- Bitcoin might prolong its worth vary within the short-term

- Coinbase analysts cited gradual Fed fee lower path and rising BTC promote strain

Coinbase analysts have cautioned that Bitcoin [BTC] might see market choppiness within the medium time period.

Of their weekly commentary, analysts David Duong and David Han cited the gradual Fed fee lower path and rising BTC provide out there.

“The broader macroeconomic backdrop stays a combined bag. The decreased chance of Fed fee cuts on the again of stronger employment knowledge and inflation dangers might mood danger asset efficiency within the quick to medium time period.”

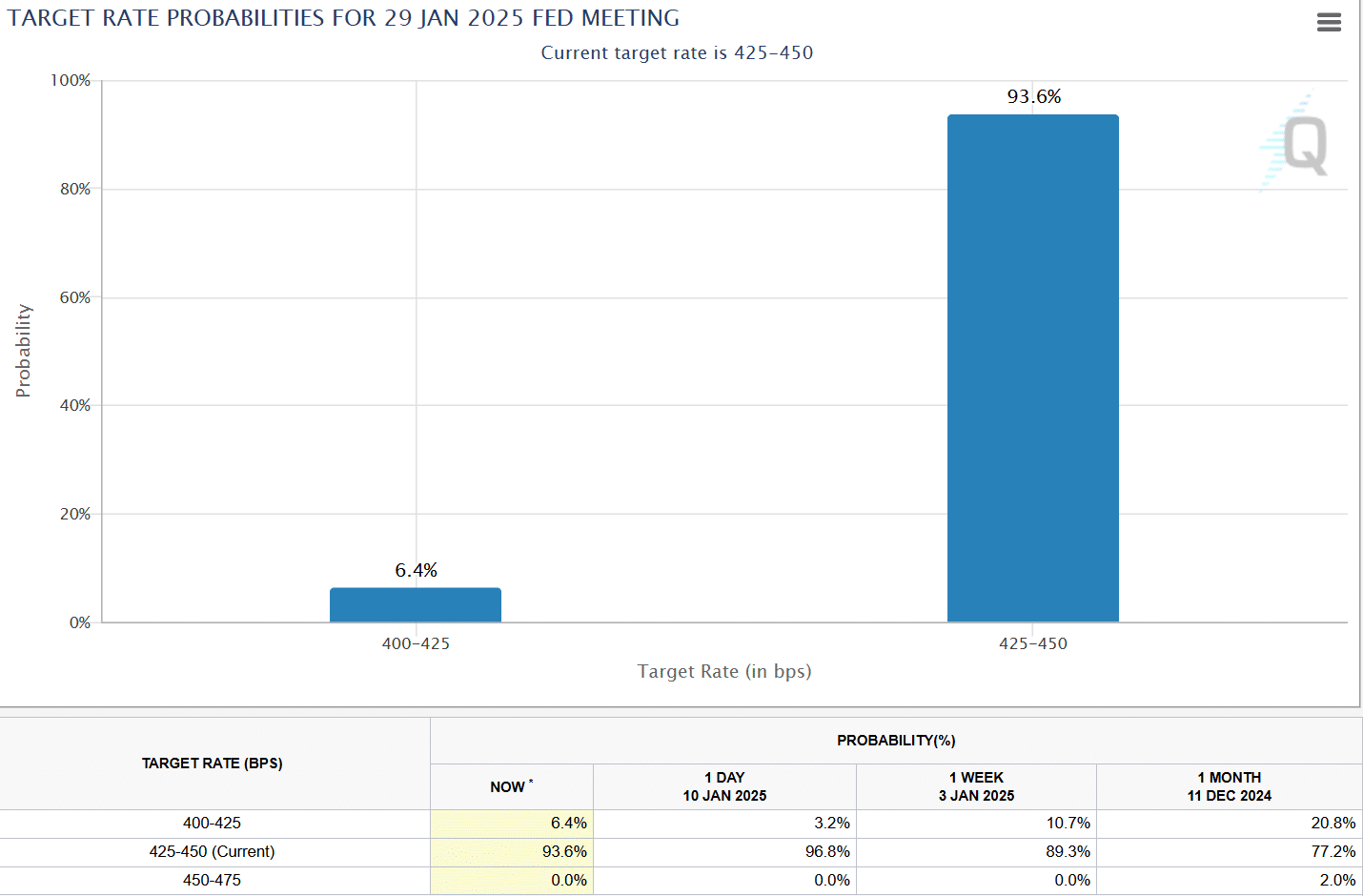

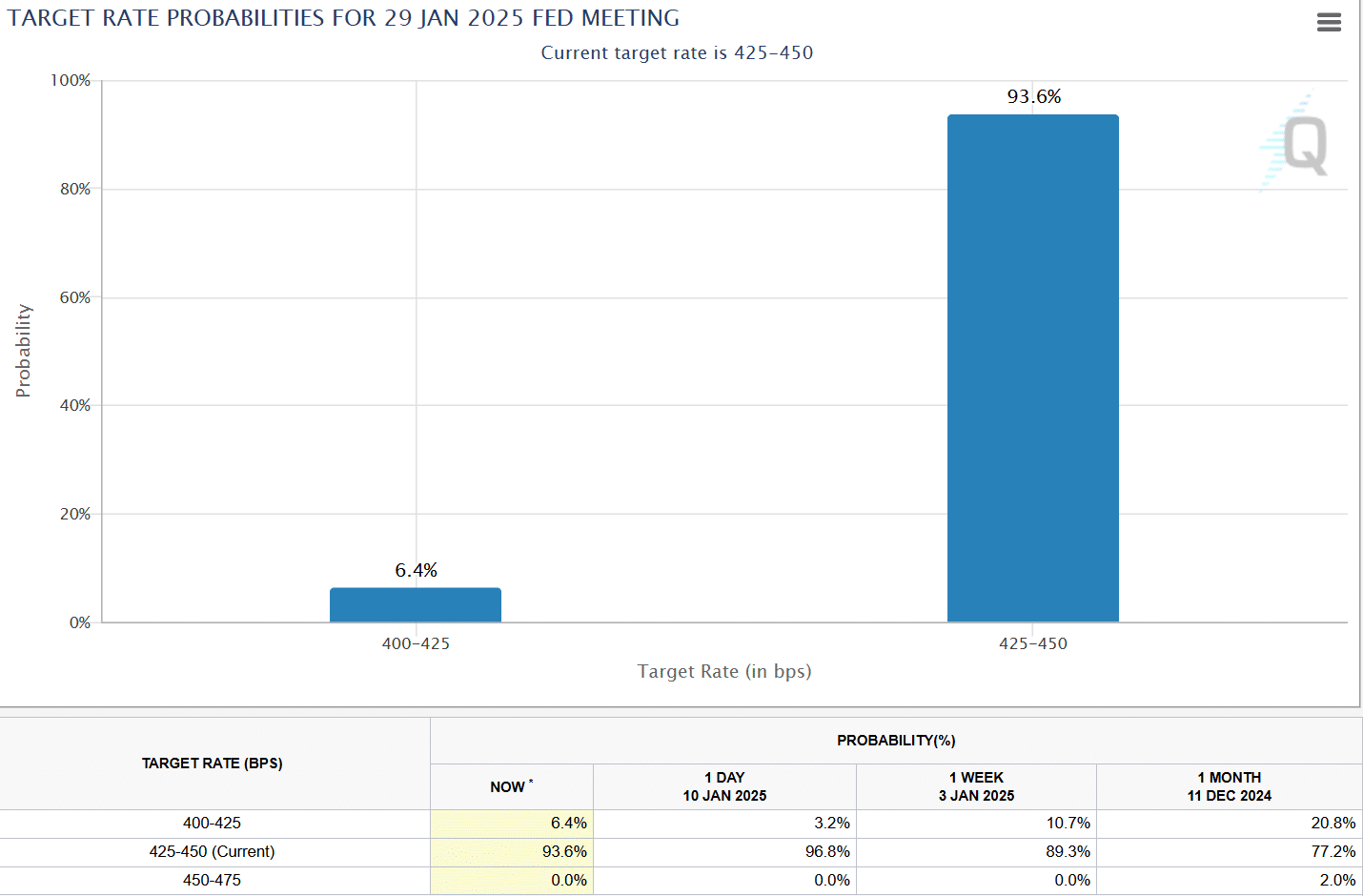

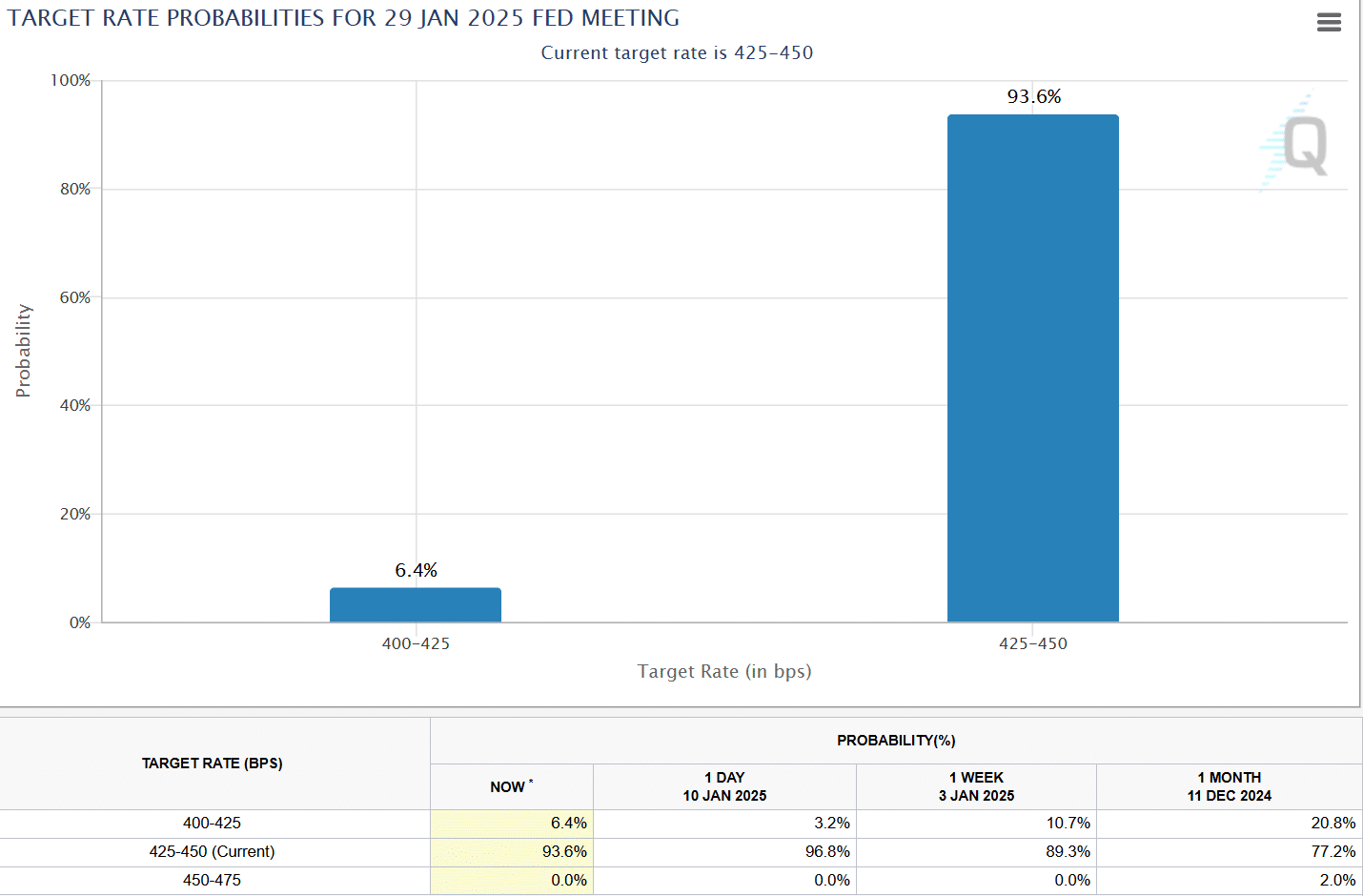

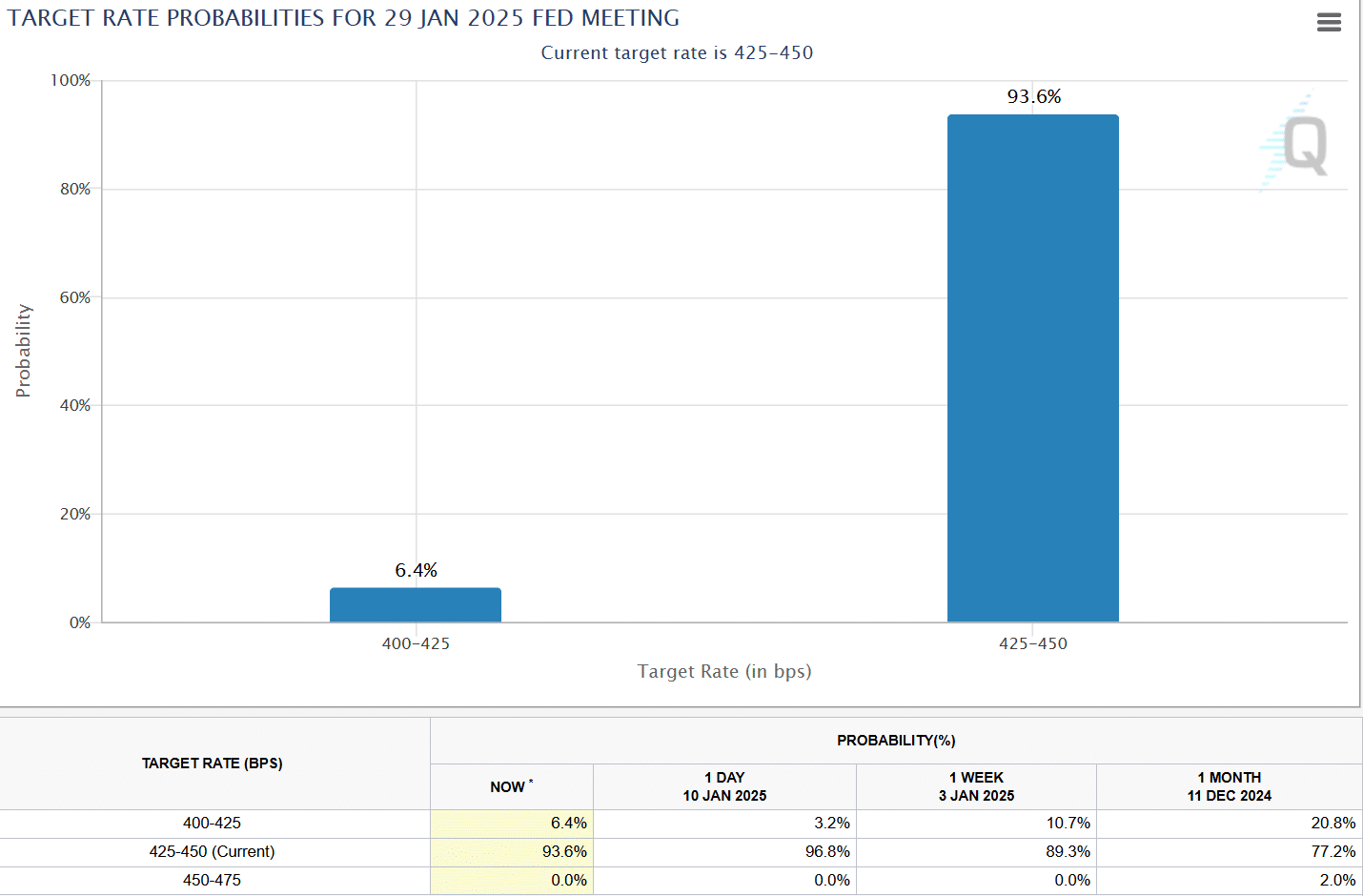

Current U.S financial knowledge revealed sticky inflation and powerful labor markets, additional diminishing expectations of extra Fed fee cuts.

