Earlier right now on the Plan B Convention in El Salvador, Tether made an announcement that has been years within the making. USDT is again on Bitcoin utilizing Taproot Property.

The following steps might be for Tether to mint the asset, which might be obtainable initially through Bitfinex.

Tether’s return to the Bitcoin ecosystem through Taproot Property isn’t just a easy re-entry; it is a strategic pivot that might herald a brand new period for each Bitcoin’s Lightning Community (LN) and the broader stablecoin panorama.

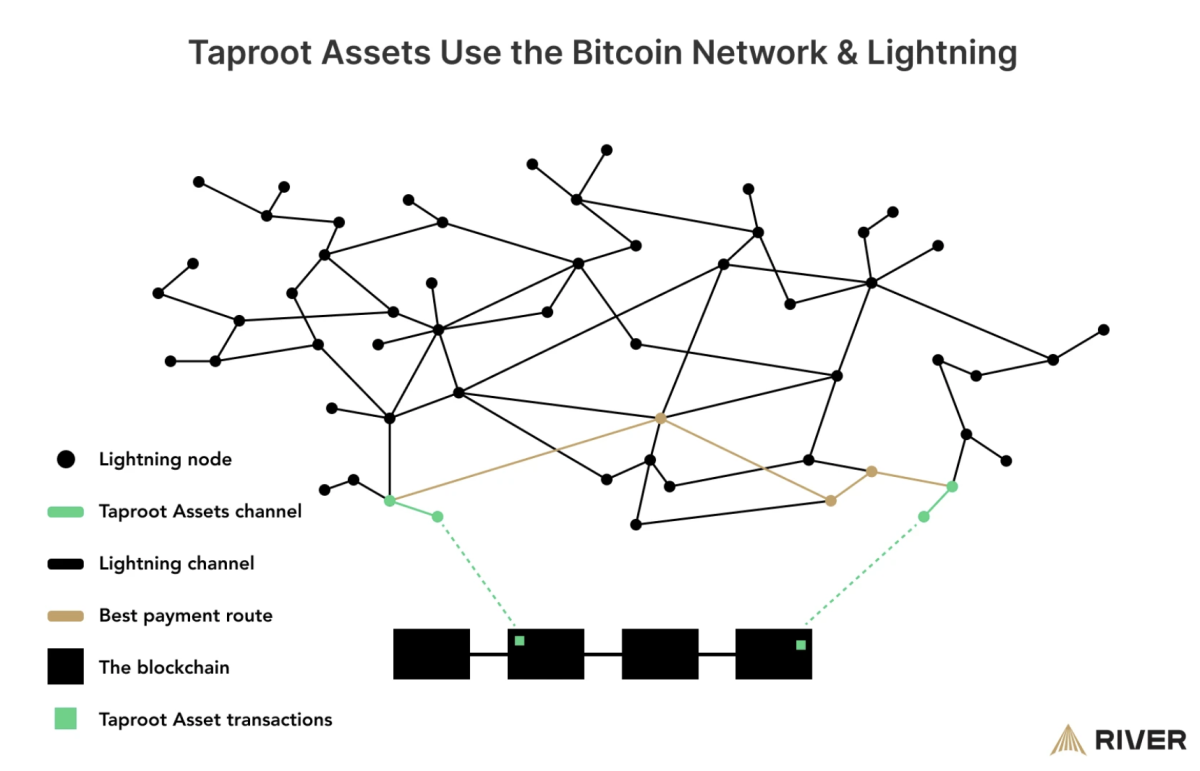

With USDT now returning to the Bitcoin community in a manner that is additionally interoperable with Lightning (it has no direct influence on bitcoin the asset – besides that it’s massively bullish), customers can get pleasure from the advantages of near-instant, low-fee transactions, that are vital for the sensible use of stablecoins in on a regular basis commerce or remittances. The combination is especially helpful in areas the place monetary infrastructure is both missing or prohibitively costly.

