Over the previous yr, the Bitcoin Renaissance has introduced vital consideration to BTCfi, or “Bitcoin DeFi” functions. Regardless of the hype, only a few of those functions have delivered on their guarantees or managed to retain a significant variety of “precise” customers.

To place issues into perspective, the main lending platform for Bitcoin belongings, Liquidium, permits customers to borrow towards their Runes, Ordinals, and BRC-20 belongings. The place does the yield come from, you ask? Similar to another mortgage, debtors pay an rate of interest to lenders in alternate for his or her Bitcoin. Moreover, to make sure the safety of the loans, they’re all the time overcollateralized by the Bitcoin belongings themselves.

How massive is Bitcoin DeFi proper now? It will depend on your perspective.

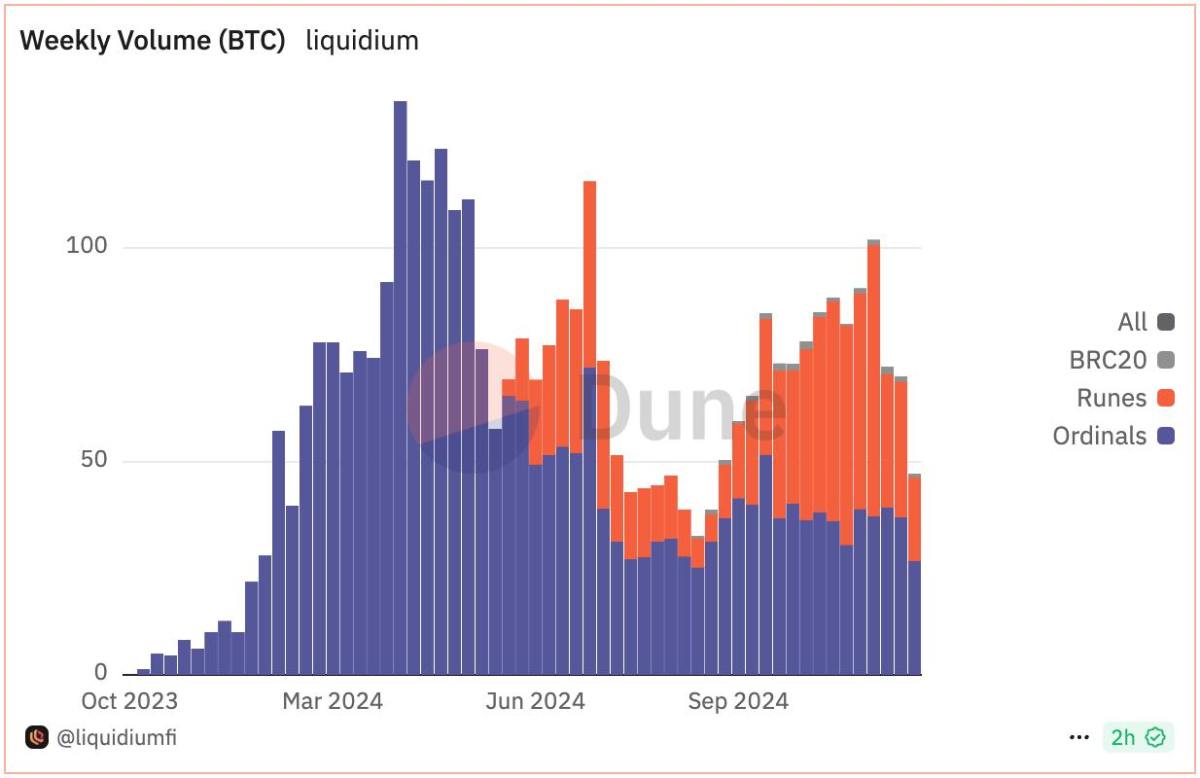

In about 12 months, Liquidium has executed over 75,000 loans, representing greater than $360 million in whole mortgage quantity, and paid over $6.3 million in native BTC curiosity to lenders.

For BTCfi to be thought-about “actual,” I’d argue that these numbers have to develop exponentially and grow to be akin to these on different chains equivalent to Ethereum or Solana. (Though, I firmly imagine that over time, comparisons will grow to be irrelevant as all financial exercise will in the end choose Bitcoin.)