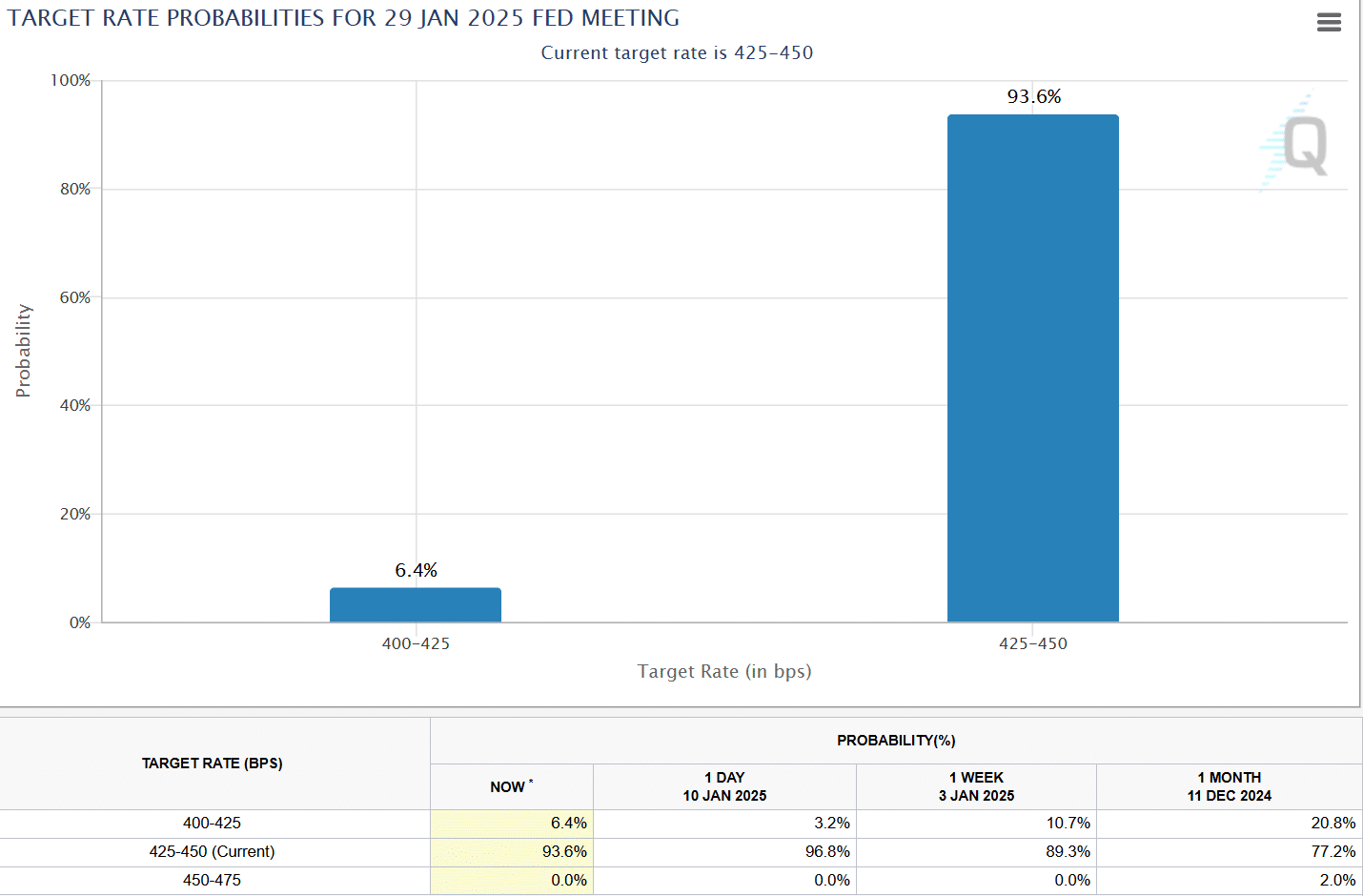

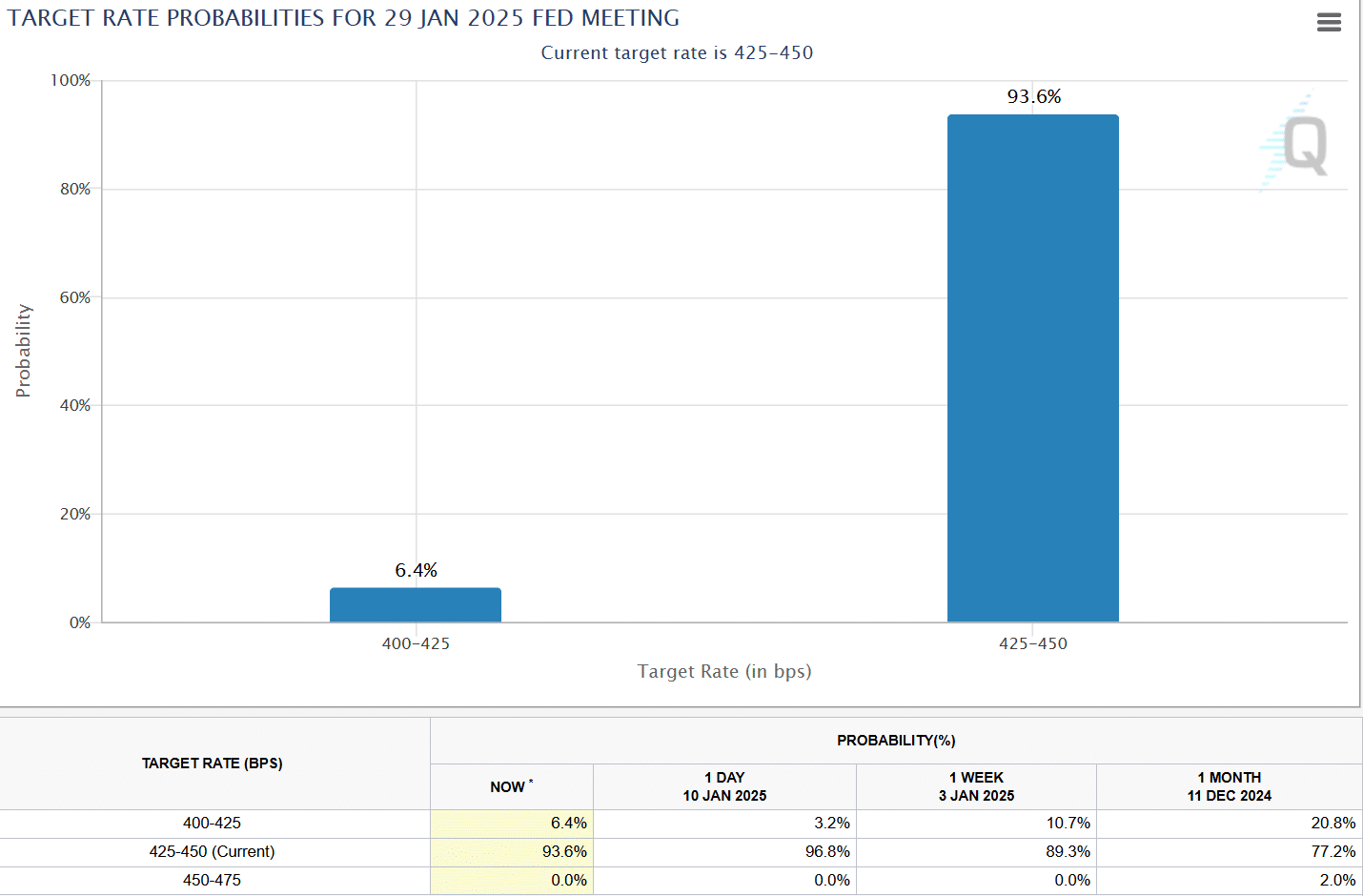

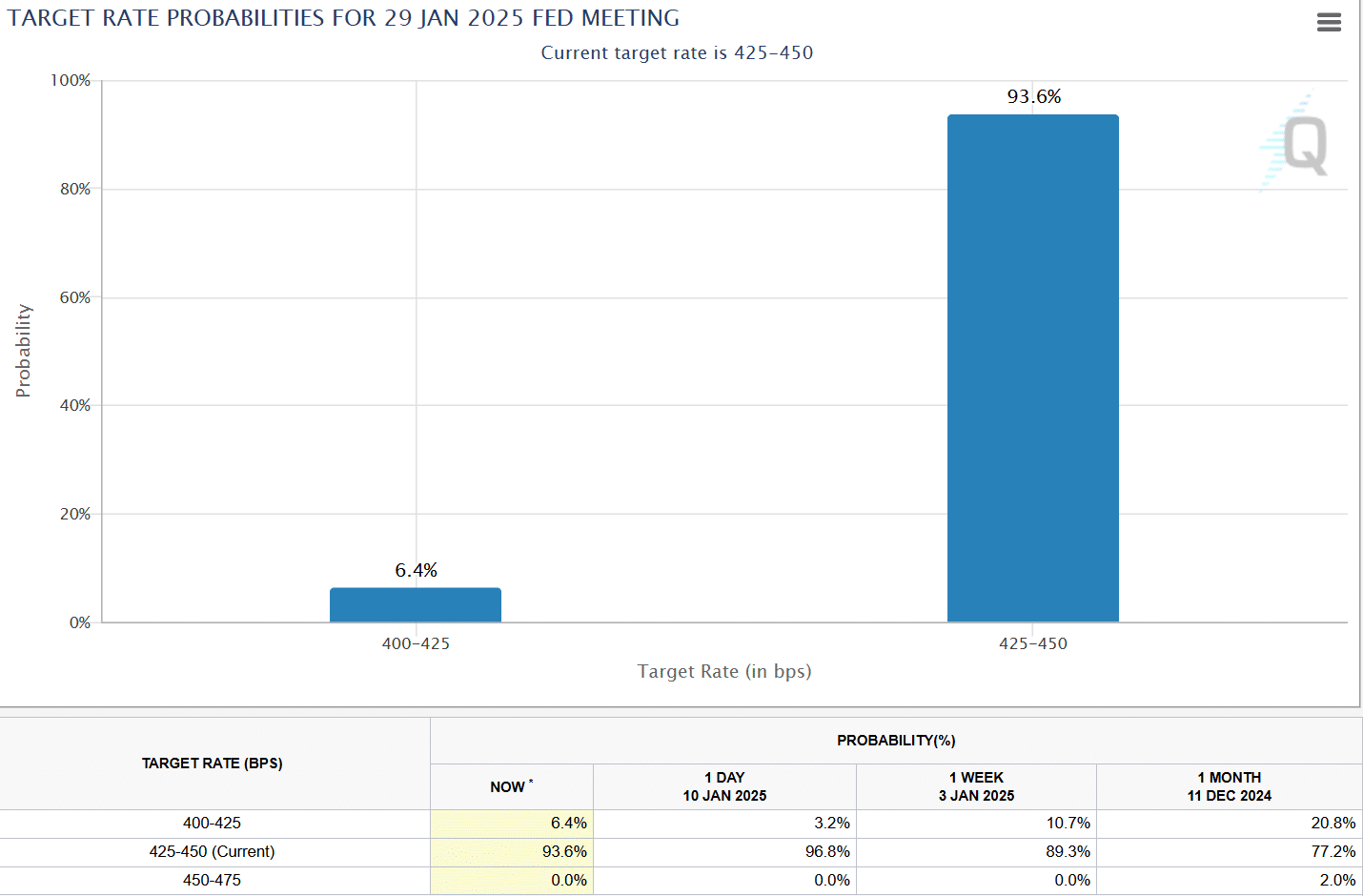

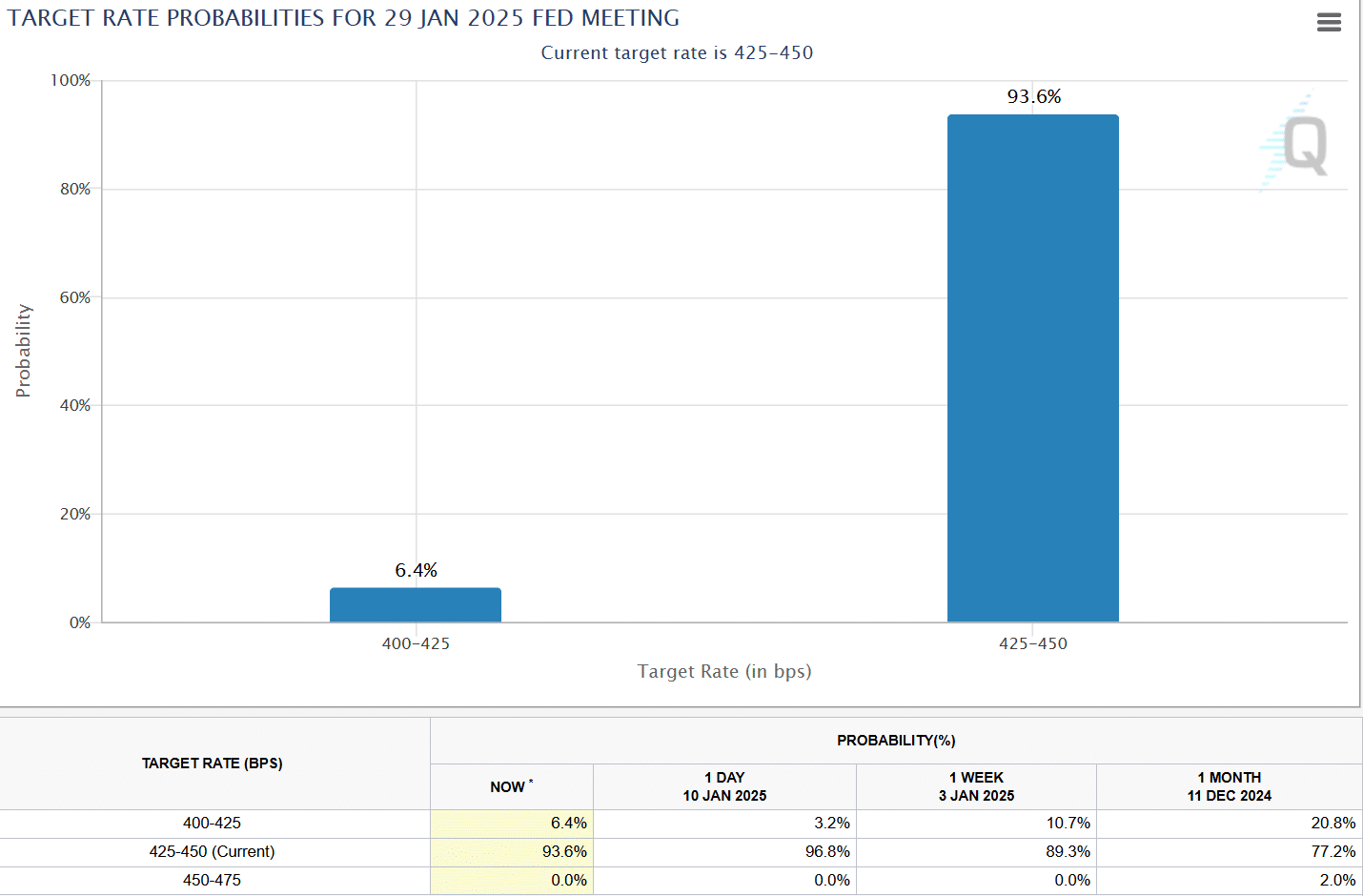

The truth is, merchants have been pricing the Fed to maintain the speed unchanged at 4.25%-4.50% for the following FOMC assembly scheduled for the tip of January.

Supply: CME

BTC promote strain soars

The analysts added {that a} surge in BTC provide might additional cap robust upside momentum on the charts.

“We expect bitcoin’s provide aspect story may mood some upside expectations within the close to time period. The energetic provide of BTC (moved onchain up to now three months) has spiked to 4.6M, up from 2.7M in October 2024.”

The report acknowledged that almost $90 billion value of BTC has been liquidated by long-term holders (LTH), marking the $100k degree as a key provide zone for early buyers. Based on the analysts, this LTH supply pressure might constrict BTC right into a worth vary.

“These supply-side dynamics counsel there might be a interval of grinding consolidation for bitcoin within the coming months just like the onchain indicators we noticed when bitcoin breached all-time-highs in March 2024”

