- Bitcoin’s latest liquidation occasion mirrored previous market crashes like FTX and COVID-19.

- Institutional shopping for curiosity recommended a possible restoration, regardless of lingering market volatility.

Bitcoin’s [BTC] latest worth drop has despatched shockwaves by the market, triggering the biggest liquidation of lengthy positions seen in months.

As BTC plunged, merchants who had been holding bullish positions had been swiftly pressured out, leading to huge losses.

This dramatic sell-off has drawn eerie comparisons to earlier market crashes, leaving many to marvel if an analogous downturn may very well be on the horizon.

A market reset in movement?

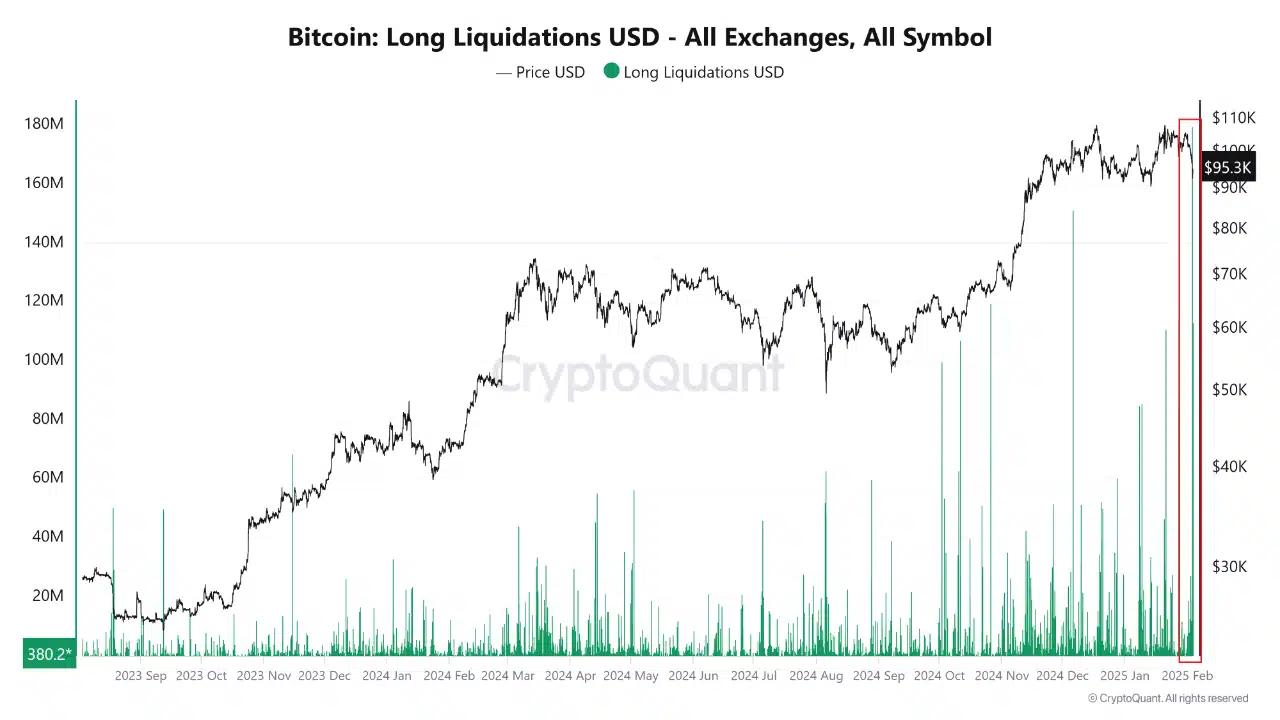

Recent data shows that Bitcoin lengthy liquidations have reached ranges unseen since September 2023.

The newest liquidation quantity exceeded $180 million, a determine that underscores the acute confidence merchants had in bullish positions earlier than the abrupt drop.

The sudden worth decline to roughly $95.3K triggered a cascade of pressured sell-offs, quickly clearing out leveraged lengthy positions.

The market’s excessive expectations for upward motion had been shortly crushed, triggering a drastic liquidation occasion.

The steep liquidation spike in late January and early February factors to extreme leverage. This caught leveraged merchants off-guard, resulting in one of the vital vital market cleanses in latest historical past.

Bitcoin: Causes and results of the value drop

The sudden BTC worth drop may be traced to a number of key elements. Overleveraged positions had been a significant driver, with merchants utilizing excessive leverage being pressured to promote as BTC declined, triggering a liquidation cascade.

