- Bitcoin’s buying and selling quantity on Binance has sharply declined, rising market vulnerability.

- Retail curiosity stays inconsistent, signaling unsure short-term market sentiment.

After a short interval of optimism earlier in December, Bitcoin [BTC] has failed to take care of its momentum, slipping beneath the $100,000 mark and remaining stagnant in latest weeks.

The digital asset has seen little upward motion, with its value now standing at $92,790, reflecting a 13.2% drop over the previous two weeks.

At this degree, Bitcoin was buying and selling 14.2% beneath its all-time excessive of $108,135 at press time, achieved earlier in December.

This lackluster efficiency has raised considerations amongst market members, with each buying and selling quantity and retail curiosity exhibiting noticeable declines.

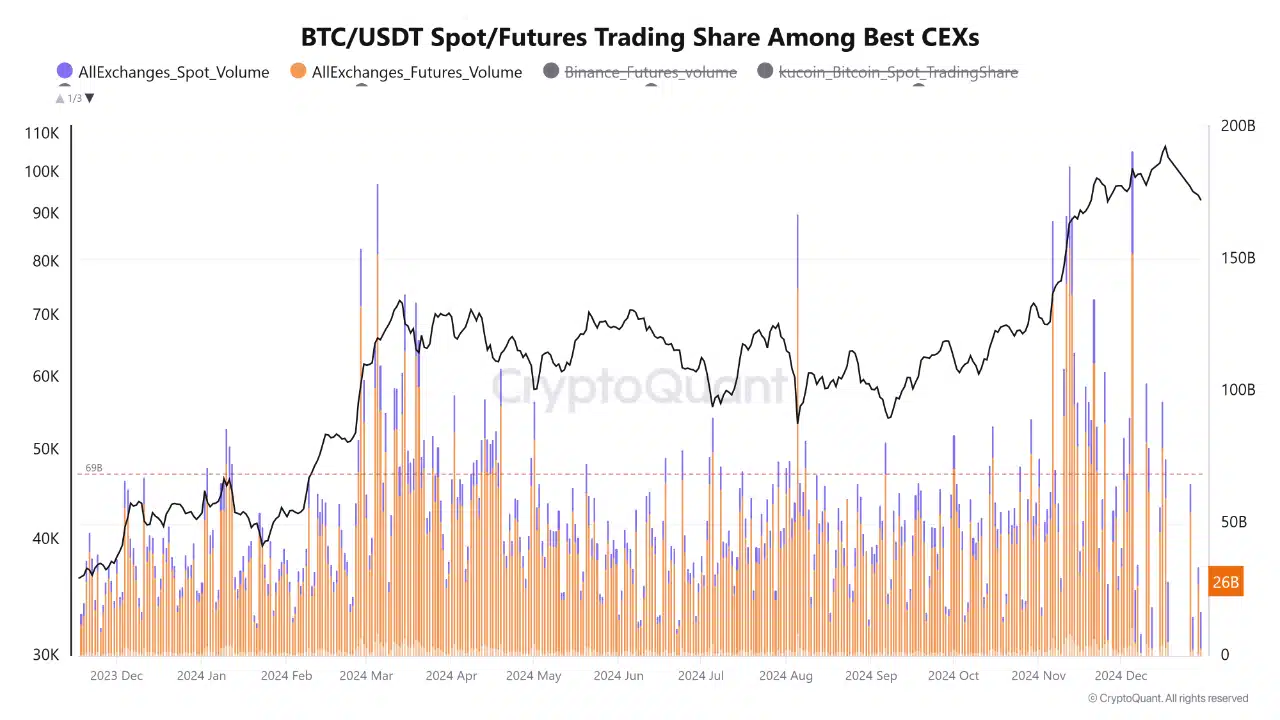

A key factor contributing to this subdued efficiency is the numerous drop in Bitcoin buying and selling quantity on Binance, the world’s largest cryptocurrency alternate.

Over the previous week, trading activity on each spot and Futures BTC/USDT pairs has sharply declined.

