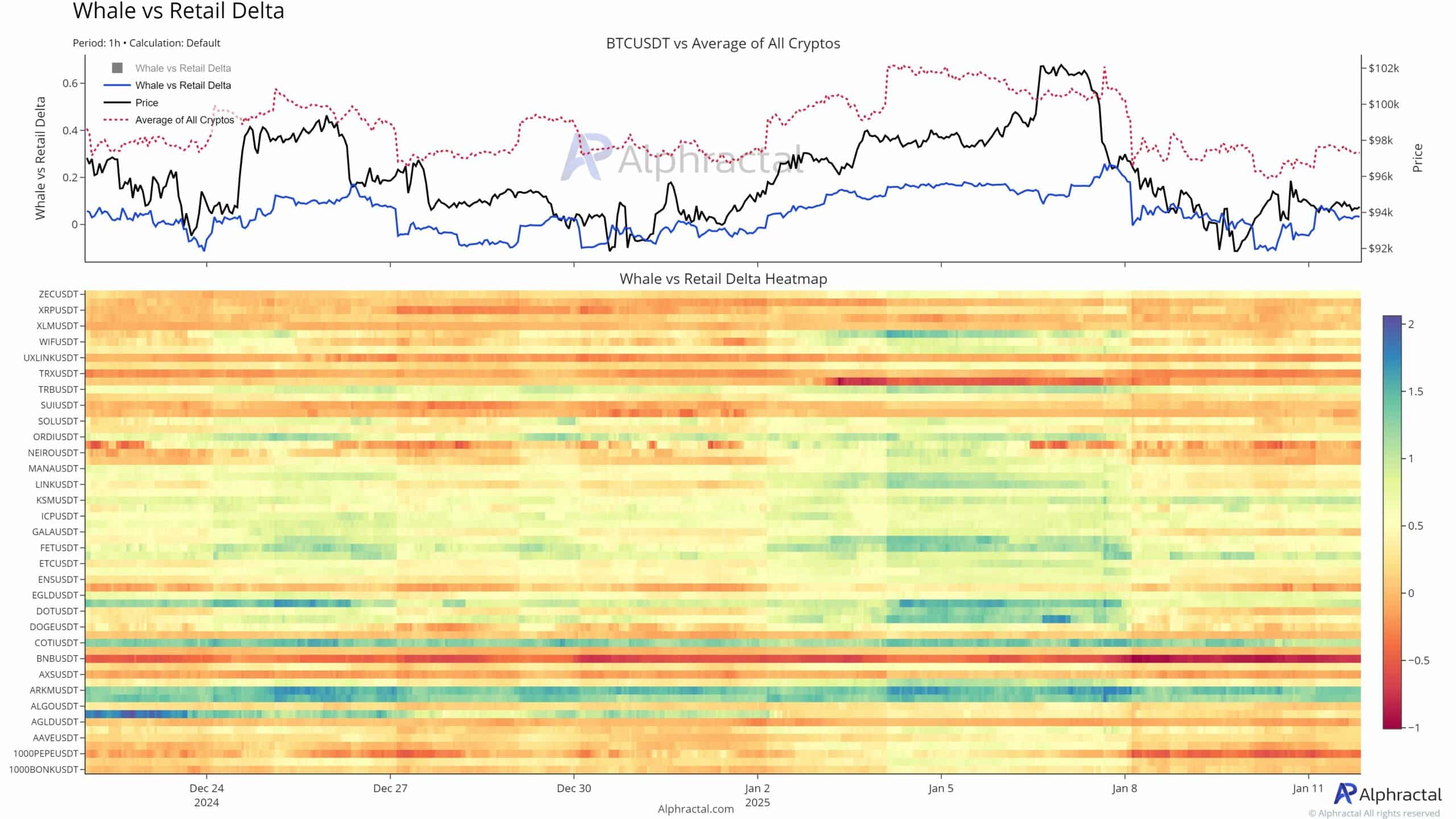

The retail lengthy/quick ratio heatmap revealed clear traits in altcoin positioning. Main the cost in lengthy positions are property equivalent to SUI and SOL, with sustained inexperienced zones indicating elevated retail bullishness.

Alternatively, cash like TRX and XRP exhibited increased ranges of quick curiosity, suggesting merchants anticipate draw back actions.

