- Declining profitability for Bitcoin’s short-term holders signaled potential value corrections.

- BTC has surged by 6.08% over the previous week as consumers regained the market.

Because the begin of 2025, Bitcoin [BTC] has proven robust resilience, reclaiming $99k ranges. Over this era, BTC has surged from $92768 to $99857.

Regardless of the latest value upsurge, analyst have shared their issues with BTC’s present market circumstances. Inasmuch, CryptoQuant analysts have prompt a possible correction, citing declining profitability amongst short-term holders.

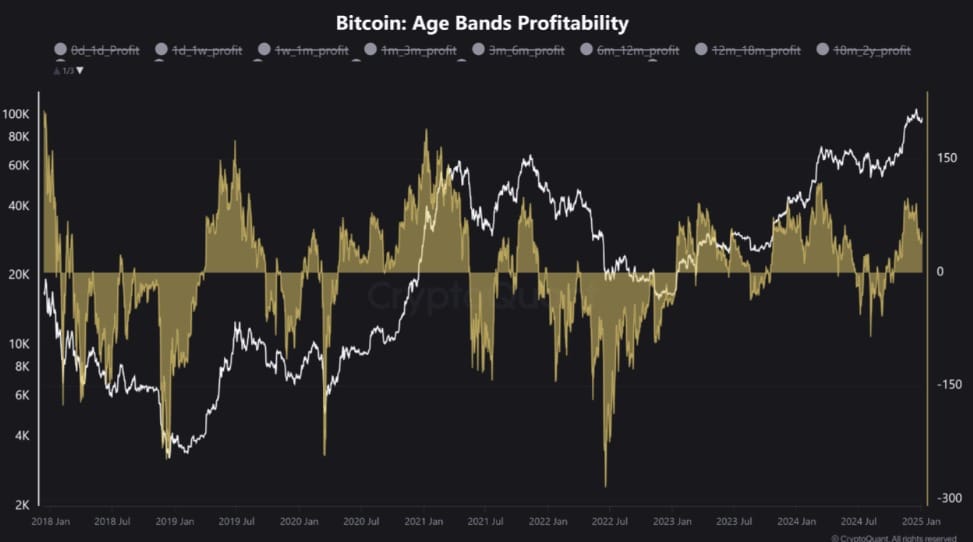

Bitcoin’s short-term holders’ profitability decline

Analyst Crazzy Block noticed that Bitcoin’s short-term holders had been seeing their profitability drop.

The following failure to reclaim BTC’s $108K ATH induced the profitability margin for STHs to say no considerably.

When profitability for STH drops, it indicators weakening market demand and rising bearish sentiment over the quick and medium time period.

Such a drop in demand suggests an elevated probability of value correction. So, short-term corrections are inevitable, whereas Bitcoin has large potential for long-term development.

Influence on BTC charts?

Whereas short-term holder’s profitability has diminished with Bitcoin buying and selling beneath $100k, the market appears positioned for extra positive aspects within the quick time period.

Due to this fact, different market indicators counsel that bulls try to drive costs up and an enormous market correction appears unlikely, particularly within the quick time period.

