Crypto analyst Tony Severino has supplied an ultra-bullish outlook for the Bitcoin value, predicting that the flagship crypto may rally to as excessive as $321,000. The analyst admitted that this goal was too excessive for BTC however added that it was merely the “math.

Bitcoin Value To Attain $321,000 In This Market Cycle

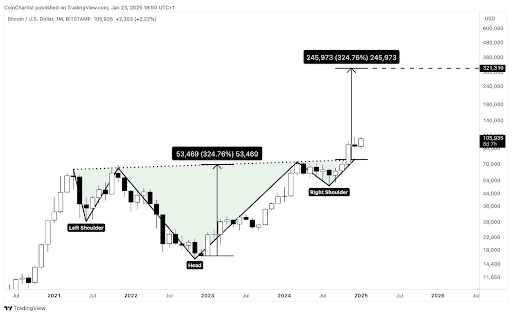

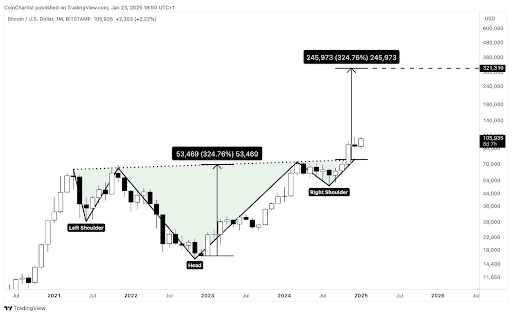

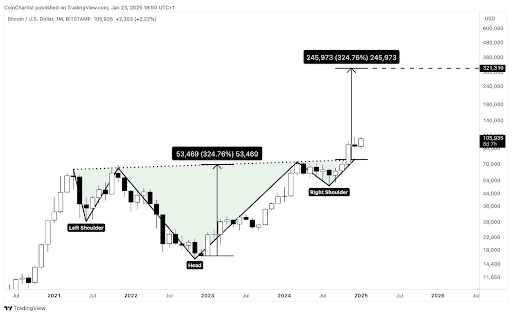

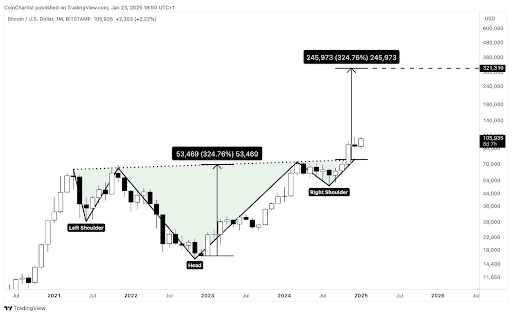

In a substack post, Tony Severino predicted that the Bitcoin value may rally to as excessive as $321,000 on this bull run. This got here because the analyst highlighted a possible head and shoulders pattern that had shaped on Bitcoin’s chart. The analyst claimed that if this bullish sample was legitimate, then it initiatives a most goal of $321,000 per BTC.

Associated Studying

Severino admitted that this value goal for the Bitcoin value is just too excessive however remarked that it’s the “math.” Apparently, the crypto analyst went on to offer the next value prediction for the flagship crypto based mostly on one other bullish sample. In accordance with him, BTC may attain $345,000 if it touches the higher boundary of the primary uptrend channel over the past 8 years or thereabouts.

In the meantime, Severino additionally supplied extra conservative targets for the Bitcoin value. The analyst predicted that BTC may at the very least contact $158,000. This got here as he famous that the 2021 cycle peak inverse Fibonacci extension may venture the 2025 cycle peak. If that’s the case, he acknowledged that this peak inverse Fib extension is positioned among the many lowest estimates for BTC at $158,000.

The crypto analyst additional remarked that one other methodology of utilizing the 1.618 Fib extension entails projecting the goal from the height of wave 3 from the underside of wave 1. Based mostly on this, he added that this requires a possible goal of $194,000.

