- Bitcoin’s latest 5% dip to $95K isn’t a typical shakeout of weak arms.

- With all financial indicators pointing to a unstable rally forward, it’s time to remain sharp and cautious.

Every week of reduction, and the crypto market delivers one other twist. Bitcoin [BTC] printed a obtrusive crimson candlestick on its each day chart, signaling a 5% drop.

Surprisingly, overheating isn’t the offender right here. So, who’s pulling the strings this time?

The excitement factors to a different case of potential “manipulation”. With no technical indicators warning of a downturn, this drop feels extra like a calculated transfer than a market correction.

Both approach, the chance is sky-high

New data simply dropped, revealing sturdy PMI numbers, excessive job openings, and a surprisingly resilient U.S. economic system. However what adopted? A pointy crash in unstable belongings, marking the second such blow in below a month.

Bitcoin’s first crash noticed it tumble to $91K, simply two weeks after hitting a file excessive of $108K. However, in true Bitcoin trend, it bounced again shortly, reclaiming $100K in simply seven days.

Equally, this newest drop in BTC could possibly be a bullish signal. Regardless of the dollar index [DXY] hitting a two-year excessive of 109.27, a 5% dip nonetheless reveals energy.

Moreover, Bitcoin has a monitor file of bouncing again, particularly when institutional traders swoop in to scoop up liquidity, which means a possible provide shock could possibly be looming.

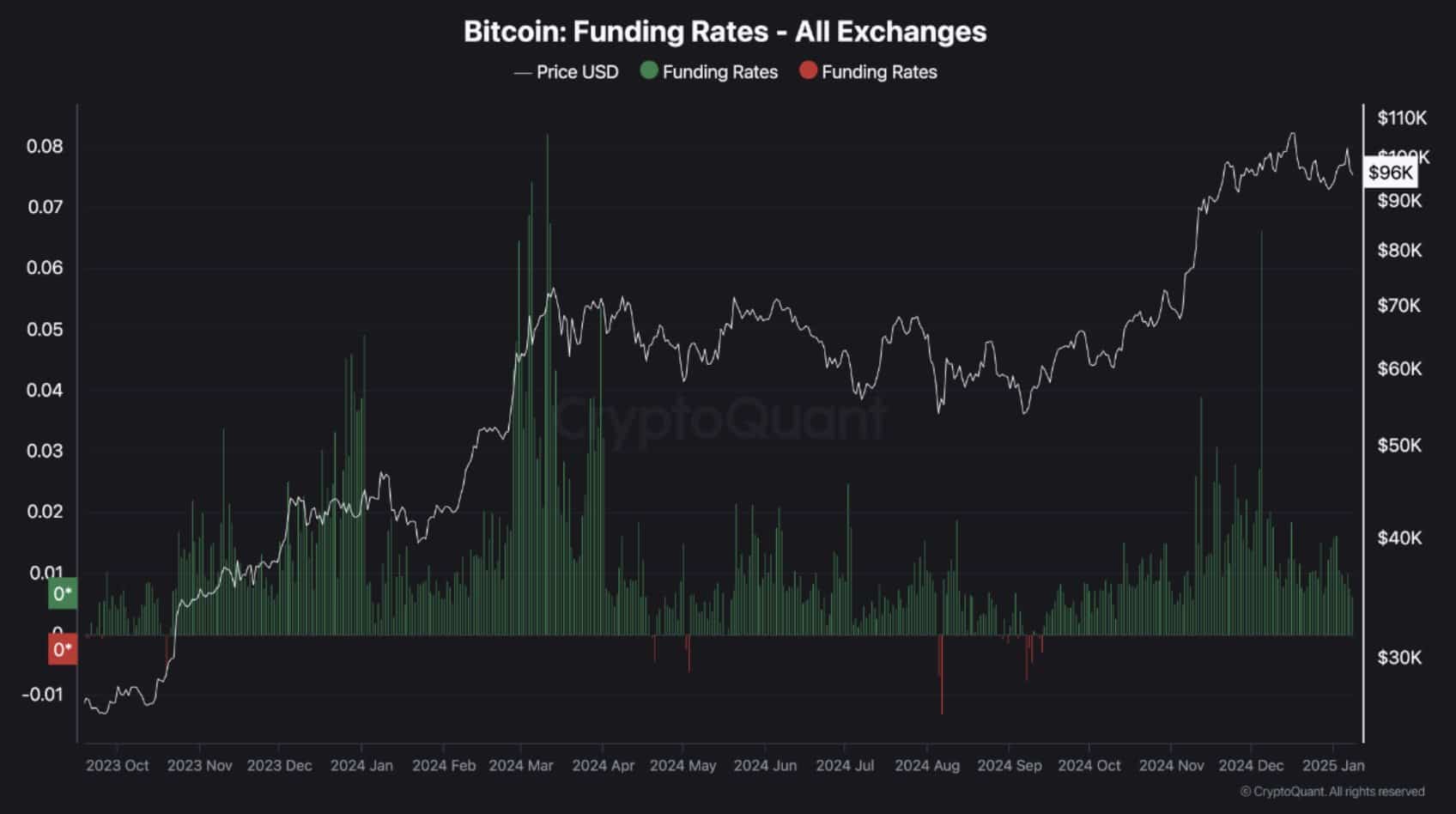

Nonetheless, there’s one cloud hanging over this restoration: the “high-risk” sentiment gripping the market. With over $114 million in lengthy positions wiped out, Funding Charges are steadily declining.

