- BTC dropped by 0.88% because it remained caught inside a consolidation vary.

- The market value is but to succeed in the underside, as indicated by the Lengthy/Quick Ratio.

Over the previous week, the broader crypto market has skilled heightened volatility. As such, each altcoins and Bitcoin have skilled excessive value fluctuations. In actual fact, over this era, Bitcoin’s[BTC] has continued to commerce sideways, consolidating between $94k and $100k.

Due to this fact, the prevailing market circumstances have left key stakeholders questioning if the crypto market has reached the underside.

Why the market’s backside is just not but…

Of their evaluation, Alphractal steered the market value backside has not but been reached, citing a Lengthy/Quick Ratio crossover.

Traditionally, market value bottoms happen when Bitcoin’s Lengthy/Quick ratio crosses the Common Lengthy/Quick Ratio of altcoins.

When such a crossover happens, it means that traders are extra assured with Bitcoin than altcoins.

On the time of writing, BTC’s Lengthy/Quick Ratio was at 1.48, whereas Altcoins are round 2.55. Thus, no crossover has occurred since September 2024.

Since no crossover has occurred, it means that traders are nonetheless extra assured and bullish on altcoins than Bitcoin.

What BTC’s charts say

Whereas traders are extra inclined to altcoins than Bitcoin, BTC holders, and merchants stay bullish.

As such, the prevailing market circumstances spotlight that Bitcoin might be rising with frequent corrections leading to continued consolidation.

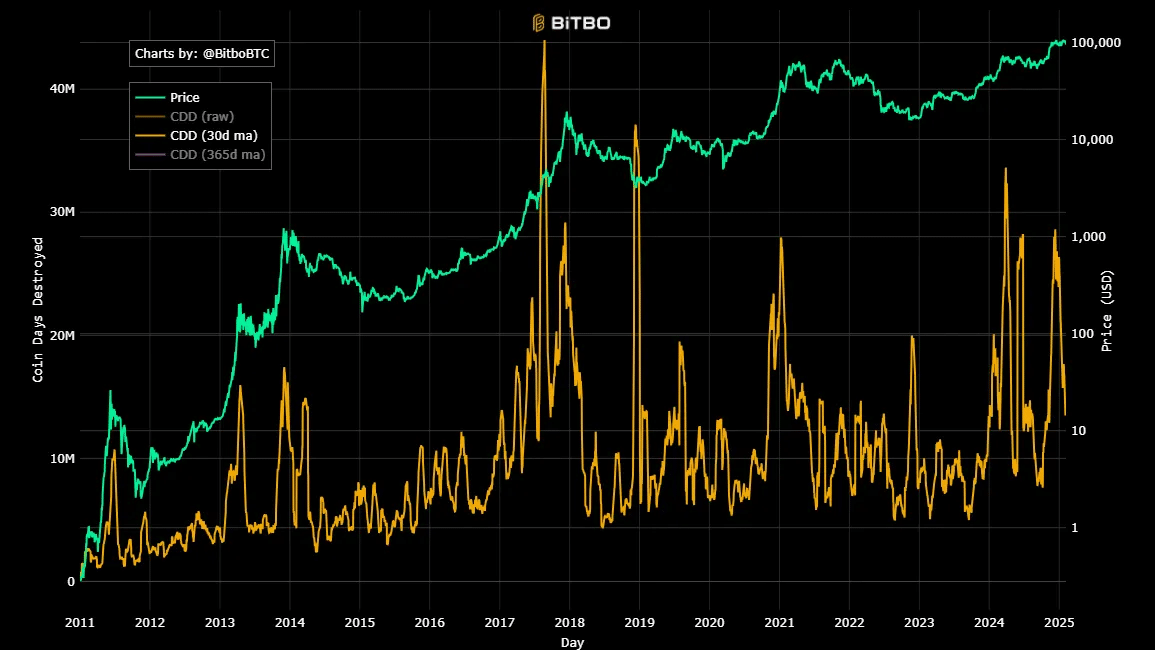

AMBCrypto noticed bullishness amongst Bitcoin holders, as Bitcoin’s CDD has sharply declined over the previous week.

When Coin Days Destroyed (CDD) declines, it implies that Bitcoin’s long-term holders are holding onto their BTC as a substitute of promoting. This habits means that long-term holders count on costs to rise.

