- Bitcoin miners’ reserves declined sharply, including promoting strain throughout This autumn 2024

- 2025 has to this point seen lowered sell-offs, hinting at a possible market shift in direction of consolidation

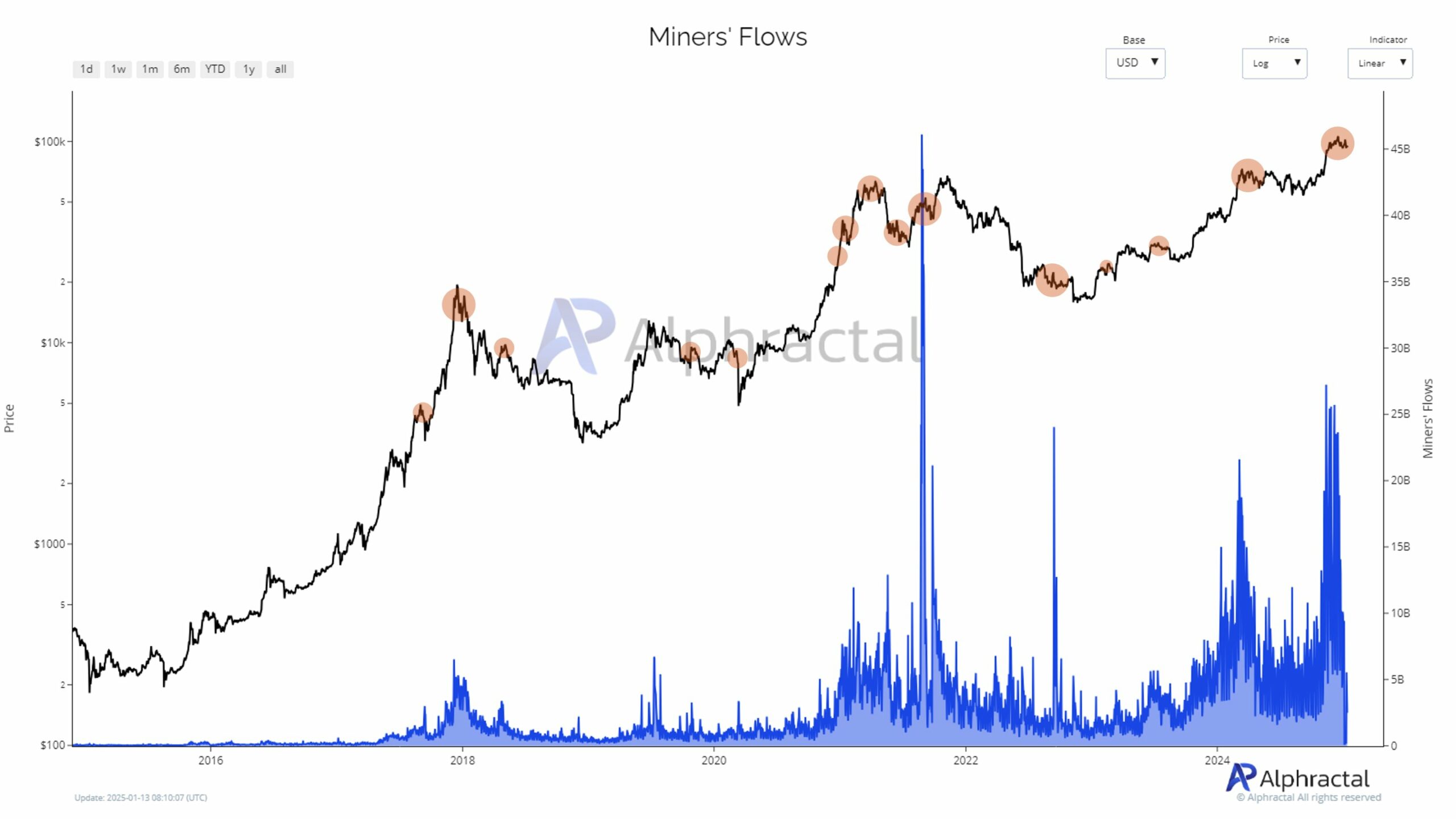

In late 2024, Bitcoin [BTC] miners set a brand new file for the best greenback worth ever moved, with vital outflows from their reserves including promoting strain to the market. Report-high hash charges have pushed up mining prices, forcing miners to liquidate Bitcoin to cowl bills. Nevertheless, knowledge from January 2025 revealed a slowdown in miner promoting, elevating questions in regards to the market’s future.

Rising miner outflows

The top of 2024 noticed an unprecedented surge in Bitcoin miner outflows, with greenback values hitting new all-time highs. This heightened exercise aligns with marked promoting strain as miners opted to liquidate vital parts of their reserves.