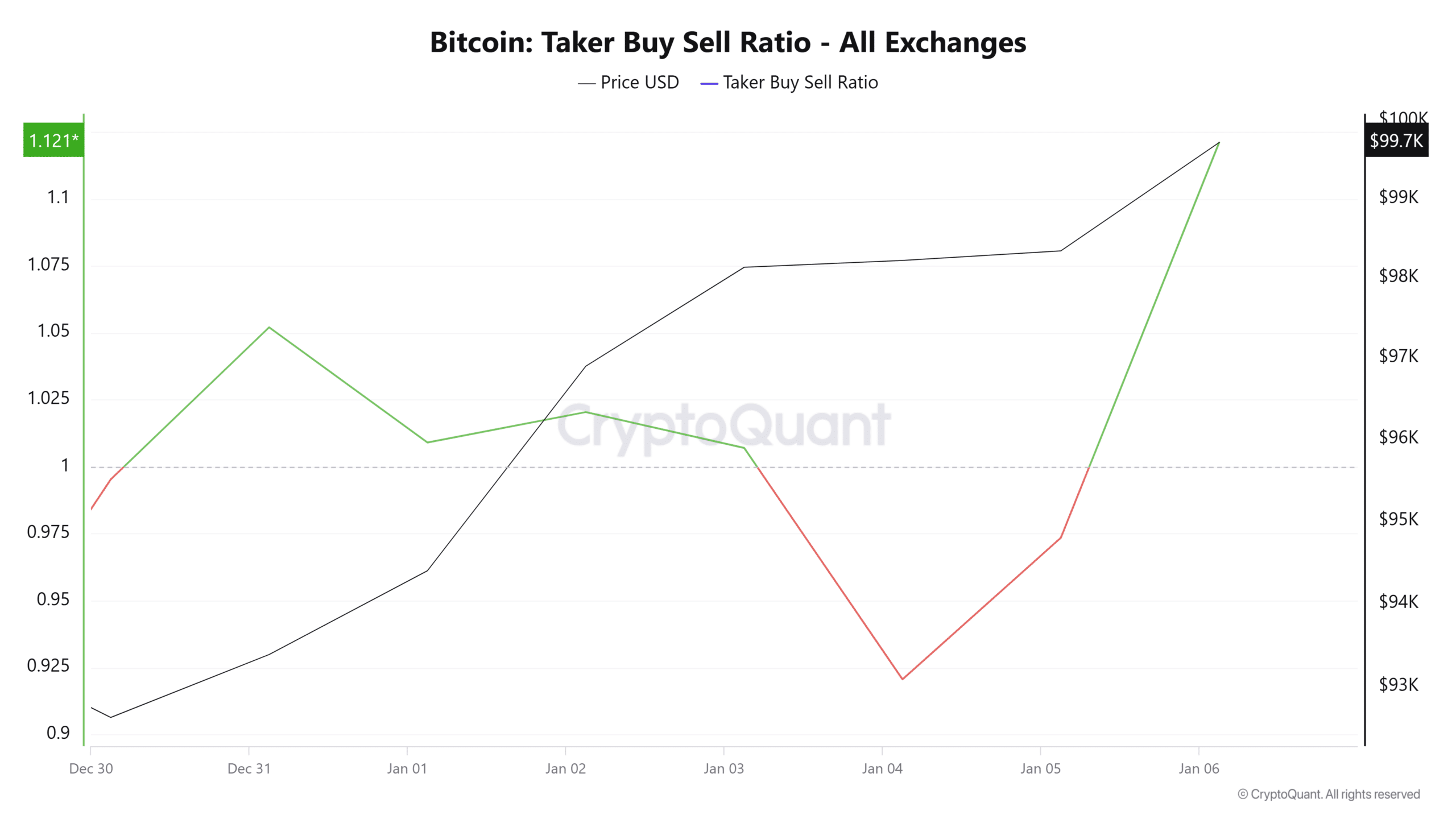

For instance, Bitcoin’s Taker buy-sell ratio has surged over the previous 48 hours to succeed in 1.121. With a ratio above 1, it means that BTC experiencing aggressive shopping for actions, with consumers outpacing sellers.

This displays bullish sentiment as short-term momentum in direction of the upside, with consumers dominating the market.

