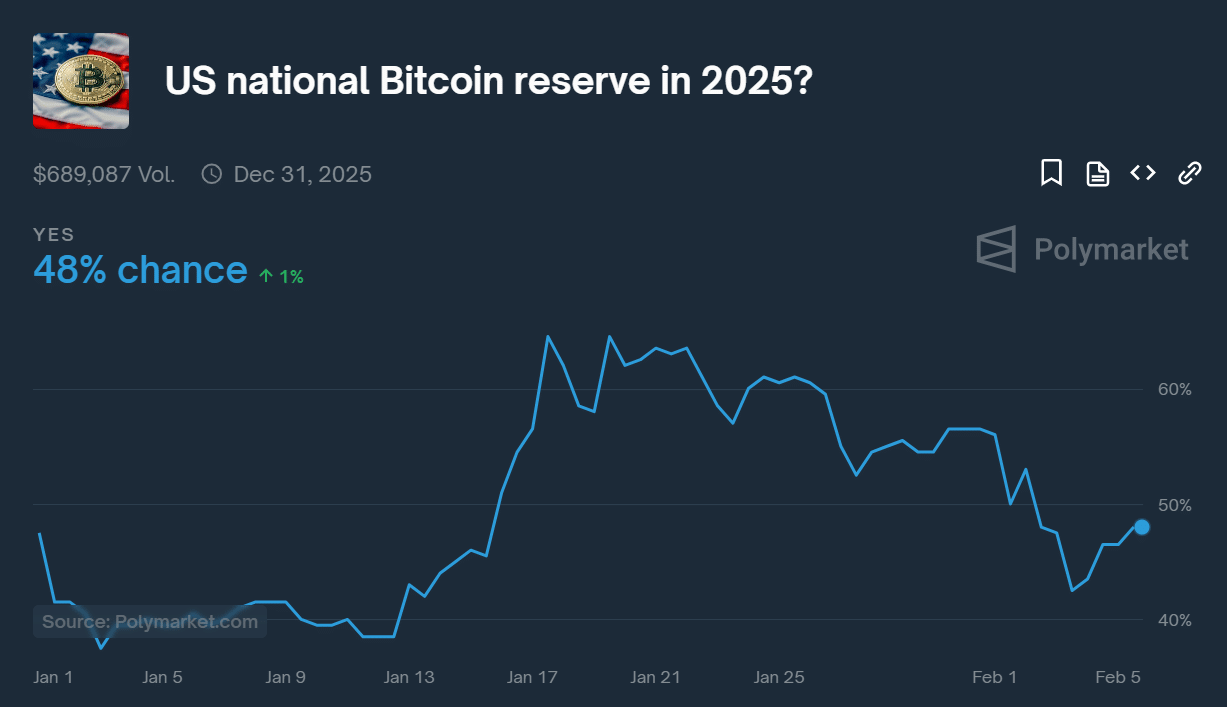

That stated, Polymarket’s odds of a U.S. BTC reserve in 2025 have dropped from a report of 65% on the seventeenth of January to under 50%, at press time.

Over the identical interval, BTC shaped a neighborhood prime between $108K and $109K.

Supply: Polymarket

- Trump’s crypto czar confirmed that they’ll conduct a BTC reserve feasibility.

- BTC dropped under $100K once more after Sacks’ presser amid combined neighborhood reactions.

President Donald Trump’s crypto and AI czar, David Sacks, held his first press convention on digital belongings on the 4th of February, eliciting combined views from the crypto neighborhood.

In a presser flanked by key congressional leaders, together with Banking Committee Chair Tim Scott, Sacks famous that they’re ‘evaluating’ the feasibility of Bitcoin reserve. He said,

‘One of many issues that the president instructed us to do is to judge the concept of Bitcoin reserve. We’re nonetheless ready for some Cupboard Secretaries of the working group to be confirmed.”

The crypto chief additionally reiterated that the just lately introduced Sovereign Wealth Fund will likely be separate from the Bitcoin[BTC] reserve.

Nevertheless, some within the crypto neighborhood had been skeptical of this end result.

No extra Bitcoin reserve?

In response to market analysis analyst, Jim Bianco, the ‘wordings’ utilized by the officers urged doable ‘stalling’ for BTC reserve. He said,

“Trump stated he would do a $BTC Reserve, not promise to “consider it.” Consider/Research is what Washington does once they don’t need to do one thing. $BTC is down ~5% since this announcement.”

Apparently, Arthur Hayes, founding father of BitMEX, echoed the same sentiment and said that Trump insurance policies would take longer to materialize.

In a rejoinder, famend macro knowledgeable Lyn Alden urged customers to double down on BTC and ignore the reserve. She stated,

“Lengthy Bitcoin. Fade the reserve.”

For perspective, in his first week in workplace, President Trump signed a crypto executive order, which included a possible ‘nationwide digital asset stockpile’ inside 180 days.

Insiders like Senator Cynthia Lummis implored {that a} BTC reserve wants a legislative framework that stands no matter who’s in energy.

In consequence, the preliminary excessive expectation of a U.S. BTC reserve inside 100 days has evaporated. Nevertheless, some leaders additionally criticized the skeptical response to Sacks’ presser.

Bitwise CEO Hunter Horsely, urged the neighborhood to be affected person for the seemingly fruitful end result from the anticipated crypto insurance policies.

“The crypto neighborhood’s impatience is one in all it’s nice strengths and nice weaknesses. A lot that this house has hoped for is underway — however the mainstream strikes on the velocity of months, not days. Good issues come to those that can wait.”

That stated, Polymarket’s odds of a U.S. BTC reserve in 2025 have dropped from a report of 65% on the seventeenth of January to under 50%, at press time.

Over the identical interval, BTC shaped a neighborhood prime between $108K and $109K.

Supply: Polymarket