Latest knowledge indicated that these large-scale liquidations have corresponded carefully to native value peaks, suggesting miners strategically bought into energy to maximise returns. This dynamic has amplified volatility in Bitcoin markets, making a suggestions loop the place greater miner exercise feeds bearish sentiment.

And but, the current tapering of outflows noticed in early 2025 appeared to trace at a possible shift in market circumstances, with miners showing much less incentivized to dump holdings regardless of elevated operational pressures.

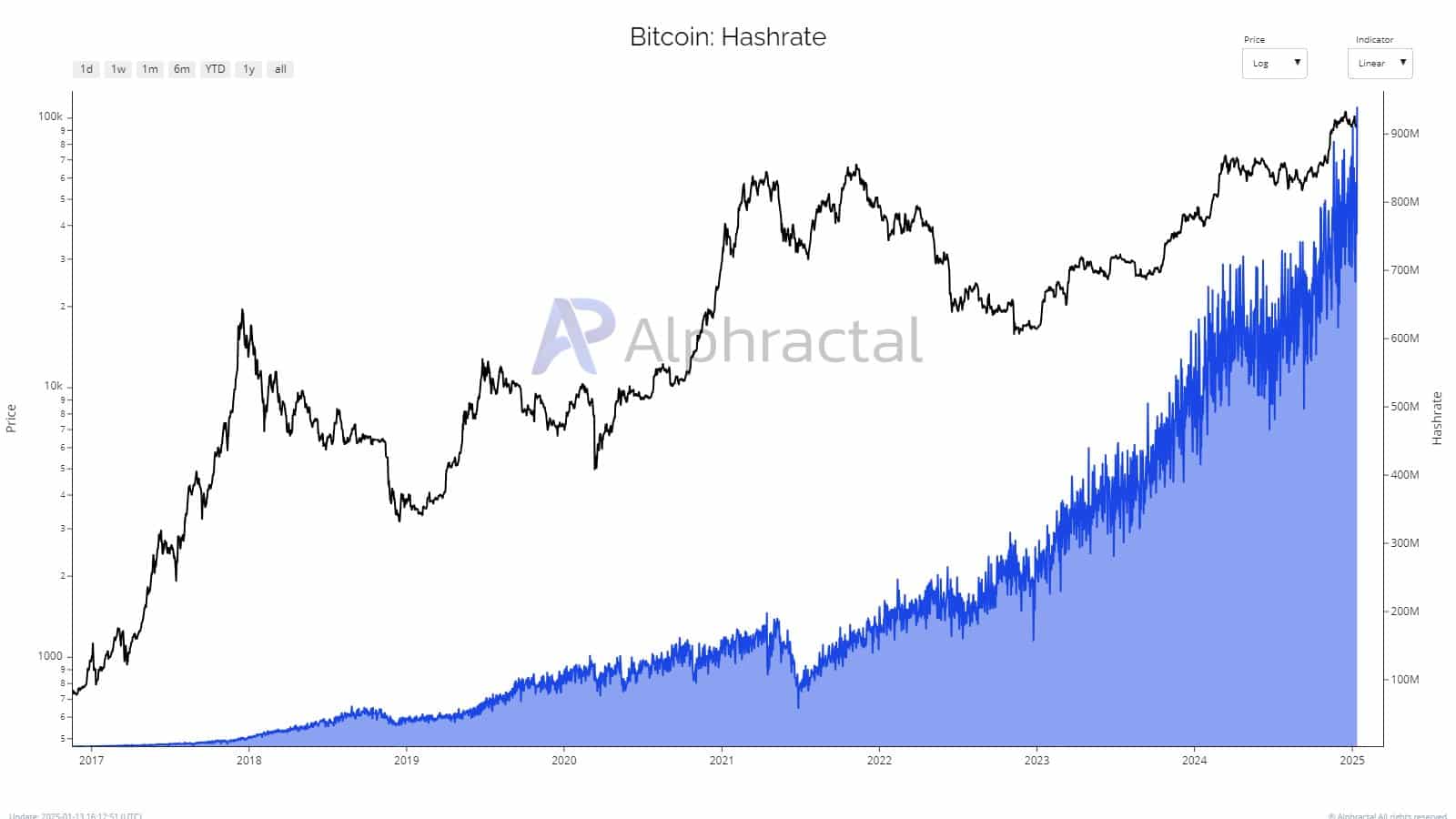

An ATH hashrate

Bitcoin’s hashrate reached an all-time excessive in late 2024, reflecting the community’s strong safety and fierce competitors amongst miners. The speedy ascent correlated with the rising problem in mining new Bitcoin, pushing operational prices to their peak.

Whereas greater hash charges sign confidence in Bitcoin’s underlying protocol, in addition they impose vital monetary pressure on miners. Particularly since they have to then preserve costly {hardware} and energy-intensive operations.