Macroeconomic uncertainty, together with issues over financial coverage or new laws, additionally spooked buyers and contributed to the sell-off.

The results of this worth drop have been vital. The liquidation occasion worn out many overleveraged merchants, resetting the market’s leverage.

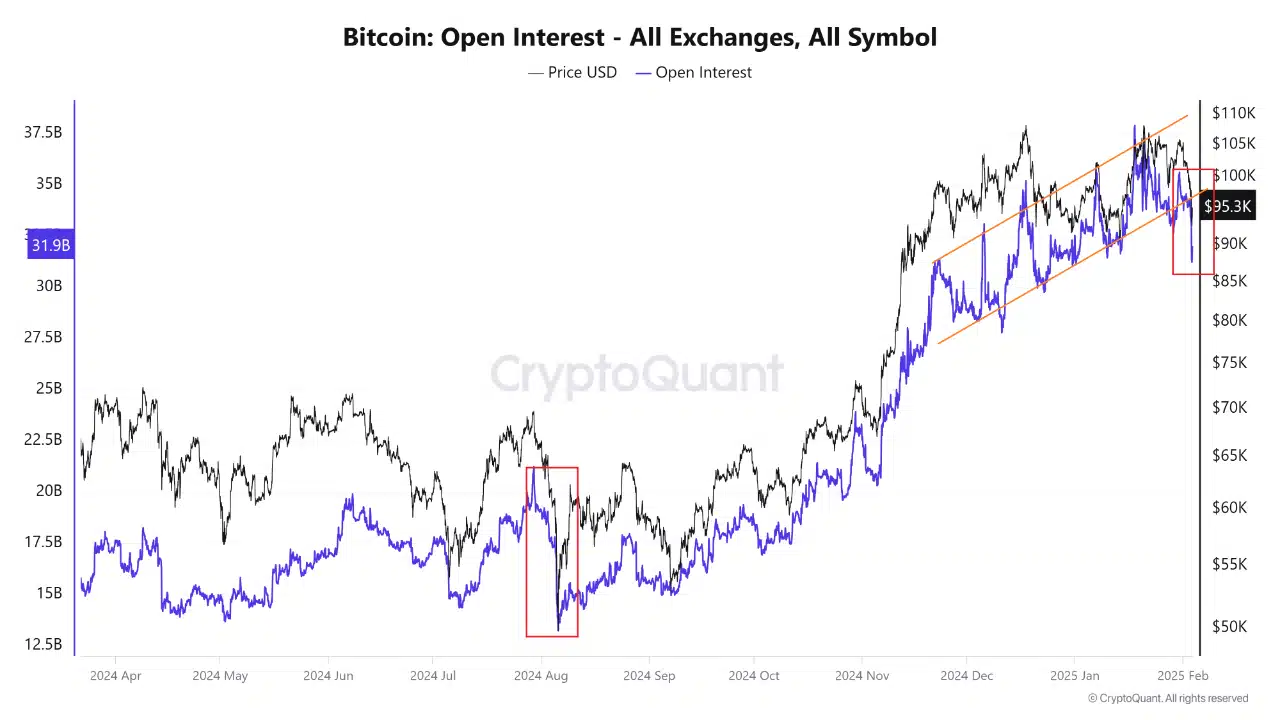

It additionally heightened volatility, inflicting sharp worth swings. Nevertheless, with extra leverage cleared, the market might now be in a greater place for a extra steady, natural restoration.

Comparability to comparable mammoth crashes

The latest liquidation occasion exhibits hanging similarities to previous market crashes.

Bitcoin: Resetting expectations

The Coinbase Premium Hole reveals vital shopping for curiosity following Bitcoin’s dip to the $92K-$95K vary.

The optimistic premium means that institutional buyers are stepping in to soak up liquidity, capitalizing on the value drop to build up BTC at decrease ranges.

This exhibits robust institutional demand regardless of the broader market weak spot.

Nevertheless, the MVRV Momentum indicator has remained negative for the reason that starting of the 12 months, hinting that many buyers are nonetheless underwater.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

Traditionally, a destructive MVRV suggests extended consolidation or additional draw back if confidence doesn’t return quickly.

This liquidation occasion has reset market sentiment, and whereas extreme leverage has been cleared, the market stays unstable.