Severino supplied one other model that initiatives the 1.618 Fib extension from the highest of subwave iii of 5 to the underside of subwave i of 5. If this performs out, BTC may attain a barely decrease goal of $186,000. Lastly, the crypto analyst additionally raised the opportunity of the Bitcoin value peaking at $191,000. He highlighted a bull pattern, which, if legitimate, may ship BTC to this goal.

BTC’s Value Motion In The Quick Time period

Crypto analyst Ali Martinez supplied insights into the Bitcoin value motion within the brief time period. In an X submit, he acknowledged that the important thing help degree for Bitcoin is at $97,877, the place greater than 101,000 BTC had been collected. The analyst additional remarked that holding above this degree is essential to sustaining the bullish momentum for the flagship crypto.

Associated Studying

In one other X submit, the crypto analyst supplied a bullish outlook for the Bitcoin value. He famous that the variety of BTC transactions over $100,000 has doubled prior to now week, rising from $15,620 to $32,320.

On the time of writing, the Bitcoin value is buying and selling at round $104,300, down virtually 1% within the final 24 hours, based on data from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com

Crypto analyst Tony Severino has supplied an ultra-bullish outlook for the Bitcoin value, predicting that the flagship crypto may rally to as excessive as $321,000. The analyst admitted that this goal was too excessive for BTC however added that it was merely the “math.

Bitcoin Value To Attain $321,000 In This Market Cycle

In a substack post, Tony Severino predicted that the Bitcoin value may rally to as excessive as $321,000 on this bull run. This got here because the analyst highlighted a possible head and shoulders pattern that had shaped on Bitcoin’s chart. The analyst claimed that if this bullish sample was legitimate, then it initiatives a most goal of $321,000 per BTC.

Associated Studying

Severino admitted that this value goal for the Bitcoin value is just too excessive however remarked that it’s the “math.” Apparently, the crypto analyst went on to offer the next value prediction for the flagship crypto based mostly on one other bullish sample. In accordance with him, BTC may attain $345,000 if it touches the higher boundary of the primary uptrend channel over the past 8 years or thereabouts.

In the meantime, Severino additionally supplied extra conservative targets for the Bitcoin value. The analyst predicted that BTC may at the very least contact $158,000. This got here as he famous that the 2021 cycle peak inverse Fibonacci extension may venture the 2025 cycle peak. If that’s the case, he acknowledged that this peak inverse Fib extension is positioned among the many lowest estimates for BTC at $158,000.

The crypto analyst additional remarked that one other methodology of utilizing the 1.618 Fib extension entails projecting the goal from the height of wave 3 from the underside of wave 1. Based mostly on this, he added that this requires a possible goal of $194,000.

Severino supplied one other model that initiatives the 1.618 Fib extension from the highest of subwave iii of 5 to the underside of subwave i of 5. If this performs out, BTC may attain a barely decrease goal of $186,000. Lastly, the crypto analyst additionally raised the opportunity of the Bitcoin value peaking at $191,000. He highlighted a bull pattern, which, if legitimate, may ship BTC to this goal.

BTC’s Value Motion In The Quick Time period

Crypto analyst Ali Martinez supplied insights into the Bitcoin value motion within the brief time period. In an X submit, he acknowledged that the important thing help degree for Bitcoin is at $97,877, the place greater than 101,000 BTC had been collected. The analyst additional remarked that holding above this degree is essential to sustaining the bullish momentum for the flagship crypto.

Associated Studying

In one other X submit, the crypto analyst supplied a bullish outlook for the Bitcoin value. He famous that the variety of BTC transactions over $100,000 has doubled prior to now week, rising from $15,620 to $32,320.

On the time of writing, the Bitcoin value is buying and selling at round $104,300, down virtually 1% within the final 24 hours, based on data from CoinMarketCap.

Featured picture from Unsplash, chart from Tradingview.com