This imbalance pressured many to liquidate belongings over the past quarter of 2024, exacerbating downward value momentum. With early 2025 exhibiting secure hash charge ranges, miners could discover short-term aid. Nevertheless, sustainability issues loom as power costs and competitors proceed to climb.

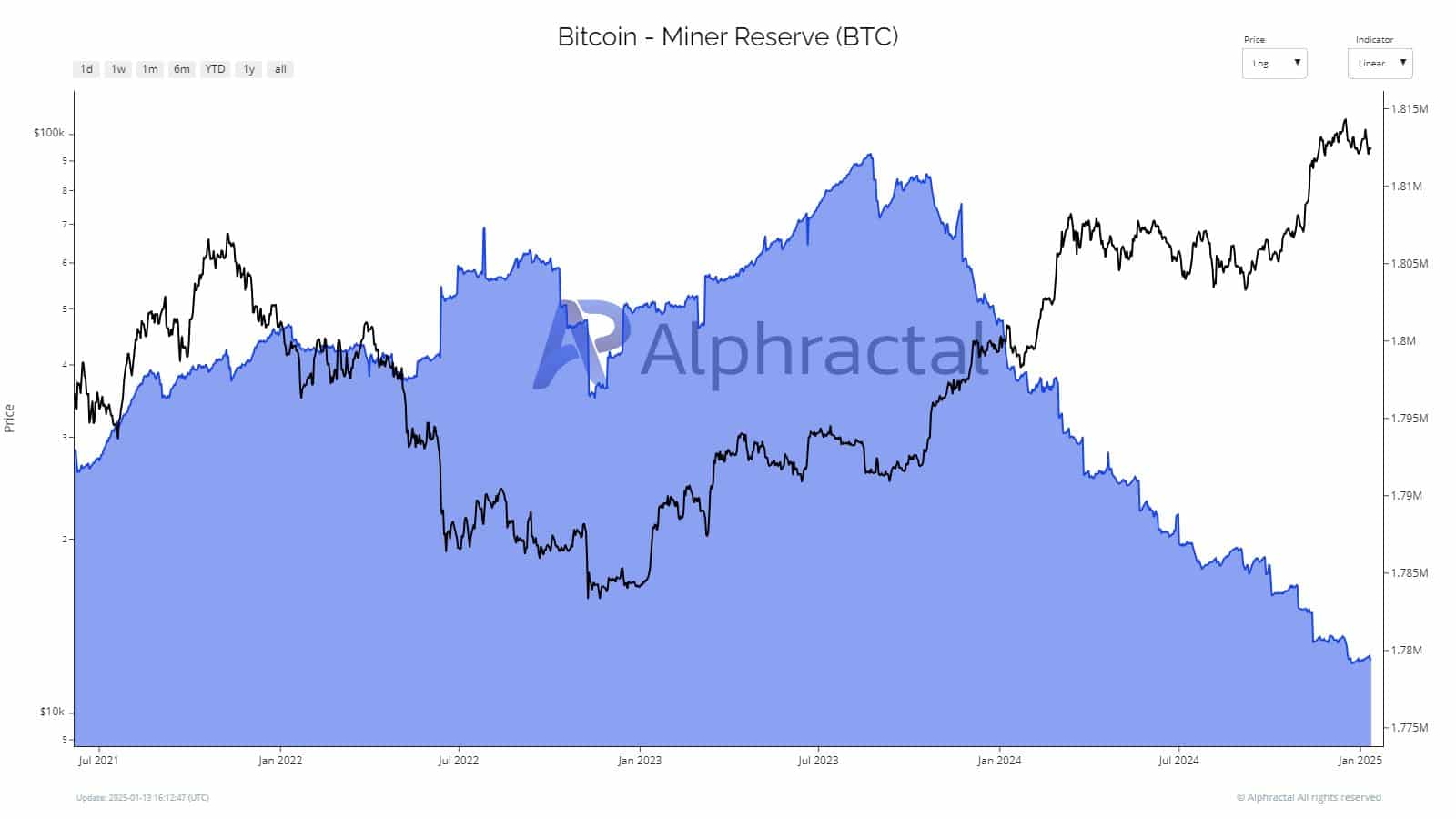

Declining miner reserves and sell-off dynamics

Bitcoin miners have been steadily lowering their reserves since mid-2023, pushed by hovering operational bills attributable to file hash charges and rising power prices. This strategic shift highlights miners’ want for liquidity in an more and more unsure market, with most important reserve reductions occurring throughout native value peaks.

As reserves strategy multi-year lows getting into 2025, issues have grown about miners’ diminishing skill to stabilize the market throughout corrections.

