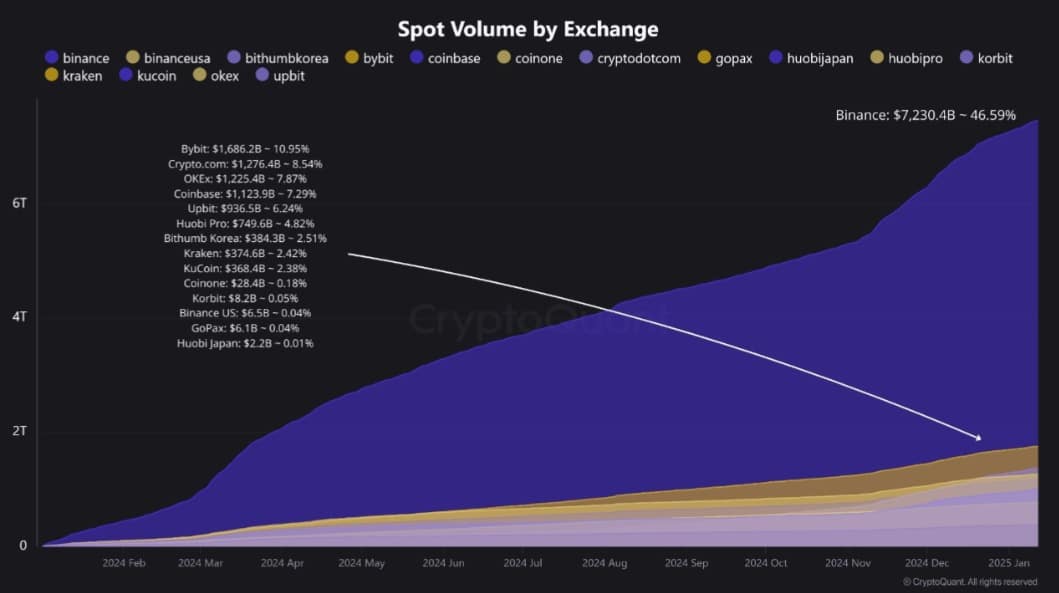

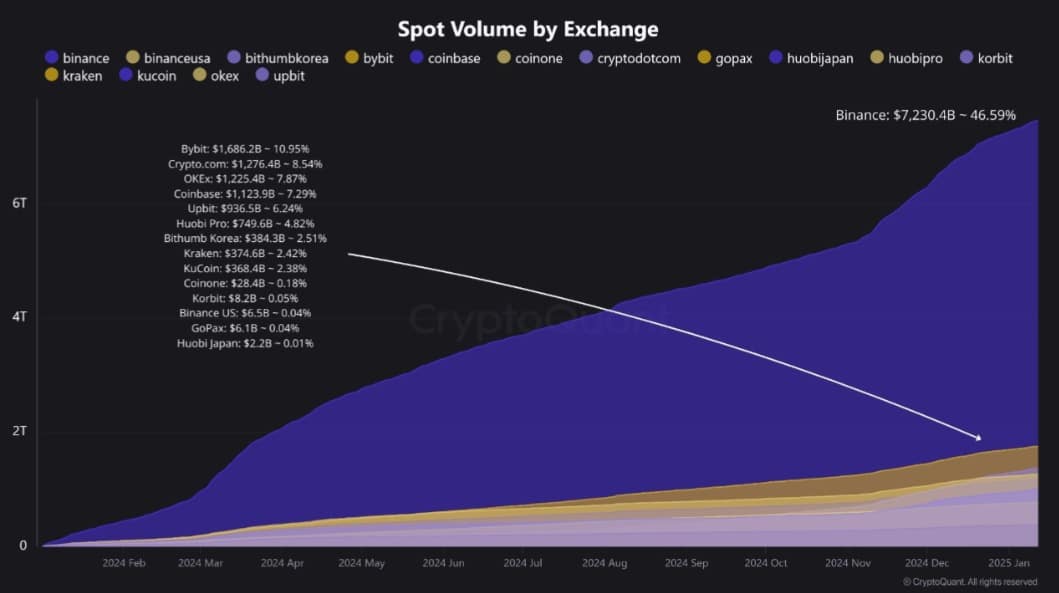

Binance’s cumulative spot quantity reached $7.23 trillion in 2024 marking 46.59% of the whole market share.