Centralized exchanges are important in offering liquidity and sustaining equilibrium between provide and demand.

With diminished exercise on Binance, the market is now extra susceptible, as decrease demand makes it tougher to counter promoting strain.

This imbalance creates an surroundings the place even minor fluctuations in shopping for or promoting exercise might set off substantial value swings.

Analysts suggest merchants train warning and keep away from impulsive choices, as the present market sentiment stays fragile.

Combined indicators from retail exercise

Past buying and selling quantity, different crucial Bitcoin metrics present additional perception into the asset’s present market situation.

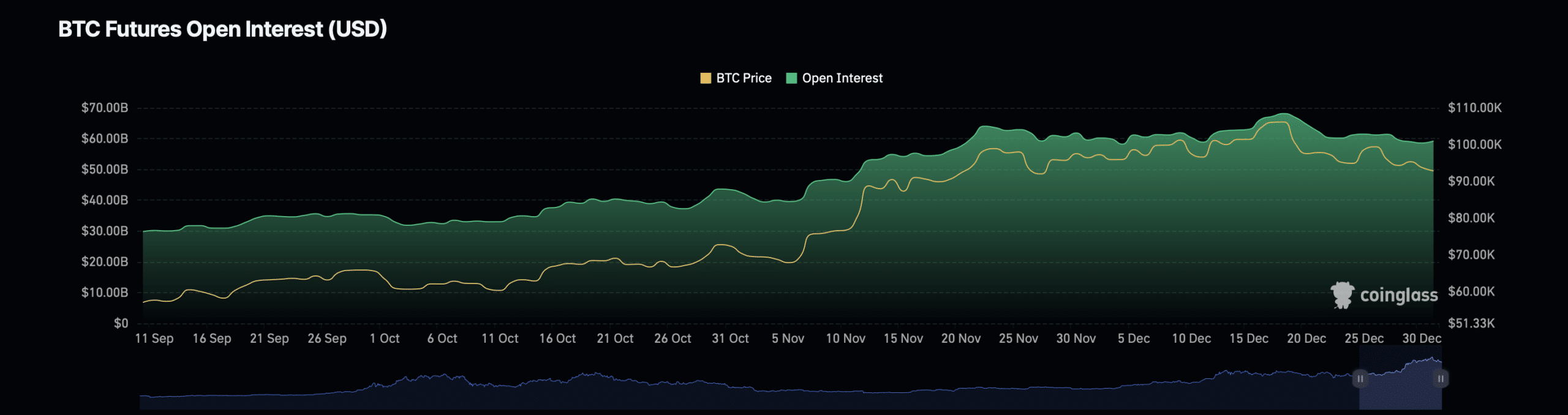

Data from Coinglass revealed that Bitcoin’s Open Curiosity—representing the overall worth of excellent futures contracts—has decreased by 2.58% to roughly $57.66 billion.

This drop signifies waning curiosity from Futures merchants, usually interpreted as an indication of diminished speculative exercise.

Nevertheless, in distinction, Bitcoin’s Open Curiosity quantity has surged by 71.7%, now valued at $109.92 billion.

This rise means that whereas fewer merchants are lively, these nonetheless collaborating out there are taking bigger positions, doubtlessly indicating a level of confidence in future value actions.

