- Bitcoin’s market buzz intensified forward of Trump’s inauguration, signaling a pivotal second for traders

- Crypto market cap declined by over 3% within the final 24 hours

Because the crypto market gears up for a historic second, Bitcoin traders are carefully watching the upcoming inauguration of Donald Trump on 20 January 2025. Identified for his latest shift in the direction of pro-crypto insurance policies, Trump’s second time period might herald vital adjustments for the cryptocurrency panorama.

The market is abuzz with hypothesis about whether or not this political occasion will set off a brand new rally for Bitcoin or lead to short-term profit-taking.

Market optimism surrounding Trump’s inauguration

Donald Trump’s second time period as U.S. President has reignited optimism within the cryptocurrency market. His pro-crypto place, a pointy departure from his earlier skepticism, has raised expectations for insurance policies that would favor digital property. Following Trump’s victory within the 2024 elections, Bitcoin rallied considerably, crossing $73,000 to climb as excessive as $108k as investor confidence grew.

This optimism stems from the potential for clearer regulatory frameworks and better institutional adoption below his administration. Such elements have led to heightened hypothesis that Bitcoin’s rally may lengthen additional, particularly within the backdrop of higher institutional participation.

Bitcoin’s post-election efficiency and investor sentiment

Since Trump’s 2024 victory, Bitcoin’s value has surged previous $90,000, reflecting sturdy investor sentiment. Institutional inflows have performed a pivotal function, with approval of Bitcoin spot ETFs serving as a catalyst for bullish momentum.

On-chain information, akin to internet outflows from exchanges, indicated vital accumulation by whales and institutional traders, reinforcing the long-term confidence in BTC.

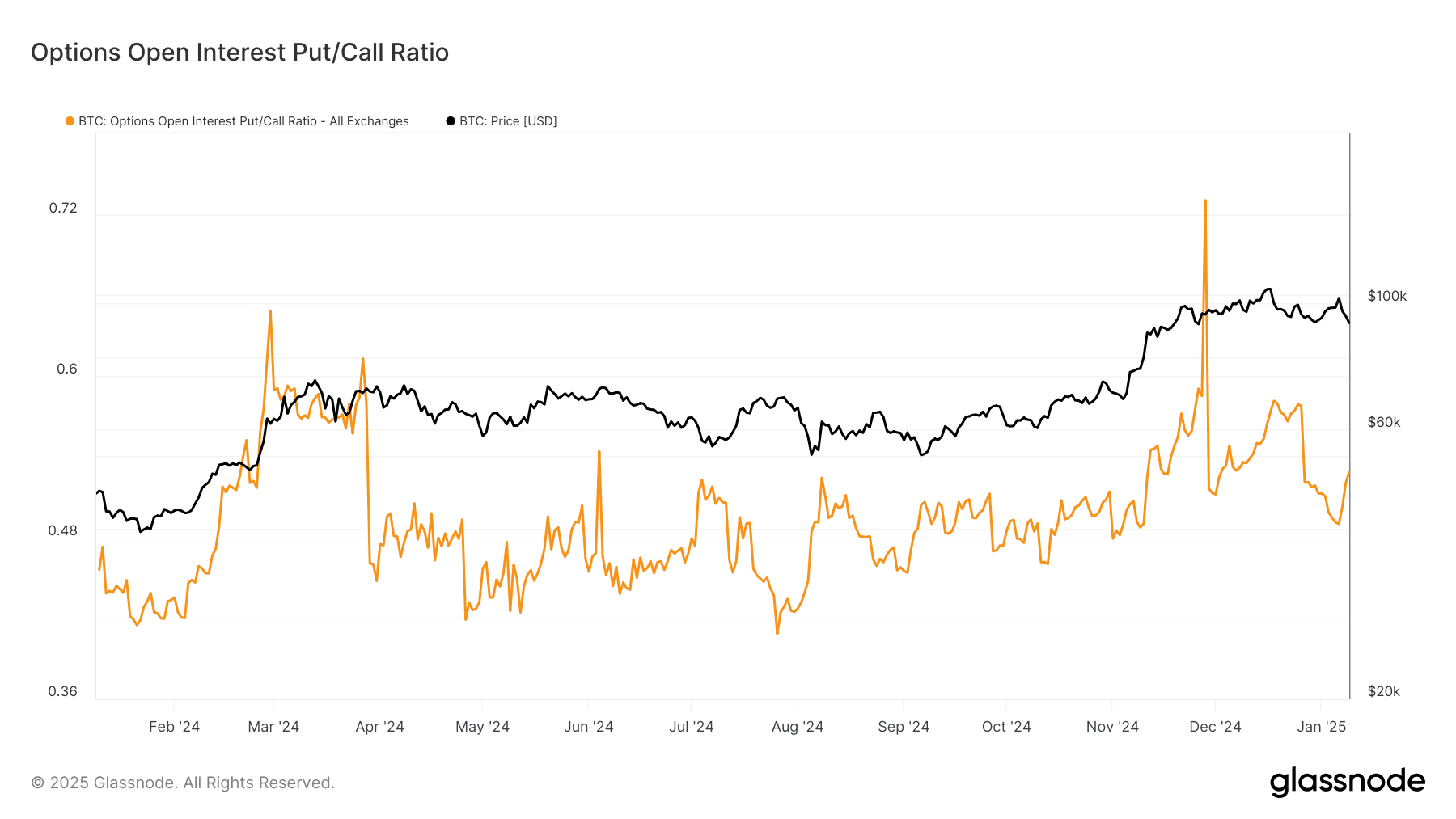

The Options Open Interest Put/Call Ratio revealed an attention-grabbing shift in market sentiment. The rising desire for name choices pointed to rising optimism about additional value hikes. This development was in step with the anticipation of favorable insurance policies and innovation below Trump’s management.