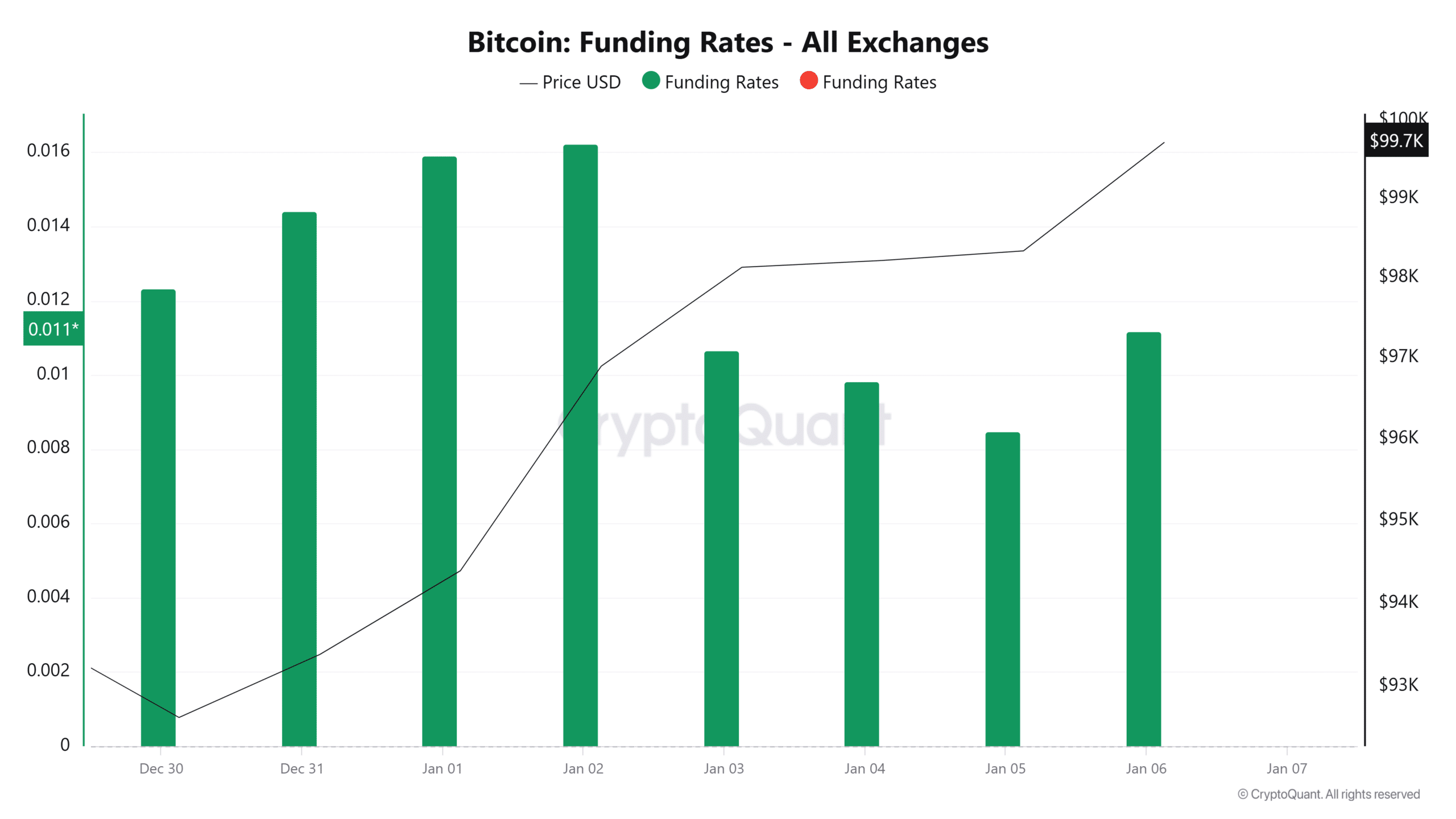

Moreover, Bitcoin’s Funding Charge surged over the previous day from 0.0084 to 0.0124. When the Funding Charge rises, it reveals that extra merchants are bullish and are opening lengthy positions.

A requirement for lengthy positions displays market confidence, with buyers anticipating BTC costs to rise.

