- Bitcoin merchants de-risk as FOMC uncertainty looms.

- With a 9% January acquire, can Trump’s insurance policies gasoline contemporary momentum for BTC?

January has traditionally been a sluggish month for Bitcoin [BTC], however 2025 is bucking the pattern with a 9% acquire. But, a document drop in Open Curiosity and detrimental CME premiums sign that merchants are slicing their BTC publicity.

With the U.S. economic system as the important thing set off, is that this simply warning—or the start of a bigger shift?

What’s taking place within the U.S.?

U.S. traders are those to observe proper now. The Coinbase Premium Index (CPI) has been within the red for seven days straight, aligning with BTC’s dip from $104K to $102K.

As de-risking continues, with over $3 billion in Futures positions closed, shopping for strain stays tepid.

With the FOMC assembly looming giant, merchants are stepping again from high-risk leverage trades, conserving any main surge in open positions off the desk – for now.

Though inflation appears beneath management and Trump is pushing for decrease oil costs, it’s the execution of those insurance policies that has the market in a holding sample. Till readability comes, merchants are staying on the sidelines.

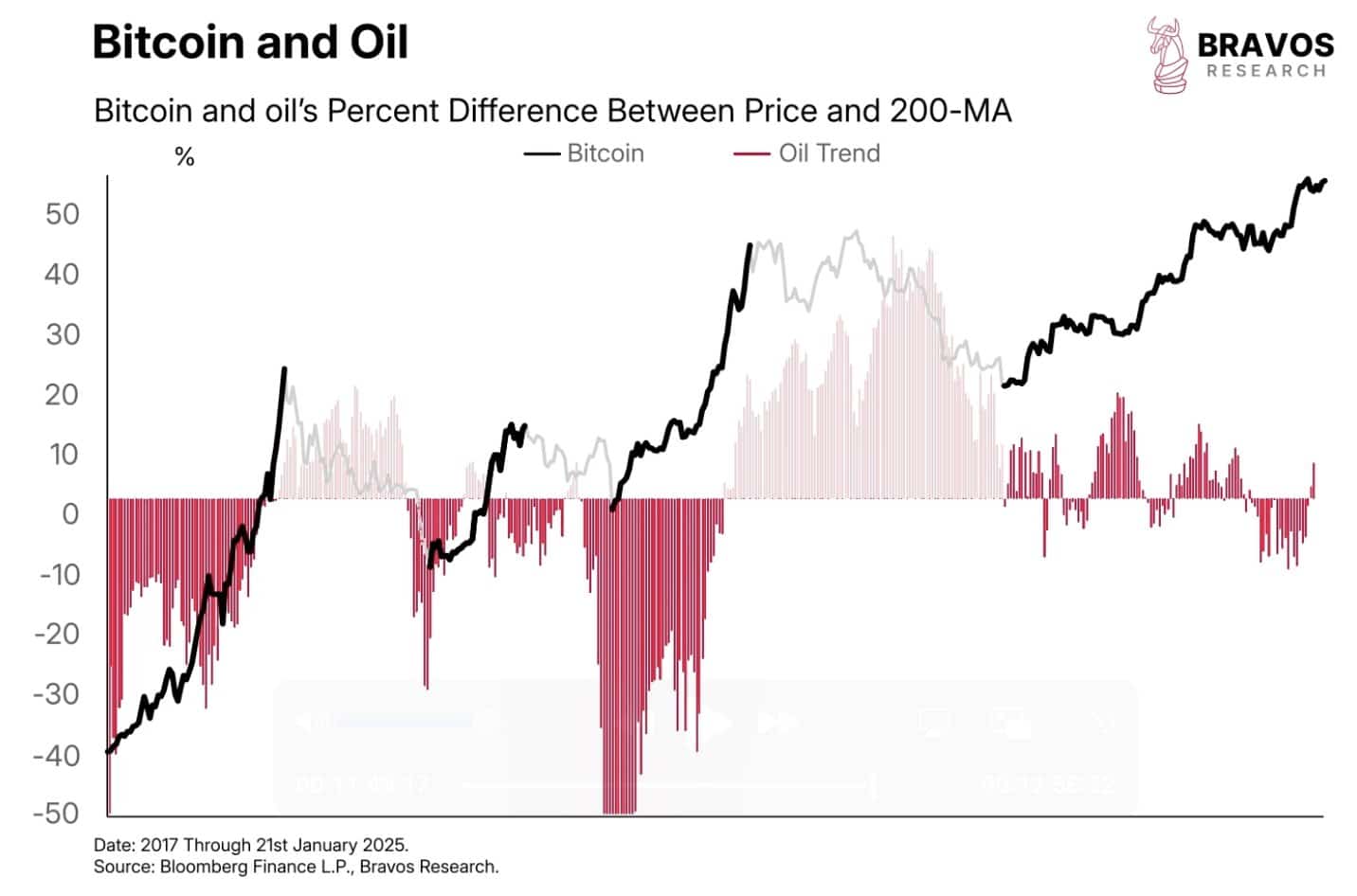

Bitcoin usually performs effectively when oil costs fall. If oil helps cool inflation, the Fed might reduce charges. Watch this intently—it could possibly be a key issue within the coming days.

Bitcoin in January

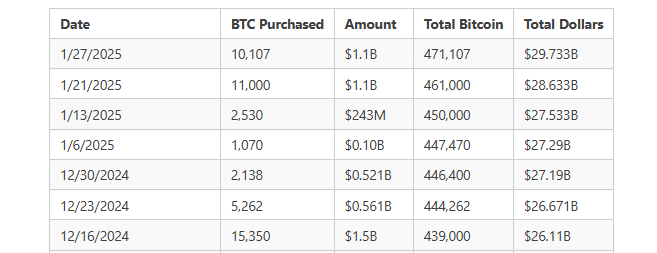

Between Trump’s inauguration, MicroStrategy’s ongoing main Bitcoin accumulation, and a 10-month excessive in ETF quantity, Bitcoin noticed a stable 9% bounce in January.

These key drivers are setting the stage for a possible market shift. If bullish expectations falter, the $87K–$90K vary might emerge as a robust assist zone, with main gamers possible stepping in to purchase up BTC.

It’s harking back to December’s worth drop, when BTC fell from $106K to $89K in simply two weeks after inflation ticked up 0.2%.

Throughout that interval, MicroStrategy made three large Bitcoin purchases, every value over a billion {dollars}, doubling down on their Bitcoin guess.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

So, whereas the market is treading cautiously, a Bitcoin ‘crash’ appears unlikely.

If something, a serious shock might come if the Fed defies expectations – however with Trump pushing for decrease charges, the market appears poised to climate any potential storm, bringing much-needed reduction in 2025.