Bitcoin’s latest value fluctuations have left traders in a state of uncertainty, because the cryptocurrency has seen a dramatic decline from its peak of almost $107,000 to round $94,550. This volatility raises important questions in regards to the potential of Bitcoin to keep up its rally and whether or not it may regain its footing within the coming weeks.

Associated Studying

Important Help Ranges Underneath Risk

CryptoQuant analyst Shayan has had one thing necessary to say about present situations in Bitcoins. In keeping with him, the worth is making an attempt to stabilize proper above the worth of $92,000 stage, which he additional says is a key help.

He notes that Bitcoin is stabilizing close to the $92,000 mark, which he identifies as an important help zone. If Bitcoin breaks beneath this stage, it might set off a wave of lengthy liquidations and push costs down towards the 100-day transferring common of $81,000. Additionally, this line has been performing as an actual dynamic help by attracting shopping for inflows and also can cushion costs throughout additional descent.

Shayan underlines the function of market sentiment and technical indicators. At current, Bitcoin is fluctuating at vital help ranges that are created within the $90K stage and Fibonacci retracement ranges at $87K and $82K. If the above-mentioned ranges don’t maintain, there may very well be additional promoting strain with corrections.

Bitcoin Bullish Outlook Regardless of Bearish Fears

Amidst this uncertainty, famend cryptocurrency analyst Crypto Rover has expressed a bullish outlook for Bitcoin. He just lately in contrast right now’s value motion with historic patterns, suggesting that January might see constructive tendencies for Bitcoin.

#Bitcoin historical past is precisely repeating.

January will flip inexperienced.

You’ll remorse not shopping for extra right here. pic.twitter.com/DCssLNMGh6

— Crypto Rover (@rovercrc) January 8, 2025

In a tweet, he acknowledged, “Bitcoin historical past is precisely repeating. January will flip inexperienced. You’ll remorse not shopping for extra right here.” His evaluation signifies that if Bitcoin can break by the essential resistance stage of $100,000, it might doubtlessly barrel previous $107,000.

Large Capital Inflows

Rover’s positivity is strengthened by the large capital inflows in Bitcoin ETFs, which attracted greater than $900 million of inflows from establishments like BlackRock and Constancy. Rising institutional curiosity additionally indicators confidence within the long-term prospect of Bitcoin. Nonetheless, he additionally cautions that failure to shut above the $100,000 mark will result in a pullback to $92,000 and even decrease.

The broader cryptocurrency market is feeling the pressure too. This decline is available in tandem with Bitcoin’s failure to remain afloat, and different cryptocurrencies resembling Ether and Solana have fallen by greater than 7%.

Associated Studying

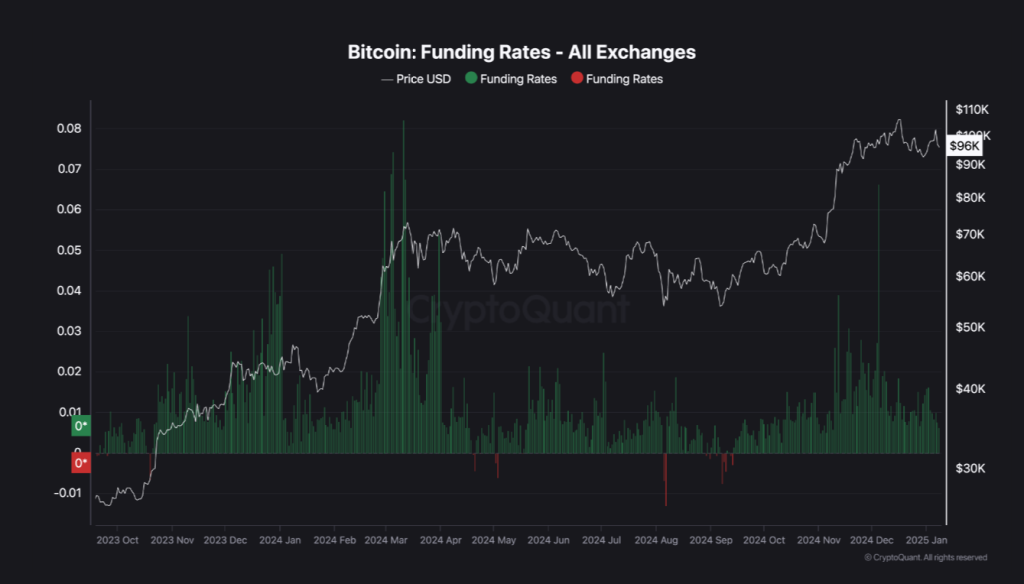

Even the standard shares of the crypto sector, resembling MicroStrategy and Coinbase, have been down sharply. Funding charges falling inside the derivatives market provides yet one more layer of bearish sentiment round Bitcoin. In keeping with Shayan, the lowering funding charges had mirrored dipping demand for derivatives, which additionally performed a pivotal function in sustaining value tendencies.

Featured picture from Pixabay, chart from TradingView