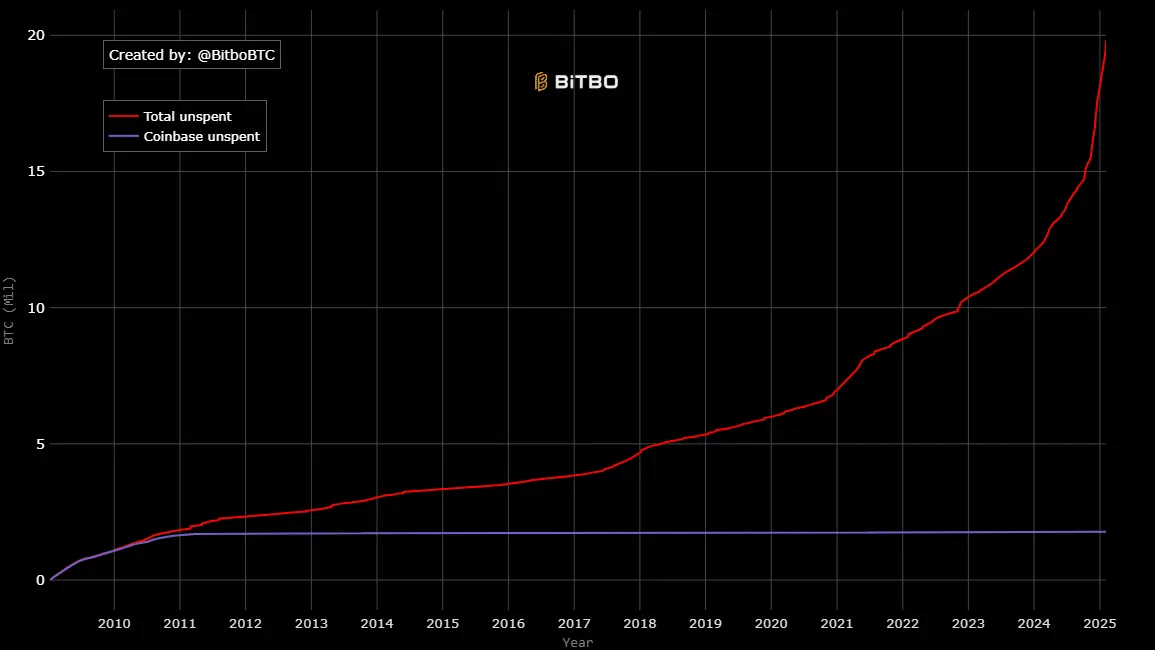

This market sentiments are additional confirmed by a surging whole unspent of dormant cash. As such, the overall unspent has spiked reaching 18.1 million.

Such a spike implies that LTHs proceed to carry their BTC.

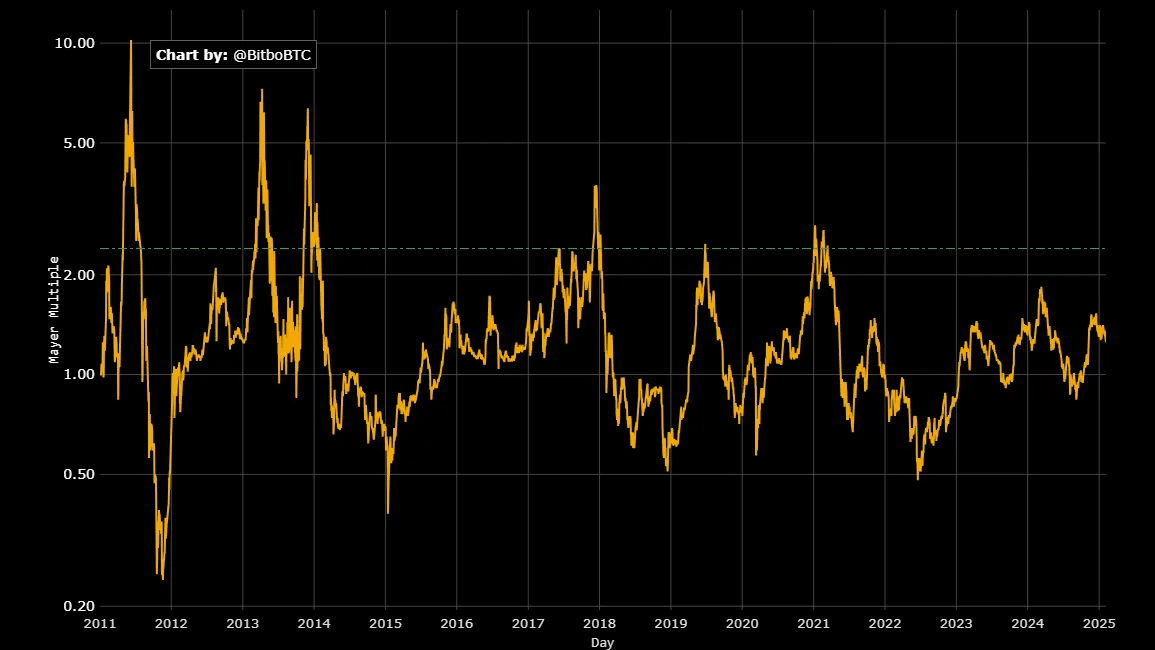

Lastly, Bitcoin’s Mayer A number of has dropped to 1.25. Traditionally, BTC’s Mayer A number of has been increased than the 40% noticed at present.

At 1.25, it implies Bitcoin is buying and selling 25% above its 200DMA, signaling bullish momentum. In earlier cycles, bull markets speed up when it’s between 1.2 and 1.5. On the present degree, BTC has room for extra upside motion.

In conclusion, whereas the underside has not but been reached, and neither has the highest, the crypto market appears positioned for continued rise with frequent corrections.

As such, Bitcoin long-term holders stay optimistic and count on costs to proceed rising. If this development holds, BTC will reclaim $99,500 and try a transfer above $100k once more.

– Learn Bitcoin (BTC) Price Prediction 2025-26

Nonetheless, with a drop over the previous day, if macroeconomics stays unpredictable, it may drop once more to $94k.

Consequently, altcoins will proceed to commerce sideways as consumers reenter the market each time costs drop.