The crypto market faces renewed volatility and uncertainty following the current Bitcoin price crash beneath the $100,000 mark. Consequently, a crypto analyst has shared a relatively prolonged X (previously Twitter) put up outlining what to anticipate following this important decline. He warns of important ranges to look at as selling pressures intensify, noting that each macro and technical indicators paint a blended image of Bitcoin’s short-term value trajectory.

Key Ranges To Watch After The Bitcoin Worth Crash

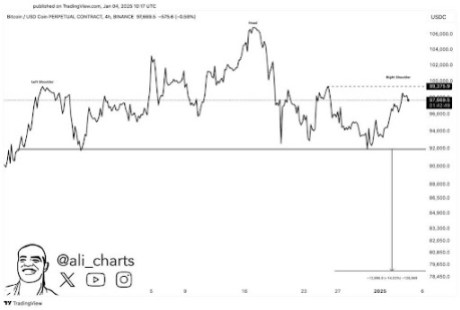

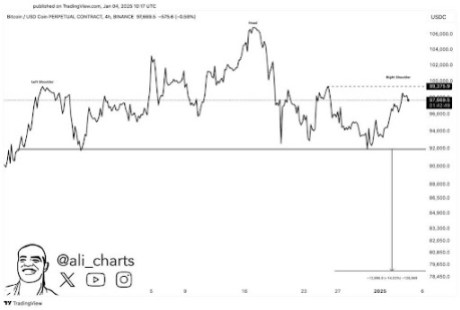

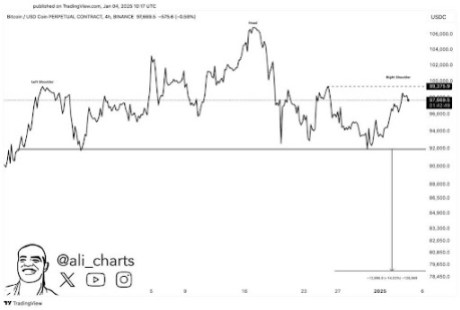

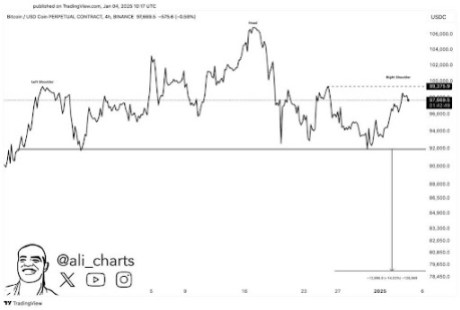

In line with outstanding crypto analyst Ali Martinez, the Bitcoin value is as soon as once more buying and selling beneath $100,000 after surpassing this milestone earlier this week. Martinez revealed that in the day prior to this, Bitcoin breached the best shoulder of a Head and Shoulder pattern, fully invalidating its bearish setup on the time. Nevertheless, in simply 24 hours, the cryptocurrency erased these important good points, pushing its value again beneath the best shoulder of the technical sample and reigniting bearish sentiment.