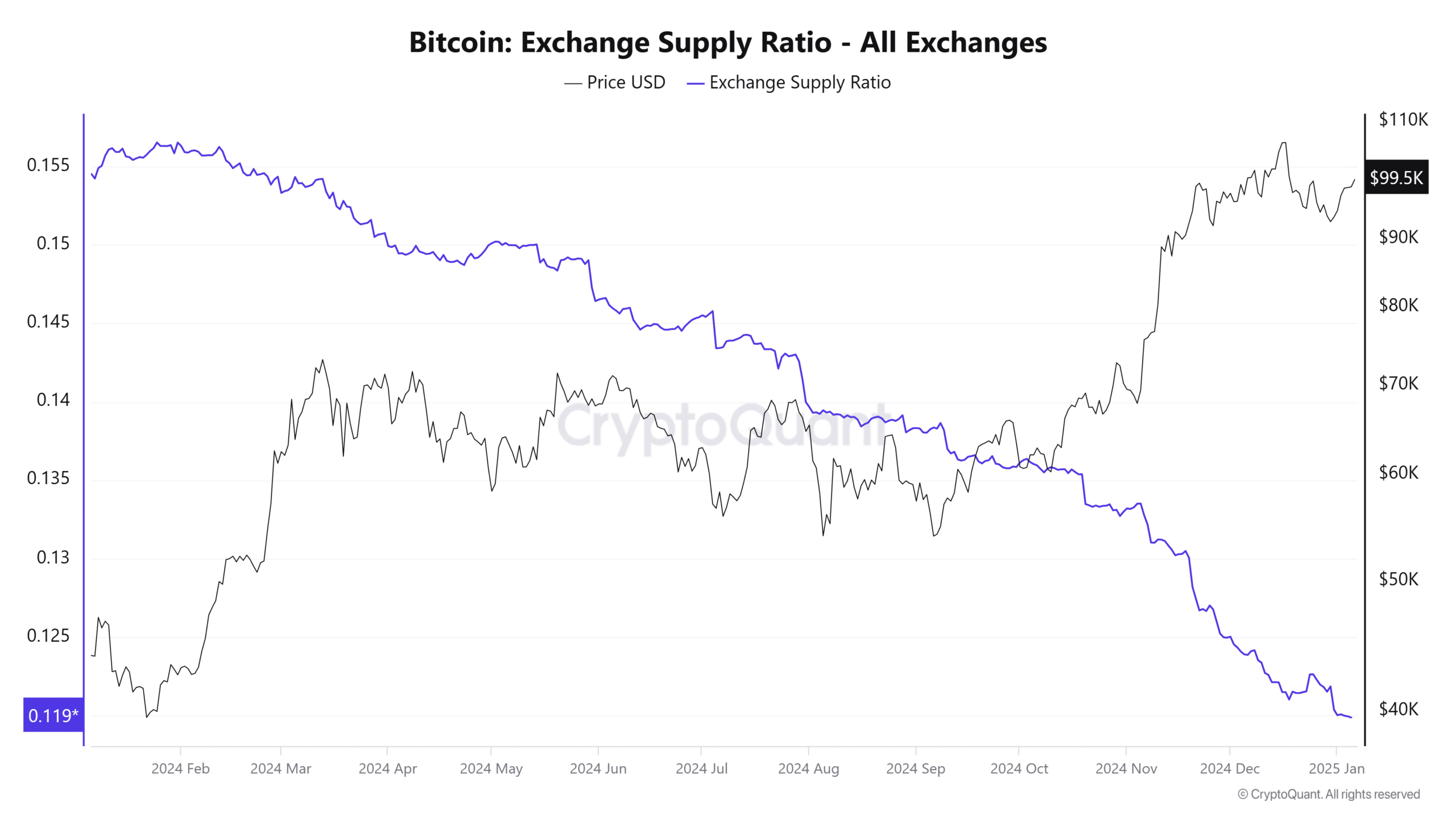

Lastly, Bitcoin’s Change provide ratio has declined to hit a yearly low.

With a dip in provide to exchanges, it implies that buyers are accumulating BTC by transferring to non-public wallets, anticipating costs to rise additional.

Merely put, though short-term holder’s profitability has declined, the market nonetheless appears robust, particularly within the quick time period.

Due to this fact, this diminished profitability is but to sign short-term market correction as buyers are nonetheless bullish.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

With bullish sentiments nonetheless prevailing available in the market and consumers regaining management, we might see BTC reclaim $100k and surge to $102,777.

Consequently, if the anticipated correction happens, Bitcoin will drop to $95000.