- Binance’s cumulative spot quantity reached $7.23 trillion in 2024.

- BTC buyers on the alternate remained bullish via 2024 driving costs to historic highs.

With the cryptocurrency market experiencing regular progress all through 2024, Binance has change into probably the most vital Crypto Alternate platform.

Over this era, the crypto alternate has dominated the market, reflecting continued market confidence within the platform.

In line with CryptoQuant evaluation of 2024 cumulative spot quantity by exchanges, exchanges have performed a significant function within the continued progress and growth of the market.

Binance market dominance

As per CryptoQuant report, Binance has change into probably the most dominant alternate platform.

As such, Binance recorded a cumulative spot quantity of $7.23 trillion in 2024. This marked 46.59% of the whole market share.

Supply: CryptoQuant

In comparison with different prime exchanges similar to Bybit, Crypto.com, OKEx, and Coinbase, Binance accounted for 34.65% of the market share, reflecting an 11.94% lead over these opponents.

With the alternate’s market share rising, it means that a good portion of Bitcoin’s liquidity and value actions happen on Binance.

Due to this fact, Binance’s efficiency is instantly correlated with BTC value actions, stability, and tendencies, given its excessive buying and selling quantity on the platform.

What it means for BTC

Since Binance is the dominant crypto alternate, buyers’ sentiment on the platform displays broad market sentiment.

In line with AMBCrypto’s evaluation, the alternate’s market share has grown steadily, however buyers have been largely constructive about Bitcoin.

All through 2024, BTC buyers on Binance have proven optimism, driving costs to historic highs.

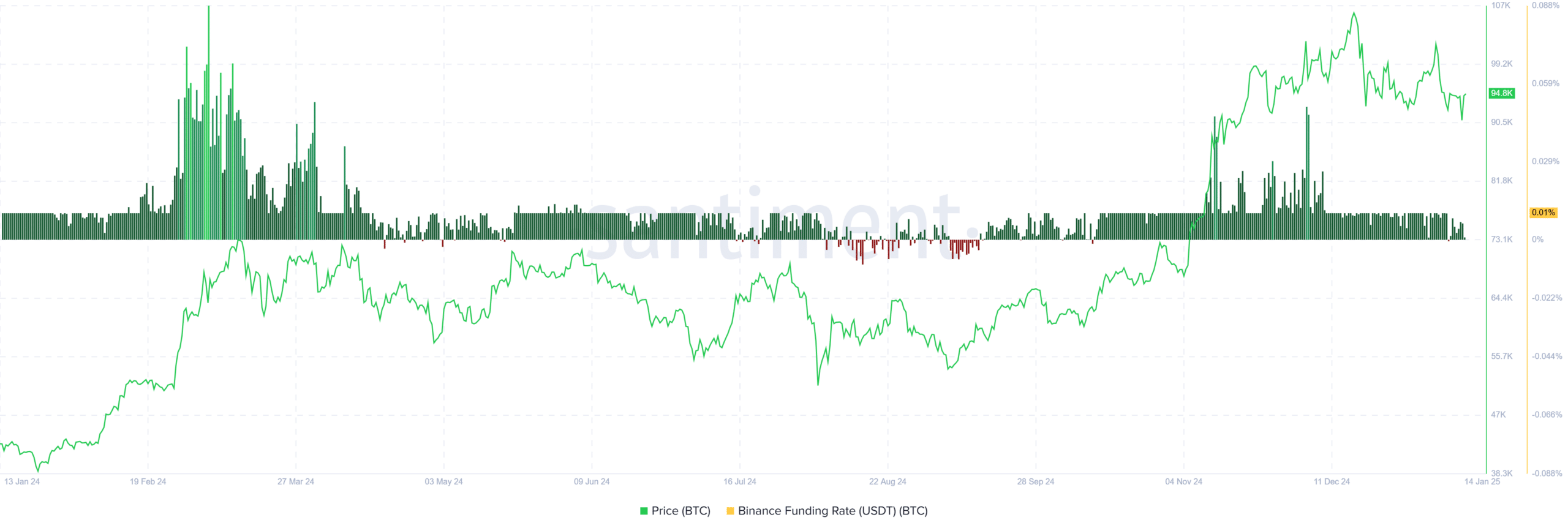

This bullish sentiment is evidenced by a constructive Binance funding charge. All through 2024, 10 months recorded a constructive funding charge, aside from October and September.