That is making a psychological barrier, significantly for retail traders and day merchants, who is likely to be ready for the precise second to re-enter for higher earnings.

The important thing? If the hole between $102K and the brand new worth is vast sufficient, it could possibly be the set off that brings confidence again into the market.

So, the place is the following Bitcoin backside?

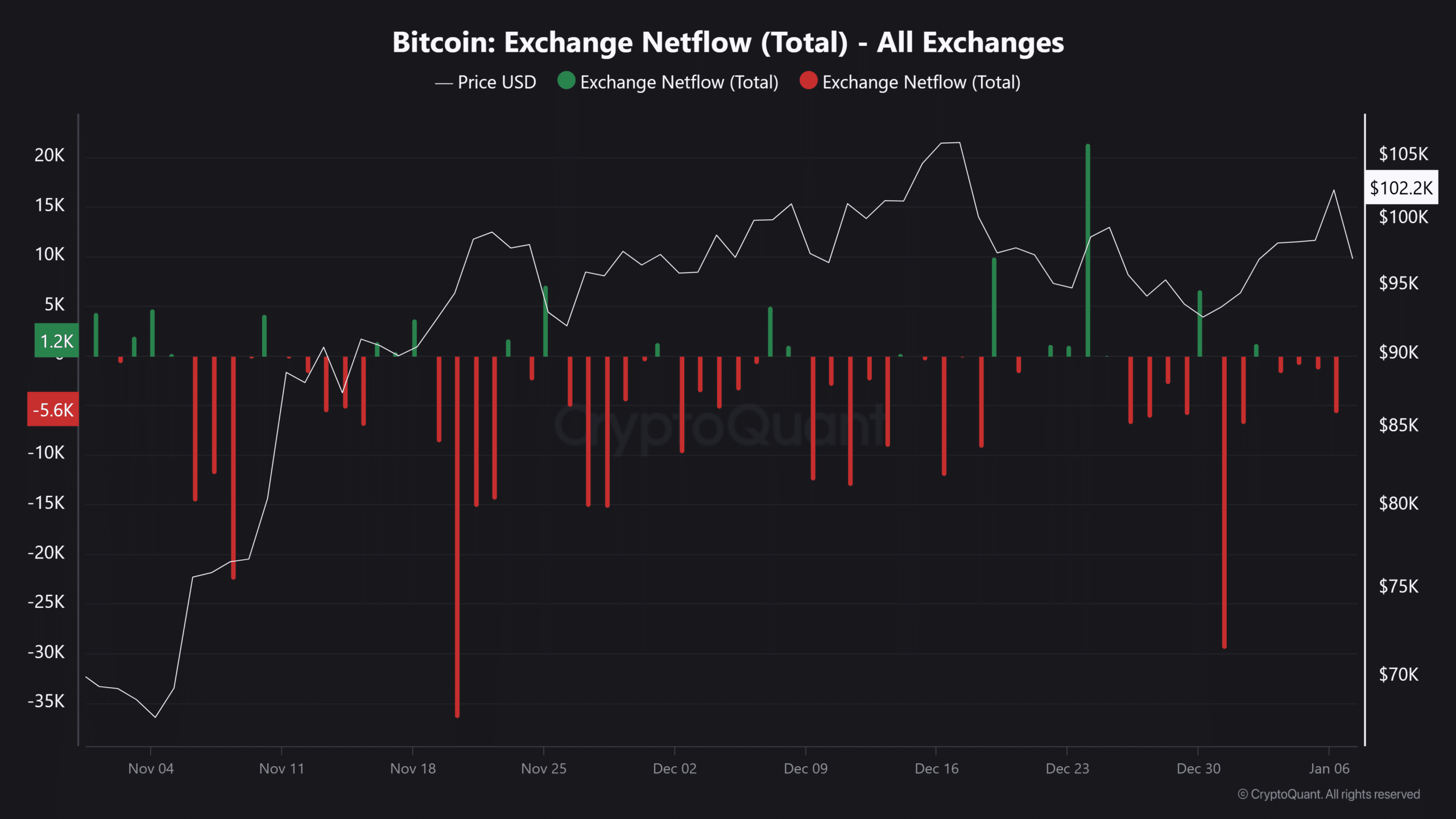

As talked about earlier than, when Bitcoin dropped to $91K, it made a robust comeback. A more in-depth look reveals that at this level, retail capital poured again into the market, with internet outflows hitting $25K — the very best in a month.

However right here’s the twist: whereas the online circulate has turned crimson, it’s nowhere close to these ranges, sitting at simply $5K.

This implies that the anticipated “buy-the-dip” second hasn’t absolutely kicked in but, confirming AMBCrypto’s concept that the market is ready for the precise set off.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

With the scars of the latest crash nonetheless recent, anticipating an prompt rebound is likely to be too hopeful. As an alternative, your persistence could also be examined.

Whereas a pointy reversal isn’t imminent, a deeper pullback to $89K — $91K could possibly be the candy spot to look at for.