Associated Studying

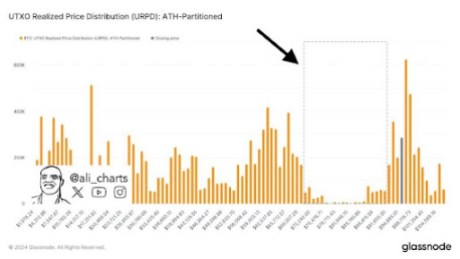

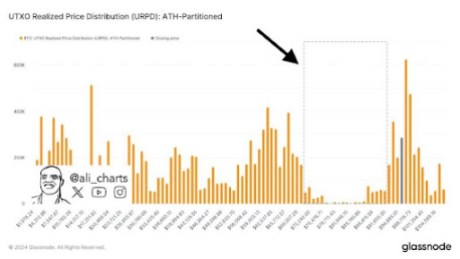

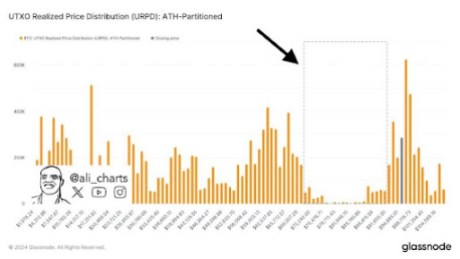

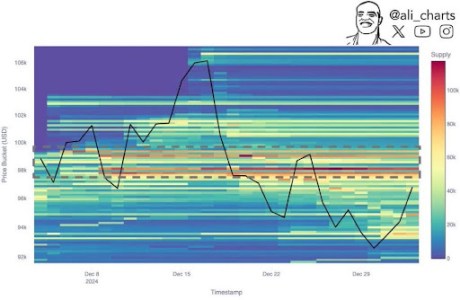

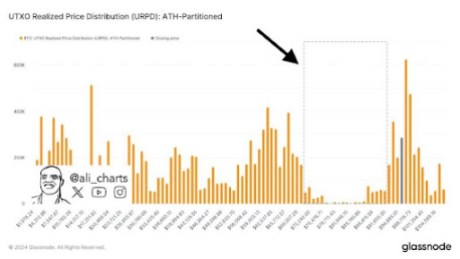

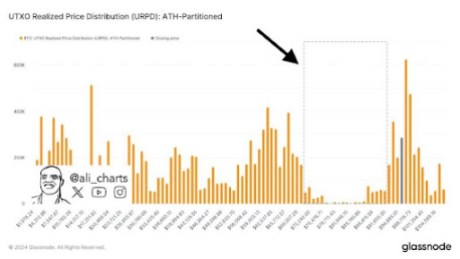

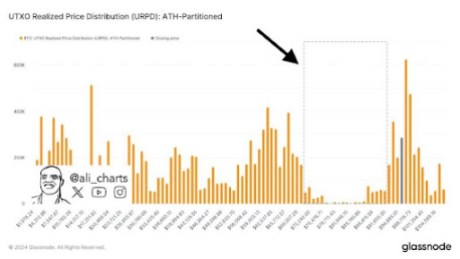

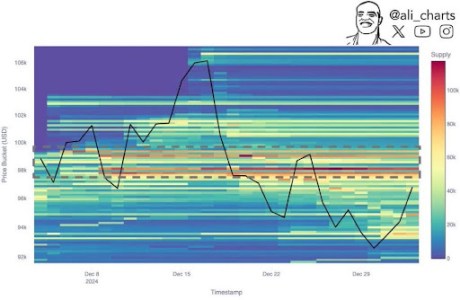

With its huge crash below $100,000, Bitcoin has now plummeted considerably beneath the important thing demand zone between $95,000 and $98,000, an space the place roughly 1.77 million wallet addresses had bought greater than 1.53 million BTC, price over 141.3 billion at the moment market price.

Whereas many buyers sometimes purchase and maintain BTC for revenue, the current Bitcoin value crash has raised considerations that house owners of the 1.77 million pockets addresses could also be pressured to sell off their holdings to chop down potential losses. Martinez warns that rising promoting pressures may push the Bitcoin value beneath $92,000, doubtlessly triggering a good sharper and extra speedy decline, with restricted assist till it reaches the $74,000 mark. Notably, the analyst labels a drop beneath $92,000 a “free fall territory,” which means Bitcoin may proceed to crash as panic selling intensifies and liquidity dries up.

Including to the continued uncertainty, Bitcoin’s reversal beneath the best shoulder of the Head and Shoulders sample, mixed with present bearish market circumstances, has reignited fears, leaving many buyers bracing for a deeper price crash.

Rebound On The Horizon Or Extra Ache Forward?

Regardless of Bitcoin’s present bearish outlook, Martinez reassures crypto neighborhood members {that a} value rebound is feasible. The analyst disclosed that Bitcoin’s TD sequential indicator not too long ago flashed a purchase sign on the 4-hour chart, suggesting {that a} potential price recovery and rebound could also be underway.