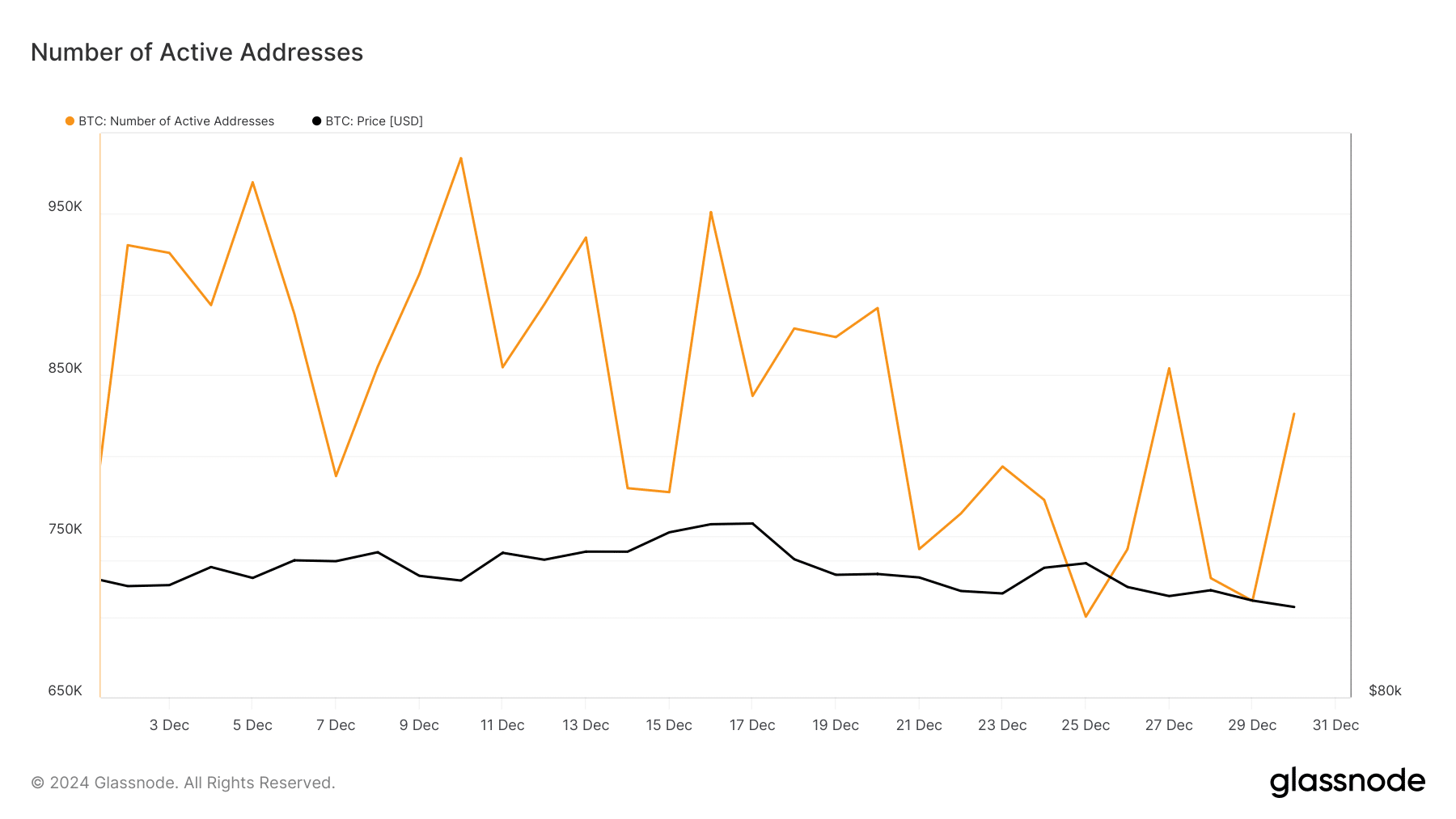

Shifting ahead, Bitcoin’s lively tackle depend gives a window into retail participation and on-chain exercise. Energetic addresses mirror the variety of distinctive Bitcoin addresses concerned in transactions on a given day.

Earlier in December, lively addresses hit a low of 787,000 earlier than recovering to 984,000 on the tenth of December.

Nevertheless, exercise dropped once more to 700,000 by the twenty fifth of December earlier than rebounding barely to 826,000 as of the thirtieth of December.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

This sample signifies inconsistent retail curiosity, with brief bursts of exercise adopted by sharp declines.

Such fluctuations recommend a scarcity of sustained retail momentum, which stays essential for driving Bitcoin’s value increased throughout bull cycles.