- Mapping Bitcoin’s worth prediction as BTC consolidated inside $100K-$105K after Trump’s inauguration.

- Choices merchants eyed $90K and $96K as doubtless ranges for potential drops.

After shaking off the early ‘disappointment’ from the Trump inauguration, Bitcoin [BTC] has defended the $100K stage. Previously two days, the king coin has been swinging between $100K and $105K.

With key on-chain metrics suggesting a potential breakout from the general worth vary, what’s subsequent for BTC within the quick time period?

BTC extends worth vary

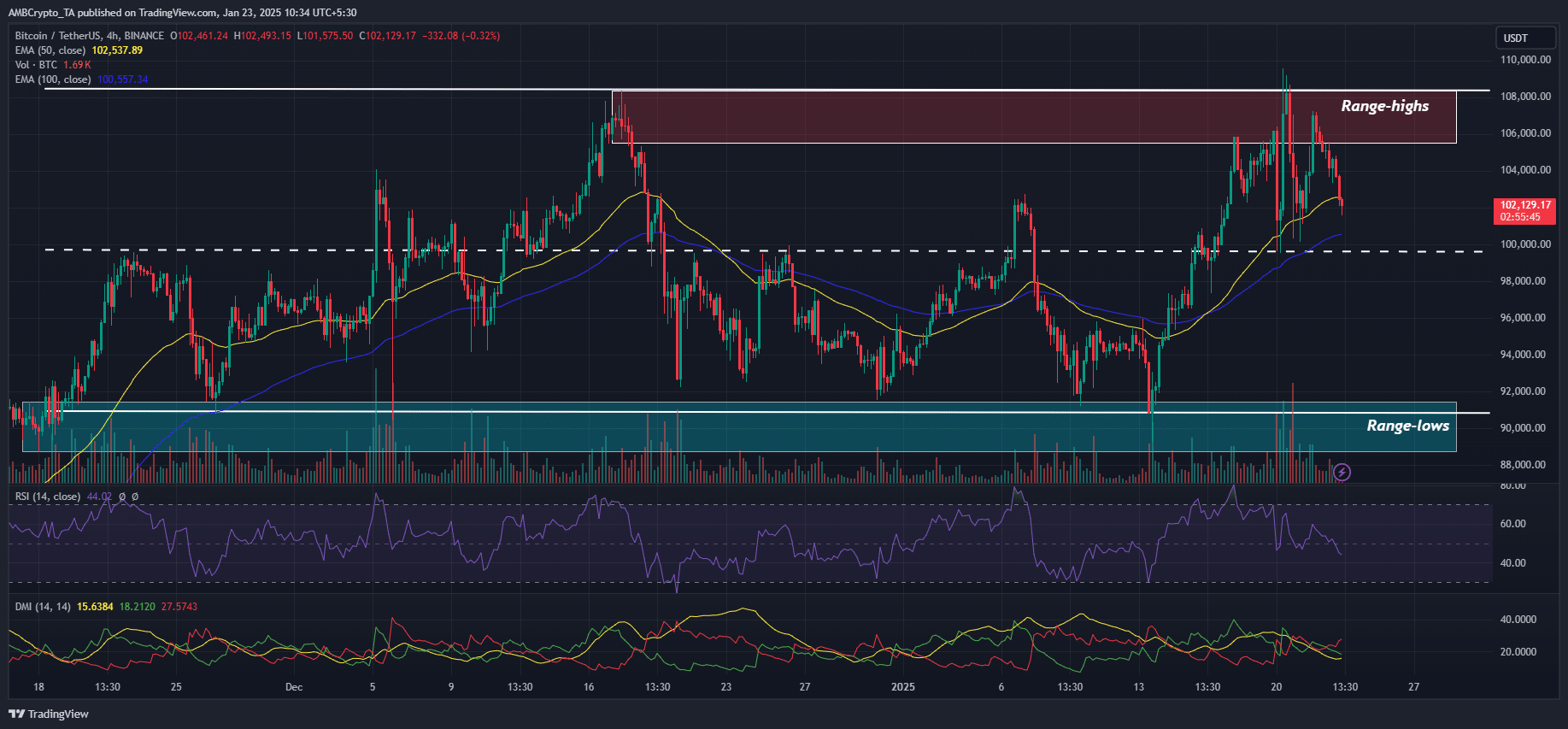

The latest worth motion was caught within the higher vary of $90K-$108K. Though bulls have beforehand used the 50-EMA (yellow) on the 4-hour chart for short-term re-entry, key chart indicators indicated elevated weakening.

For example, the Directional Motion Index (DMI), confirmed that short-term momentum has eased considerably (crimson line above inexperienced) and will embolden short-sellers.

