Two days in the past, the atebites X account identified that THORChain’s lending service presently has nowhere close to sufficient bitcoin to repay its collectors.

As of the time of the publish, the overall quantity of bitcoin to be repaid to depositors was 1,604, whereas the lending pool solely had 592 bitcoin in it.

We have to be elevating consciousness on simply how dangerous of a form Thorchain lending is true now, posing a possible threat to the protocol itself.

Because it stands, at present mark to market charges for RUNE, full mortgage closure will mint 24 million RUNE.

1,604 in BTC collateral, 18,258… pic.twitter.com/OykZbMQCdx

— atebites (@ate_bites) January 8, 2025

As Lava founder Shehzan Maredia defined in a publish on X, while you borrow on THORChain, they promote the bitcoin you place up as collateral for their very own token, RUNE. If you repay your mortgage, they promote the RUNE for bitcoin to provide you again your collateral.

I predicted the Thorchain collapse in 2023 after they launched their "lending" characteristic, and it's taking place now. The lesson individuals by no means appear to study: any system in crypto that may fail will fail.

If you borrowed on Thorchain, they’d promote your BTC collateral for his or her…

— Shehzan (@MarediaShehzan) January 10, 2025

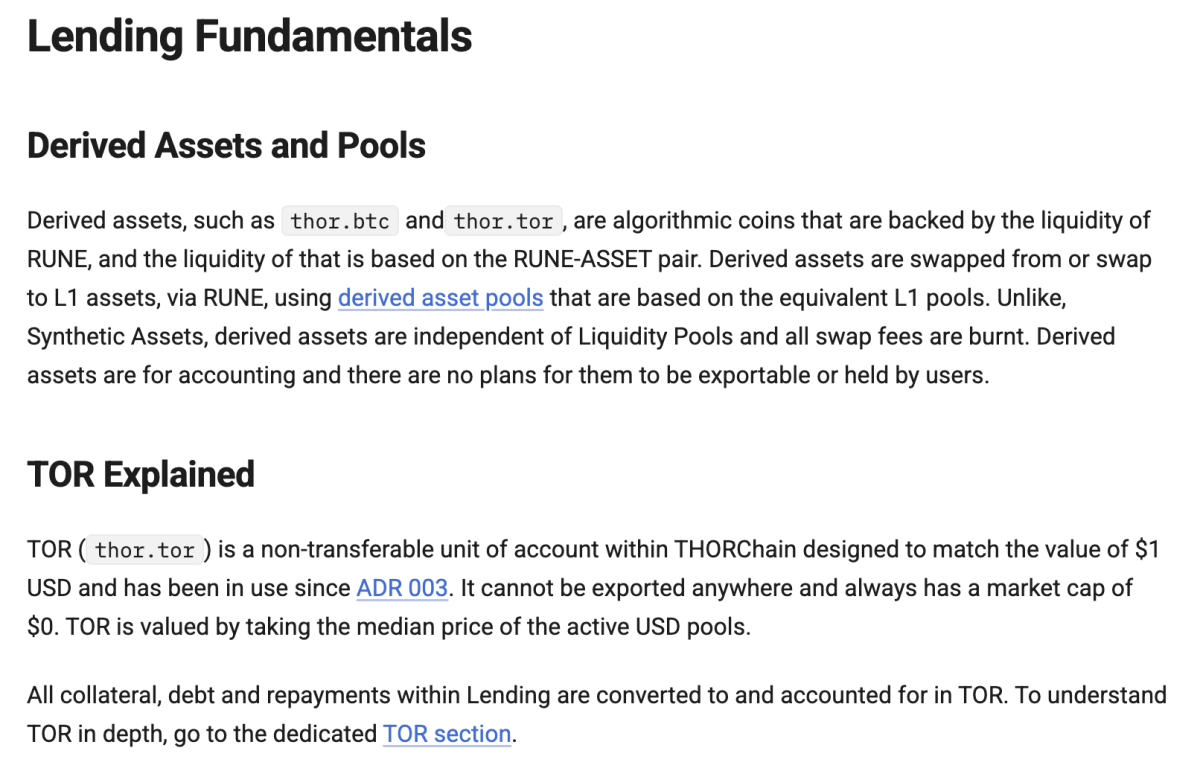

The precise mechanics of how this works are a bit extra advanced and are detailed on THORChain’s web site.

See screenshots from the web site under:

The first subject on this situation is that half of the worth borrowed in U.S. greenback denominations was borrowed when bitcoin traded at considerably decrease costs than that at which bitcoin trades at the moment, in accordance with atebites.

Because of this for THORChain to satisfy its present calls for, it might want to mint upwards of 24 million RUNE (as of January 8). Whereas this may solely be about 8% of the circulating supply of RUNE, it will result in a discount within the value of the asset, which might give THORChain even much less buying energy as they attempt to purchase bitcoin again on behalf of their collectors.

If merchants have been to start out shorting RUNE on prime of this, THORChain’s skill to buy the required quantity of bitcoin to redeem its collectors would diminish even additional.

This might result in one thing akin to the Terra/Luna death spiral we noticed in 2022.

With that stated, outstanding supporter of the venture Erik Voorhees shared that THORChain’s lending service is working because it was supposed to and that there is no such thing as a foreseeable hazard:

Thorchain continues working as designed.

Sure, mortgage redemptions trigger downward stress on RUNE value, however scale is just not harmful.

When you're nervous, simply go repay your mortgage.

— Erik Voorhees (@ErikVoorhees) January 10, 2025

A core developer for THORChain that goes by the title 9 Realms on X additionally made the case that THORChain is resilient:

1/ Addressing Neighborhood Considerations

There's been plenty of dialogue lately in regards to the state of the community and the excellent lending protocol legal responsibility.

Let’s dive into the information to make clear what’s actually taking place and why we stay assured in THORChain's resilience.

— 9 Realms (@ninerealms_cap) January 10, 2025

With all of this stated, when you’re nonetheless feeling skittish about having lent THORChain your bitcoin as collateral for a mortgage, you would possibly wish to redeem it. If I have been utilizing the service, I might.

This text is a Take. Opinions expressed are totally the writer’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.