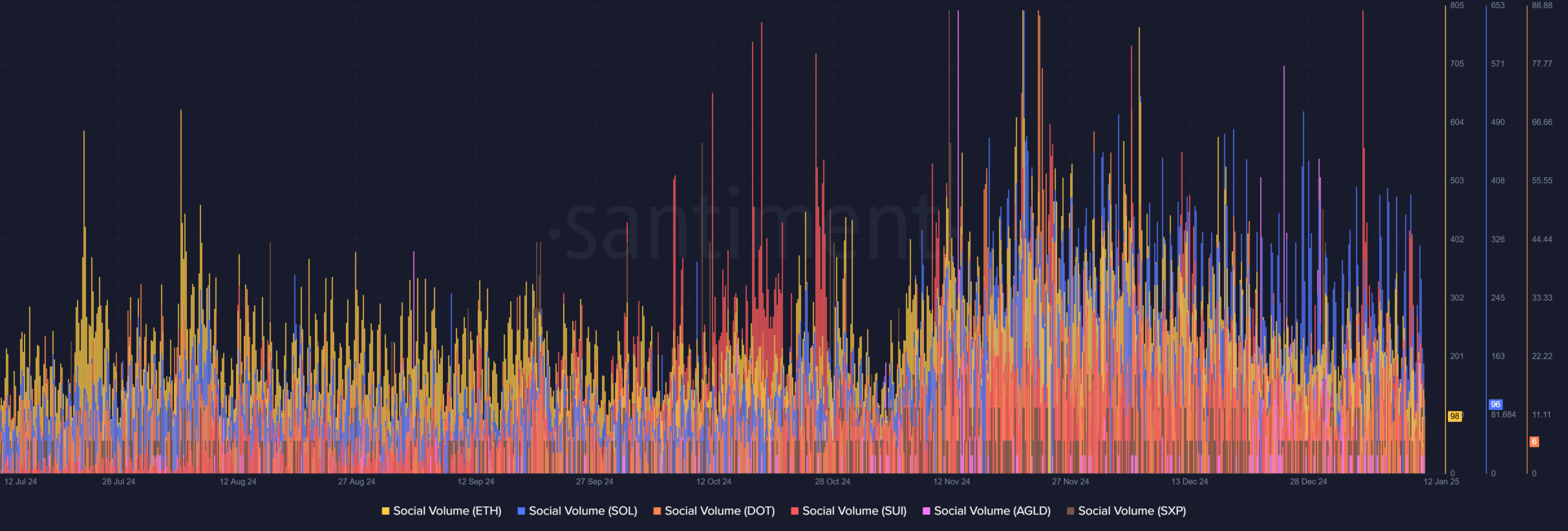

Social quantity information echoed this sentiment. As will be seen on the chart, whereas Ethereum [ETH] maintained excessive engagement ranges, SUI and Solana have been quickly closing the hole, buoyed by community developments and community-driven hype. Altcoins like DOT and AGLD additionally noticed spikes in social quantity, pointing to their rising reputation in buying and selling discussions.

Regardless of the optimism round altcoins, Bitcoin seemed to be in a impartial to barely bearish zone. The common retail lengthy/quick ratio for BTC was near parity, reflecting warning amongst merchants amid slower worth momentum.

This divergence is proof of evolving market dynamics – Merchants are searching for increased risk-to-reward setups in altcoins whereas Bitcoin’s dominance wanes in speculative fervor. For now, the altcoin rally appears to be pushed by a mixture of speculative retail curiosity and enhancing social sentiment.

Bitcoin’s lengthy/quick ratio alerts warning

Bitcoin’s impartial lengthy/quick ratio highlighted its alignment with macroeconomic uncertainty and merchants’ choice for stability.

With slower worth momentum and an absence of decisive development alerts, members seem hesitant to take giant directional bets, favoring hedging methods over speculative performs.

The Whale v. Retail Delta heatmap revealed muted whale curiosity in BTC in comparison with different altcoins, indicating that enormous holders usually are not considerably accumulating or offloading. As an alternative, their habits appeared to be in step with sustaining stability somewhat than amplifying volatility.

This, in sharp distinction with cash like TRX or GALA, the place pronounced retail exercise – typically unbalanced by whale trades – fuels sharper worth swings.

Learn Bitcoin’s [BTC] Price Prediction 2025-26

Diverging optimism – Altcoins and market stability

The uneven sentiment throughout altcoins recommended the market is at a crossroads. Cash like SUI and SOL noticed concentrated bullish momentum, but this optimism isn’t common. Quick positioning in property equivalent to TRX and XRP alluded to rising skepticism in different pockets of the market.

This bifurcation appears to be hinting at a possible liquidity tug-of-war, the place overly optimistic performs in some altcoins may amplify volatility spillovers. For market stability, this fragmented sentiment introduces dangers.

If speculative euphoria in sure altcoins unwinds abruptly, it may dampen broader confidence and result in contagion results. Conversely, sustained optimism in choose property may entice sidelined capital, fueling a wider rally.