Equally, the 4-hour RSI slipped beneath 50 at press time, indicating muted demand, maybe linked to warning post-inauguration.

The above bearish readings may endanger the $100K assist and mid-range. If cracked, BTC may head decrease to $96K or the range-lows at $92K.

Key BTC ranges per liquidity

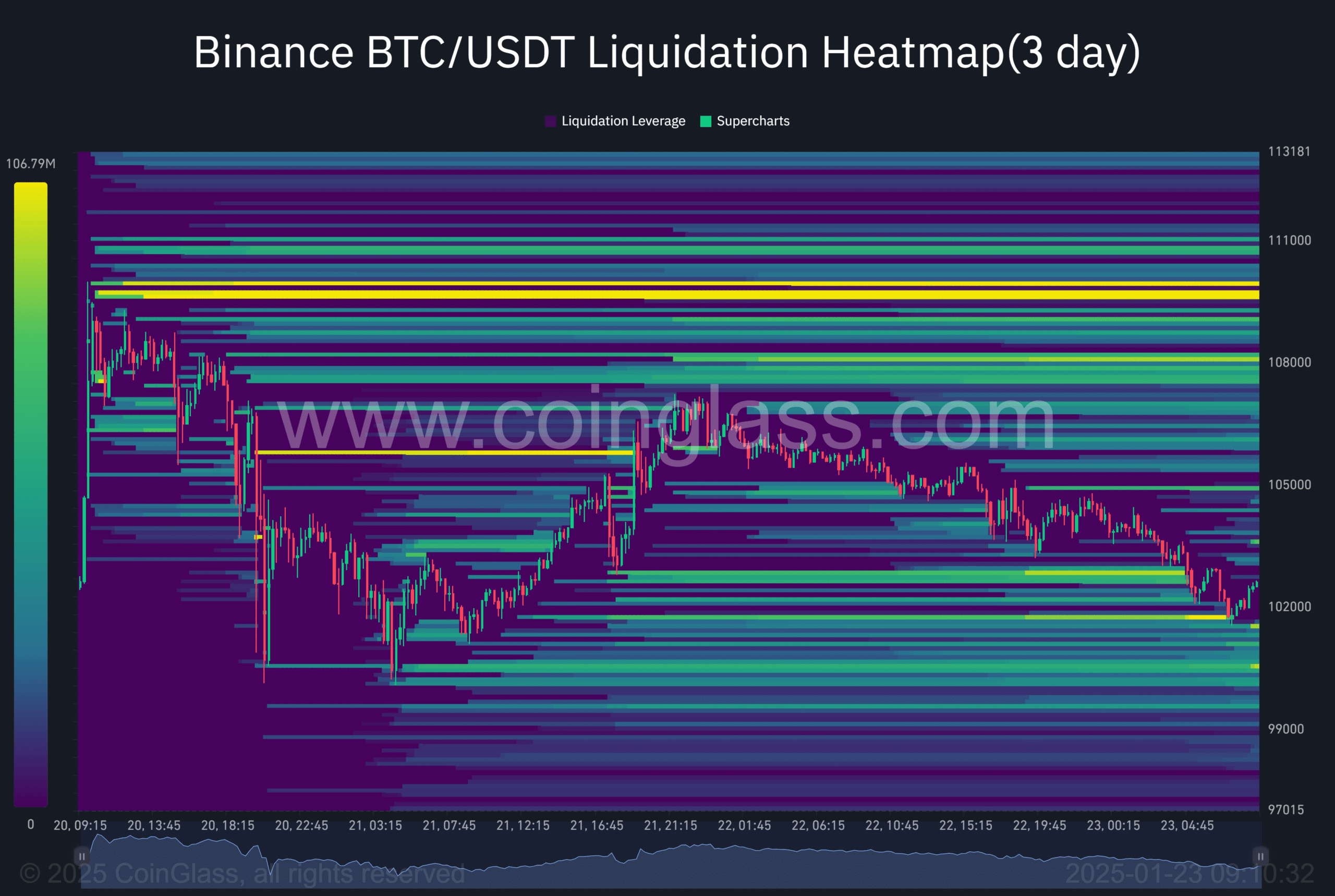

Nonetheless, the liquidation heatmap disagreed with the above outlook. At press time, there was an enormous pocket of liquidity (brilliant yellow) at $109K.

This meant a number of gamers have been shorting the asset on the latest all-time excessive. By extension, the huge liquidity may act as a worth magnet and drive costs upward. In that case, then $100K may very well be defended once more.

That stated, the Futures market remained bullish regardless of cautious sentiment within the spot markets.