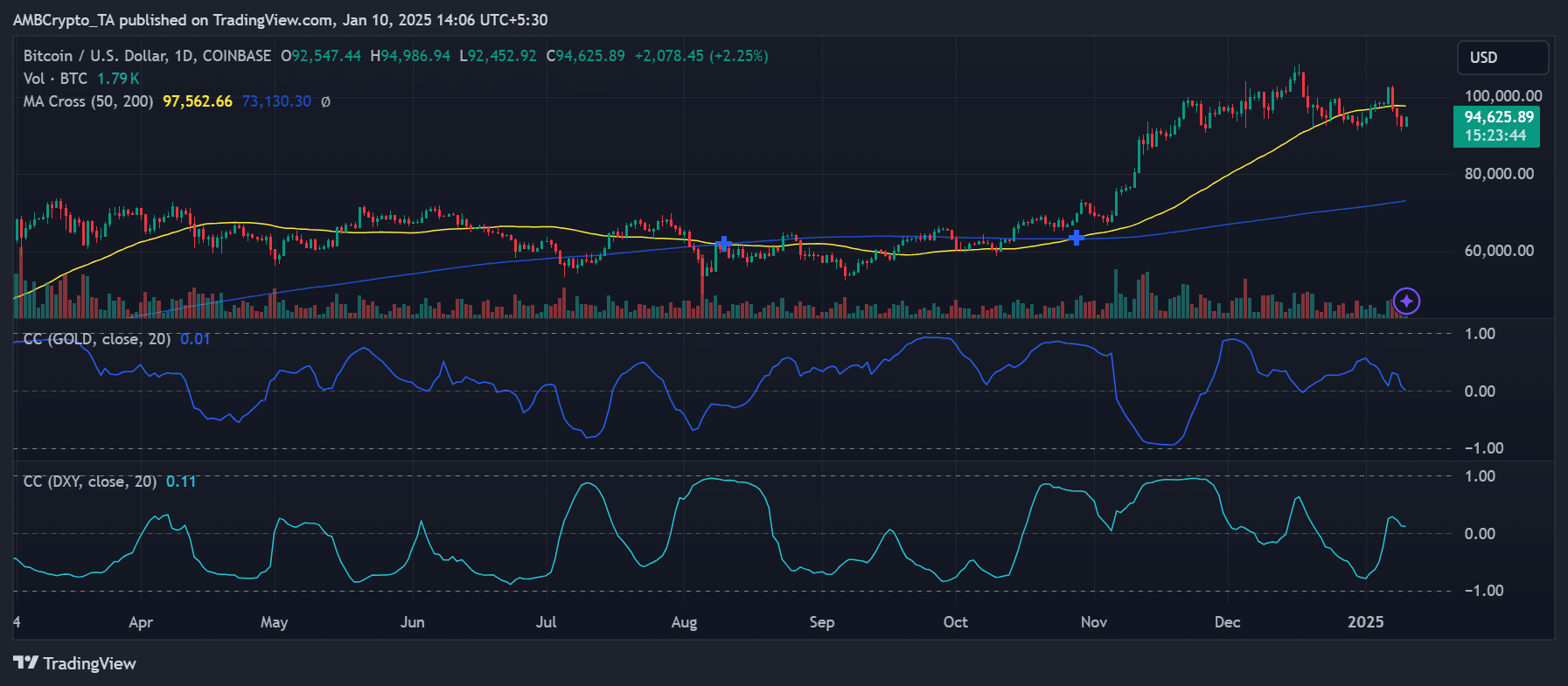

BTC’s correlation with Gold and DXY

An evaluation of Bitcoin’s correlation with Gold and the U.S. Greenback Index (DXY) provided some crucial insights into its present market dynamics. The chart highlighted Bitcoin’s optimistic correlation with gold, underscoring its function as a hedge in opposition to financial uncertainties.

Concurrently, its inverse correlation with the DXY mirrored Bitcoin’s sensitivity to greenback actions, the place a weakening greenback might act as a tailwind for BTC.

These correlations underline Bitcoin’s evolving narrative as each a safe-haven asset and a speculative funding, relying on macroeconomic situations. This duality uniquely positions BTC throughout the monetary ecosystem, interesting to many traders.

Cautious optimism – A ‘purchase the information’ or ‘promote the information’ occasion?

Regardless of the optimism surrounding Trump’s pro-crypto rhetoric, warning is warranted. Historic traits counsel that vital occasions typically result in profit-taking, leading to short-term market volatility. The potential for a “promote the information” situation can’t be ignored, particularly given the speculative shopping for that has pushed Bitcoin’s latest rally.

Furthermore, uncertainties about Trump’s precise coverage implementations loom giant. Whereas his marketing campaign rhetoric was crypto-friendly, the market awaits tangible actions to validate these expectations. Any missteps might dampen the prevailing enthusiasm.

What lies forward for Bitcoin and the crypto market?

The interval main as much as Trump’s inauguration is poised to be a mixture of optimism and uncertainty. Key elements, akin to regulatory readability, institutional conduct, and macroeconomic traits, will form Bitcoin’s trajectory. Whereas Trump’s administration is predicted to supply a supportive backdrop for digital property, the sustainability of the present rally is dependent upon how the market digests these developments.

– Is your portfolio inexperienced? Try the Bitcoin Profit Calculator

Bitcoin’s distinctive place, with correlations to each gold and the DXY, provides an intriguing layer to its value dynamics. Because the market anticipates Trump’s insurance policies, Bitcoin might emerge as a standout performer in 2025, mixing traits of each conventional safe-havens and high-growth property. Traders are actually watching carefully to find out whether or not Trump’s inauguration will catalyze a brand new crypto period or a short-lived speculative spike.