Having stated that, the Lightning Community might be not able to dealing with the exercise and consumer movement taking place on competing chains like Solana or Tron. There’s additionally the query of how effectively the Lightning Community will deal with the elevated load of stablecoin transactions with out degrading efficiency or resulting in centralization of node operations as a result of want for increased liquidity.

The reply to this lies in a single easy variable: Good infrastructure – and that is the place Joltz is available in.

Additionally current on the Plan B convention, Joltz’s early wager on Taproot Property now appears prescient. Joltz introduces some notable developments within the Bitcoin infrastructure ecosystem with its distinctive options. It is one of many solely self-custodial cell wallets supporting Taproot Property, enabling customers to handle multi-asset funds and swaps immediately on Bitcoin. Past the standalone wallet, Joltz affords a software program growth package (SDK) that could possibly be built-in by different builders, lowering the time and value concerned in including help for these belongings, in addition to Bitcoin on-chain and Lightning transactions. This could possibly be helpful for current crypto wallets, asset issuers, stablecoin platforms, fintechs, cost apps, and exchanges, providing them a pathway to reinforce their providers with much less growth effort. Builders who need early entry to the Joltz SDK can join here.

Just like how Trump promised to free Ross on Day 1, we must always demand that USDT be supported all over the place on Day 1, with good UX. Joltz will ship on that – hopefully main the best way for others to see the size of the chance that lies forward for Bitcoin.

Now: Why must you even need stablecoins on Bitcoin?

The current surge in meme coin exercise on Solana has led to important community congestion, pushing transaction charges to document highs. Solana’s each day price income hit practically $78 million in late 2024, a direct results of the meme coin increase, however this got here at the price of increased transaction charges and occasional community congestion, difficult the consumer expertise. Equally, Tron has confronted its personal challenges with transaction charges. Tron’s each day price income has been reported to surpass $5 million, reflecting its important position in dealing with stablecoin transactions but in addition highlighting the stress on its closely centralized community. We would like these charges on Bitcoin, for miners and routing operators.

LN affords practically infinite scalability by permitting transactions to happen off-chain, solely deciding on Bitcoin when needed. This strategy contrasts starkly with the scalability struggles of single-layer blockchains like Solana and Tron.

Moreover, with LN, there’s potential for brand new monetary merchandise. Locking Bitcoin inside Lightning channels can open up yield-generating alternatives like liquidity provision (leasing) or much more complicated monetary devices associated to routing, offering customers with new methods to generate NATIVE Bitcoin Yields not based mostly on questionable practices. (Additionally see my recent report on Bitcoin Stablecoins.)

The announcement right now underscores a broader lesson within the crypto area: whereas particular chains like Solana and Tron have made strides in pace and value, true scalability requires time and plenty of funding into infrastructure to ensure decentralization and trustless exit: in any other case what’s the purpose? Centralized chains lead on Stablecoins is non permanent – Bitcoin is ceaselessly.

Tether’s return to Bitcoin by means of Taproot Property signifies a vote of confidence in Bitcoin’s evolving capabilities. It is a testomony to the innovation inside the Bitcoin area and a reminder of how foundational applied sciences like Bitcoin can adapt and develop to satisfy new calls for regardless of the yapping of high-time desire critics of LN targeted on chasing distractions as a substitute of true utility (meow).

This transfer may very effectively set the stage for additional improvements in decentralized finance (DeFi) on Bitcoin (BTCfi), reshaping how we take into consideration Bitcoin as the final word Settlement Layer for all sorts of financial exercise.

Welcome again Tether! <3

This text is a Take. Opinions expressed are fully the creator’s and don’t essentially replicate these of BTC Inc or Bitcoin Journal.

Articles Guillaume specifically might talk about matters or corporations which are a part of his agency’s funding portfolio (UTXO Management). The views expressed are solely his personal and don’t characterize the opinions of his employer or its associates. He’s receiving no monetary compensation for these Takes. Readers mustn’t contemplate this content material as monetary recommendation or an endorsement of any explicit firm or funding. At all times do your personal analysis earlier than making monetary selections.