In accordance with the Choices buying and selling desk, QCP Capital, there have been extra bullish bets than bearish performs on the Futures aspect. It stated,

“In the meantime, BTC futures proceed to pattern upward, particularly on the entrance finish, as market’s net-long publicity from final week stays strong. Bullish bets at present outpace bearish ones by a ratio of roughly 20:1.”

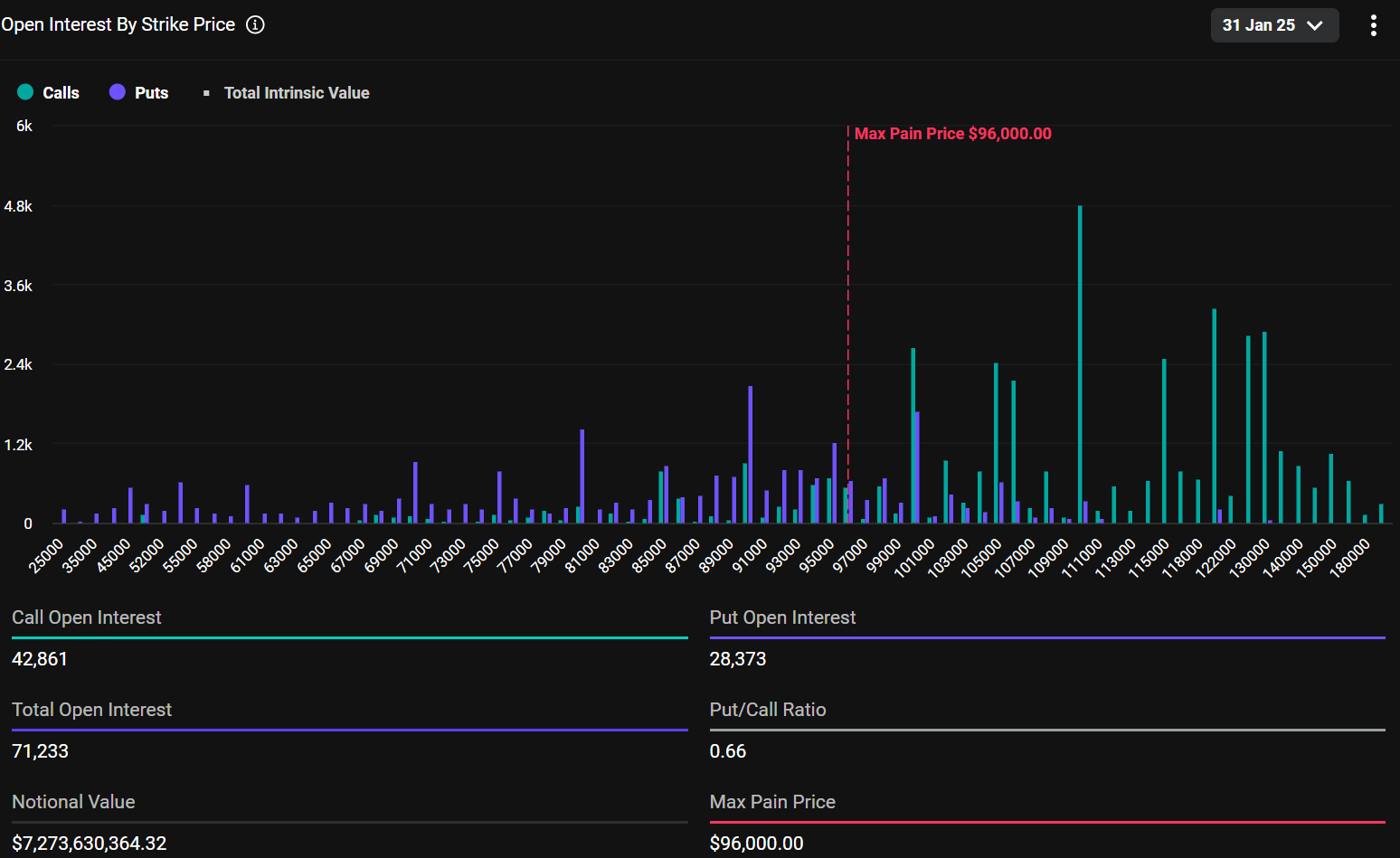

AMBCrypto checked Deribit’s subsequent key Choices’ expiry (thirty first January) for extra insights. The $110K and $120K had the very best Open Interest for calls (bullish bets), marking them as key bullish targets by the tip of January.

Learn Bitcoin [BTC] Price Prediction 2025-2026

On the draw back, $90K (highest places, bearish bets) and the max ache level of $96K have been key ranges anticipated by Choices merchants for potential sharp drops.

Merely put, the market expects worth swings throughout the $90K-108K vary, with a attainable deviation to $110K.

Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.