Associated Studying

Apparently, Binance traders stay bullish on Bitcoin, with this optimistic sentiment pointing to a short-term restoration towards $98,600, a value degree with a $35 million liquidation zone that market makers covet. Martinez highlights {that a} sustained break above the $100,000 mark is important to invalidating Bitcoin’s present bearish outlook and setting the stage for new all-time highs.

Nevertheless, if Bitcoin fails to reclaim this psychological degree and falls beneath $92,000, it dangers additional draw back, doubtlessly correcting towards new vary lows between $78,000 and $74,000. As of writing, the Bitcoin value is buying and selling at $94,154, which means a drop in these vary lows would mark an enormous 17.16% to 21.41% decline.

Featured picture created with Dall.E, chart from Tradingview.com

The crypto market faces renewed volatility and uncertainty following the current Bitcoin price crash beneath the $100,000 mark. Consequently, a crypto analyst has shared a relatively prolonged X (previously Twitter) put up outlining what to anticipate following this important decline. He warns of important ranges to look at as selling pressures intensify, noting that each macro and technical indicators paint a blended image of Bitcoin’s short-term value trajectory.

Key Ranges To Watch After The Bitcoin Worth Crash

In line with outstanding crypto analyst Ali Martinez, the Bitcoin value is as soon as once more buying and selling beneath $100,000 after surpassing this milestone earlier this week. Martinez revealed that in the day prior to this, Bitcoin breached the best shoulder of a Head and Shoulder pattern, fully invalidating its bearish setup on the time. Nevertheless, in simply 24 hours, the cryptocurrency erased these important good points, pushing its value again beneath the best shoulder of the technical sample and reigniting bearish sentiment.

Associated Studying

With its huge crash below $100,000, Bitcoin has now plummeted considerably beneath the important thing demand zone between $95,000 and $98,000, an space the place roughly 1.77 million wallet addresses had bought greater than 1.53 million BTC, price over 141.3 billion at the moment market price.

Whereas many buyers sometimes purchase and maintain BTC for revenue, the current Bitcoin value crash has raised considerations that house owners of the 1.77 million pockets addresses could also be pressured to sell off their holdings to chop down potential losses. Martinez warns that rising promoting pressures may push the Bitcoin value beneath $92,000, doubtlessly triggering a good sharper and extra speedy decline, with restricted assist till it reaches the $74,000 mark. Notably, the analyst labels a drop beneath $92,000 a “free fall territory,” which means Bitcoin may proceed to crash as panic selling intensifies and liquidity dries up.

Including to the continued uncertainty, Bitcoin’s reversal beneath the best shoulder of the Head and Shoulders sample, mixed with present bearish market circumstances, has reignited fears, leaving many buyers bracing for a deeper price crash.

Rebound On The Horizon Or Extra Ache Forward?

Regardless of Bitcoin’s present bearish outlook, Martinez reassures crypto neighborhood members {that a} value rebound is feasible. The analyst disclosed that Bitcoin’s TD sequential indicator not too long ago flashed a purchase sign on the 4-hour chart, suggesting {that a} potential price recovery and rebound could also be underway.

Associated Studying

Apparently, Binance traders stay bullish on Bitcoin, with this optimistic sentiment pointing to a short-term restoration towards $98,600, a value degree with a $35 million liquidation zone that market makers covet. Martinez highlights {that a} sustained break above the $100,000 mark is important to invalidating Bitcoin’s present bearish outlook and setting the stage for new all-time highs.

Nevertheless, if Bitcoin fails to reclaim this psychological degree and falls beneath $92,000, it dangers additional draw back, doubtlessly correcting towards new vary lows between $78,000 and $74,000. As of writing, the Bitcoin value is buying and selling at $94,154, which means a drop in these vary lows would mark an enormous 17.16% to 21.41% decline.

Featured picture created with Dall.E, chart from Tradingview.com