In the meantime, the continuing sell-offs have intensified market strain. Nevertheless, the BTC miner reserves pointed to a slowdown in promoting exercise as miners balanced rising prices with revenue margins. This tapering might sign improved operational effectivity or exterior help, probably resulting in lowered volatility and a extra secure market within the coming months.

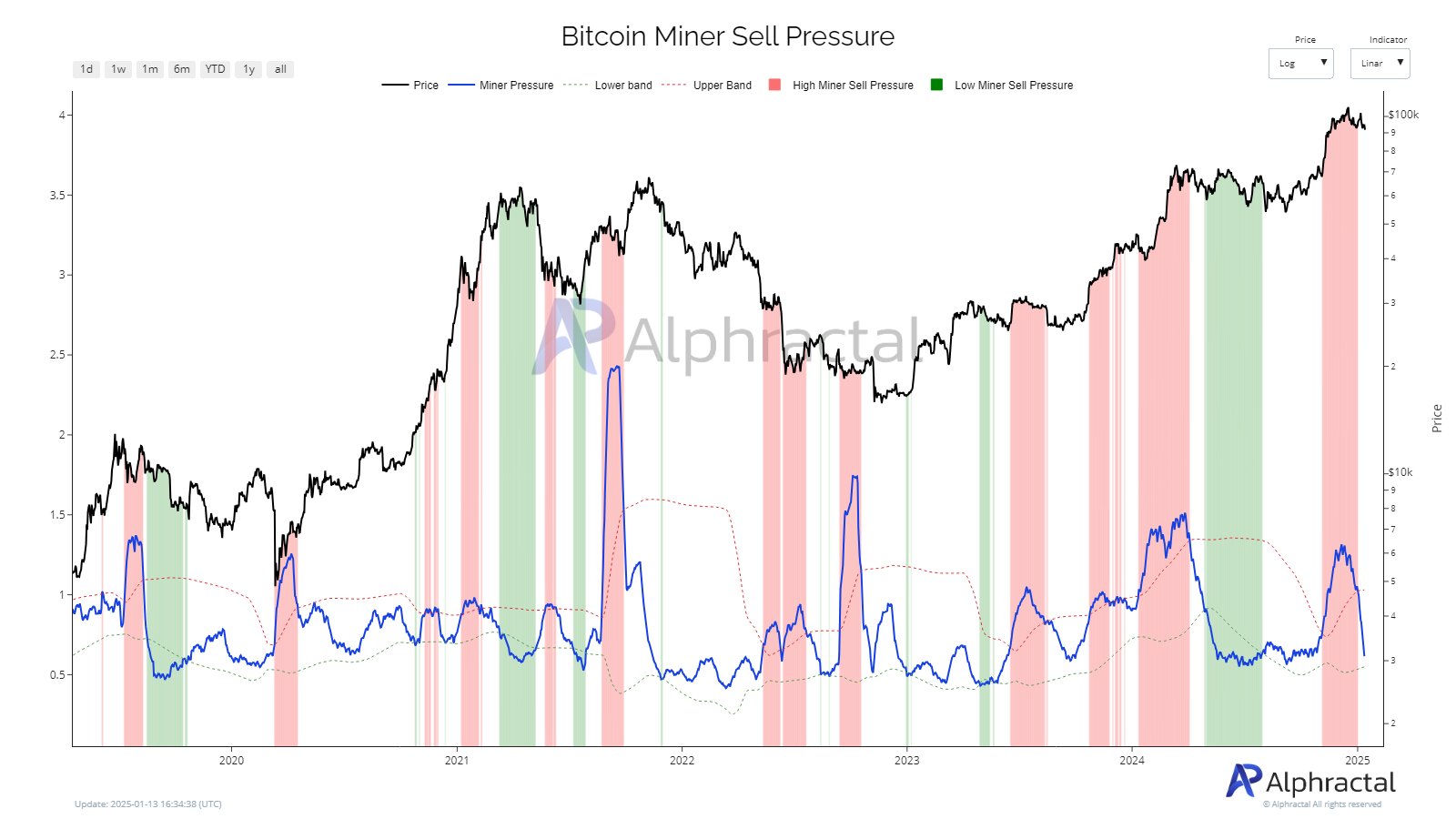

Fall in promoting exercise in 2025

January 2025 has to this point marked a noticeable drop in Bitcoin miner promoting strain. The miner promote strain chart revealed a pointy decline in outflows in comparison with late 2024, signaling a possible shift in market dynamics.

This steered that miners are adopting a extra strategic strategy, presumably holding reserves in anticipation of upper costs. Moreover, operational changes or exterior funding could have alleviated the necessity for aggressive liquidations, lowering the bearish affect of miner exercise on Bitcoin markets.

Learn Bitcoin (BTC) Price Prediction 2025-26