That stated, these achievements are spectacular for a protocol that’s barely a yr outdated, working on a series the place even the slightest point out of DeFi usually meets with excessive skepticism. For added context, Liquidium is already outpacing altcoin rivals equivalent to NFTfi, Arcade, and Sharky in quantity.

Bitcoin is evolving in actual time, with out requiring modifications to its base protocol — I’m right here for it.

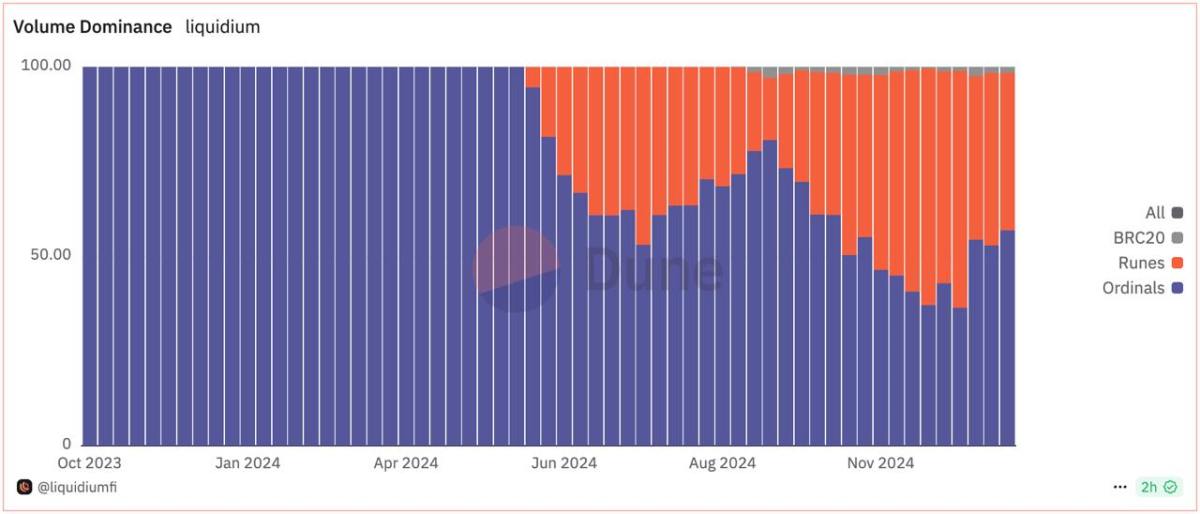

After a rocky begin, Runes at the moment are accountable for almost all of loans taken out on Liquidium, outpacing each Ordinals and BRC-20s. Runes is a considerably extra environment friendly protocol that provides a lighter load on the Bitcoin blockchain and delivers a barely improved person expertise. The improved person expertise offered by Runes not solely simplifies the method for current customers, but in addition attracts a considerable variety of new customers that might be prepared to curiosity on-chain in a extra advanced manner. In distinction, BRC-20 struggled to amass new customers as a consequence of its complexity and fewer intuitive design. Having further monetary infrastructure like P2P loans is subsequently marking a step ahead within the usability and adoption of Runes, and probably different Bitcoin backed belongings down the road.

The quantity of loans on Liquidium has persistently elevated over the previous yr, with Runes now comprising nearly all of exercise on the platform.

Okay so Runes at the moment are the dominant asset backing Bitcoin native loans, why ought to I care? Is that this good for Bitcoin?

I’d argue that, no matter your private opinion about Runes or the on-chain degen video games occurring proper now, the truth that actual individuals belief the Bitcoin blockchain to take out decentralized loans denominated in Bitcoin ought to make freedom lovers get up and cheer.

We’re successful.

Bitcoiners have all the time asserted that no different blockchain can match Bitcoin’s safety ensures. Now, others are starting to see this too, bringing new types of financial exercise on-chain. That is undeniably bullish.

Furthermore, all transactions are natively secured on the Bitcoin blockchain—no wrapping, no bridging, simply Bitcoin. We must always encourage and help people who find themselves constructing on this manner.

This text is a Take. Opinions expressed are solely the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.