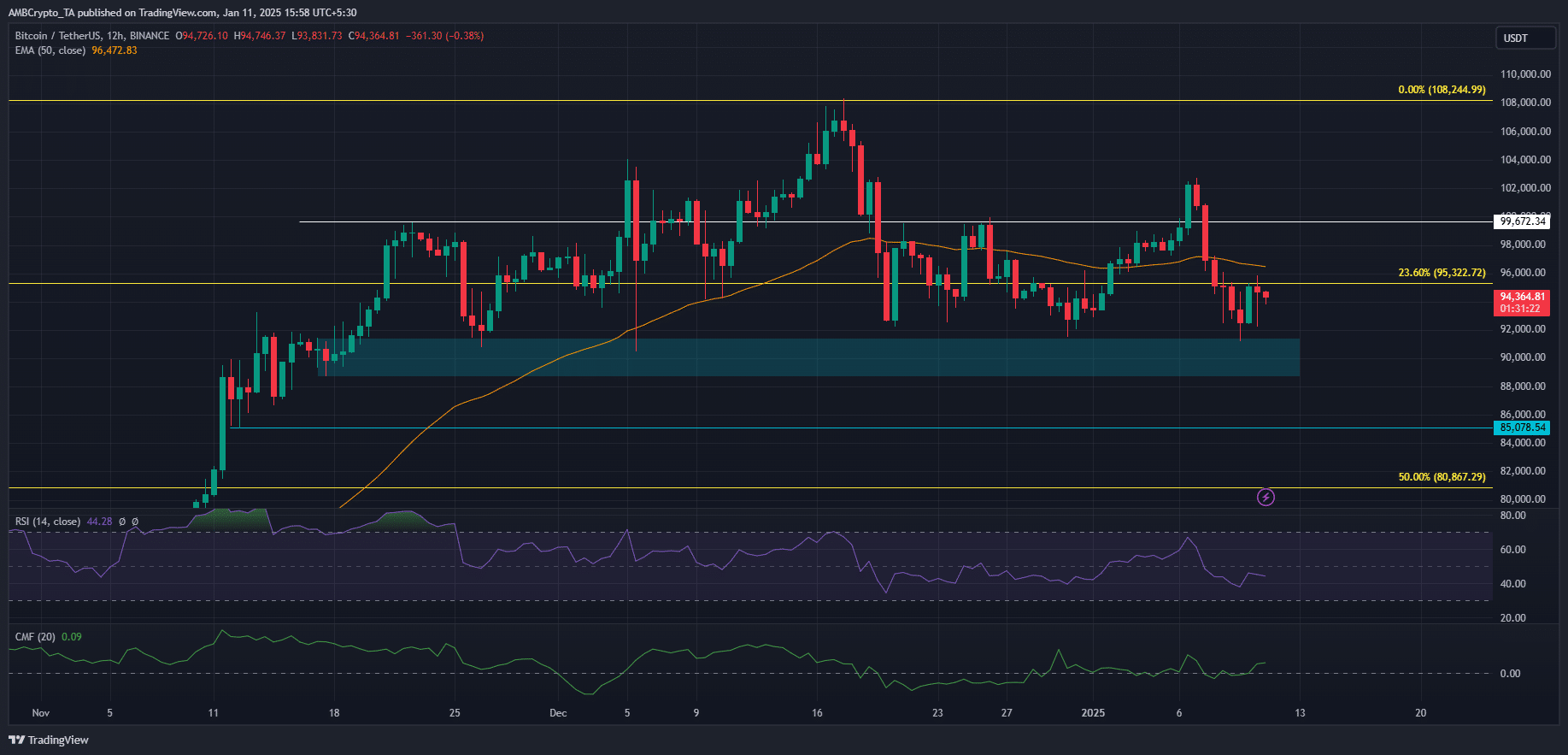

Within the meantime, BTC swept the vary lows and bounced, however the restoration stalled at $95k. This bolstered the $90k-$100k consolidation vary talked about by the analysts.

- Bitcoin might prolong its worth vary within the short-term

- Coinbase analysts cited gradual Fed fee lower path and rising BTC promote strain

Coinbase analysts have cautioned that Bitcoin [BTC] might see market choppiness within the medium time period.

Of their weekly commentary, analysts David Duong and David Han cited the gradual Fed fee lower path and rising BTC provide out there.

“The broader macroeconomic backdrop stays a combined bag. The decreased chance of Fed fee cuts on the again of stronger employment knowledge and inflation dangers might mood danger asset efficiency within the quick to medium time period.”

Current U.S financial knowledge revealed sticky inflation and powerful labor markets, additional diminishing expectations of extra Fed fee cuts.

The truth is, merchants have been pricing the Fed to maintain the speed unchanged at 4.25%-4.50% for the following FOMC assembly scheduled for the tip of January.

Supply: CME

BTC promote strain soars

The analysts added {that a} surge in BTC provide might additional cap robust upside momentum on the charts.

“We expect bitcoin’s provide aspect story may mood some upside expectations within the close to time period. The energetic provide of BTC (moved onchain up to now three months) has spiked to 4.6M, up from 2.7M in October 2024.”

The report acknowledged that almost $90 billion value of BTC has been liquidated by long-term holders (LTH), marking the $100k degree as a key provide zone for early buyers. Based on the analysts, this LTH supply pressure might constrict BTC right into a worth vary.

“These supply-side dynamics counsel there might be a interval of grinding consolidation for bitcoin within the coming months just like the onchain indicators we noticed when bitcoin breached all-time-highs in March 2024”

Within the meantime, BTC swept the vary lows and bounced, however the restoration stalled at $95k. This bolstered the $90k-$100k consolidation vary talked about by the analysts.