- Stablecoins are an important element of crypto markets

- Tendencies in alternate reserves can provide clues about market sentiment and wider worth tendencies

Stablecoins are important to facilitating a seamless crypto expertise. It’s a hedge towards volatility since it’s pegged to fiat and maintains its worth. Stablecoins present liquidity to the markets and eases complicated actions reminiscent of lending, borrowing, and good contract deployment in DeFi.

It is usually one of many harbingers of a bull run. Rising stablecoin quantities on-chain are an indication of better adoption and participation, reflecting demand. This was made obvious by the regular minting of stablecoins reminiscent of Tether (USDT) and USD Coin (USDC).

Affirmation of a bull run?

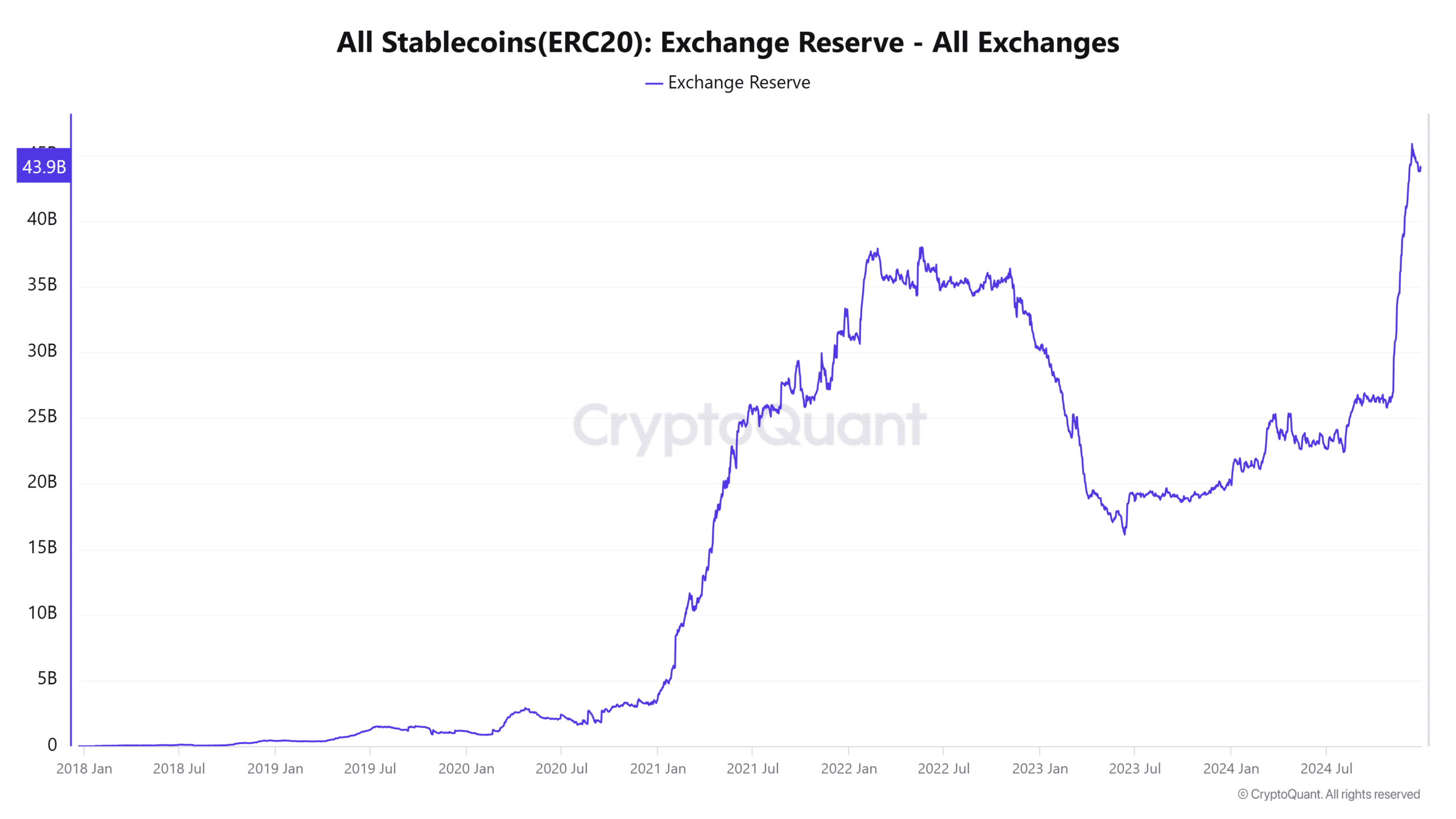

Supply: CryptoQuant

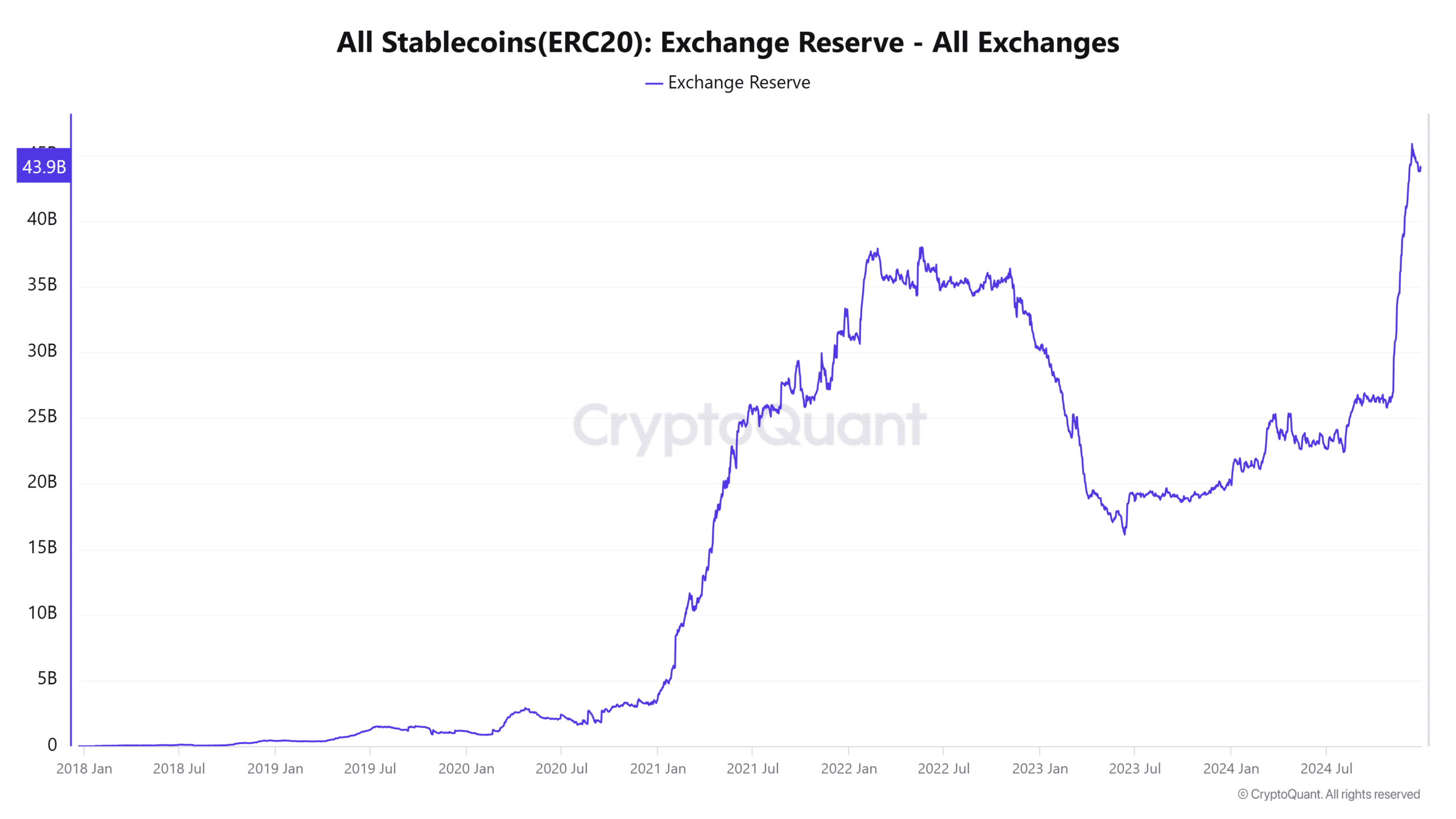

Binance, the world’s largest crypto alternate by quantity, has $29 billion in USDT and USDC reserves – The 2 largest stablecoins. In a publish on CryptoQuant Insights, analyst CrazzyyBlockk highlighted the main alternate’s rising stablecoin reserves.

The implications appeared to be strongly bullish. Binance’s reserves guarantee seamless transfers between crypto and fiat, and its deep liquidity provides merchants and buyers the arrogance to purchase and promote massive portions of crypto property.

Supply: CryptoQuant

Nevertheless, it weren’t simply the USDT reserves on Binance that have been rising. The overall stablecoin reserves on all widespread exchanges have been trending upwards. From 24 October to 27 December, exchanges’ stablecoin reserves have expanded from $25.7 billion to $44.1 billion.

The final time such a swift, decisive uptick occurred was again in December 2020 – January 2021. This uptrend lasted until early 2022, heralding the earlier bull run. An analogous situation is taking part in out now. Inflow of stables to reserves is usually seen as dry powder that will gasoline the subsequent worth enlargement.

