The Bitcoin value has spent nearly all of the previous seven days consolidating across the $94,000 mark with signs of a break to either side. In response to a crypto analyst, Bitcoin’s latest value actions have led to the creation of liquidity blocks noticed between the $86,000 to $104,000 vary, which raises an equal chance of a bounce in direction of $104,000 or a downside break to $86,000 from the present value.

Huge Liquidity Blocks In Each Instructions

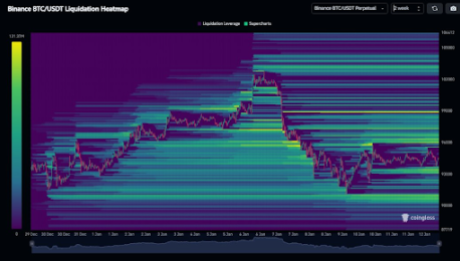

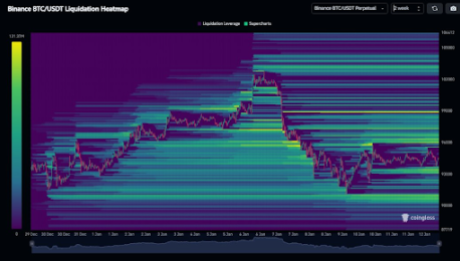

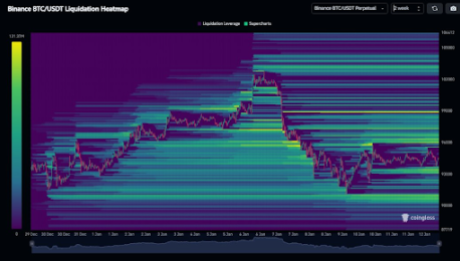

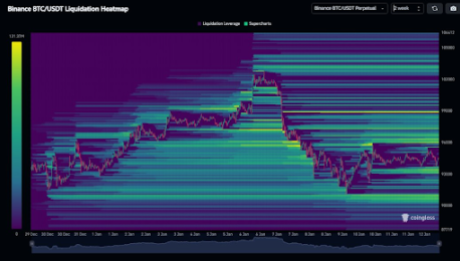

Bitcoin’s latest value consolidation has given little to no thought of what to anticipate from right here, with the liquidation heatmap additionally relaying the identical development. As highlighted by crypto analyst Kevin (@Kev_Capital_TA), Bitcoin’s liquidation heatmap relays huge liquidation blocks from $86,000 to $90,000, all the way in which to $104,000.

Associated Studying

In response to the analyst, these huge liquidation blocks increase the likelihood that the Bitcoin value would proceed to brush between these ranges and create an up-and-down motion between $86,000 up till $104,000 until the tip of the month. Nonetheless, a break to $86,000 might have a devastating impact on the Bitcoin value. The Bitcoin UTXO Realized Worth Distribution (URPD) ATH-Partitioned shows a $12,000 support void beneath this value level. Due to this fact, a decline to $86,000 opens up the potential for an extra crash to $75,000.

BItcoin’s value motion is more likely to proceed shifting within the $86,000 up till $104,000 buying and selling vary and a bullish case will solely emerge if Bitcoin eventually breaks above $108,000. This degree is essential as a result of it serves as Bitcoin’s present value peak. A breakout past $108,000 would translate to new all-time highs for the main cryptocurrency and will pave the way in which for a extra sustained bullish development.

The analyst additionally emphasizes the significance of monitoring USDT dominance, which at present stands at 3.7%. Kevin argues {that a} clear breakdown of USDT dominance is a vital sign for a extra steady and bullish market atmosphere. A consequence of the much less USDT dominance is that traders are changing their stablecoins into Bitcoin and different cryptocurrencies.

Logical Strategy To The Liquidation Blocks

Kevin famous that the logical approach can be to keep watch over the market throughout these predicted up-and-down uneven actions. This method is much more sensible for merchants who’re extra concerned in latest trades and present value motion.

Associated Studying

Alternatively, merchants who’ve been holding because the bear market lows may find it easier to climate the present volatility, on condition that the broader bullish outlook projects further price increases all through 2025.

On the time of writing, Bitcoin is buying and selling at $94,050 and is down by 0.5% and 5.46%, respectively, previously 24 hours.

Featured picture created with Dall.E, chart from Tradingview.com

The Bitcoin value has spent nearly all of the previous seven days consolidating across the $94,000 mark with signs of a break to either side. In response to a crypto analyst, Bitcoin’s latest value actions have led to the creation of liquidity blocks noticed between the $86,000 to $104,000 vary, which raises an equal chance of a bounce in direction of $104,000 or a downside break to $86,000 from the present value.

Huge Liquidity Blocks In Each Instructions

Bitcoin’s latest value consolidation has given little to no thought of what to anticipate from right here, with the liquidation heatmap additionally relaying the identical development. As highlighted by crypto analyst Kevin (@Kev_Capital_TA), Bitcoin’s liquidation heatmap relays huge liquidation blocks from $86,000 to $90,000, all the way in which to $104,000.

Associated Studying

In response to the analyst, these huge liquidation blocks increase the likelihood that the Bitcoin value would proceed to brush between these ranges and create an up-and-down motion between $86,000 up till $104,000 until the tip of the month. Nonetheless, a break to $86,000 might have a devastating impact on the Bitcoin value. The Bitcoin UTXO Realized Worth Distribution (URPD) ATH-Partitioned shows a $12,000 support void beneath this value level. Due to this fact, a decline to $86,000 opens up the potential for an extra crash to $75,000.

BItcoin’s value motion is more likely to proceed shifting within the $86,000 up till $104,000 buying and selling vary and a bullish case will solely emerge if Bitcoin eventually breaks above $108,000. This degree is essential as a result of it serves as Bitcoin’s present value peak. A breakout past $108,000 would translate to new all-time highs for the main cryptocurrency and will pave the way in which for a extra sustained bullish development.

The analyst additionally emphasizes the significance of monitoring USDT dominance, which at present stands at 3.7%. Kevin argues {that a} clear breakdown of USDT dominance is a vital sign for a extra steady and bullish market atmosphere. A consequence of the much less USDT dominance is that traders are changing their stablecoins into Bitcoin and different cryptocurrencies.

Logical Strategy To The Liquidation Blocks

Kevin famous that the logical approach can be to keep watch over the market throughout these predicted up-and-down uneven actions. This method is much more sensible for merchants who’re extra concerned in latest trades and present value motion.

Associated Studying

Alternatively, merchants who’ve been holding because the bear market lows may find it easier to climate the present volatility, on condition that the broader bullish outlook projects further price increases all through 2025.

On the time of writing, Bitcoin is buying and selling at $94,050 and is down by 0.5% and 5.46%, respectively, previously 24 hours.

Featured picture created with Dall.E, chart from Tradingview.com