When the funding charge stays largely constructive, it means that buyers are bullish and keen to pay a premium for lengthy positions, reflecting optimism about future value actions.

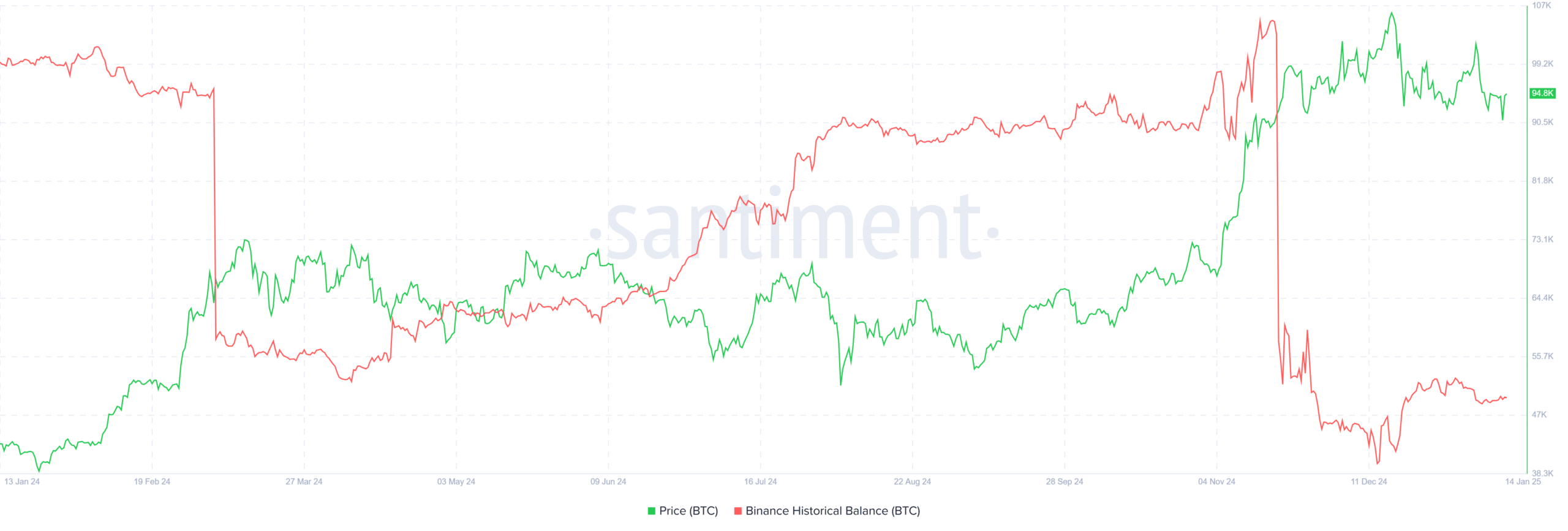

Moreover, Binance’s historic BTC balances skilled a powerful decline via November 2024. This drop suggests buyers are accumulating BTC as they withdraw extra belongings from the alternate to private wallets.

Traditionally, modifications within the alternate’s BTC balances have at all times affected costs. As an example, when it dropped to a yearly low, BTC surged to an all-time excessive (ATH) of $108k in November 2024.

The same sample was seen in March 2024 when BTC reached $70k for the primary time. Conversely, a surge in Binance balances induced a value drop, similar to in August 2024 when costs fell to $49k.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

In conclusion, rising Binance market dominance has considerably impacted the crypto market. Whereas the alternate has skilled large progress, BTC buyers’ optimism on Binance has pushed costs to new ATHs.

With favorable situations, Bitcoin is well-positioned for extra positive factors. As such, we may see BTC reclaim $96,700 if merchants stay bullish on the alternate.