Complete market cap projections for 2025

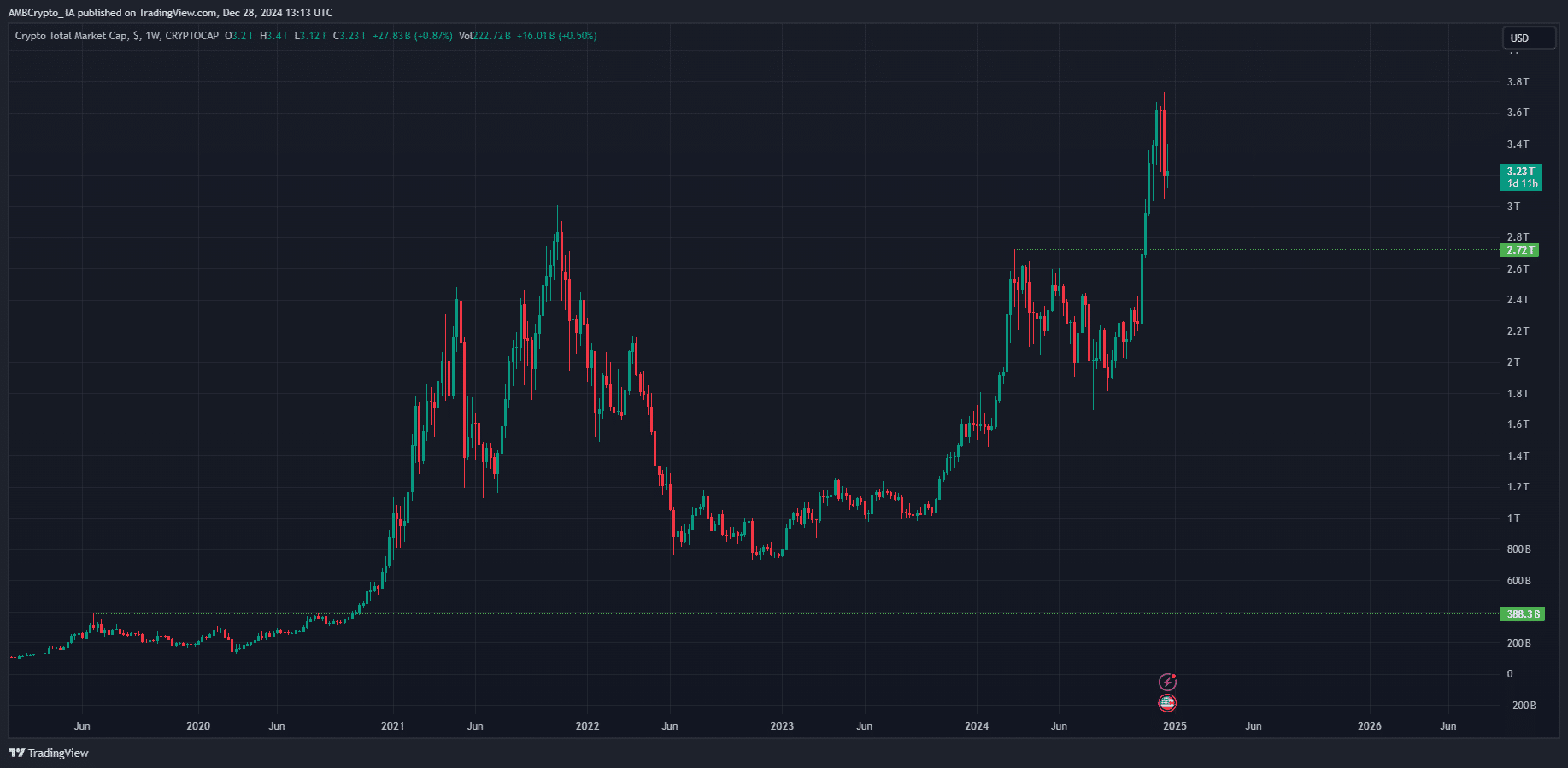

In early November 2020, the whole crypto market cap surpassed the native excessive at $388 billion. Over the subsequent 12 months, it rallied by 685% to hit a excessive of $3.01 trillion. Quick ahead to 2024 and a brand new all-time excessive has been established.

If one other 500%-600% rally materializes, it could teleport the whole crypto market cap to $16.8 trillion – $19.5 trillion. If Bitcoin has a roughly 50% market dominance, that will put its market cap across the $8 trillion-mark.

Is your portfolio inexperienced? Verify the Bitcoin Profit Calculator

This is able to see a $400k worth for Bitcoin. No matter whether or not these lofty worth targets are met, the conclusion stays the identical.

One other bull run is in play proper now. And, the market is taking part in guessing video games with new worth targets.